After falling to three-month lows, breaking below its bear market threshold around $40/bbl, oil prices rebounded sharply in the last two weeks on positive forecasts from the IEA, and news of a possible oil output freeze talk by OPEC’s members. Adding to the support, last week’s decline in U.S. gasolines and crude oil inventories have also supported the rally in oil prices.

The current rally in oil prices has resulted in Brent crude settling above $50/bbl. A level which oil prices crossed few weeks ago before retreating back below $50/bbl on worries of supply glut. During that time, the strong rally in oil prices encouraged U.S. shale oil producers to resume drilling activities especially when oil prices reached to $50/bbl.

The same thing is happening all over again now as the rally in oil prices is back in action. In fact, this time it is happening much faster than before. This can be seen from the immediate increase in U.S. rig count in the last two weeks since oil prices started rising.

During the first week of the current oil prices rally, U.S. rig count surprisingly increased by 17 rigs. And last week, as oil prices reached to $50/bbl, U.S. rig count also increased by 10 rigs and U.S. crude oil production increased sharply by 152,000 bbl/day for the first time this year.

It is clear that the current positive news and forecasts from OPEC and IEA are not only supporting the rally in oil prices. They are also increasing the threat to oil prices’ sustainability especially as oil prices reach levels higher than $50/bbl.

The sharp and immediate increase in U.S. rig count and oil production in the last two weeks is a clear example of such side effect to the current support to oil prices. In fact, the increase in both U.S. rig count and oil production is what caused the oil prices to fall few weeks after reaching to $50/bbl as supply glut resurfaced.

But why should we worry about the current increase in U.S. rig count and oil production. It is a normal thing that when oil prices increase, oil producers resume drilling activities which leads to an increase in oil production. That is true, however this time things are a bit different and here are two reasons why the current increase in U.S. rig count and oil production is a threat awaiting oil prices at $50/bbl and above.

1- Disappearance of the Lag Between the Movements in Rig Count and Oil Prices

One of the important lessons of the current oil market downturn is that, we have to admit the fact that so many things have changed in the dynamics of the oil industry and the relationship between different oil market parameters. We can look back at the past, and learn the lessons. But we must not evaluate the current oil market state solely based on these lessons.

The relationship between rig count and oil prices is a simple example. Past lessons of the oil market cycle have thought us that rig count and oil prices influence each other, and that there is a lag between the effect of the movements in oil prices and rig count on one another. Unfortunately, that is not the case anymore, at least in the current oil market state.

I read an article on March 2016 in which the author discusses the impact of the increase in oil prices on rig count. Based on the past lessons, the author concluded that “the rig count may not rebound immediately even if oil prices rise”. And based on that, he expected U.S. crude oil production to continue declining. What actually happened next was the exact opposite.

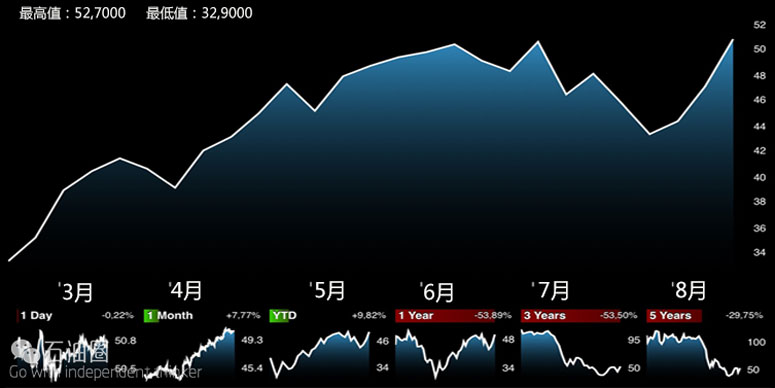

Since the end of May 2016 up until today, U.S. rig count has been in a continuous increase with only few declines as seen in the figure below. In addition, U.S. oil production’s response to the rise in rig count and oil prices was faster than many analysts have expected. Almost one month after U.S. rig count started its upward trend, crude oil production reversed course and started increasing in early July 2016 for almost a month.

These trends have caught the oil market by surprise and resumed worries over supply glut when oil prices rose above $50/bbl last time. Because, in a market that is already struggling with oversupply issues, an increase in rigs and the subsequent increase in oil production is the last thing we need. These increases in U.S. rig count and oil production put so much pressure on oil prices in the last weeks, and along with other parameters, they were responsible for the recent fall in oil prices.

What we understand from this example is that, the lag between the effects of the movement in either oil prices or rig count on each other is no longer as what it used to be. The impact now is almost an immediate impact and last two week’s increases in U.S. rig count does support this fact.

Immediate impact of oil prices on rig count means that as oil prices increase or even if prices are sustained around $50/bbl, U.S. rig count will continue increasing. This increase in rig count will be translated into an increase in oil production in a short period of time. And the last thing the oil market needs right now is an increase in oil production.

2- The Current Scenario Has Already Happened Before

Not so long ago, crude oil prices rose above $50/bbl for the first time in May 2016. We all remember that event. But, do you still remember what prevented oil prices from continuing its rally or even sustaining it at that level? It was the fact that as oil prices hit $50/bbl, glut worries resurfaced.

At that time, oil and gas investors and traders started to worry about robust price gains. They felt that strong price gains could encourage drilling activities and result in more oil output which will add to the global glut. They were not wrong at all.

In fact, as oil prices reached to $50/bbl on May 2016 for the first time, U.S. rig count started an upward trend increasing since that time up until today. And less than a month later, U.S. crude oil production reversed a course as well and started increasing as shale oil producers begun drilling more wells on plays which were economical at that price level. These activities along with other market factors led to the recent collapse in oil prices few weeks ago.

The same scenario is taking place right now. Oil prices are rising on support from OPEC’s output freeze talk and IEA’s forecasts and have already reached to $50/bbl. U.S. rig count is increasing and expected to continue this trend for few weeks to come. U.S. oil production started increasing sharply last week for the first time after it increased in July during the previous rally. And soon enough, worries of supply glut will be back, repeating what happened during the last few weeks.

It should be clear by now that the only way to achieve a sustainable recovery in oil prices is for all oil producers to collaborate together to stabilize oil prices. OPEC’s output freeze talk could help oil prices reach to $60/bbl. However, the fast return of shale oil producers could turn things up side down. OPEC’s talk could end up as a failure if shale oil producers resumed drilling activities fast, and U.S. oil production continued increasing like how it did last week.

We should not also forget that Saudi Arabia’s market share war is not over yet. The only purpose for their recent output freeze talk is to prevent oil prices from collapsing further bellow $40/bbl, not to support a fast return of U.S. shale oil producers. Therefore, if U.S. rig count and oil production continued increasing in a fast pace, OPEC’s output freeze deal could fail, and oil prices might not sustain their current gains.

石油圈

石油圈