自当前经济形势低迷、油价下跌以来,跨国公司特别是几家大型跨国石油公司经营均处于守势,压缩投资已是主流趋势,但行业内仍出现了多起公司收购案,那么,下一桩公司收购案将会发生在哪家公司呢?今天,我们来聊一聊有什么独特的方法可以进行判断。

如果我们要判断一家石油公司是否有可能在未来收购其他的公司,那么我们首先会分析这家公司是否有能力在吸收了巨额债务的同时还能保证自身的资本负债率维持在合理水平。

由于国际油价持续走低,大型的企业并购案已鲜有发生。另外,油价的下跌也导致许多石油公司的资本负债率飙升。如果有一家石油巨头拥有足够的财力进行一桩大型收购的话,那么这家公司必然有能力承担债务并保持“健康”。

为什么我们必须分析企业债务?

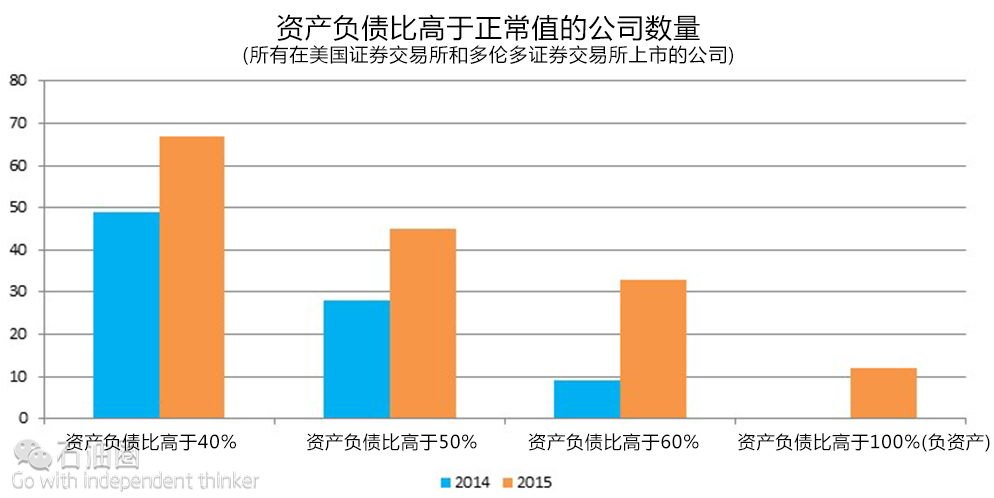

我们必须承认,自油价下跌以来,上游石油公司的资金状况已经发生了翻天覆地的变化。通过对那些在美国证券交易所上市的美国和国际公司以及在多伦多证券交易所上市公司进行分析可知,随着去年以来资产负债率的上升,这些公司的风险也在不断累积。同时,我们也可以得到一些有趣的结论。

由上图可知,这些上市公司2015年的资产负债比明显高于2014年。鉴于当前的低油价,这种现象不足为奇,甚至有些公司在2015年已经变为了负资产。

假设一个公司的负债资产比小于35%才被认为是运行良好的话,那么我们就可以以此为依据来判断哪一家加拿大或者国际石油公司有能力承担收购产生的额外债务,并保证自身债务维持在可控水平。以Tourmaline石油公司为例,根据该公司2016第一季度的资产负债表,它在收购其他公司的时候有能力承担7.99亿加元的债务,并保证其负债资产比低于35%。当然,这并不意味着这些公司一定会并购其他公司,只是说明他们拥有这样做的能力而已。

分析:油价低迷时期的几大收购案

在油价低迷时期,最高调的一桩公司收购案当属皇家壳牌以大约810亿美元的价格收购BG集团。而在加拿大,Suncor能源公司以66亿加元的价格收购加拿大油砂公司,并成为了Syncrude项目的最大股东。

这两桩收购案都拥有许多共同点:皇家壳牌和Suncor能源公司都是以发行股票的形式对目标公司进行收购,同时都承担了巨额债务。根据BG集团2015年的年度报告,壳牌是以每股383便士现金加0.4454股壳牌B股股份收购BG,并承担了BG集团100亿美元的债务;BG在2014年第四季度创50亿美元亏损,其主要缘由是公司在澳大利亚的资产因大宗商品价格下跌而被迫进行资产减记,且减值额度高达90亿美元,大量的收购致使成本膨胀,投资开发项目计划也一再推迟,使许多新发现大型油田的开采一直停滞不前,BG被收的命运似乎难以扭转。

据媒体报道,Suncor是用0.28股森科股票交换一股加拿大油砂公司股票对其进行收购,同时承担了24亿加元的债务。

2016年6月份,加拿大也出现了几桩类似的收购案。在Raging River勘探公司收购Rock能源公司的过程中,Raging River承担的债务总额为6700万加元,占总收购价格的61%;Gear能源公司将以2.325股Gear股票交换一股Striker股票对其进行收购,同时承担Striker公司1000万加元的债务。所以说,分析一家公司是否有能力承担债务并保证自身正常运作,是判断这家公司是否会收购其他公司的关键。

Suncor能源公司和皇家壳牌都有着出色的举债能力。根据媒体的报道,Suncor同其他几桩收购案都有牵连,而壳牌公司则考虑出售旗下的资产。据传,壳牌公司将在不久的将来出售该公司旗下的资产,波及10多个国家,并将对市场产生巨大冲击。

在前文提到的这些负债能力较强的公司中,许多公司已经开始出售其在加拿大的特许经营权,从而缓解油价低迷期现金流不足的问题。

近两年,石油公司想尽各种方法控制自身成本。同时,随着油价止跌回升,虽然以上几桩收购案并不代表大规模的收购潮正在到来,但也许我们很快就会见到下一桩石油行业收购案的发生。近日,埃克森美孚公司将以36亿美元的高价收购天然气开采商InterOil公司,以获得巴布亚新几内亚的石油开采,用于填补现有的天然气出口供应缺口。埃克森德克萨斯分公司的欧文在一份声明中表示,埃克森美孚公司将以45~71.87美元每股的价格将公司股票出售给InterOil,具体的价格取决于InterOil公司Elk-Antelope油田的储油量。如果收购成本的范围为25亿到30亿美元之间,那这会是埃克森四年以来最大的收购案件。

2015年是自2004年以来并购和收购最低的一年,而今年,在北美地区油气行业并购达43.9亿美元,业内人士称,这一结果有望继续保持。油价低迷的大环境下整个行业正陷入空前的萧条中,更多石油相关产业与企业将面临严峻挑战。油气公司收购行为可以说是一场赌局和博弈,固然有利好一面,但风险同样存在,究竟利大于弊还是弊大于利,都需要时间和历史的检验。

作者/Mark Young 译者/张强 编辑/Wang Yue

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈