While low commodity prices can hurt any major producer, oil prices can have a particularly detrimental effect on oil-rich economies. This is because, for better or worse, many of these economies hold onto oil as an anchor for achieving growth, filling government coffers, and even fueling social programs.

If those revenues don’t materialize as planned, these countries turn increasingly fragile. In the worst case scenario, an extended period of low oil prices can cause the fate of an entire regime to hang by a thread.

WHICH COUNTRIES ARE DAMAGED MOST BY LOW OIL PRICES?

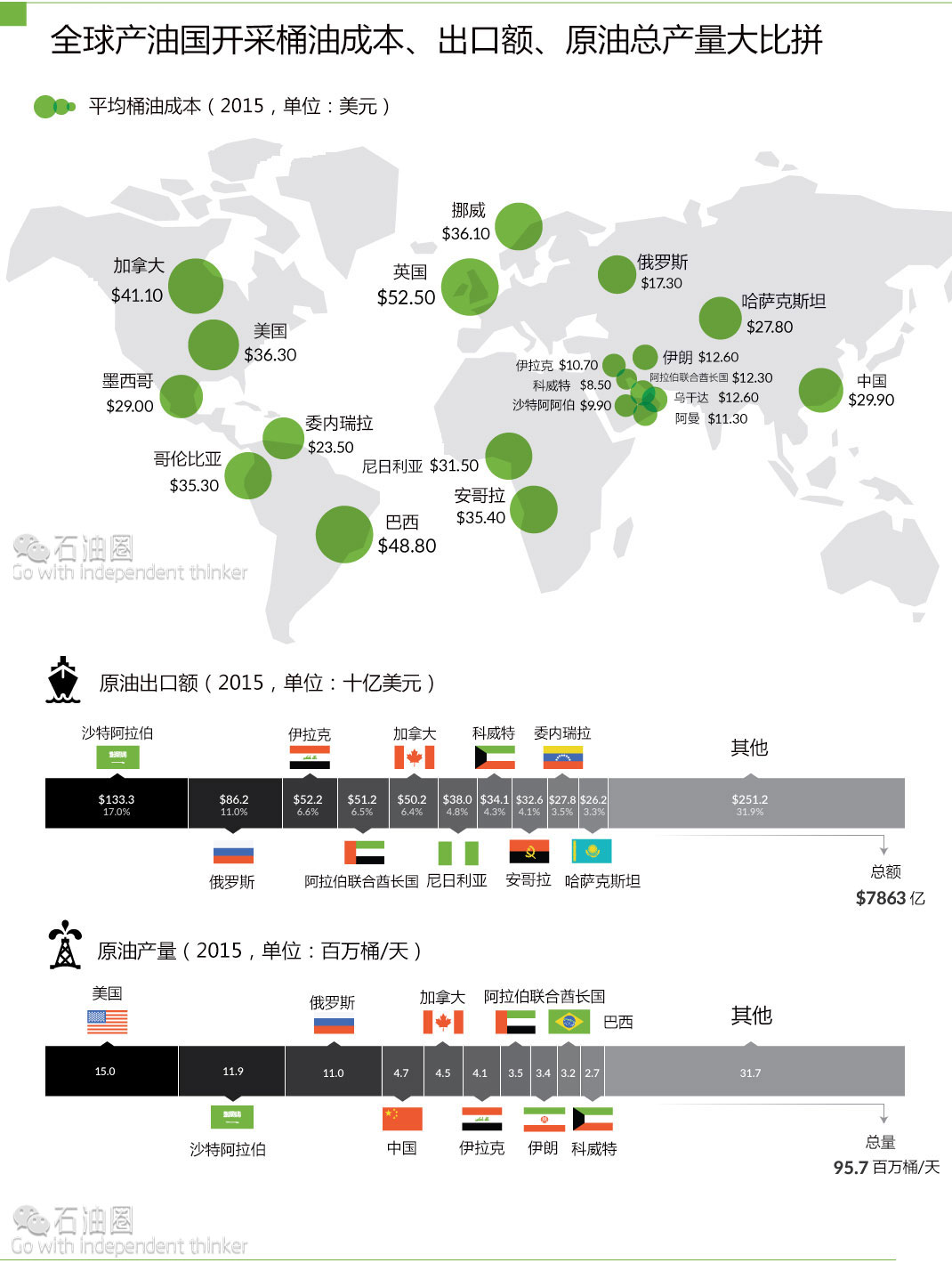

This week’s chart explores three key pieces of high-level data on the oil sector from 2015: the cost of production ($/bbl), total oil production (MMbbl/day), and the world’s top exporters of oil ($).

The general effects of these factors are pretty straightforward:

Countries that have a high cost of production per barrel are going to find it tough to make money in a low oil price environment

Countries that are major producers or exporters tend to rely on oil revenues as a major economic driver

Oil producers that are major exporters also have to deal with another factor: the effect that low oil prices may have on their currencies

Here are some particular countries that are under duress from current energy prices:

Venezuela

Back in the Hugo Chávez era, things were better in Venezuela than they are today. Oil prices were mostly sky-high, and this enabled the socialist country to bring down inequality as well as put food on the table for its citizens. However, as the World Bank described in 2012, since oil accounted for “96% of the country’s exports and nearly half of its fiscal revenue”, Venezuela was left “extremely vulnerable” to changes in oil prices.

And change they did. Oil prices are now less than 50% of what they were when the World Bank wrote the above commentary. Partially as a result, Venezuela is having all sorts of problems, ranging from runaway hyperinflation to shortages in almost everything.

Venezuela’s cost per barrel isn’t bad at $23.50, but the country is the world’s ninth-largest oil exporter with $27.8 billion of exports in 2015. If oil prices were north of $100/bbl, Venezuela’s situation would be a lot less dire.

Russia

Russia is the world’s second-largest crude oil exporter, shipping $86.2 billion to countries outside of its borders in 2015. That’s good for 11.0% of all oil exports globally. Russia’s cost of production in 2015 was relatively low, at $17.30 per barrel.

But is declining oil revenue influencing foreign policy? It’s hard to say – but we do know that, historically, leaders have turned to nationalist projects during tougher economic times. In this case, Putin may have focused Russia’s national attention on Ukraine as a way to deflect from a less-than-rosy economic outlook.

Brazil

All is not well in Brazil, where President Dilma Rousseff could be impeached by as early as next week.

Brazil is the ninth-largest producer of oil globally, pumping out about 3.2 million barrels per day. However, a bigger concern may be the cost of producing oil in the country. The production cost in 2015 was a hefty $48.80/bbl, among the most expensive of major oil producers.

The post-Olympics hangover will be a challenging one in Brazil, as it faces its worst economic crisis in 30 years. The largest country in Latin America had its economy shrink 5.4% in the first quarter of this year.

Nigeria

Nigeria, which will soon be one of the three most populous countries in the world, is also very reliant on oil revenues to prop up its economy.

The country has a $7 billion budget deficit due to lower oil revenues, and it recently also dropped its peg to the U.S. dollar on June 15th. The naira fell 61% against the dollar since then, wreaking havoc throughout the economy. Nigeria also recently lost its title of “Africa’s largest economy”, handing it back to South Africa.

Nigeria is the sixth-largest exporter of oil, with annual exports of $38 billion in 2015. Its cost of production is higher than average, as well, at $31.50 per barrel.

Canada

Canada’s economy is largely diversified, but it is also the world’s fifth-largest exporter of oil with $50.2 billion of exports in 2015. Costs are also high in the oil sands, and the average cost of production per barrel was $41.10 throughout the country.

The oil bust has dragged the energy-rich province of Alberta into a recession, and the Canadian dollar is alsoseverely impacted by oil prices for multiple reasons. Alberta’s economy is about to have its largest two-year contraction on record, while the provincial government’s deficit has exploded to $10.9 billion.

Energy investment in Alberta is forecast to be about half of the total from 2014. Meanwhile, economic conditions elsewhere have also been impacted, as areas such as housing, retail, labor markets, and manufacturing have all felt the pinch.

石油圈

石油圈