During the summer of 2014, WTI oil traded at prices north of $105/bbl.

Around this time, Bloomberg had an article titled “Oil Topping $116 Seen Possible as Iraq Conflict Widens”while even Investopedia forecasted on June 19, 2014 that oil prices could “hit $118.75” in the coming weeks.

Forecasting is hard, and that’s why we don’t usually do it. In this case, oil prices stunned many investors by dropping off a cliff, tumbling to less than $50/bbl close to six months later.

As Warren Buffett says, many people were caught swimming naked when the tide of high oil prices went out.

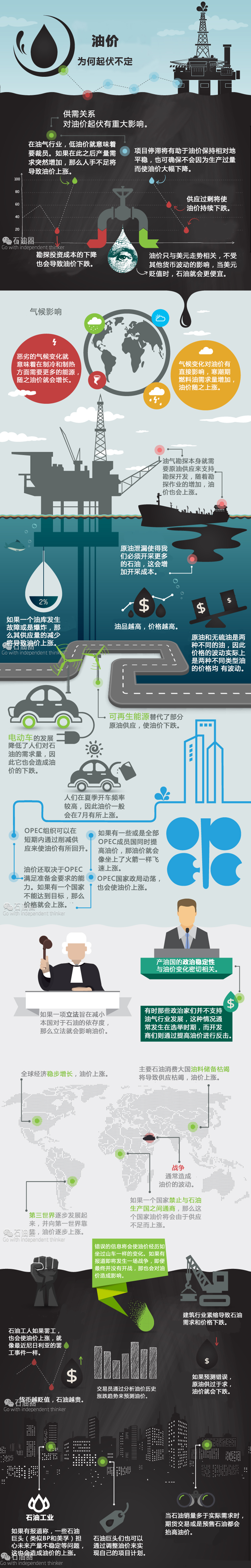

UNDERSTANDING WHY OIL PRICES FLUCTUATE

To avoid being caught in a similar situation in the future, it helps to understand why and how oil prices fluctuate. Today’s infographic from Jones Oil is here to help us understand the many different issues that can impact global oil prices.

It covers supply and demand, weather, technology, geopolitics, as well as other factors that make oil prices fluctuate.

Why Oil Prices Fluctuate

Supply and demand plays a big part in the rise and fall of oil prices.

Low prices mean layoffs in the oil sector. If this is followed by a sudden demand for increased production, the lack of staff will drive the price up.

Stalled projects help keep the price at a consistent rate and ensure it does not drop any further due to overproduction.

A higher level of supply than necessary will cause oil prices to continue to drop.

A global downturn reduces demand and oil prices.A drop in oil prices is often due to a drop in exploration investments.

Oil is valued in US dollars so regardless of any foreign currency fluctuation, when the dollar is deflated, it makes oil cheaper.

Weather

Extreme weather changes mean extra heat or air conditioning is required so oil becomes more expensive in response to demand.

Weather changes have a direct effect on oil prices. Heating oil is in demand during a cold spell, and so prices rise.

Oil exploration itself requires oil so the more exploration taking place, the higher the price of oil.

Oil spills into the ocean take away from supplies so more oil has to be brought into production, which increases cost.

If an oil reserve breaks down or blows up, it creates a strain on available supplies causing prices to rise.The higher quality the oil, the more it is sold for.

Crude oil and sweet oil are priced differently so it seems prices are fluctuating but in fact they are two different types of oil.The switch to electric vehicles has lowered the demand for oil, and as a result, oil prices.

The rise in renewable energies frees up oil supplies, causing a price dip.

People drive more in summer, so the price of petrol goes up in July.

OPEC(the Organisation for Petroleum-Exporting Countries) can cause a short-term spike in the price of oil by cutting supply.

If any or all of the OPEC countries decided to increase their price for oil, the overall price would rocket.

The price of oil depends on the ability of OPEC to meet reserve requirements. If one country can’t meet its targets, prices rise.

Policy changes –OPEC again- can spark a rise in oil prices.

LEGISLATION can influence oil prices where countries introduce laws aimed at reducing their reliance on oil.

POLITICAL INSTABILITY in oil-producing countries and volatile oil prices tend to go hand in hand.

Occasionally when oil falls out of favour with poloticians –usually during an election- the oil industry can hit back by increasing the price of oil.

GROWTH in global economies –and increased stability- causes the price of oil to rise.

Depleted oil reserves in major consumer nations create a DRAIN ON SUPPLY which sparks a rise in oil prices.

As third-world countries come in line with FIRST-WORLD STANARDS they need more oil so prices rise.

WAR creates volatile oil prices.

If a country places an EMBARGO on an oil-producing country, the prices of oil usually increases as supply has just dried up.

False information can cause the price of oil to rocket. If a war is reported as pending but doesn’t happen, it still affects the price of oil.

Workers in the oil industry can contribute to increased oil prices when they go on strike, as seen recently in Nigeria.

A contraction in the construction sector creates a fall in demand and in prices.

When a dip in currency occurs, oil becomes more expensive.

Traders set the price of oil in the future by relying on historical information.

If forecasts turn out to be wrong, there is more oil in supply than required, which causes the price to drop.

PETROLEUM INDUSTRY

If there are reports of instability around any of the large oil companies, such as BP or Esso, fear of future production problems drives prices up.

Major oil producers can change prices to suit their agenda.

Futures trading, or selling oil now for delivery in the future, can cause prices to rocket when more oil is sold than is actually available.

Ultimately, oil prices fluctuate because of changes to supply and demand, but the challenge for investors is that there are multiple factors at play that can affect those fundamentals. Many of them are interconnected.

These include weather events, supply interruptions (such as worker strikes or spills), broader demand trends such as the emergence of renewable energy, OPEC decisions, or other events that can have an immediate effect on supplies.

There are also meta factors, such as the “fear” that a future event may happen that could in turn affect supply and demand. This is where geopolitical risks get priced in, such as potential escalation of conflict in the Middle East or future election results of oil exporting nations.

Information and forecasts can also play a role. Imagine being an oil producer in early 2014, hearing some of the bullish reports above. Would you, or would you not invest in a project that had a breakeven of $60/bbl oil? Even a significant oil price fluctuation of +/- 30% would still have you come out on top.

However, as in the situation in 2014, this would have actually increased margin production, which would have only added to the glut in supply.

石油圈

石油圈