Louisiana’s Sinking Coast Is a $100 Billion Nightmare for Big Oil.The state can’t pay, so someone has to. And the water keeps rising.

From 5,000 feet up, it’s difficult to make out where Louisiana’s coastline used to be. But follow the skeletal remains of decades-old oil canals, and you get an idea. Once, these lanes sliced through thick marshland, clearing a path for pipelines or ships. Now they’re surrounded by open water, green borders still visible as the sea swallows up the shore.

The canals tell a story about the industry’s ubiquity in Louisiana history, but they also signal a grave future: $100 billion of energy infrastructure threatened by rising sea levels and erosion. As the coastline recedes, tangles of pipeline are exposed to corrosive seawater; refineries, tank farms and ports are at risk.

“All of the pipelines, all of the things put in place in the ’50s and ’60s and ’70s were designed to be protected by marsh,” said Ted Falgout, an energy consultant and former director of Port Fourchon.

Louisiana has an ambitious — and expensive — plan to protect both its backbone industry and its citizens from this threat but, with a $2 billion deficit looming next year, the cash-poor state can only do so much to shore up its sinking coasts. That means the oil and gas industry is facing new pressures to bankroll critical environmental projects — whether by choice or by force.

“The industry down there has relied on the natural environment to protect its infrastructure, and that environment is now unraveling,” said Kai Midboe, the director of policy research at the Water Institute of the Gulf. “They need to step up.”

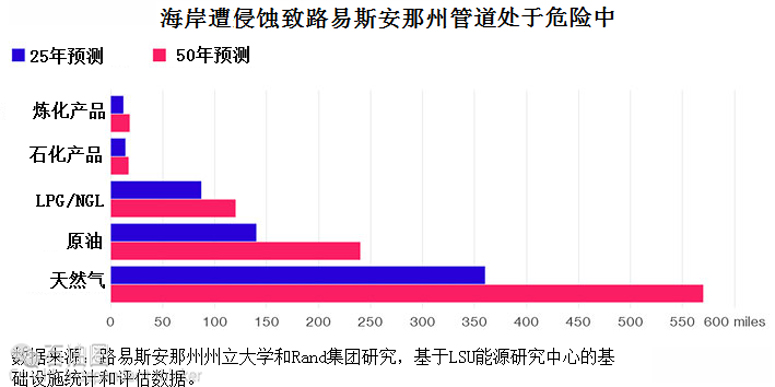

Every year in Louisiana, more than 20 square miles of land is swallowed by the Gulf. At Port Fourchon, which services 90 percent of deepwater oil production, the shoreline recedes by three feet every month. Statewide, more than 610 miles of pipeline could be exposed over the next 25 years, according to one study by Louisiana State University and the Rand Corporation. Private industry owns more than 80 percent of Louisiana’s coast.

The land loss exacerbates another natural threat: storm-related flooding, like that affecting Baton Rouge now. As days of heavy rainfall caused water to overrun levees along several tributaries this week, Exxon Mobil Corp. began shutting units at its Baton Rouge refinery, the fourth-largest in the U.S. About 40,000 homes in southeastern Louisiana have been affected by the devastating flooding, and at least 11 people have died.

In Louisiana, marshes, swamps and barrier islands can mitigate flooding, soaking up rainfall like a sponge and reducing storm surge. But as the land erodes, storms advance without a buffer, and Louisiana’s flood protection systems become less effective. The state estimates that damage from flooding could increase by $20 billion in coming years, if the coastline isn’t reinforced.

Midboe, with the Water Institute and the U.S. Business Council for Sustainable Development, is leading an effort to get companies to invest in restoration projects that directly affect their infrastructure. This month, over a lunch of fresh Gulf shrimp at Port Fourchon’s headquarters in Galliano, Midboe made his pitch to a group of about 20 industry representatives.

“The problems are real. We need to deal with them now,” Midboe told the executives. “The public funding needed to protect this infrastructure is going to fall far short.”

The task force, Midboe explained, would identify restoration projects that could protect the industry’s hard assets. Member dues would cover operational costs, and companies that would benefit from projects would share the cost of construction.

r to environmental threats to its infrastructure, according to a study by America’s Wetlands Foundation and Entergy Corp. By 2030, those losses could exceed $350 billion.

The America’s Wetlands Foundation has already partnered with ConocoPhillips, Chevron Corp. and CITGO Petroleum Corp. to build a one-mile, $1 million pilot project mitigating erosion along the Gulf Intracoastal Waterway, a shipping route used by oil and gas companies.

“I would think that the larger investors in Louisiana would be willing to look at this as part of their long-term business plan,” Val Marmillion, managing director of America’s Wetlands, said. “We can figure out a way to do these projects.”

But so far there is little sign that companies are clamoring to spend the millions — or billions — of dollars needed. BP Plc., Chevron Corp., Royal Dutch Shell Plc. and Exxon Mobil Corp. declined to comment on the extent of their investments in environmental projects.

ConocoPhillips, the largest private wetlands owner in the state, said a combination of public and private funding was used to pay for 77 restoration projects enhancing 177,000 acres of its own wetlands. An additional 18 are underway, spokesperson Andrea Urbanek said.

There’s another model for getting a company to pay up.

On the southern tip of Louisiana, state contractors are working 24 hours a day on a narrow strip of beach island along the Gulf of Mexico that will shield nearby Port Fourchon — and its more than $1 billion of infrastructure — from storms and flooding.

The project is being paid for out of the nearly $9 billion Louisiana is receiving from BP Plc and others for the 2010 Deepwater Horizon disaster.

The state has earmarked the bulk of those funds for rebuilding its coastline. While other Gulf states affected by the oil spill must use their settlement money on projects that directly remedy harm caused by the disaster, Louisiana fought to spend its share on unrelated coastal restoration projects.

“Louisiana asked for very specific language in the plea agreement,” said Tanner Johnson, director of the Gulf Environmental Benefit Fund responsible for dispensing $2.5 billion of the BP payout.

That decision has jump-started Louisiana’s efforts, but even those billions won’t be enough. Saving Louisiana’s coastline could cost between $50 billion and $100 billion, according to the state’s Coastal Protection and Restoration Authority. That has prompted some state and local officials to press other oil and gas companies for even more cash.

“Those responsible for the Deepwater Horizon spill are paying, but we are still tens of billions short” in paying for the coastal restoration plan, New Orleans Mayor Mitchell Landrieu said at a conference in June. “It’s time for a new covenant, between the leaders of the oil industry and the people of Louisiana: We want you to drill and explore, but only if we repair what you have broken.”

Landrieu’s remarks touch on a sensitive issue for Louisianans: The BP settlements are funding a good deal of the state’s coastal restoration plans. To what extent should the rest of the oil and gas industry do the same? It’s not just a theoretical question.

Four parishes – Jefferson, Plaquemines, Cameron and Vermilion – are suing dozens of oil companies for money to fund coastal restoration projects in their vicinity. The suits allege that, over decades, the companies violated their coastal land use permits by not remediating the areas in which they operated.

The industry has been contending with similar “legacy suits” for at least 15 years. New this time around is the establishment support this effort has received from politicians as high as Governor John Bel Edwards. In April, Edwards moved to make the state of Louisiana a plaintiff in the litigation.

“If there are any financial proceeds that come out of this, we want to make sure they are appropriately used to restore the coast,” said Patrick Courreges, a spokesman for the Department of Natural Resources, which intervened in the litigation on the governor’s behalf.

BP’s payments should not be a model, others in the industry argue.

“That’s a situation where money was obtained because a company’s conduct caused a problem. That’s not a license to sue all oil companies,” Bobby Meadows, an attorney representing Chevron, said about the lawsuits.

Industry representatives argue that oil and gas companies are already paying for coastal restoration through offshore oil and gas royalties. However, low oil prices and related production cuts have dramatically reduced the revenues that Louisiana’s receiving from offshore royalties. In 2015, the state pulled in just $816,728.

That could change within a few years. If production increases, Louisiana could receive a maximum of $176 million in 2018.

“That’s a lot of money that’s going to be going into the coastal program,” said Don Briggs, president of the Louisiana Oil and Gas Association. Those revenues, he argues, are a “sufficient” contribution from the industry. As such, “There is absolutely no talk among industry of any settlement” to the lawsuits, Briggs said.

Settling would be tantamount to shouldering responsibility for a crisis that has many causes.

From the passenger seat of a Cessna 185 sea plane, some of the thousands of miles of canals cut through the delta are still visible as straight lines of green jutting out into the murky Gulf waters. The canals played a role in today’s coastal crisis, enabling salt water from the Gulf to infiltrate the freshwater wetlands, deteriorating them, according to the U.S. Geological Survey.

While many Louisianans are frank about the damage that oil production has done to coastal lands, they hesitate to lay the blame on industry alone.

“Unquestionably, oil and gas activity has impacts,” said energy consultant Falgout, who owns large swaths of marshland affected by erosion and subsidence. “But oil and gas did what government let it do, like everyone else.”

Another culprit is the U.S. Army Corps of Engineers, which made the fateful decision to levee the Mississippi River after the Great Flood of 1927, thus preventing the river from naturally depositing its sediment across the delta. Also, shipping lanes were dredged over decades, and agriculture played a role.

Chris Dalbomb of the Tulane University Water Institute says: “I don’t think any of us can say we are not responsible to some extent.”

石油圈

石油圈