India was the third-largest energy consumer in the world after China and the United States in 2013, and despite having notable fossil fuel resources, the country has become increasingly dependent on energy imports.

India was the third-largest energy consumer in the world after China and the United States in 2013, and its need for energy supply continues to climb as a result of the country,s dynamic economic growth and modernization over the past several years.1 India’s economy has grown at an average annual rate of approximately 11% between 2004 and 2014, and it proved relatively resilient following the 2008 global financial crisis.

The latest slowdown in growth of emerging market countries and higher inflation levels, combined with domestic supply and infrastructure constraints, reduced India’s annual inflation-adjusted gross domestic product (GDP) growth from a high of 10.3% in 2010 to 5.1% in 2012, according to the World Bank. India’s GDP growth rebounded to 7.3% in 2014 and 2015.2 India was the third-largest economy in the world in 2014, as measured on a purchasing power parity basis.3 Current risks to economic growth in India include continued fiscal deficits, infrastructure deficiencies, delays in structural reforms, and global energy price volatility. Overall, the low energy prices during the past two years have been beneficial for India, a major energy consumer, by reducing overall expenses and government subsidies. On the other hand, persistent lower energy prices could affect the capital investment needed to develop India’s more technically challenging upstream oil and natural gas projects.

The Bharatiya Janata Party (BJP), elected as the majority party in May 2014 to govern India in the following five years, faces several challenges to meet the country’s growing energy demand including securing affordable energy supplies and attracting investment for upstream projects and transmission infrastructure. Highly regulated fuel prices for consumers, fuel subsidies that are shouldered by the government and state-owned upstream companies, transmission bottlenecks, a complex regulatory environment, and inconsistent energy sector reform currently hinder energy project investment. Some parts of the energy sector, chiefly coal production, remain relatively closed to private and foreign investment, while others such as electric power, petroleum and other liquids, and natural gas have had regulated price structures that have discouraged private investment in the recent past. Insufficient and aging infrastructure impedes the flow of energy supply to meet India’s growing demand. Along with its pledge for deeper economic reforms, the new administration is supporting several energy reforms such as reducing petroleum product subsidies, reforming natural gas pricing policy, reducing electricity transmission and distribution losses and theft, alleviating regulatory burdens, and providing fiscal incentives to attract energy supply investment and to reduce infrastructure constraints.

Despite having large coal reserves and overall growth in coal and natural gas production over the past two decades, India is increasingly dependent on imported fossil fuels. India’s current administration under Narendra Modi has a goal of reducing India’s import dependency on oil and natural gas to two-thirds by 2022 and to half by 2030.5 India is also looking to further develop and harness its coal and various renewable energy sources. These actions would effectively increase India’s energy supply and create more efficiency in energy consumption. India has already begun implementing oil and natural gas pricing reforms since 2013 to foster sustainable investment and help lower subsidy costs.

Primary energy consumption in India more than doubled between 1990 and 2013, reaching an estimated 775 million tons of oil equivalent.6 The country has the second-largest population in the world, at nearly 1.3 billion people in 2014, growing about 1.4% each year since 2004, according to World Bank data.7 At the same time, India’s per capita energy consumption is one-third of the global average, according to the International Energy Agency (IEA), indicating room for higher energy demand in the long term as the country continues its economic development.8

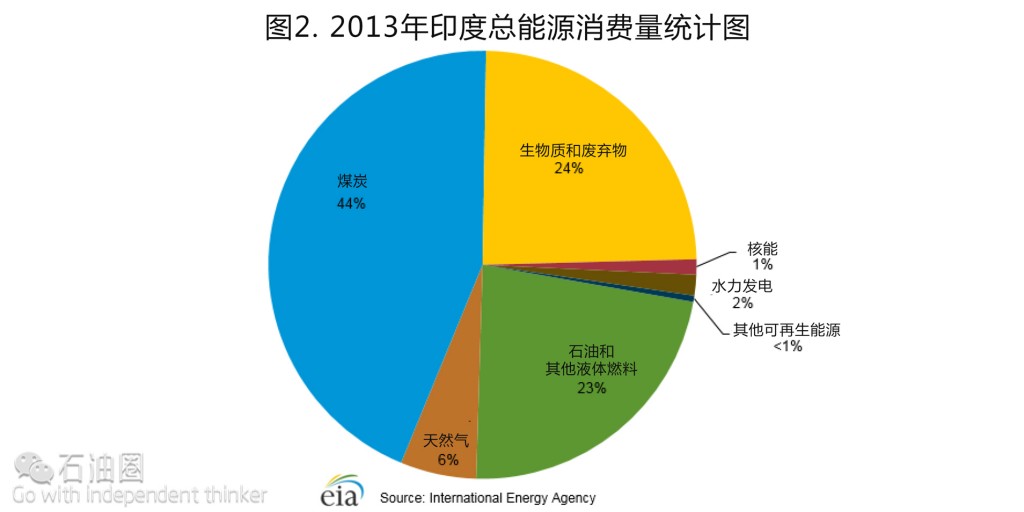

As shown in Figure 2, India’s largest energy source is coal (44%), followed by traditional biomass and waste (24%) and petroleum and other liquids (23%). Other renewable fuel sources make up a small portion of primary energy consumption, although the capacity potential is significant for several of these resources such as solar, wind, and hydroelectricity. Since the beginning of the New Economic Policy in 1991, India’s population has increasingly moved to cities, and urban households have shifted away from using traditional biomass and waste for cooking and lighting to using electricity sourced from other energy sources such as hydrocarbons, nuclear, biofuels, wind, and solar.

India’s power sector is one of the largest and fastest-growing areas of energy demand, rising from 11% to 15% of total energy consumption between 2000 and 2013, according to IEA.9 Although electrification rates in India vary by source based on definitional differences of electricity access, the IEA estimates that 19% of the population (240 million people) lacked basic access to electricity in 2013, while electrified areas still suffer from rolling electricity blackouts.10 The government seeks to balance the country’s growing need for electricity with environmental concerns from the use of coal to produce electricity. India’s transportation sector, primarily fueled by petroleum products, is set to expand as the country focuses on improving road and railway transit.

Petroleum and other liquids

India was the fourth-largest consumer of crude oil and petroleum products in the world in 2015, after the United States, China, and Japan. The country depends heavily on imported crude oil, mostly from the Middle East。

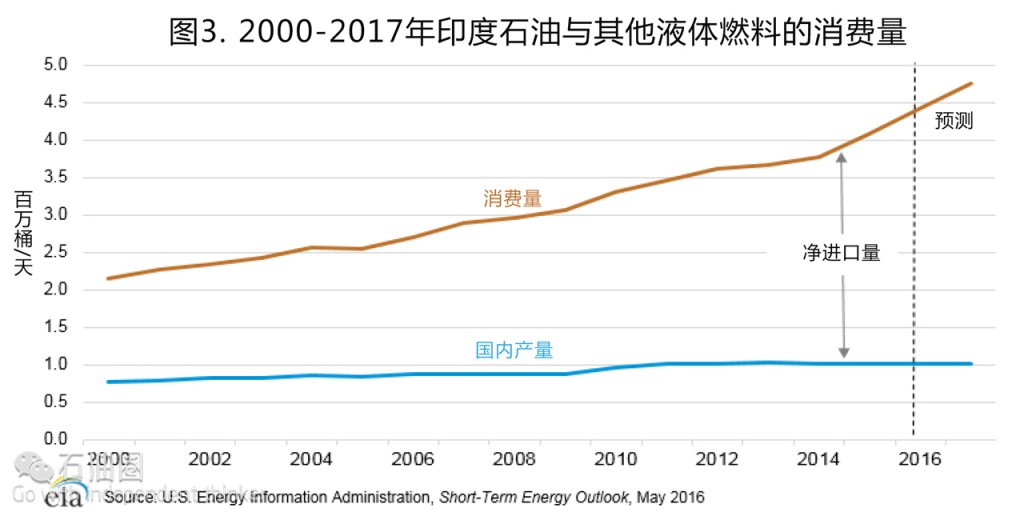

India was the fourth-largest consumer of crude oil and petroleum products after the United States, China, and Japan in 2015, and it was also the fourth-largest net importer of crude oil and petroleum products. The gap between India’s oil demand and supply is widening, as demand in 2015 reached nearly 4.1 million barrels per day (b/d), compared to around 1 million b/d of total domestic liquids production (Figure 3). EIA expects demand to accelerate in the 2016 through 2017 timeframe as India’s transportation and industrial sectors continue to expand under economic development, oil price declines since mid-2014, and recent government policy initiatives to increase highway and road infrastructure and promote Indian manufacturing.11 Dependence on imported crude oil has led Indian energy companies to diversify their supply sources. To this end, Indian national oil companies (NOCs) have purchased equity stakes in overseas oil and natural gas fields in South America, Africa, Southeast Asia, and the Caspian Sea region to acquire reserves and production capability. However, most crude oil and condensate imports continue to come from the Middle East, where Indian companies have little direct access to investment.

Sector organization

lndiais upstream petroleum industry is still mainly owned by state-owned firms, although the sector attracts some level of private and foreign investment. The government regulates the fuel price for petroleum products, although the mounting costs of fuel subsidies in recent years have encouraged the government to lift retail price caps on many oil products.

Almost two decades after nationalizing the country,s hydrocarbon resources in the 1970s, the Indian government embarked on the New Economic Policy in 1991 that pushed for open market competition across a variety of energy sectors. The government introduced the New Exploration Licensing Policy (NELP) in 1999 that allowed investors to bid on development blocks with up to 100% foreign control.

The last NELP bidding round (NELP IX) was concluded in 2012. International investment in India’s petroleum industry is still relatively low as a result of India’s complicated regulatory environment, recent legal disputes between some companies and the government, and a need for greater assessment of India’s oil and natural gas resources. NELP has had only limited success in reducing India’s oil dependence leading India recently to revamp its bidding process with new policies that could potentially allow for greater investment.

The previous system included a production-sharing mechanism allowing producers to recover exploration costs during production before sharing profits with the government. The new policy introduced a revenue-sharing system where the producer shares the revenues with the government prior to cost recovery as well as switching to an ad valorem production tax that is more flexible for producers during oil price volatility. Also, the government allows license operators to produce all types of oil and natural gas, including unconventional resources. It is unclear whether these policy changes will attract more private sector investment in India’s oil and natural gas upstream industry and alleviate some of the long-standing legal disputes between the government and oil and natural gas companies over project revenues.12 In May 2016, India’s government opened its first bidding round for 67 small and marginal fields in 9 basins under the new policy. Both state- owned and private companies can bid on these fields.13

The Ministry of Petroleum and Natural Gas (MOPNG) regulates the entire value chain of the oil sector, including exploration and production (E&P), refining, supply, and marketing. Under the MOPNG, the Directorate General of Hydrocarbons regulates the upstream side of the oil sector, as well as coalbed methane (CBM) projects. Another sub ministry, the Petroleum and Natural Gas Regulatory Board (PNGRB), acts as a downstream regulator, for activities including petroleum product sales and distribution.

Until 2002, the Indian government set the price of petroleum products through the Administered Pricing Mechanism (APM), which followed the principle of allowing a predetermined return (rather than market-based prices) on investments in the oil sector. After 2002, only certain products (namely kerosene and liquefied petroleum gases, or LPG, often used for cooking or home heating) remained regulated, while oil companies could set their own prices for other fuels. However, many oil marketing companies set retail prices at below- market levels so they could claim under-recoveries (the difference between a global market price and the local price) from the Ministry of Finance for certain products at favorable rates. In response to a mounting level of subsidies shouldered by the government and oil companies especially when international oil prices were high, the government began domestic fuel price reform and officially deregulated gasoline prices in 2010.

Deregulation of diesel prices was completed in October 2014 after a nearly two-year process to phase out the price caps.

Two state-owned companies, the Oil and Natural Gas Corporation (ONGC) and Oil India Limited (OIL), hold most of the production and refining activity in India. ONGC is India’s largest oil producer, accounting for about 69% of the domestic production in 2014, including oil produced from its joint ventures, according to the company’s annual report.15 A few private companies have emerged as important players in India’s oil industry the past decade, although they have not made significant inroads into the upstream sector. Cairn India, primarily owned by London-based firm Vedanta Resources, is the largest privately-owned producer of crude oil in India and has major equity stakes in the Rajasthan and Gujarat regions and in the Krishna-Godavari basin. Private Indian companies like Reliance Industries (RIL) and Essar Oil have become major refiners.

Exploration and Production

India held nearly 5.7 billion barrels of proved oil reserves at the end of 2015, mostly in the western part of the country. Domestic production has not kept pace with demand in recent years, leading to exploration of deepwater and marginal fields and investment in improving recovery rates of existing fields. In addition, Indian national oil companies are purchasing more upstream stakes in overseas oil fields to secure more oil supply from their own production.

According to the Oil & Gas Journal (OGJ), India held nearly 5.7 billion barrels of proved oil reserves at the end of 2015.16 The country’s offshore reserves have grown over the past several years, while onshore reserves have fallen. Offshore reserves made up slightly more than half of the country’s recoverable reserves as of April 2015. Most recoverable reserves are found in the western part of India, particularly the Western offshore area near Bombay and the onshore area in Gujarat. The Assam-Arakan basin in the northeastern part of the country is also an important oil-producing region and contains more than 22% of the country’s reserves.17 India remains underexplored as a result of insufficient investment in more technically challenging deepwater reserves and a challenging regulatory environment.

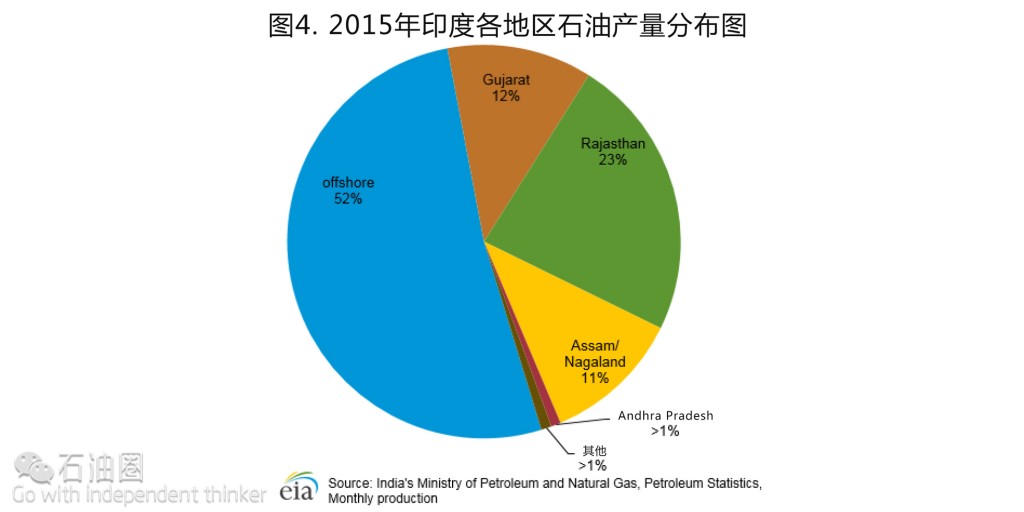

Historically, ONGC dominated the upstream oil sector and relied on production from the Mumbai High field and its associated satellite fields in the western offshore area. India’s total petroleum and other liquids production, including crude oil and condensates, natural gas liquids, biofuels, and refinery gains, has gradually increased during the past 15 years, growing at an average of 2% each year through 2015. Total petroleum and other liquids production has hovered around 1.0 million b/d since 2011. In 2015, about 75% of total production consists of crude oil and lease condensates, and the remainder is from natural gas liquids, biofuels, and refinery gains. Slightly more than half of the crude oil production stems from offshore fields, although this share has dropped in the past several years as production from the large, aging Mumbai High field has declined (Figure 4). The onshore Gujarat and Assam-Arakan basins contain mature fields also experiencing production declines. Several redevelopment projects, enhanced oil recovery efforts, and marginal field development projects in these basins are underway, and ONGC has plans to raise production from the Mumbai High field by 2030 through enhanced oil recovery methods. Production from Mumbai High field has already edged up while onshore production declined in 2015.18

Indian and foreign companies have invested in more frontier developments and marginal fields to help offset production declines from mature basins. In recent years, major discoveries in the Barmer basin in Rajasthan and in the offshore Krishna-Godavari basin hold some potential to diversify the country’s production. Cairn India brought online Mangala, the largest onshore field in India and part of the Rajasthan block in northwestern India, in 2009, with a production capacity of 150,000 b/d.19 The Rajasthan fields, including Mangala, produced 177,000 b/d in 2015,20 and the Indian government raised the block’s production capacity to 300,000 b/d. However, a production increase depends on the outcome of negotiations between Cairn India and the government over the contract terms and cost-sharing structure of a license renewal due by 2020.21

Despite Cairn’s successful drilling in Rajasthan, foreign investment in India has waned in recent years, both because of increased competition from domestic Indian companies and India’s complex exploration and production laws.22 Also, the low international oil price environment since late 2014 has negatively affected profits of the international oil companies, causing some to curtail capital expenditures in 2016. Cairn plans to cut capital expenses by about 75% from an originally proposed $1.2 billion to $300 million in fiscal year 2016 (April to March).23 However, both ONGC and OIL India are attempting to take advantage of the lower production and service costs and meet goals to increase domestic production in the next few years.

The government has encouraged companies to acquire overseas upstream assets as a way to shield the domestic energy sector from global price volatility and to reduce India’s growing dependence on imported foreign oil. Indian companies hold large stakes in Sudan’s GNOP block, Russia’s Sakhalin-1 project, and Venezuela’s San Cristobal and Carabobo blocks. Amerada Hess Corporation sold key oil fields in Azerbaijan to ONGC in 2012.25 Also, ONGC purchased a 15% stake in Vankor, Russia,s second-largest oil field, in late 2015.

Downstream and refining

India’s government promotes the country’s refining sector, and India became a net exporter of petroleum products in 2001. India has several world-class refineries, and the private sector has significant investments in the country’s refining industry.

India’s government started encouraging energy companies to invest in refineries at the end of the 1990s, and the investment helped the country become a net exporter of petroleum products in 2001. In particular, the government eliminated customs duties on crude imports, lowering the cost of fuel supply for refiners. These reforms made domestic production of petroleum products more economic for Indian companies. In its 11th Five Year Plan (2007-12), India’s government set the goal of making India a global exporting hub of refined products. Between 2005 and 2013, India’s oil product exports, mostly from gasoil and gasoline, almost tripled to more than 1.3 million b/d before falling back to less than 1.2 million b/d in 2015 as domestic demand for products escalated at a faster pace.27 Some export-oriented refineries began reorienting oil production for domestic use in 2009 to help ease shortages of motor gasoline, gasoil, kerosene, and liquefied petroleum gas (LPG).

Diesel remains the most-consumed oil product, accounting for 41% of petroleum product consumption in 2015 and is used primarily for commercial transportation and, to a lesser degree, in the industrial, electric power, and agricultural sectors.28 Following the government’s lifting of diesel subsidies during 2013 and 2014 and attendant higher retail prices that ensued, diesel demand growth flattened during this period before rising again in 2015. Gasoline use has increased at a fast pace over the past decade, and in the past few years, this fuel has replaced some diesel in the transportation sector.

India still imports LPG products for domestic use. Many rural areas of India use LPG and kerosene along with traditional biomass as cooking fuels (see Biomass and waste below). The government is encouraging a shift from kerosene used as a cooking fuel in rural areas to LPG, a cleaner and less-expensive fuel. As a result, LPG demand has soared by 20% between 2013 and 20 1 5.29 Liquid fuels have competed with natural gas in the past several years as the power and fertilizer industries are using natural gas as a substitute for some naphtha and fuel oil supply. Recent natural gas production shortages have encouraged higher LPG use in residential heating and cooking.

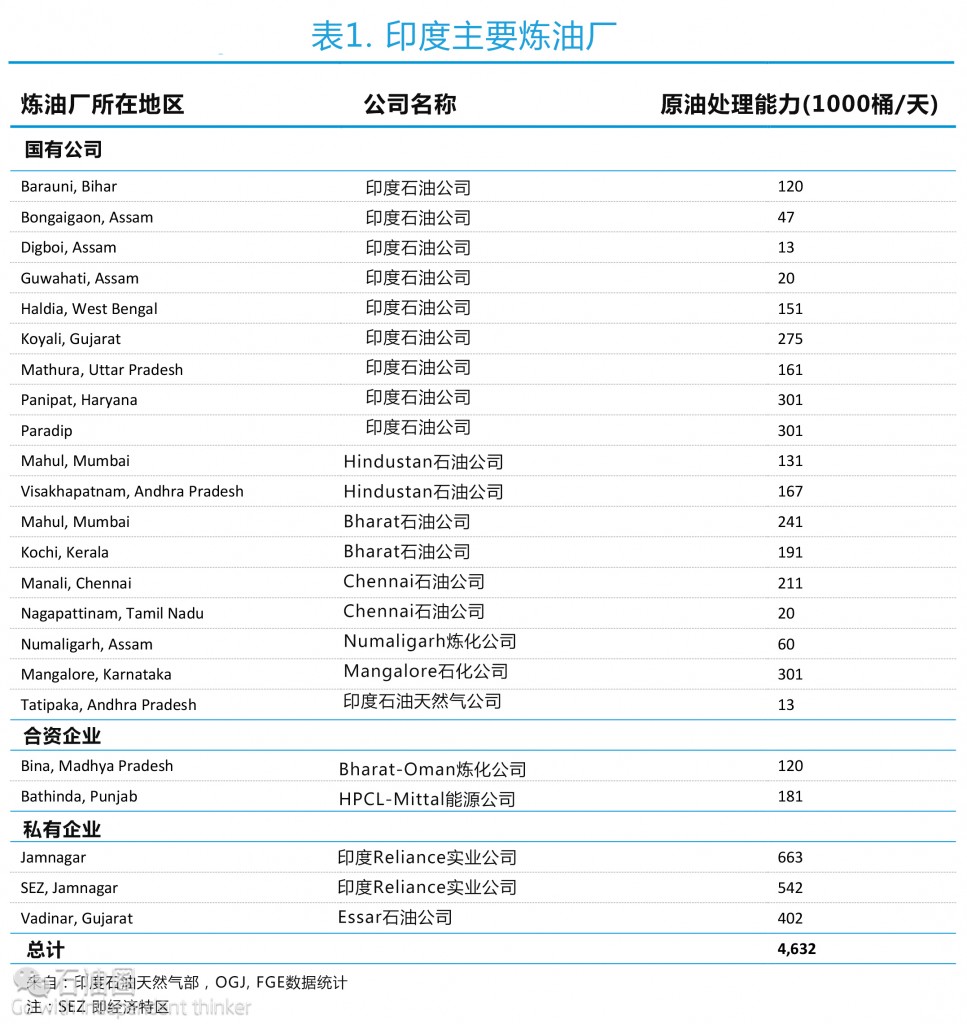

The refining industry is an important part of India’s economy, and the private sector owns about 37% of total capacity. In early 2016, India had 4.6 million b/d of nameplate refining capacity, making it the second-largest refiner in Asia after China.30 The two largest refineries by crude capacity, located in the Jamnagar complex in Gujarat, are world-class export facilities and are owned by Reliance Industries. The Jamnagar refineries account for 26% of India’s current capacity (Table 1). These refineries are on the country’s western coast close to crude oil-producing regions in the Middle East, which allows them to take advantage of lower transportation costs.

India projects an increase of the country’s refining capacity to 6.3 million b/d by 2017 based on its current five- year plan to meet rising domestic demand and supply export markets, although several refinery projects have faced delays in the past few years as a result of financial issues, bad weather, and regulatory hurdles.31 Also, there is now greater competition in Asia from countries such as China that have built large refineries able to process more complex crude oil types. After several years of delays, India’s new Paradip refinery in Odisha began commercial operations in 2016 and added about 300,000 b/d of capacity.32 This refinery is one of India’s most complex facilities with the ability to process more sulfurous sour crude oil grades and maximize production of high-valued oil products such as diesel and gasoline.

Indian companies have plans to upgrade several existing refineries to produce higher-quality auto fuels to comply with more stringent specifications for vehicle fuel standards. India plans to adopt the equivalent of Euro IV fuel efficiency standards on a nationwide basis by April 2017 and both Euro V and Euro VI standards on transportation fuels by 2020.33 Indian companies have proposed several expansions to existing facilities and new refineries by 2020, although the timeline of these projects depends on the success of project investments and fuel sales in both domestic and export markets.

Trade

India is a significant importer of crude oil, as the country’s demand growth continues to outstrip domestic supply growth and as India’s refiners export greater volumes of oil products. The Middle East was the major source of crude oil imports to India in 2015, although the Western Hemisphere’s share has risen in recent years.

India has increased its total net oil imports from 42% of demand in 1990 to an estimated 75% of demand in 2015. India,s demand for crude oil and petroleum products is projected to continue rising, barring a serious global economic recession. Oil import dependence will continue to climb if India fails to achieve production growth equal to demand growth.

The Indian Ocean historically has been a major transit route, bringing crude oil from suppliers in the Persian Gulf and Africa to markets in Asia. Tanker sea lanes pass near Indian waters between major chokepoints such as the Strait of Malacca and the Strait of Hormuz (see the World Oil Transit Chokepoints report). The majority of Indian oil ports are located on the country’s western side to receive shipments of crude oil that pass through these routes.

India’s crude oil imports reached more than 3.9 million b/d in 2015.34 Saudi Arabia is India’s largest oil supplier, with a 20% share of India’s crude oil imports. In total, approximately 58% of India’s imported crude oil came from Middle East countries, mostly Saudi Arabia and Iraq. The second-largest source of oil imports is Africa (19%), with most of that crude oil coming from Nigeria. Indian oil companies plan to import more of Africa’s light, sweet crude oil grades and have imported 91,000 b/d more crude oil from Africa since 2014. The Western Hemisphere accounted for 18% of India’s crude oil imports, mostly from Venezuela (Figure 5), and imports from this region have grown substantially over the past several years. Supply disruptions in several countries, including Iran, Libya, and Sudan, in addition to India’s growing dependence on imported crude oil, have compelled India to diversify its crude oil import slate over the past few years. India has reduced its crude oil and condensate imports from Iran as a result of the U.S. and European sanctions imposed on Iranian oil exports that began in 2011. Following the lifting of sanctions in January 2016, India’s crude oil imports from Iran are likely to rebound.

Despite being a net importer of crude oil, India has become a net exporter of petroleum products by investing in refineries designed for export, particularly in Gujarat. Essar Oil and RIL export naphtha, motor gasoline, gasoil, and jet fuel to the international market, particularly to the United Arab Emirates, Singapore, Saudi Arabia, the United States, Kenya, and the Netherlands.

Strategic Petroleum Reserve

India,s high dependency on crude oil imports makes the country susceptible to external forces such as supply disruptions and international prices. To shield India from global oil supply disruptions and to reduce its overall crude oil import levels in the longer term, the Indian government decided to set up strategic storage of 39 million barrels of crude oil at three locations (Visakhapatnam, Mangalore, and Padur) as part of its first phase of strategic petroleum reserves development. The Indian Strategic Petroleum Reserves Limited (ISPRL), a special-purpose legal entity owned by the Oil Industry Development Board, would manage the proposed facilities, which are expected to be completed in 2016. The Visakhapatnam facility came online in June 2015 and began filling its facilities.35 The government unveiled plans to increase reserves to cover 90 days1 worth of imports and add another 91 million barrels to the state’s strategic crude oil capacity in a second phase by 2020.

Natural gas

Natural gas serves as a substitute for coal in electricity generation and fertilizer production in India. The country began importing liquefied natural gas from Qatar in 2004 and increasingly relies on imports to meet domestic natural gas needs.

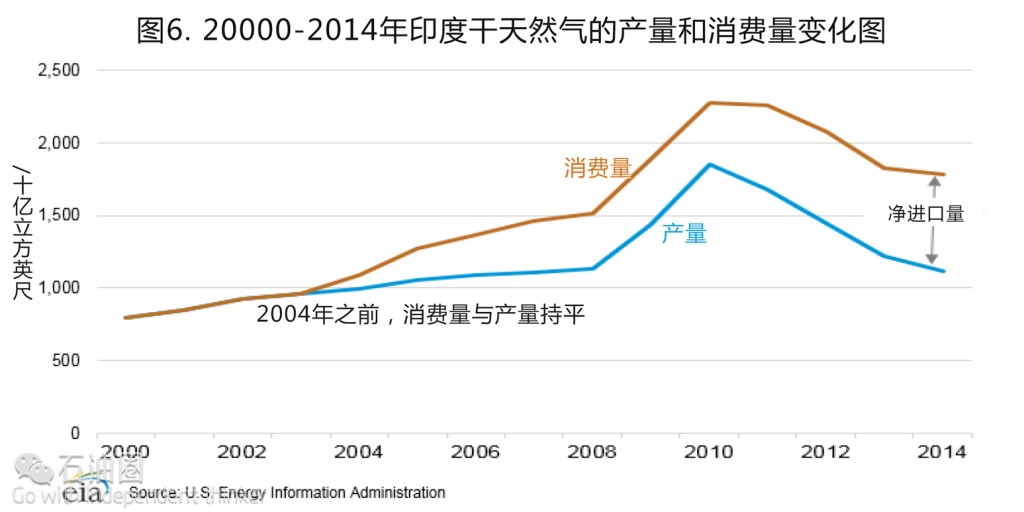

Natural gas mainly serves as a substitute for coal for electricity generation and as an alternative for liquefied petroleum gas (LPG) and other petroleum products in the fertilizer and other sectors. India was self-sufficient in natural gas until 2004, when it began to import liquefied natural gas (LNG) from Qatar. Because it has not been able to create sufficient natural gas infrastructure on a national level or to produce adequate domestic natural gas to meet domestic demand, India increasingly relies on imported LNG. India was the world’s fourth-largest LNG importer in 2015, following Japan, South Korea, and China, and the country consumed nearly 7% of the global trade.

Natural gas consumption grew at an annual rate of 6% from 2000 and 2014, although supply disruptions starting in 2011 resulted in declining consumption. Natural gas consumption in India was tied closely to domestic production until imports became available in 2004. In 2014, India consumed 1.8 trillion cubic feet (Tcf) of natural gas (Figure 6). LNG imports accounted for about 37% of 2014 demand and are expected to account for an increasing portion of demand at least in the next several years. Higher LNG imports will depend on the pace of expansion in regasification terminal capacity and pipeline infrastructure connecting natural gas supplies to markets that currently lack access. The government’s recently revised natural gas pricing system that provides a premium for production from India’s more technically-challenging fields acts as an economic incentive for producers to invest upstream and raise domestic output. India’s demand will rely on both LNG imports and production to supply the country’s growing fuel needs.

Most of the natural gas demand in 2014 came from the power sector (23%), the fertilizer industry (32%), and the replacement of LPG for cooking oil and other uses in the residential sector (14%), according to India’s MOPNG.38 The government has labeled these as priority sectors for receiving new natural gas supplies. The fertilizer sector, which is highly price-sensitive, has been able to maintain low fuel costs by using natural gas.39 The recent unexpected dry natural gas production declines since 2011 have forced electric generators to seek fuel alternatives, primarily coal, and this sector has seen the largest decline in natural gas use.40 The government is promoting the use of natural gas in the residential sector as an alternative to LPG and biomass as cooking fuels.

Sector organization

In 2013, India began natural gas pricing reforms, and the government subsequently approved a new pricing scheme to further align domestic prices with international market prices and to help raise investment for the sector.

As with the oil sector, India,s Ministry of Petroleum and Natural Gas (MOPNG) oversees natural gas exploration and production activities. MOPNG,s Directorate of Hydrocarbons functions as an upstream regulator and monitors coalbed methane projects. Until 2006, the Gas Authority of India Limited (GAIL) functioned as a near monopoly operating India]s natural gas pipelines. However, the government began to reform natural gas pricing and created the Petroleum Natural Gas Regulatory Board to regulate downstream activities such as distribution and marketing.

Prior to the recent natural gas pricing reform, there were various price regimes for domestically-produced natural gas depending on the timeframe and terms of the production sharing contracts. The government set prices for nominated state-owned producers of natural gas, while joint-venture producers generally indexed their prices to international rates. The Indian government approved a new natural gas pricing regime in 2013 to attract investment critical to increasing domestic natural gas production and to mitigate upstream project delays. Historically, most of India’s natural gas consumers have paid rates that are much lower than the prices of imported natural gas. The new pricing regime is designed to more closely align India’s natural gas prices with international market rates and attempt to create a more uniform pricing structure. The new pricing policy took effect in November 2014, and prices are adjusted every six months based on a weighted average formula of benchmark gas prices in North America, Europe, and Russia. Although the government initially raised the benchmark rate by 20% from $4.20/MMbtu to $5.05/MMBtu, the current low global natural gas prices has had a downward effect on India’s gas price, which was revised to $3.06/MMBtu in April 2016. 41 Lower prices could spur demand but is likely to dampen incentives for domestic upstream investment, particularly by foreign companies.

LNG prices are completely market-driven and are not included in the new price reform. Petronet LNG renegotiated its high long-term contract price with Qatar at the beginning of 2016 to more accurately reflect the current low Asian LNG prices. The Indian government recently announced a premium for undeveloped fields from deepwater and high-pressure and high-temperature areas to compensate investors in these challenging fields. The ceiling price for these fields, which is based on a weighted average prices of alternative fuels, was determined at $6.61/MMBtu through September 2016.42 These new prices will likely provide greater incentive for companies to invest in India’s deepwater fields. However, India will continue to seek imports to make up for supply shortages and to use other fuels since the timeframe for bringing such challenging fields online is a few years and the low hydrocarbon price environment is having a significant downward effect on international oil and gas company expenditures.

New private Indian companies, such as Petronet LNG Limited, that have formed in recent years, aim to benefit from growing LNG imports in India by building regasification plants. Privately-owned RIL emerged as an important upstream player in the natural gas market after discovering significant reserves in the Krishna- Godavari basin in 2002. RIL also operates the important East-West natural gas pipeline from Andhra Pradesh to Gujarat.

International firms have some stake in India’s natural gas sector. BP owns part of the KG-D6 field in the Krishna-Godavari basin, and Royal Dutch Shell has invested in potential future LNG facilities.

Exploration and production

Most of India’s natural gas reserves are located offshore, and production peaked in 2010. Since then, production has declined as a result of performance problems and insufficient investment.

According to the Oil & Gas Journal, India had nearly 53 Tcf of proved natural gas reserves at the end of 2015.43 About 34% of total reserves are located onshore, and 66% are offshore, according to India,s Ministry of Oil and Gas.44 In 2002, energy companies made a number of large natural gas discoveries in the Krishna-Godavari (KG) basin off of India’s eastern coast, pushing up both the reserve base and production. However, production from some of the more mature fields has declined in recent years. Also, RIL cut the recoverable reserves of its two major natural gas fields in the major D6 block (D1 and D3) of the KG basin, and production at KG-D6 has dropped since it came online in 2009 because of unexpected declines and reservoir performance problems. Total natural gas production in India declined from a record high of 1.8 Tcf in 2010 to 1.1 Tcf in 2014 as a result of these technical issues and high development costs. India’s MOPNG estimates that natural gas production continued to decline during 2015.45

The two biggest state-owned companies, ONGC and Oil India Ltd. (OIL), dominate India’s upstream gas sector. ONGC operates the Mumbai High field, which provides about 50% of India’s natural gas supply. 46 ONGC remains India’s largest natural gas producer, accounting for 70% of the domestic production in 2014 as reported in the company’s annual report.47 However, the government has encouraged private and foreign companies to enter the upstream sector in recent years. RIL became a major upstream force because of natural gas discoveries in the Krishna-Godavari basin. RIL has a strategic partnership with BP, which holds a 30% stake in 21 of RIL’s production-sharing contracts. Other major international oil companies do not have significant investments in India’s natural gas upstream sector. ONGC and Gujarat State Petroleum Corporation Limited (GSPCL) are also developing several offshore areas in Krishna-Godavari basin. Another promising producing area is the Cambay basin in western India, where independent company Oilex has done some preliminary work assessing the potential for tight natural gas.48

India began awarding coalbed methane (CBM) blocks for exploration in 2001, although it has taken more than a decade to begin producing at these fields. Foreign companies have largely been absent from CBM production, leaving domestic Indian companies struggling to attract enough expertise and technology to develop these resources. Great Eastern Energy Corporation Limited (GEECL) has developed the Raniganj block in West Bengal. Essar Oil and RIL have also been developing blocks in West Bengal, and began commercial production in 2007. CBM production in 2014 amounted to 7.4 Bcf, a fraction of the country’s total natural gas production.49 CBM remains a nascent industry, and production faces geological and water supply challenges, insufficient investment as a result of low natural gas prices, slow development of natural gas infrastructure, and delays in regulatory approvals.50

Companies are interested in exploring the Cambay basin in Gujarat, the Assam-Arakan basin in northeast India, and the Gondwana basin in central India for shale gas resources, although there has been no commercial production. In its 2013 assessment of global shale gas reserves, the U.S. Energy Information Administration estimates India has 96 Tcf of technically recoverable shale gas reserves.

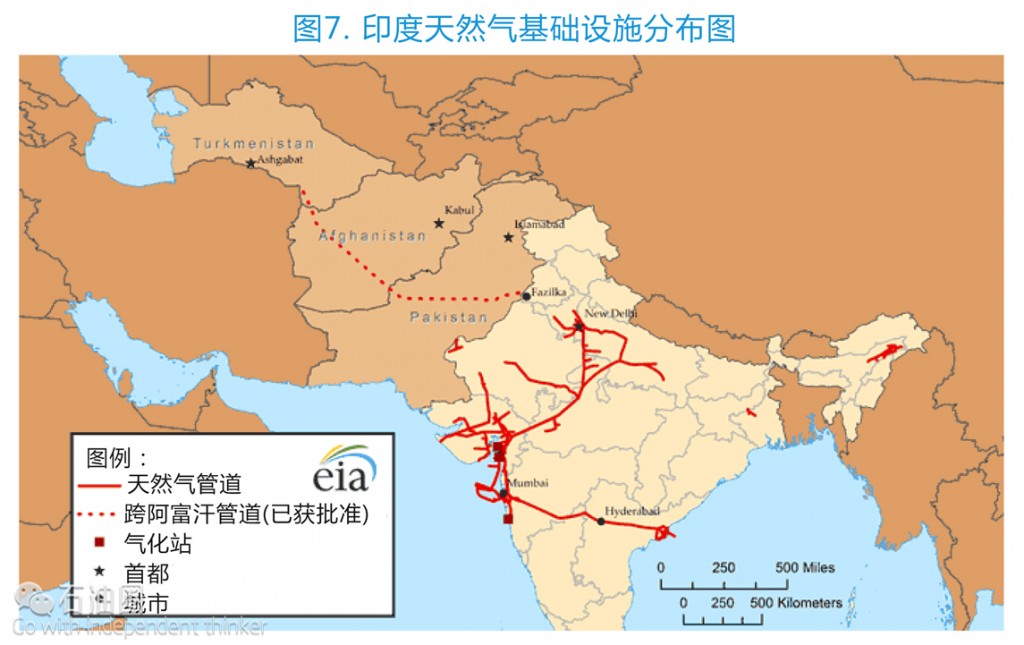

Pipelines and infrastructure

The two most important companies operating India’s large natural gas pipeline system are GAIL and Reliance Gas Transportation Infrastructure Limited (RGTIL). GAIL, the state-owned natural gas transmission and marketing company, operates two major natural gas pipelines in northwestern India: the Hazira-Vijaipur- Jagadishpur (HVJ) line running from Gujarat to Delhi, and the Dahej-Vijaipur (DVPL) line. Reliance Gas Transportation Infrastructure (RGTIL, owned by RIL) is a key private investor in the natural gas transmission structure and brought the East-West pipeline online in 2009 to link the promising KG-D6 natural gas field to GAIL’s pipeline network and demand centers in the northern and western regions. However, RIL’s East-West pipeline remains underutilized as a result of lower-than-expected production from the KG-D6 field. Other players like Assam Gas Company and Gujarat State Petronet Limited (GSPL) have significant pipeline assets that service regional demand centers in northeastern India and Gujarat, respectively.

Insufficient pipeline infrastructure and lack of a nationally integrated system are key factors that constrain natural gas supply in India, although GAIL and other companies are investing in several pipeline projects. The country’s onshore natural gas pipeline network totaled over10,800 miles in 2015, more than double the level in 2008.52 GAIL plans to expand its network and further integrate pipelines in southern India with the pipeline system in the northwest of the country. In early 2013, GAIL commissioned the Dabhol-to-Bengaluru (Bangalore) pipeline, the first line to connect the southern part of the country to the national grid. GAIL also plans to build a pipeline from its newly commissioned LNG regasification terminal at Kochi in southwestern India to Mangalore and other parts of southern India. The pipeline was scheduled to be ready by 2016, but land acquisition issues has held up the pipeline construction.

The Indian government has considered importing natural gas via pipeline through several international projects, although many of these projects have proven unfeasible. In 2009, India withdrew from the Iran-Pakistan-India (IPI) pipeline project. However, the government still participates in a separate pipeline project to import natural gas from Turkmenistan to India. The Turkmenistan-Afghanistan-Pakistan-India (TAPI) project, also known as the Trans-Afghanistan Pipeline, has seen more than a decade of discussion, although major geopolitical risks, technical challenges, and a lack of financial backing have prevented the project from actually starting. However, the countries have made some progress in moving TAPI forward. The partners signed a framework agreement in 2010 and agreed on unified transit tariffs for the route in early 2012. In May 2012, India signed natural gas supply and purchase agreements with Turkmenistan. In 2013, India’s government approved a special-purpose legal entity to which participating members of the pipeline would contribute investment funds, and the four participants appointed the Asian Development Bank (ADB) as the project’s technical and financial advisor. Turkmenistan began construction of the TAPI in December 2015. The project is anticipated to be operational by 2019, although much uncertainty remains about security issues as the project participants seek foreign investment.

Liquefied Natural Gas

Indian companies are investing in new regasification facilities to meet the country’s rising natural gas demand. India was the world’s fourth-largest liquefied natural gas importer in 2015.

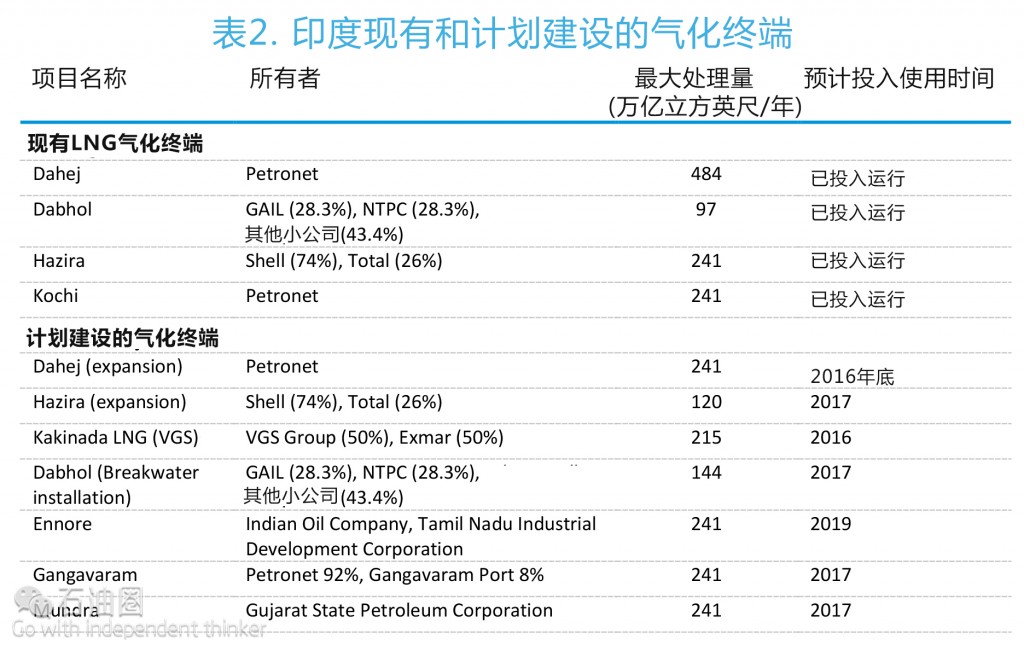

Liquefied natural gas (LNG) has become an important part of India,s energy portfolio since the country began importing it from Qatar in 2004. In 2015, India was the world,s fourth-largest LNG importer, importing around 780 Bcf, or 7%, of global trade, according to IHS Energy.55 Petronet, a joint venture between GAIL, ONGC, IOC, and several foreign firms, is the major importer of LNG supplies to India. India’s total regasification capacity now stands at 1.1 Tcf, and terminal owners have proposed capacity expansions at some of the existing terminals (Table 2).

Unexpected production declines in India’s KG-D6 natural gas field mean the country must rely on higher LNG imports. Because LNG prices are exempt from India’s natural gas price regulation, average imported LNG prices were three times the price of domestically produced natural gas during record highs in LNG spot prices in 2013 and 2014.56 The price of LNG began to drop in 2015 and even further in 2016 following lower global oil and gas prices and the revised long-term contract between Petronet and Qatar. As the Indian government’s natural gas price reform seeks to provide greater investment incentives for domestic natural gas development, new production would compete with LNG imports. However, in the next few years, LNG imports are anticipated to increase as the fastest way to meet the country’s natural gas demand.57

Indian companies have invested to increase the country’s LNG regasification capacity in recent years to meet rising demand. In early 2013, GAIL, NTPC, and several other smaller players restarted the Dabhol project, originally proposed by now-defunct energy firm Enron, which includes a regasification terminal to fuel three natural gas-fired power stations. Dabhol LNG also ships natural gas to southern India through the new pipeline to Bengaluru. GAIL is installing a breakwater facility to double Dabhol’s capacity by 2017.58

Petronefs LNG terminal at Kochi was commissioned in late 2013. However, the terminal is experiencing extremely low utilization because of delays in the approval and construction of a pipeline to Mangalore and other parts of southern India. Utilization rates at Kochi LNG are set to expand in 2017 when the pipeline is anticipated to commence operations.59 The eastern side of India lacks pipeline infrastructure and natural gas supply as a result of production declines in the KG basin; thus, companies are quickly planning terminals to come online in the next few years. Several proposed regasification projects along the western coast include GSPC’s Mundra terminal in Gujarat, expected to be built in the next few years.60

Qatar’s RasGas is India’s only long-term supplier of natural gas, with two contracts for a total of 365 Bcf.61 In 2015, Qatar was the source of 62%〇 of India’s total LNG imports.62 India has been an active importer of spot cargoes of LNG following interruptions in the KG-D6 field production after 2010, when the country began receiving LNG cargoes from a variety of exporting countries. Nigeria, Egypt, and Yemen have become India’s largest short-term LNG suppliers.

Coal

Coal is India’s primary source of energy. The country has the world’s fif^h-largest coal reserves, ranked third-largest in terms of both production and consumption in 2013, and became the largest importer of coal in 2015. The state retains a near-monopoly on the coal sector. The power sector accounts for a majority of the country’s coal consumption.

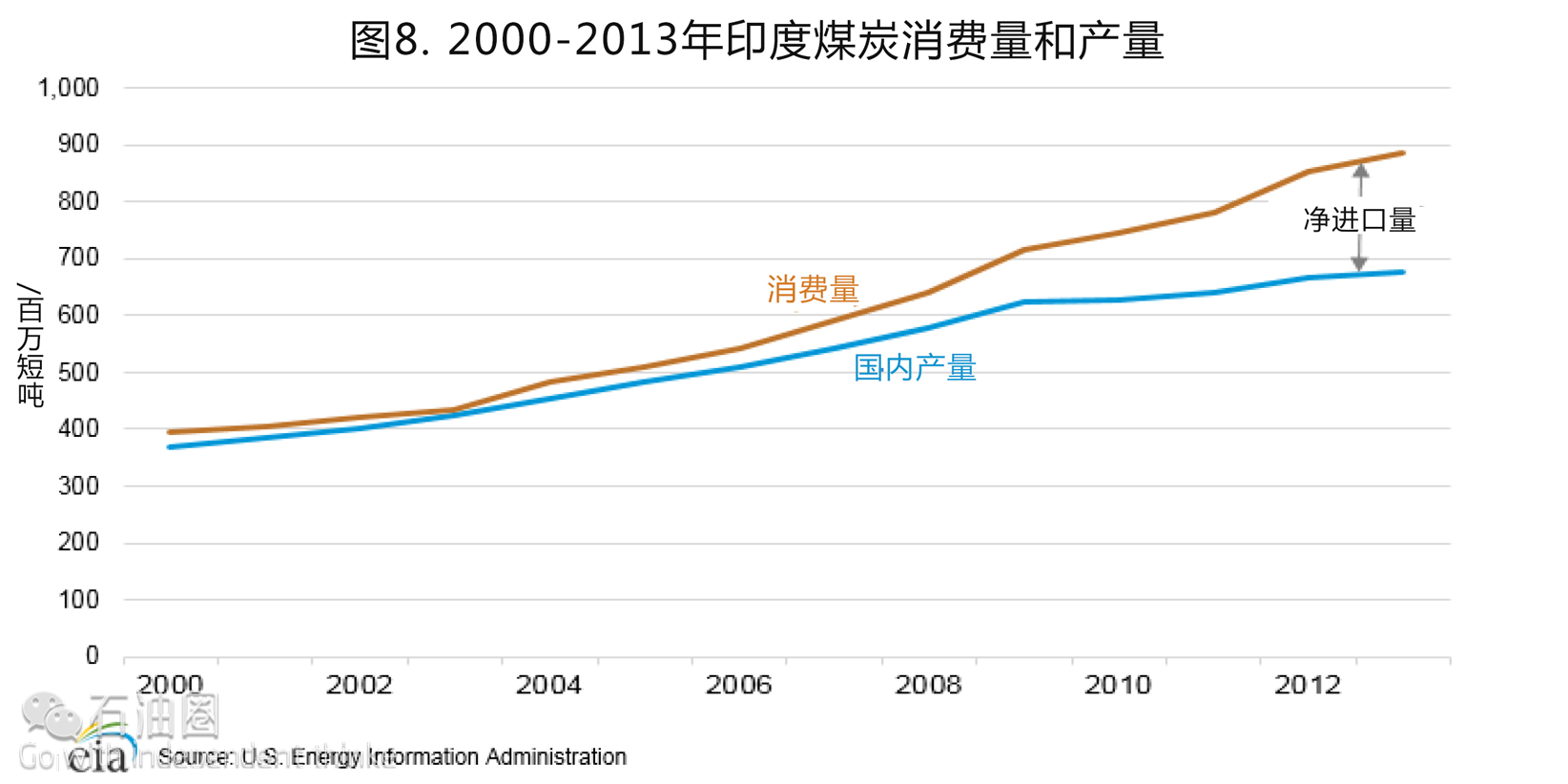

Coal is India’s primary source of energy, and the country was the third-largest global consumer in 2013, according to EIA estimates. The country has the fifth-largest coal reserves in the world.64 At the same time, the coal sector is one of the most centralized and inefficient sectors in India. Two state-owned companies have a near-monopoly on production and distribution. The country also faces a widening gap between supply and demand. Although production has moderately increased by about 5% per year between 2003 and 2013, producers have consistently failed to reach the government’s production targets. Meanwhile, demand grew by more than 7% annually during the same decade, and reached 886 million short tons (Figure 8). Because coal output cannot keep pace with demand, particularly from the power sector, India has met more of its coal needs with imports. However, India’s recent regulatory reforms are aimed at promoting greater self-sufficiency in coal supply through higher domestic production65.

The power sector is the largest consumer of coal, accounting for an estimated 65% of coal consumption in 2014.66 Because power plants rely so heavily on coal, coal shortages are a major contributor to shortfalls in electricity generation and consequent blackouts throughout the country. Also, coal demand has escalated in the past few years from the power sector, which encountered problems accessing natural gas supply and hydroelectricity-sourced generation during years with a weaker monsoon season (such as 2009 and 2012). The National Coal Distribution Policy, initiated in 2007, provided favorable coal pricing to the power sector to allow for greater demand in this sector.

Steel and cement industries are also significant coal consumers. India has limited reserves of coking coal, which is an important raw material for steel production. The state of Jharkhand holds most of India’s coking coal reserves, but it does not supply enough to meet the industry’s needs. Because of this shortage, India imports slightly more coking coal that it produces.

Sector organization

India’s government took control of the country’s coal reserves with the 1973 Coal Mines Nationalization Act, leading to the establishment of Coal India Limited (CIL) in 1975 as the state-owned sole producer and aggregating coal production and investment. After 1993, India tried to encourage foreign and private investment in the coal sector through the National Mineral Policy. By 2000, the government deregulated coal prices, allowing CIL and other companies to increase prices when there is a rise in the cost of production. However, the Ministry of Coal and Mines continues to control the distribution of coal resources and subsidies to various companies. In 2007, the government passed the New Coal Distribution Policy that attempted to allocate limited coal supplies to priority sectors, particularly the power and fertilizer industries. India’s 12th Five Year Plan calls for CIL to increase indigenous coal production to match growing fuel requirements of power plant projects expected to come online by 2017.

CIL remains the country’s largest coal producer, producing slightly more than 80% of the country’s coal in 2014. Singareni Collieries Company Limited (SCCL), another public-owned company, was responsible for nearly 10% of the country’s coal production, mainly in the southern region of the country. Captive producers, or private industries mining coal for their own use, constitute the remaining 10% of production.68 In 2015, India decided that the captive blocks (blocks allocated by the government over the last two decades to be used by private companies for their own consumption) were void, and the government would re-auction them for sale. This reform is intended to bolster coal production, to attract more private investment including from Indian subsidiaries of foreign companies, and to create a more transparent system of competitive bidding for coal production rights.

Exploration and production

India ranks as the third-largest coal producer in the world, on a volumetric basis. However, the country continues to experience regulatory, land acquisition, technical, and distribution challenges that limit production growth and create bottlenecks hindering efficient transportation of coal to key demand centers.

India had about 96 billion short tons of proved coal reserves in 2013, the fifth-largest in the world (third-largest reserves in anthracite and bituminous coal after the United States and China).69 The Indian Ministry of Coal estimated higher proved reserves at 139 billion short tons in 2014.70 Indian coal typically has high ash, low sulfur content, and a low-to-medium calorific value, signifying that more coal content is required to receive the same energy output as a coal of higher calorific value.

Most coal reserves are located in the eastern parts of the country. Jharkhand, Chhattisgarh, and Odisha account for approximately two-thirds of the country’s coal reserves.71 Other significant coal-producing states include West Bengal, Andhra Pradesh, Madhya Pradesh, and Maharashtra.

India is the third-largest global coal producer based on volume, with coal output nearly doubling between 2000 and 2013 to 675 million short tons. Virtually all of India’s coal production remains in the country to meet domestic demand. Estimates of 2014 production indicate that coal output increased by about 9% annually.72 Also, preliminary estimates report that CIL’s 2015 production grew by more than 9%, which curbed growth of the country’s imports.73 Despite its sizeable reserves and rising production, India struggles with supply shortages and systemic problems with its mining industry. About 90% of the country’s coal mines are opencast, or surface, mines (less than 1,000 feet deep), which is more cost-effective and less dangerous for workers than underground mines but causes more negative environmental impact.74 The lack of more advanced technology to engage in large-scale underground mining operations keeps India’s productivity levels low. A lack of competition within the coal sector inhibits private and foreign investment that could be used to improve underground mining techniques. Also, many coal deposits are located in areas that have environmental issues or involve potential dislocation of people. Regulatory hurdles continue to impose delays in obtaining environmental and land acquisition approvals for mining companies.

In 2015, India announced an aggressive coal production target of 1.7 billion short tons by 2020, nearly three times the 2013 production level. CIL is slated to meet two-thirds of the goal, while private sector and captive mines are expected to make up the other third. Although India intends to reduce regulatory burdens and sector inefficiencies, reaching this target could be challenging.75

India’s coal mines are also located far from the highest-demand markets in southern and western India, posing a significant logistical challenge to coal producers and distributors. Railcars, used mostly for long hauls, transport most of India’s coal.76 Limited railway capacity, delays to railroad projects, and high transport costs to demand centers are other factors that continue to negatively affect India’s coal output and deliveries to users.

Trade

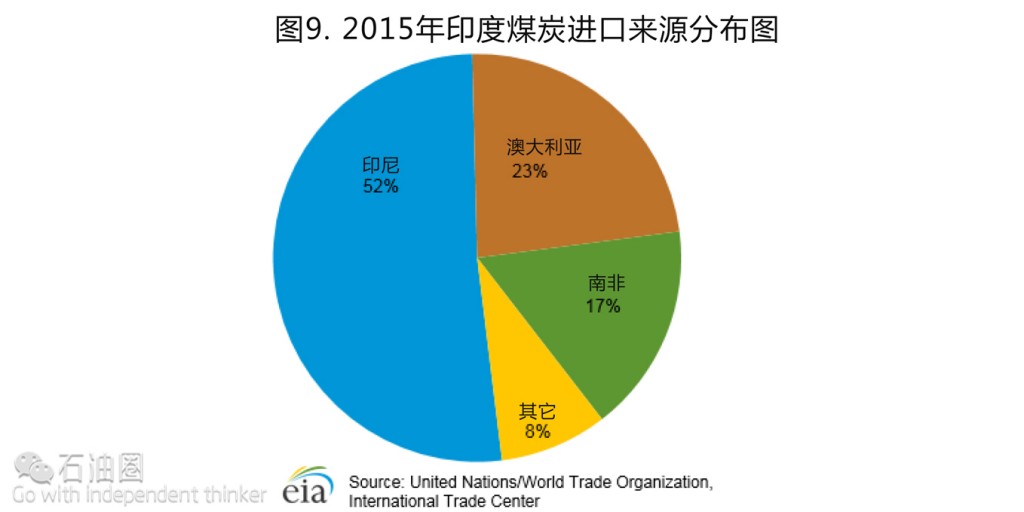

Although historically not a major importer of coal, India has imported coking coal for more than two decades to meet high demand in the iron and steel industry. The country’s recent supply shortages in both thermal coal (used for power generation) and coking coal spurred India’s significant increase of coal imports over the past few years from several key exporting countries. In 2015, India purchased 226 million short tons of coal from overseas, surpassing China as the world’s largest coal importer. However, coal import growth slowed to 5% in 2015 from double-digit growth rates in more recent years as domestic production accelerated and domestic stocks rose. Indonesia is the largest source of coal imports to India, accounting for 52% of total coal imports (Figure 9).77 India imports thermal (steam) coal used in power plants mainly from Indonesia and South Africa and coking coal for steel production from Australia.

Electricity

India had more than 300 gigawatts of installed electricity generation capacity connected to the national network in early 2016, mostly from coal-powered plants. Because of insufficient fuel supply and power generation and transmission capacity, the country suffers from a severe electricity shortage, leading to rolling blackouts.

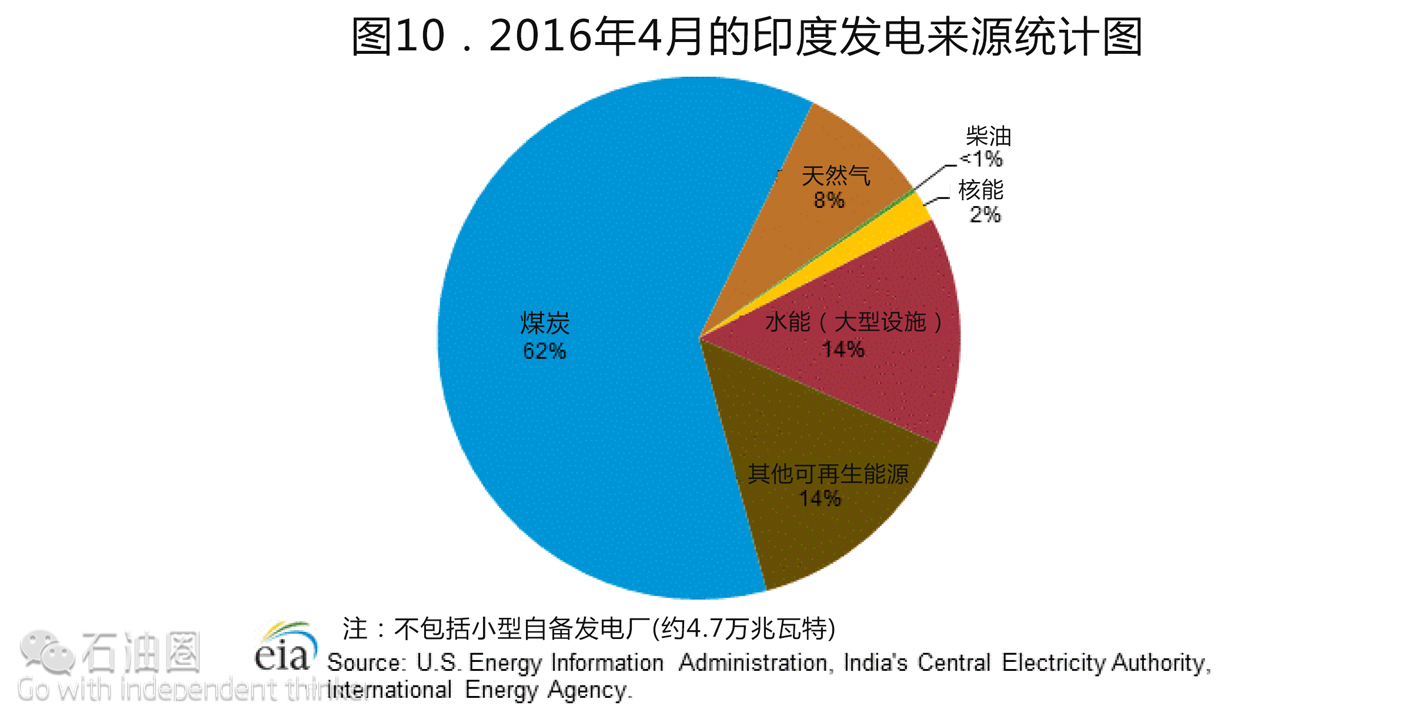

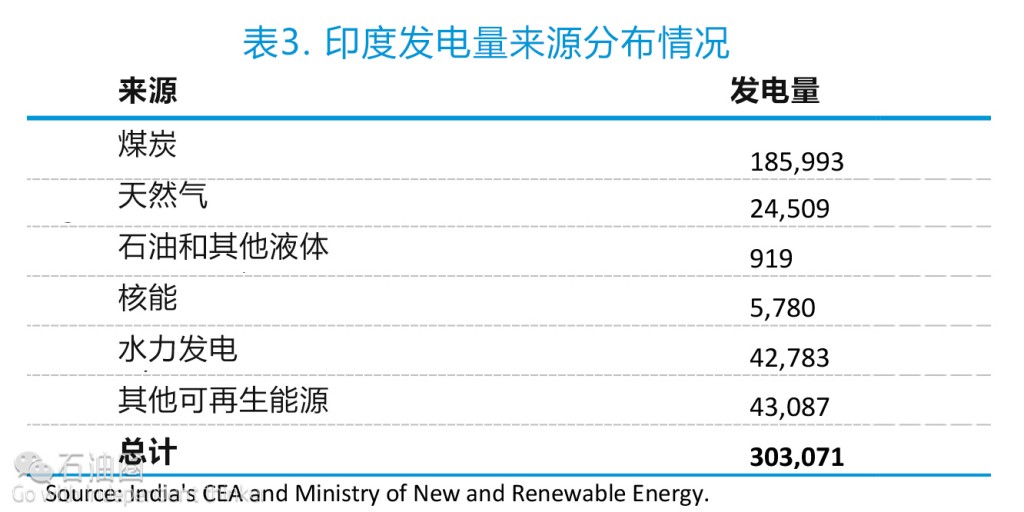

As of April 2016, India had 303 gigawatts (GW) of utility-based installed electricity generating capacity, mostly from coal-fired power plants, according to India,s Central Electricity Authority (CEA).79 Generation capacity from smaller captive power plants, or those that serve specific industries for in-house consumption and may not be connected to the grid, registered about 47 GW in 2014.80 Installed capacity of coal and natural gas power plants is heavily clustered in the more populated western region of the country, particularly in Maharashtra and Gujarat. Large-scale hydropower is the second-largest source of electricity, accounting for 14% of India]s utility- based installed capacity in early 2016 (Figure 10 and Table 3).81 The industrial sector has been a key driver of electricity consumption in the past decade, as a result of India’s rapidly expanding economy.

India suffers from severe shortages of electricity, particularly during peak hours of demand, and often experiences blackouts lasting from several hours to days in certain areas. India suffered an unprecedented electricity blackout for two days in July 2012 that affected an estimated 680 million people across the country’s northern states. This outage highlighted the increasing need for India’s power system to secure more fuel supplies and infrastructure investment in each stage of power transmission. Utilization rates in India’s power plants using fossil fuels have fallen steadily since 2007 (from a peak of about 79%) to less than 65% in 2014 because of disruptions in domestic fuel supplies, transmission and distribution constraints, and financial distress of distribution companies that refrain from purchasing electricity generation.82 Insufficient coal and natural gas supply to power plants has led some plant owners to curtail operations and even to mothball some plants. Transmission and distribution losses and technical problems in moving electricity between various states also impair system reliability. Additionally, India’s relatively low electricity tariffs have made it challenging for distribution companies to purchase generation at higher costs. The current government recently announced a plan to relieve some of the utilities’ debts to alleviate some bottlenecks in the country’s power generation system.83

Other factors contributing to power shortages are the lag of power capacity expansions and the need to replace older, less efficient units. India has historically fallen short of its capacity addition targets for electricity, although the country has successfully attracted private investment for power plant construction in the past decade. In its 12th Five Year Plan (2012-17), India plans to add more than 118 GW of power capacity to the grid, with more than half of it composed of coal-fired generation capacity.84 巳y early 2016, about 87% of this planned additional capacity had been brought online.85

To diversify the generation portfolio and offset some carbon dioxide emissions from fossil fuel sources, the government is promoting renewable energy use. In 2015, established an ambitious plan to more than quadruple electricity capacity from wind, solar, biomass, and waste projects to 175 GW by 2022. Most of this expansion is set to come from wind (60GW) and solar (100GW) resources. Accomplishing this target will depend on greater capital investment accompanied by government financial incentives, support for the local distribution companies, more favorable regulation policies for land rights, and alleviation of bottlenecks in the transmission system.

In addition, significant parts of the country, particularly in rural areas, do not have access to electricity. The IEA estimates that overall household electrification in India was 81%, representing 237 million people without electricity, in 2013. Although 96% of urban households had electricity, only 74% of rural households had access, and often the rural consumers experienced much more frequently interrupted electricity supply.89 The government initiated a rural electrification program in 2005 to provide electricity to all villages containing at least 100 households through significant investments in rural electrification. The program was modified by India’s new government in 2015 to strengthen transmission and distribution infrastructure, to reduce power supply curtailments, and to improve the system monitoring. Although the program has succeeded in electrifying many rural areas over the past decade, power supply is unreliable and frequent blackouts persist.

Sector organization

The Ministry of Power is responsible for planning and implementing India,s power sector policy, with various subunits handling different parts of the sector, including thermal, hydropower, and distribution. The CEA advises the central government on long- and short-term policy planning. The Central Electricity Regulatory Commission and State Electricity Regulatory Commissions set generation and transmission policies.

The source of India’s current electricity regulatory framework is the 2003 Electricity Act, which attempted to reform the state electricity boards, to open access to transmission and distribution networks, and to create state electricity regulatory commissions (SERCs) to manage electricity on a regional basis. Several key private investors, namely Reliance Power, Tata Power, and Essar Power, have entered India’s power generation sector, and the share of private sector to state-run generation capacity is increasing. The government has not fully implemented many parts of this legislation, and India’s electricity sector continues to face serious challenges in procurement and distribution of sufficient fuel for generation.

Power tariffs for end users are highly regulated and residential and agricultural sectors pay the lowest amount for electricity. Low retail prices often do not match higher generation costs, triggering financial losses for transmission and distribution companies and lower investment in electricity distribution. Higher costs from imported fuels and price swings in international fuel markets create financial constraints for power producers who cannot pass their full costs to some of their customers. To mitigate supply risk from fuel sources with high price volatility and to reduce carbon dioxide emissions growth, India’s government is encouraging more generation from renewable energy sources, although these sources generally require government financial incentives for projects to defray some of the higher capital costs.

Fossil fuels

Fossil fuel generation, mostly from coal, accounted for about 81 % of India’s net electricity generation of 1,208 terawatthours (TWh) in 2014.91 Coal-fired power plants dominate India’s electricity generation sector and accounted for almost 186 GW (or 62%) of the utility-based installed capacity in early 2016.92 India plans to add more than 72 GW of fossil fuel-fired power capacity to the grid, with almost 70 GW from coal-fired stations, between 2012 and 2017. According to Indian government data, the country has already met this goal by early 2016.93 Most coal-fired power plants in India use subcritical technology. The government is attracting private investment for its Ultra-Mega Power Plants Program, which involves installing large-scale, supercritical coal- fired power plants that are more energy efficient and create lower carbon emissions. To alleviate fuel transportation constraints, these power plants will be located near domestic coal supplies and near the coasts to accommodate imports.

Natural gas fuels most of the remaining share of fossil fuel-fired electricity generation as a supply source for peak load requirements. After the newly developed Krishna Godavari basin (including the KG-D6 field) began producing significant amounts of natural gas and India began importing LNG during the past decade, natural gas use in power began to rise. Since 2011, natural gas-fired generation has waned, and some power plants have ceased operation since production of natural gas at the KG-D6 field began to decline. Natural gas-fired generation capacity was nearly 25 GW in early 2016, or 8% of total generation capacity.94 The government intends to revitalize some of the natural gas-fired plants through a plan to subsidize some power generators and to support more LNG imports.

Hydroelectric

India was the world’s seventh-largest producer of hydroelectric power in 2014, with around 130 TWh of gross generation.96 Total utility-based installed capacity of hydropower (not including 4.3 GW of small facilities) was less than 43 GW by April 2016 and was the second-largest source of power production in India after fossil fuels.97 India,s estimated hydropower resource potential is more than 148 GW, leaving the country with substantial room to develop this resource. However, many large hydropower projects face delays from a myriad of challenges: high costs, insufficient private investment, lack of transmission infrastructure, environmental issues, infrastructure challenges in the mountainous northeastern region, population resettlement concerns, and regulatory delays.

India benefits from a tropical climate, which gives the country increased hydropower potential, particularly during the summer months. In particular, states with significant river systems such as Himachal Pradesh, Jammu, Kashmir, and Uttarakhand benefit from energy surpluses as a result of abundant precipitation during the monsoon period. However, coal and natural gas generation is related inversely to hydropower capacity. When hydropower utilization falls, for example, with a weak monsoon season, coal-fired power plants will generate more electricity to compensate for the shortfall.

Nuclear

India has 21 operational nuclear reactors at 7 nuclear power plants with a net generation capacity of 5.3 GW, representing about 2% of total utility-based generation capacity. The first unit of the Kudankulam power plant, India’s first large nuclear plant, in the southern state of Tamil Nadu became operational at the end of 2014, and the second unit is slated for commissioning in 2016. Each of these units adds nearly 1 GW to the country’s nuclear capacity. As of early 2016, six reactors with a combined net installed capacity of 3.9 GW are under construction and could come online by 2017.100 Several other large projects are in various stages of planning.

As India seeks reliable electricity supply to accommodate its swiftly growing power demand, the government has indicated that it plans to increase the nuclear share of total generation from 3% in 2014 to 25% by 2050.101

In September 2008, India became a party to the Nuclear Suppliers’ Group agreement, which opened access to nuclear technology and expertise through several cooperative agreements. The government has signed several such agreements with countries including the United States, Russia, France, the United Kingdom, South Korea, and Canada. In addition, India gained access to reactor parts and uranium fuel from other countries as a result of these agreements.

Indians protested nuclear power after the Fukushima disaster in Japan, and the government responded by organizing safety audits for existing reactors. The Atomic Energy Regulatory Board (AERB) conducted stress tests of all nuclear power plants. The Indian government has a three-stage nuclear development plan to gradually shift from powering reactors with natural uranium to accumulating reserves of other fissile materials such as thorium. Although the Indian nuclear sector historically has had limited access to uranium, it has abundant thorium reserves that can power more sophisticated reactors. India’s commitment to the thorium fuel cycle sets it apart from most nations with nuclear power programs.

Biomass and waste

The lack of electricity in some parts of India results in a substantial use of traditional biomass and waste products primarily for household uses in rural areas. Biomass and waste are estimated as the second-largest source of primary energy consumption. A small portion of biomass and bagasse contributes to power plant feedstock.

Many rural areas of India tend to rely on traditional biomass (including firewood, animal dung, and agricultural residue) for cooking, heating, and lighting because these areas lack access to other energy supplies. These sources can be burned directly to produce heat and electricity.

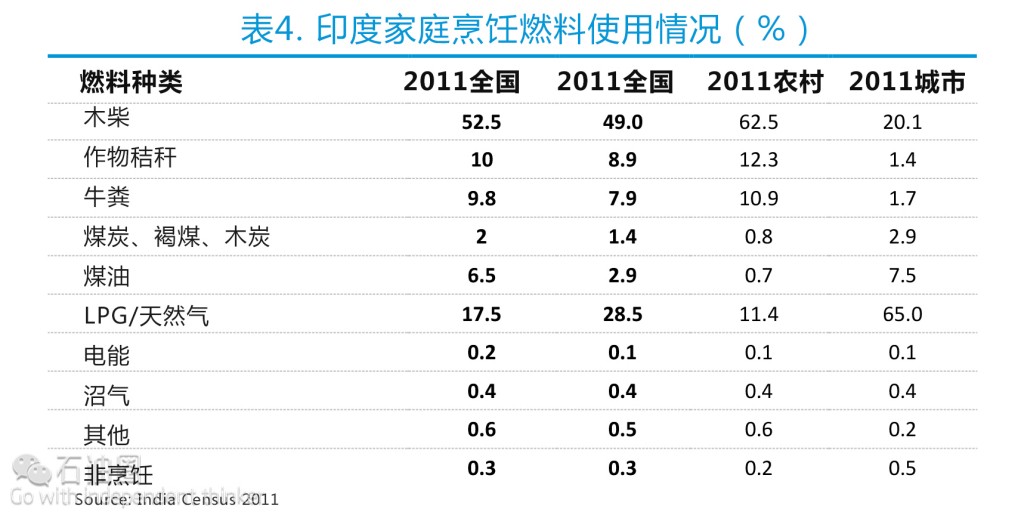

Large parts of India rely on biomass as the primary fuel for cooking. According to the 2011 India census, 87% of rural households use solid fuels (firewood, crop residue, dung, and coal) for cooking (Table 4). By contrast, only 26% of urban households use solid fuels; 65% of urban households use LPG as the primary fuel source for cooking. Using solid fuels for cooking can cause health problems from exposure to waste products and pollution or environmental problems when forests or crops are harvested unsustainably. On the whole, about 66% of India’s total population used traditional biomass for cooking purposes in 2011.

India also uses biomass in the power sector. According to India,s Ministry of New and Renewable Energy, India had 4.9 GW of utility-based installed capacity and nearly 1 GW of o^-grid facilities using biomass, bagasse (crushed sugarcane or sorghum stalks), and waste by early 2016.104 India’s Ministry of New and Renewable Energy reports the country has an additional 18 GW and 5 GW of potential electricity generation capacity from biomass and bagasse, respectively.105 Although India has a 20% biofuels blending goal by 2017 and a current target of 5% ethanol blending, consumption of biodiesel and ethanol has been low. The Indian government has rolled out policies and fiscal incentives recently to facilitate greater biofuel use.

石油圈

石油圈