最近国际油格有回暖趋势,公众对于未来石油价格走势众说纷纭。油价会持续上升吗,这其中有什么原因?石油行业是否会被新能源替代,未来该如何发展?让石油圈和您一起来分析一下吧。

油价回暖 能持续多久?

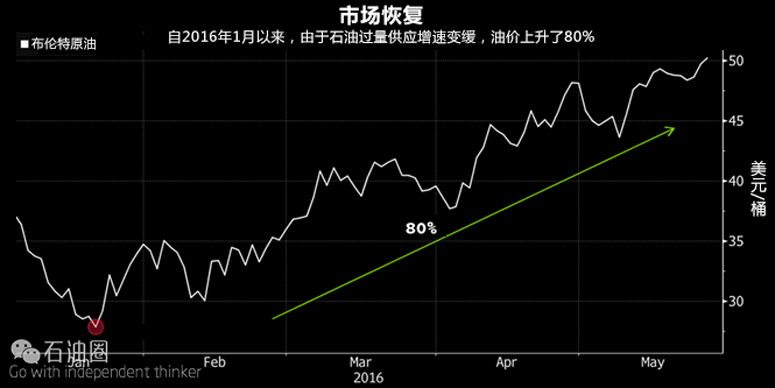

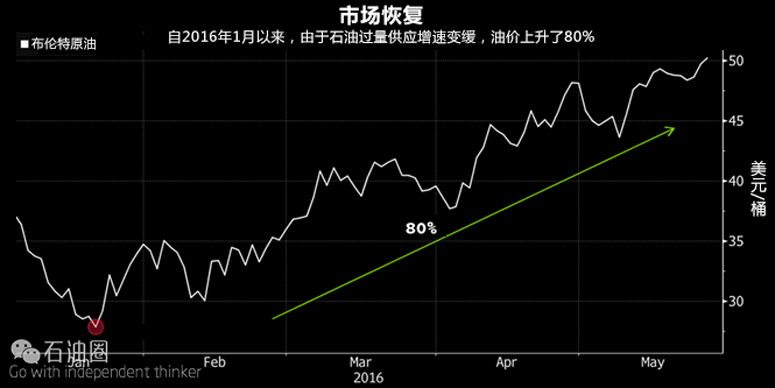

今年1月份油价低至27美元/桶,而今油价几乎是翻番了。越来越多的行业分析师认为石油市场正在复苏,其中还有分析师认为到今年圣诞节,油价将升至85美元/桶,一个证据有力的印证了他的说法:OPEC在石油生产限额上未能达成一致,他们希望价格回升,非OPEC国家则在原油输出上呈平稳下降趋势,夏季是驾驶高峰期,也是OPEC国家亟需石油的高峰期。

事实上,专业的分析师预测:受供应中断的影响,油价虽然恢复缓慢但却持久,这主要由于中国和印度持续上升的石油需求及原油产量增长率的下降。国际能源署预测,2016年早期需求为130万桶/天,属于供过于求的时期,到年末将下降20万桶/天。如果这一趋势持续,那么供应短缺将在几年内成为现实,加之在过去两年间,5千亿美元的投资项目已被搁置。

在短期内,尼日利亚、利比亚、委内瑞拉、科威特和加拿大供应中断,这加速石油市场恢复平衡。尼日利亚由于武装活动使得其石油产业呈现严重危机,其日产量降低40~50%,前期其日产量达240万桶,后续战火可能继续燃烧。然而,新进入市场的一些石油抵消了尼日利亚战火引发的危机,因此石油产量并没有随之降低。

首先,今年伊朗石油增加70万桶/天,预计今年年底还会增加30万桶/天。其次,全球石油储量已创记录新高,超过经合组织国家的32亿桶。这一现象导致的结果是:库存的消耗速度可能会加快,尤其是当前局势下如果油价以当前速度反弹,其消耗速度难以估量。第三,一些长期的海上项目和含油砂项目到2017年年底将以50万桶/天的速度进行原油开采。第四,也是最关键的因素,美国页岩气开发厂商捕捉到一些国家中断石油供应的消息,迅速提高产量来弥补过去一年的损失。

因此,价格涨幅过大反而影响市场恢复平衡,这是目前存在的最大风险。一些如先锋自然能源公司(Pioneer Natural Resources Company)和大陆资源等公司表明:当桶油成本高于50美金时他们将继续钻探。油价上升后,超过四千口已钻但未完成的井将在几周内完成并投产。事实上,当油价能够达到55~60美元时,他们将继续完成许多未完成的页岩气作业,而美国前几周钻机数量有所增加,开钻的井位也为后续美国石油产量增长埋下伏笔。在中东,已完钻且其产能的提升有利于保障他们海湾厂商的市场份额,以上种种迹象表明,油价持续上升并不会持续很久。

油气行业面临的压力

长期看来,石油与天然气产业面临的压力让人望而生畏。我们居住的地球正日趋变暖,受厄尔尼诺现象的影响,已破8个月持续高温记录。近几年,出于对全球变暖的担忧,现在重新主张向一些矿物燃料公司进行投资,最近Bill和Melinda Gates Foundation基金会备受瞩目,他们转让了大量股份,对于矿物燃料公司的投资已不再是安全的选择了。在今年五月的G7峰会上,首次将2025年矿物燃料津贴终止。此外,巴黎方面做出协定,不允许燃烧矿物燃料,这也是由175个国家在四月反复强调的事情。据估计,80%的煤、30%的石油和50%天然气将不允许开采。除其他因素外,Chatham研究所高度重视这一点,然而这一跨国公司的商业模式已经十分陈腐。

如果没有一个持续且稳定的替代品,我们的世界极有可能因仅将45%的石油用于交通运输而导致仍然依赖于石油。石油服务于人类许多重要方面,从化肥到化纤,都是组成生活的重要成分,这些确保我们能够生产足够的粮食和服装,供70亿人吃饱穿暖。

结果是,许多石油巨头已经渡过低迷期,而且没有因为石油经济萧条而受到太大损失,这主要是由于他们能够从化工方面弥补石油开采方面造成的损失,埃克森美孚在2015年甚至获得盈利。但是,在没有可替代的化工原料的前提下,如果气候事件频发,也会影响石油行业的长远发展。

事实上,科学家们预测海平面上升的速度将是前期预测值的两倍,这将在未来的几十年内给世界的一些沿海城市带来洪涝灾害。气候变化的影响已经波及到Alberta,五月引起该地森林火灾,导致加拿大100万桶/天的原油停产。更具讽刺的是气候的变化,已经影响了石油市场,尽管这并不是环保人士所期待的。

在中期,石油将面临其最严重的挑战,因为用于运输的45%的石油将开始面对来自电动汽车(EV)的繁荣发展的激烈竞争。特斯拉3号,一次充电便可行驶200多公里,这在市场十分畅销,而且在汽车行业引起巨大冲击。这款车将在明年推出,保守估计其销量能超过40万,这是一个前所未有的数字。相比之下,宝马3系仅为10万台,这一品牌在市场已成为标杆,每年在美国市场销量很好。因此这些数字表明,电动汽车已经渐渐超越了早期阶段。

在最近KBB.com网站的一次调查显示,80%的购车者在研究市场报告时,更加关注新款电动汽车。随着通用公司的Volt,即第一款能够一次充电行驶200公里的电动车,将在今年下半年首次亮相,宝马、大众、东风日产、梅赛德斯-奔驰宣布计划在未来三年内引进可以行驶200公里以上的电动汽车,这表明电动汽车的时代已经来临。彭博社预测,到2023年,电动汽车的畅销将导致与前几年一样石油市场供过于求的现象。

人们忽略了电动车对石油的影响,反观电动汽车对石油行业带来的挑战越来越显著,例如,近期EIA预测电动汽车在2030年的美国将占汽车市场的2%。过去,人们低估了可再生能源的增长速度,然而2015年可再生能源占全球能源的90%。

其原因是,可再生能源的成本在过去的五年中明显下降。现在,太阳能和风能成为汽车动力的来源,与天然气有着相当的竞争力,其影响十分深刻,全球温室气体排放量在一年内首次下降,同时全球的GDP也有相应增长,从而我们可以得出经济增长得益于温室气体排放量的下降。

由于天然气供过于求,液化气产能过剩,因此价格下跌,以至于新建的燃煤发电被挤出了市场。据彭博社提供的数据显示,超过一半的全球煤炭行业,由于收入不足以支付他们的利息,因此走向破产。世界上最大的煤炭控股集团Peabody能源公司,已申请破产,这也是预示未来石油工业走向的前兆。

前车之鉴 石油行业如何发展

未来世界对能源的需求仍然会上升,但是如果认为石油的需求也会相应上升这就大错特错。石油行业在十年内将面临一个短暂的发展,随之而来的是一个缓慢、持续的下降趋势。石油行业的相关人士应汲取柯达、施乐、诺基亚这些公司的一些经验教训,它们曾在影像、计算机及手机行业的响当当的品牌的经历都给世人留下警示。他们未能继续创新,因此只能一步步看着自己的市场份额被其他厂商吞没。对于石油行业而言,也面临这一维谷,因此为了生存,石油公司要利用自己的专长和优势来面对未来十年的挑战:

• 开发光伏太阳能电池能够提升能效;

• 推广先进材料,使风力涡轮机重量更轻、质量更可靠;

• 建立储能基础设施,以缓解间歇性的可再生能源需求高峰;

• 发展生化工艺以及先进的热工艺,以代替化工原料。

石油行业是出了名的保守行业,不过,人们越来越认识到这个行业急需发展改变的紧迫性。在过去的几个月中,道达尔、壳牌、埃克森宣布后续将专注于寻找可替代的能源,尤其是道达尔公司,制定了一个20年内跻身世界太阳能公司前三的计划。虽然这并不是第一次出现石油公司涉猎其他能源行业,但正是因为目前经济形势影响,通过这些方法才有可能获得制胜法宝。

工程公司、设备制造公司和技术支持公司如果想支撑下去,就必须在市场找到自己的定位。这些公司不应该去裁掉一些有才能的员工,而是应该引导他们去应对能源挑战,在他们身上投资,才有可能让他们的公司占据优势。这不仅仅需要一套良好的管理模式,更重要的是需要极其优秀的管理能力及管理者自身的勇气。我们的石油行业已经征服了无人居住的沙漠、冰封雪地的北极以及深不可测的大海,相信我们也将战胜未来的挑战,迎接五彩斑斓的明天。

作者/Chet Biliyok 译者/罗曼 编辑/Wang Yue

The price of oil has nearly doubled since the lows of $27 per barrel reached at the end of January. The growing consensus among market analysts is that a market recovery is underway, with one analyst going as far as predicting that oil will reach $85 per barrel by Christmas. A glance at the evidence greatly supports this – OPEC’s failure to agree on a quota hasn’t curtailed the price rally, there is a steady drop in non-OPEC (read US shale) output, and a summer driving season is giving oil demand a boost.

In fact, analysis after analysis now forecast a slow but sustained recovery due to the combined effects of supply disruptions, naturally declining production rates and growing demand particularly from China and India. The IEA predicts that the supply glut will fall from the 1.3 million barrel per day (bpd) recorded in early 2016 to 0.2 million bpd by the end of the year. If the trend continues, the spectre of a supply shortfall will become a reality within a few years, due to the $500 billion investments that have been shelved over the past two years.

In the short-term, supply disruptions in Nigeria, Libya, Venezuela, Kuwait and Canada, have accelerated a rebalance in the market. The situation in Nigeria appears most onerous as renewed militant activities have knocked off up to 40 – 50% of its 2.4 million bpd production capacity, with a high likelihood of more attacks to follow. However, new oil entering the market is offsetting these, mostly temporary, supply disruptions. First, 0.7 million bpd of Iranian oil has been added this year, with an additional 0.3 million bpd anticipated by the end of the year. Second, global storage is at the highest recorded level ever, exceeding 3.2 billion barrels among OECD nations. As a result, inventory drawdown is likely to accelerate over the year especially if the price rally is sustained. Third, the completion of some long-term offshore and tar sands projects will introduce about 0.5 million bpd production capacity by the end of 2017. Fourth, but the most crucial factor, is the willingness of nimble US shale producers to ramp up production quickly to stem the losses of the past year.

Therefore, the danger exists that prices rise so much that they prevent the market from rebalancing. Companies like Pioneer Natural Resources and Continental Resources Inchave gone on record to state that they will resume drilling when prices stay above $50 per barrel. Compounding this is the existence of over four thousand drilled but uncompleted wells that can be brought online within weeks to take advantage of the oil price rally. In fact, many shale drillers will start completing their backlogs of unfinished wells when prices reach the $55 to $60 range. A small increase in the number of rigs operating in the US over the previous week is foreshadowing a reversal in declining US production. And with drilling already ramping up in the Middle East as Gulf producers gear up to defend their market share, a ceiling for the oil prices will be arrived at shortly.

In the long term, the oil and gas industry faces daunting environmental pressures. That we live in a warming planet is a scientific fact buttressed by eight successive months of record-breaking temperatures spurred on by a strong El Niño. For a few years now, concerns about global warming have continued to fuel a divestment movement that has advocated redirecting investments from fossil fuel companies, with Bill and Melinda Gates Foundation being the latest high-profile organisation to sell off such holdings. Good intentions have never been a compelling driver for investment decisions, yet investing in fossil fuel companies is no longer the safe choice it once was. In May, G7 nations for the first time set a deadline of 2025 for the ending of most fossil fuel subsidies. Also, a crucial implication of the Paris agreement, which was reaffirmed by 175 countries in April, is that some fossil fuel reserves are unburnable. It is estimated that to limit global warming to the oft-stated 2 oC, 80% of coal, 30% of oil and 50% of gas reserves will have to remain in the ground. This is one factor, among others, highlighted in a report by the respected Chatham House, that has rendered the business model of multinationals obsolete.

Without a viable alternative, the world is likely to remain addicted to oil as only about 45% of produced oil is used for transportation. Oil serves mankind in so many other vital ways, being a key component in the production of varied essentials from fertiliser to synthetic fabrics, hence ensuring that we can produce enough food and garments to feed and clothe over 7 billion people.

As a result, many oil majors have been able to ride out the downturn without being worse for wear, as they were able to fall back on their chemicals portfolio to stem their losses from the oil production side of their business, with Exxon & Total even turning a profit in 2015. However, even in the absence of viable alternative chemical feedstocks, the increasing frequency of major climatic events may force the issue in the long run.

Indeed, scientists are now predicting sea levels will increase by twice the rate that has been previously estimated, which will cause extreme flooding in many of the world’s coastal cities within a few decades. And the fingerprint of climate change is all over the wildfires that raged in Alberta in May and shut in 1 million bpd Canadian production. The irony is that climate change is already affecting the oil markets, just not the way that environmentalists may have hoped.

It is in the medium term that oil will face its most serious challenge as the 45% of oil used for transportation will begin to face stiff competition from other energy sources on the power grid, due to the proliferation of electric vehicles (EVs). The reception of the Tesla Model 3, a mass-market EV with a 200+ mile range on a single charge, has sent shockwaves beyond the automobile industry. It is due for release next year, yet the number of reservations has exceeded 400 thousand, an unprecedented figure. By comparison, only 100 thousand BMW 3-series, the benchmark for the market segment, is sold annually in the US. These numbers reveal that EVs have progressed beyond the early adopter stage, and in a recent KBB.com survey, 80 percent of buyers reported looking at an EV when in the market for a new car. With the GM Volt, the first 200+ mile range mass-market EV debuting later this year, and BMW, Volkswagen, Nissan and now Mercedes-Benz announcing plans to introduce 200+ mile EVs within the next three years, the age of the EV has arrived. Bloomberg predicts that by 2023, EVs will create an oil glut similar to one experienced this past couple of years.

The challenge brought on by the EVs becomes even more compelling when one recognises that most energy demand forecasts have dismissed the impact of EVs. For example, only recently the EIA estimates that EVs will make up only 2% of vehicles in the US by 2030. In the past, such forecasts greatly underestimated the growth of renewable energy, yet renewables accounted for 90% of global power investments in

The reason is that the costs of renewable energy have declined so greatly over the past five years, that solar and wind are now competitive with gas power generation. The impact has been so profound that global greenhouse gas emissions have fallen for the first time in a year that the world experienced a global GDP growth, thereby decoupling economic growth from emissions. Gas prices are also depressed due to oversupply and LNG overcapacity, so much so that new build coal power generation is being crowded out of the market. According to data compiled by Bloomberg, more than half the assets in the global coal industry are now held by companies that are either in bankruptcy proceedings or don’t earn enough money to pay their interest bills. Peabody Energy, the world’s largest coal holdings, has filed for bankruptcy, a harbinger of things to come for the oil industry.

The world needs energy and in the coming years, demand for energy will indeed rise, but the assumption that this increase will result in a corresponding growth in oil demand is incorrect. The oil industry faces a decade that will begin with short-lived boom followed by a slow, sustained and inescapable decline. Organisations only need to look at a few business case studies to appreciate the predicament that they face – Kodak, Xerox and recently, Nokia are cautionary tales of companies that held dominant positions in the photography, computing, and mobile markets respectively. They stood still and failed to innovate, only to watch their market share get swallowed by enterprising upstarts. Organisations in the oil industry face a similar dilemma – either wind down with falling oil demand or evolve to become energy companies. To survive, organisations will need to leverage their expertise and resources to solve energy challenges of the coming decade:

• develop photovoltaic solar cells with enhanced energy efficiencies,

• develop advanced materials to make lighter and more reliable wind turbines,

• build energy storage infrastructure to deal intermittent renewables and peak energy demand,

• develop biochemical and advanced thermal processes to provide alternative chemical feedstocks,

The oil industry is notoriously conservative, yet, there is a growing recognition of the need to evolve. Over the last couple of months, Total, Shell, and Exxon have announced major initiatives to focus on alternative energy, with Total, in particular, having a target to be a top 3 solar company within 20 years. Although this is not the first time such companies have dabbled in alternative energy, the urgency created by prevailing economic drivers may be the key that unlocks the winning formula. Engineering companies, equipment manufacturers and technology providers must also find a role for themselves in this changing landscape if they are to endure. As opposed to cutting loose talented employees, such organisations should direct them to tackling energy challenges, and invest in the research that will give them a leg up. This requires not only great management but also courage and leadership. An industry that has conquered uninhabitable deserts, freezing arctic landscape and unseen ocean depths to produce oil is one that can and should rise to meet this challenge.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈