持续的低油价以及利润的下滑,致使油气公司、钻井公司、油服公司三方苦不堪言。日前,三方不断降低各自运营成本,相互角力,力求顺利度过油气“黑暗时代”。在北美市场,今年前三个月三大油服公司均出现亏损,各方形势都不容乐观!节源开流能解决油气行业目前的困扰吗?这是油气低迷背景下的最佳选择吗?

低迷市场阴影笼罩下 石油巨头无处可藏

近期,埃克森美孚和荷兰皇家壳牌公司都公布了最新一季度的收益情况,两家公司的收益情况分别创造了自1999年和2005年以来的新低。而雪佛龙公司连续第三季的亏损,则标志着其27年来最长时间的衰退。BP也提出,其炼油利润率已经达到六年来的最低点。

产能过剩的现象如此持久,以致于石油产业对于生产与需求可以重归平衡的希望显得特别渺茫。同时这种现象使行业分析师感到十分迷惑,也令许多投资者内心十分纠结,处于撤资的边缘,因为原油市场看起来极有可能进入另一个熊市。

圣路易斯州Edward Jones&Co.的一名分析师Brian Youngberg在一次采访中表示,石油价格、天然气价格、炼油利润率,所有这一切现在看起来都不乐观。由于柴油价格与汽油价格也在不断下降,这些公司无法像之前原油价格下降时期那样,转而从事风险较小的炼油行业。Youngberg称,“我们可以清楚地看到,这些石油巨头们已经无处可藏了”。

BP表示,尽管与第一季度相比,布伦特原油价格的回升使得公司情况有所缓解,但炼油利润率还会继续承受很大的压力。鉴于从加拿大到尼日利亚恢复生产的趋势依然疲软不振以及需求量增长缓慢等因素,CEO Bob Dudley表示,公司依旧面临着艰难情形。

BP打响行业成本战

利润率下滑,炼油行业也无法成为各大油企的避风港,石油行业的现状每况愈下。在此背景下,削减成本,一触即发。BP墨西哥湾深水钻井项目有可能成为石油行业成本战的新成员。

当英国石油巨头BP于2011年宣布该项目的二期规划时,该项目的投资规模约200亿美元。近期,BP CEO Bob Dudley称,由于钢材、钻井服务等成本开销急剧下降,精简后的项目投资规模将降至90亿美元。

纵观整个行业,很多公司都在大刀阔斧地削减开支。根据咨询公司Wood Mackenzie预测,在2015-2020年期间,整个行业将通过裁员、推迟项目、改变钻井技术和减少外部承包商数量等措施已减少1万亿美元的开销。自2014年开始,油价下跌了60%,导致石油行业发展受阻。目前生产商力图坚持降本,保存实力,而油服公司则在设法扭亏为盈。

雪佛龙的董事会主席兼CEO John Watson表示,公司依旧在进行调整以适应低油价的环境。雪佛龙已经通过减少钻井项目、取消成本较高的的勘探项目以及解雇十分之一的员工等措施来应对市场主导的资金周转不灵的境况。公司期望通过出售资产的方式来筹资50-100亿美元,以支撑其资产负债表的均衡。

纽约的巴克莱银行分析师 J. David Anderson表示,“行业成本将是未来6-12个月的决定性话题,由于油公司开始着重于提升产能,致使他们需要更多的服务,而油服公司也利用这一机会将服务价格报的更高。”

近期,Dudley向投资者透露,即使油价反弹,BP也将坚持缩减75%的开支。在上月的收益报告中,美国页岩钻井公司称,他们一半以上的开支缩减归功于该公司不断提高的效率。但是像斯伦贝谢以及哈里伯顿这一类油服公司,他们从事的钻井和水力压裂作业项目大多位于全球各地,情形有所不同。在油价低迷期,他们可以通过降低服务费来保持业务量,但降价只是暂时性的。

休斯敦哈里伯顿公司总裁Jeff Miller表示,价格谈判就像在酒吧里大吼大叫,但他们相信价格会回升。美国的基准油价在跌破40美元/桶后,上涨了20%,而在本月初又跌进了油价熊市。

休斯敦的Apache石油勘探公司首席财务官Stephen Riney表示,Apache该公司采取的绝大多数措施都是自救式的、通过改变其工作方式来实现的,而这些举措都与第三方报价息息相关。

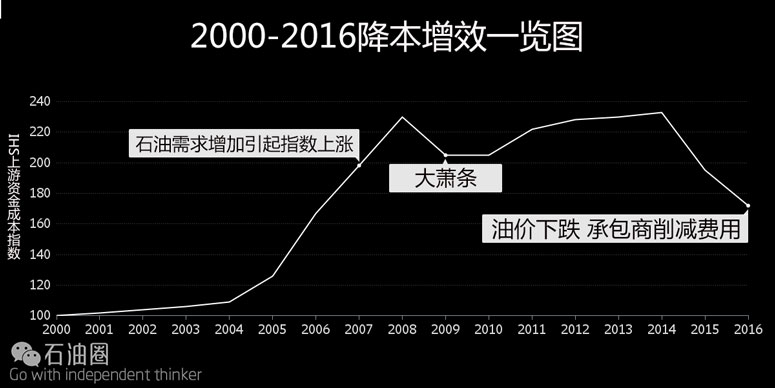

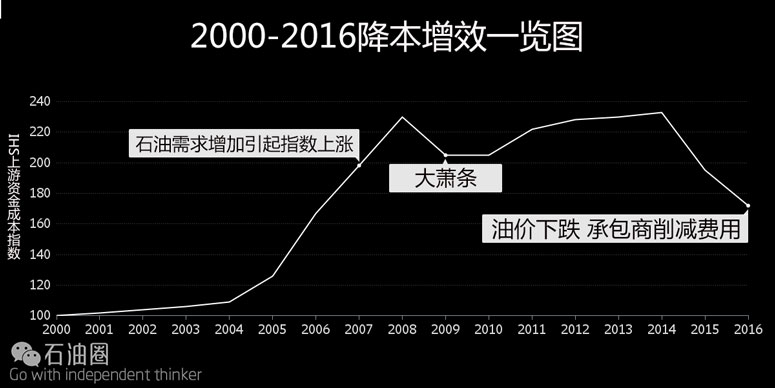

IHS Markit研究公司上游业务主管Pritesh Patel称,只有当行业变得更高效时,大家才有可能获得更多的收益。造成行业衰退的近一半原因,是美元走强造成原材料和人力成本的相对价格的下跌,其他主要原因是由于承包商的降价造成的。

利润空间几近负值 油企继续削减开支?

Patel预计石油生产商将持续削减三分之一的成本。德州南部的Eagle Ford页岩区也即将成为削减开支的典范,那里的钻机日费在两年的低迷期内已降到了之前的四分之一,据彭博社情报预测,目前钻机日费只有18208美元/天。

油服公司表示目前报价已到了退无可退的地步了。斯伦贝谢、哈里伯顿、贝克休斯,三大油服巨头均表示,2016年在北美市场前三个月均出现亏损。

在近期的一次会议上,斯伦贝谢CEO Paal Kibsgaard表示,目前各供应商都开始涨价造成公司成本大幅提高,利润空间已经成负值。

更新设施VS节源开流

石油勘探公司称他们已经作出了改变。在北海,如BP等生产商正在标准化大到钻井设备,小到灯泡、油漆等所有设施。在美国,许多公司已开始在页岩气区块扩建基础设施,通过管道运输取代卡车来运输原油和污水。

在德州西部的二叠纪盆地,Devon能源公司将井场接入电网,其CEO Tony Vaughn在8月3日的一次会议上称,此举节约了租赁300台发电机的费用。西方石油公司CEO Vicki Hollub称,公司优化了钻井设计,缩短了钻井周期,节约了80%的成本。

近期,Apache CEO John Christmann告诉行业分析师,公司已经重商讨了供电、供水以及化学品处理的合同,并削减了17%的评价钻井效率的租赁-运营费用。哈里伯顿CEO Dave Lesar上月称,生产商如Apache和 Devon,正不得不接受油服公司窘境的“现实”。

他表示,通过提高效率,公司确实从一些客户那里获得了可持续的收益,这一部分举措将继续实施。但另一些,如进一步降价等举措,则不具有可持续性,将来还得恢复价格。

降低企业运营成本,能够暂时性缓解各大油公司、油服公司的困境,那么长远角度考虑,各大油企如何挣脱自身窘境,寻求利润空间呢?欢迎大家各抒己见,分享各自的观点、看法,在下方留言一起探讨,共同寻找行业发展的曙光。

作者/Alex Nussbaum 译者/白小明 编辑/徐文凤

Mad Dog, BP Plc’s drilling project deep in the Gulf of Mexico, could be Exhibit A in the oil industry’s war on cost.

When the British oil giant announced the project’s second phase in 2011, it put the price at $20 billion. Last month, after simplifying plans and benefiting from a sharp drop in everything from steel to drilling services, Chief Executive Officer Bob Dudley said he could do the job for $9 billion.

Across the industry, companies have taken a chainsaw to expenses, slashing spending for the 2015-to-2020 period by $1 trillion through cutting staff, delaying projects, changing drilling techniques and squeezing outside contractors, according to consulting firm Wood Mackenzie Ltd. That’s cushioned businesses as oil prices plunged 60 percent since 2014. Now producers seek to show they can make the savings stick, while service providers try to reverse their losses.

Industry costs “may be the defining issue of the next six to 12 months,” said J. David Anderson, a Barclays analyst in New York. “As you start ramping up, the fact is you’re going to need more services and they’re going to have to come in at a higher price.”

London-based BP expects 75 percent of its reductions to hold even if oil rebounds, Dudley told investors in July. In earnings reports over the past month, U.S. shale drillers said at least half of their savings are permanent improvements in efficiency. But service providers such as Schlumberger Ltd. and Halliburton Co., which perform much of the drilling and hydraulic fracturing around the globe, tell a different tale: They may have cut rates to keep business during the oil rout, but those discounts were temporary.

“Price negotiations have been a barroom brawl,” Jeff Miller, president of Houston-based Halliburton, said on a July 20 conference call. “But we believe prices will recover.”

Who’s right could have big implications for the oil industry and the broader economy.

U.S. benchmark oil has climbed almost 20 percent since closing below $40 a barrel and slipping into a bear market earlier this month. The grade traded at $47.23 as of 9:15 a.m. New York time on Thursday.

“A lot of the actions that we’ve taken are what we would call self-help type of things, changing the way we work,” said Stephen Riney, chief financial officer of Houston-based Apache Corp., an oil explorer. “These are things that are not dependent upon the pricing from third parties.”

While the industry has gotten more efficient, it’s likely to give back most of the gains, said Pritesh Patel, upstream director at research firm IHS Markit Ltd. About half the decline came as a strong U.S. dollar reduced the relative price of materials and labor, Patel said. Contractor discounts accounted for much of the rest, he said.

Sustaining Cuts

Producers will be lucky to sustain a third of the cost reductions, Patel predicted.

One example of a cut that may soon be lost is in the Eagle Ford Shale in south Texas, where the price to lease a drilling rig with a crew tumbled by almost a quarter in the two-year downturn to $18,208 a day, according to a Bloomberg Intelligence estimate.

Service providers say they’re getting to a point where they may no longer be able to offer such a discount. Schlumberger, Halliburton and Baker Hughes Inc., the top service companies, all reported losses in North America in the first three months of 2016.

“A large wave of cost inflation from every part of the supplier industry is now building,” Schlumberger CEO Paal Kibsgaard said on a July 22 call. Profit margins, he said, are “deeply negative.”

Permanent Changes

Oil explorers insist they’ve made lasting changes. In the North Sea, producers such as BP are standardizing everything from drilling equipment to the light bulbs and paint used on offshore rigs. In the U.S., companies have built out infrastructure in shale plays, installing pipelines to transport crude and wastewater rather than paying to truck it away.

In the Permian Basin in west Texas, Devon Energy Corp. has extended electricity to its well sites, allowing it to eliminate 300 rented generators, Chief Operating Officer Tony Vaughn said on an Aug. 3 call. Occidental Petroleum Corp. CEO Vicki Hollub said her company has improved well designs and can drill more quickly, accounting for about 80 percent of cost reductions.

Apache has renegotiated power, water and chemical-handling contracts and cut lease-operating expenses, a measure of drilling efficiency, by 17 percent, CEO John Christmann told analysts on Aug. 4.

Producers such as Apache and Devon are going to have to accept “the reality” of the service companies’ situation, Halliburton CEO Dave Lesar said last month.

“Some of the efficiency gains we have made with customers are in fact sustainable and will continue, but others including deep uneconomic pricing cuts are unsustainable and will have to be reversed,” he said.

未经允许,不得转载本站任何文章:

-

- 阿佳徐

-

石油圈认证作者

- 毕业于黑龙江大学英语口译专业,具有丰富的翻译工作经验。致力于观察国际油气行业动态,能够快速、准确传递油气行业最新资讯,提供丰富的油气信息,把握行业动向,为国内企业提供专业的资讯服务。(QQ:348418756)

石油圈

石油圈