Developers of the latest generation of unconventional hydrauic fracturing models are hop- ing that current weak oil and gas prices will generate newfound interest in their software technology.

After years of rewriting old programs and coming up with new ones, the modelers say they have advanced the industry’s ability to digitally simulate how shale reservoirs react to hydraulic fracturing. If the technology works, they may have overcome the major limitations that have stymied the adoption of fracture model- ing since the onset of the North American shale revolution.

Those working on this new front include service company giants such as Schlumberger, which in recent years has built and acquired a number of modeling, simulation, and 3D seismic technologies to capture this budding market. Smaller

MillerGrid – POILand much younger startups are also in the hunt, such as Sigma3 and FracGeo, who teamed up in the summer of 2014 to introduce and market new unconventional reservoir models.

Several other players are pushing their own approaches but the concept they all share is that if shale producers can predict what subsurface properties dictate a quality completion, they can land wells in geologically and geo- mechanically favorable sweet spots and spend their capital on initiating fracture stages only in the most likely-to- produce sections of a well. The technology could also reduce the financial pain incurred through time-consuming, trial-and-error pilot programs used to determine a particular field’s best completion practices.

Ultimately, the technological goal is to lower break-even costs and deliver sustainability to the flagging shale business by engineering wells that produce more oil and gas from fewer wells, with fewer fracturing stages.

“People are struggling to make a prof- it with the current oil price just by drill- ing every location,” on a geometric grid, said Colin Sayers, an adviser with Schlumberger who works on the company’s unconventional modeling and seismic technologies. The approach he is pitch- ing is to “put the wells in the right place with the right orientation, and choose where you should complete based on data rather than just guesswork.”

One of the most important metrics of success is if the software can accurately simulate the interaction between hydraulic fractures and the natural fractures that act as the dominant transport mechanism for hydrocarbons in unconventional reservoirs. This objective is far simpler to understand compared to the underlying science involved, which some argue is not fully understood yet.

“We don’t have the physics to three places past the decimal point, but we are close enough. The number one issue is that we are lacking the data,” said Neal Nagel, chief engineer at Oilfield Geo- mechanics, who has tracked the modeling sector for nearly 30 years and is familiar with the latest approaches being introduced.

“Even if we have the physics, we need the data—and the data take time and money,” he said.

Some of the data will come relatively easy and cheap. Many operators are sit- ting on mountains of geologic and production data that will need to be sifted through in order to be useful in the modeling environment. Some will have to obtain new data by way of sophisticated well logs or seismic surveys that cost several millions of dollars, yet in some cases, still cost less than a single horizontal well.

But right now, there are only a limited number of case studies available to help convince shale producers that fracture modeling is the silver bullet solution to all of their problems.

Schlumberger says it achieved average production gains of 200% to 300% in stages where its geomodeling program was used to compare engineered completions vs. geometrically completed stages in the same well operated by an undisclosed operator in the Niobrara Shale. The software technology was also used to achieve a 35% higher initial production rate in a Marcellus Shale gas well operated by Seneca Resources.

FracGeo says its model successfully identified the need for variable well spacing and refracturing candidates for Southwestern Energy in the Fayetteville Shale. The case study will be presented at this month’s SPE Hydraulic Fracturing Conference and Exhibition in The Wood- lands, Texas.

The company is trying to prove to the industry that its geomechanical models can drive well performance and, over time, may help illuminate the shadowy science involved with hydraulic fracturing.

“The whole process here is to under- stand what we are doing to the rock as we frac it,” said Ahmed Ouenes, chief executive officer (CEO) and founder of FracGeo. “And then from that understanding, we can decide multiple things: either skip stages, change the treatment, change the spacing, or the sequence.”

Completion Customization

Such decisions would represent a degree of completion customization rarely seen in the shale industry. Despite the many geologic variations found in a lateral wellbore several thousands of feet long, the standard practice is to arbitrarily perforate into the reservoir about every 50 ft to 100 ft and group those “perfs” into sections called fracture stages. Identical stimulation treatments are injected into 30 or 50 of these stages.

Widely cited studies show that as a result of these geometric completions, 40% to 60% of stages produce little or no hydrocarbons, while 30% of the stages represent 80% of a well’s entire production. Baker Hughes estimates that ineffective stages have come at an annual cost upward of USD 40 billion.

The alternative being pitched by the model developers are called geologic or engineered completions, which concentrate stages where the data suggest both hydrocarbons and the conditions need- ed to effectively fracture the rock coexist. This approach requires a greater than usual emphasis on detailed reservoir data regarding natural fractures, rock mechanics, brittleness, bedding planes, in-situ stresses, lithology, etc.

“On the unconventional reservoirs, we kind of lost this geoscience input for many years,” explained Peter O’Conor, vice president of integrated solutions and business development at Sigma3. “People were doing factory drilling and the oil price was very high, and if 40% of the stages were not contributing to production, it was still a profitable exercise.

“Eventually, we saw as an industry that a percentage of our wells were really poor producers, some were okay, and some were really good,” he said. But since the end of 2014, it has become increasingly clear that most shale producers can no longer rely on the law of averages to balance the losses on the bad wells with the profitably of the good ones. Even when prices were at their highest, it has been said that only a third of a company’s shale wells supported an entire development.

Stress Matters

The pressure to rapidly improve that mar- gin of error has forced producers to zero in on geologic sweet spots, or sections of the formation which are likely to produce the most oil and gas. However, “There are a lot of wells that you cannot explain entirely with geological sweet spots,” said Ouenes. “Once you have good geology, you would also like to be fracking into a good geomechanical condition.”

He explained that a primary indica- tor of a geomechanical sweet spot is a zone with low differential stress. FracGeo has developed a program that can quickly generate a map to identify where these stress zones are along a proposed wellbore path. Areas with the lowest differential stress are most likely to yield complex fracture networks, whereas areas with higher differential stress are less likely.

Side-by-side comparisons of data from microseismic surveys and the stress maps reveal that areas with the most micro-seismic events are concentrated where there is the lowest differential stress. “In the high-differential stress zone, nothing much happened,” when uniform fracturing treatments were applied, Ouenes said.

Logging tools can be run inside a well to detect these stress zones but only around the near-wellbore area, not into the far field of the reservoir. By model- ing the entire stress field before a well is drilled, engineers can begin to under- stand how shifting its placement may improve their odds of achieving a complex fracture network.

If an engineer decides not to move a proposed well, they would at least have a rough idea that in high-differential stress zones fracturing fluids may need to be pumped at higher rates, or at larger volumes, or a different proppant is needed, or that they should avoid fracturing into those zones altogether.

This type of stress modeling also applies to refracturing. Once an area of the reservoir has been depleted through years of production, the stress field inside the reservoir can switch direction, a phenomenon known as stress rotation. “The maximum stress direction is now the minimum stress direction,” explained O’Conor of Sigma3. “And so when you restimulate, you open up virgin rock, and lo and behold, the production comes back to what it originally was.”

But the process of refracturing remains a tricky business because of the uncertainties involved with where and exactly how to apply it. Using production history data, completion data, and seismic as inputs, modeling may simplify the pro- cess of choosing which wells and which stages to refracture.

Another potential use for these models involves simulating the effects of stress shadowing that develops in the reservoir when sequenced fracturing operations are used on pads with multiple wells. Stress shadows are an effect of the near-wellbore stress field being altered by each stage of hydraulic fracturing and they can have dramatic impacts on the results of subsequent fractures in the same well or offset ones.

For the past few years, operators have been experimenting with these sequenced techniques, called “zipper fracs,” “parallel fracs,” and “sequential fracs,” and have sometimes seen production benefits due to the effects of stress shadowing. However, the trial-and-error approach has provided little explanation as to why a given fracturing sequence is better than another.

Without clear answers, the primary driver for sequenced fracturing has been the operational efficiency achieved when crews and equipment are used to com- plete multiple wells in quick succession. The hope is that through geomechan- ical simulations of stress shadowing, operators could have the ability to select sequences that also result in enhanced production and lower well costs.

Seeing More with 3D Seismic

Microseismic is among the most useful and popular technologies to emerge from the development of shale. Among other things, it has enabled the industry to understand stress shadowing, refracturing, and has illuminated the variability of fracture stage production. But as Sayers of Schlumberger notes, “To get micro- seismic data, you have to drill a well.”

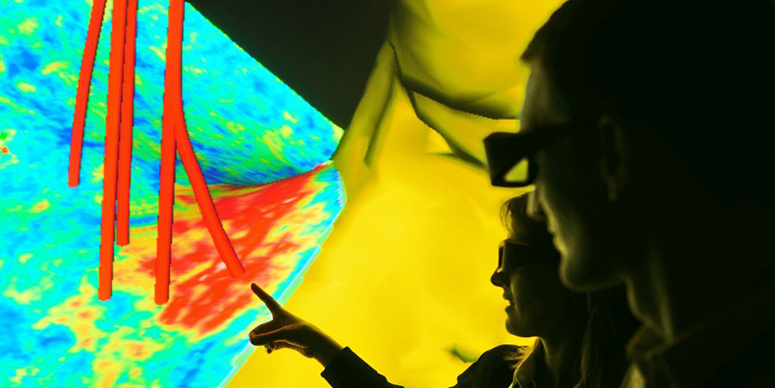

The best way to get valuable geomechanical information without first drill- ing a well is through a 3D seismic survey. For Schlumberger and others, 3D seismic data have become a major driving force behind the accuracy of their predictive models.

But until about 3 or 4 years ago, such data were hard to come by as few shale producers had run 3D surveys across their acreage. Since then, there has been an uptick in 3D seismic acquisition thanks to the adoption of geosteering technologies that are used to ensure a wellbore follows the boundaries of the target formation and for sweet-spot mapping.

For modeling efforts to really take off, this growing library of 3D data will be critical because it provides two reservoir inputs needed to run many of them: the in-situ stress state and a description of the natural fractures. Historically, this type of data has mattered more to geo- physicists than completion engineers, which is something Schlumberger is hop- ing the success of its models can change.

“To most engineers, seismic is a wiggle—so we don’t want to deliver wiggles,” said Sayers. “What we are trying to do, in a nutshell, is to make seismic a tool for the engineers.”

But applying 3D seismic to heterogeneous shale formations is a much more difficult task than it is for conventional reservoirs. The mix of clay, mineralized crystals, natural fractures, and hydro- carbons all cause seismic waves to be affected as they move through the shale formation. This has led Schlumberger to develop a new way to interpret waves after they are received.

This process, called orthotropic inver- sion, has enabled the company to quantify both the abundance and orientation of natural fractures and the stress state in the reservoir. With the seismic inversion working “hand in hand” with a geomechanical model, Sayers said the change in spatial variability of the stresses and the ease of fracture initiation and propagation may be predicted more reliably.

Because the stress field around a well- bore interacts with natural fractures, each fracture stage has the potential to affect the outcome of the one next to it. This means two fracture stages could be communicating via a connected natural fracture network and thus doing the job that a single fracture stage could do.

In wells where there is a strong tendency for stages to communicate, modeling could be used to cut down on the number of stages. For example, a well with 25 strategically placed stages might be able to produce as much hydrocarbons as a well with 35 evenly-spaced stages. “If the completion cost represents 70% of the cost of the well, that reduction in number of stages represents almost a 20% cost saving for the considered well,” said Ouenes.

Seeking Adoption

As promising as today’s state-of-the-art models sound, there is reason to be skeptical about their chances of becoming a must-have technology for producers. The first commercially available unconventional fracture models were not up to the task because they were based on codes originally developed in the 1980s and 1990s for conventional reservoirs that assumed hydraulic fractures in shale would be bi-wing and symmetrical, which they are not.

“The industry saw that the simulation tools were lacking in some areas, which gave an opportunity for entrepreneurs and universities to jump in,” said Nagel of Oilfield Geomechanics. “Now, it is going to take a period of time for the industry to accept and recognize the benefits, as well as potentially the limitations, of some of these newer codes.”

Nagel, who is also an SPE Distinguished Lecturer on the topic of stress shadowing, said that, based on the his- tory of unconventional fracture modeling thus far, he expects only one or two out of the half a dozen new approaches to be successfully commercialized. He believes if a major operator adopts fracture modeling and publicizes maybe a year or two of strong results, others will follow.

The big challenge Nagel foresees is that if collecting the data costs too much money, and calibrating the models takes too long or is too cumbersome, shale producers may move on once again regard- less of the value proposition.

“Even if you have a better mousetrap, what does it take to convince the indus- try?” he asked. “They have to make an impression by clearly increasing productivity and clearly reducing costs, other- wise it’s just going to be a sort of research tool—which is the mentality I get from most of our clients right now.”

And even if the modeling technology works as advertised, there is concern that the notoriously change-averse culture of the oil and gas industry represents yet another significant hurdle. “We need management to look at their organizational structures and how they could more optimally adopt new workflows and new technologies without some of the barriers like, ‘This is the way we’ve always done that kind of thing,’” O’Conor said.

Another Paradigm

There are routes being taken in the modeling sector other than the geomechanical or numerical approach. One of them is a data-driven model developed in 2011 by Shahab Mohaghegh, president and CEO of Intelligent Solutions. So far, the model has been used in the Eagle Ford Shale and the Niobrara by Anadarko, the Marcellus Shale by Shell, and in the Utica Shale by Total.

The Intelligent Solutions model relies on data mining programs that predict the performance of well and completion designs without trying to answer questions about the size and complexity of induced hydraulic fractures as the geo- mechanical models try to do.

“The paradigm shift is to completely abandon this way, or this approach to modeling,” he said. “When you don’t understand the physics, or your under- standing of the physics is very limited, then you try to use the data.”

The viewpoint that the industry does not know enough about the science of hydraulic fracturing puts Mohaghegh at odds with others in the modeling community. He maintains that the unresolved issues about how hydraulic fractures interact with natural fractures make it “too complicated for us to mathematically model it,” and those who attempt this “grossly approximate things to a level of irrelevance and lack of validity.”

Mohaghegh, also a professor of petroleum and natural gas engineering at West Virginia University, believes the key to accurate modeling involves “hard data” including fluid types, injection rates, proppant types, and volumes used in previous hydraulic fracturing operations. It also includes information about the construction of those wells, the reservoir’s characteristics, and production history.

“The beauty of it is that all of this data is available to every company that has a shale asset,” he said. “They probably do not realize what a treasure of data they are sitting on, the value of it, and how much we can learn from it.”

The model is validated using real pre- production data and artificial intelligence, or “machine learning,” to see if it can replicate the actual results of the wells on production. Intelligent Solutions takes the data used to construct and stimulate those existing wells to build multiple models to predict 30-day, 90-day, 6-month, and 12-month production rates.

Mohaghegh said the accuracy of the models increases from around 75% for the 30-day model to 85% to 90% for the 12-month model, which he claims is significantly greater than what other modeling technologies offer. Once there is a good level of confidence achieved in these models, they can be adjusted and tweaked to see what changes may result in completion optimizations for future wells in the same area.

He compared this way of building a model to the way models are built for driverless cars or autopilot systems in commercial aircraft. He also uses the challenges of the pharmaceutical indus- try as an analogy.

“When they want to make drugs, they have some measurements and some ideas, but nothing is precisely, deterministically, or mathematically modeled in medicine,” he said. “But we know a lot about the human body and how it functions, and so dealing with hydraulic fracturing and production optimization in shale is pretty much like that.”

石油圈

石油圈