受整体经济形势低迷、油价下跌影响,国内外各大油服公司勘探开发投资缩减、利润大幅下降,裁员人数仍在不断上升。尽管原油市场如此低迷,但最新研究表明油服行业前景依然是光明,那么究竟有哪些机会呢?一起来看一下吧。

1859年至今,全球石油工业走过了150多年历史,石油产业价值链发生深刻变化,油服产业作为石油天然气勘探、开发和生产中提供服务的行业,是整个石油工业的重要组成部分。而今,随着2016年全球石油行业勘探和开发资本、钻井和物探需求将持续下滑,供大于求的背景下,钻井、物探行业的日费率和使用率均可能持续走低。因此,低油价造成的降本增效压力,将在油公司、服务公司、分包商之间层层传导,产业链的利润率均面临挤压。

然而即便在这样的形势下,油服行业仍充满希望。油服公司依然可以在封闭市场和新兴市场寻找机会。Rystad能源服务公司是一家全球独立的石油和天然气的咨询服务和智能数据统计公司,为政府、投资者、各大油服公司提供战略咨询和研发产品。其业务遍布全球20多个国家,从2014年至2018年,其收入预计将会增加300亿美元。

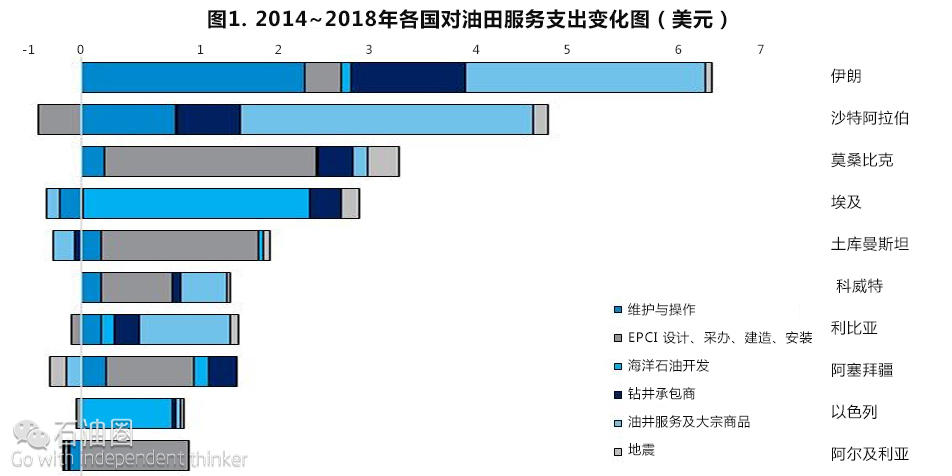

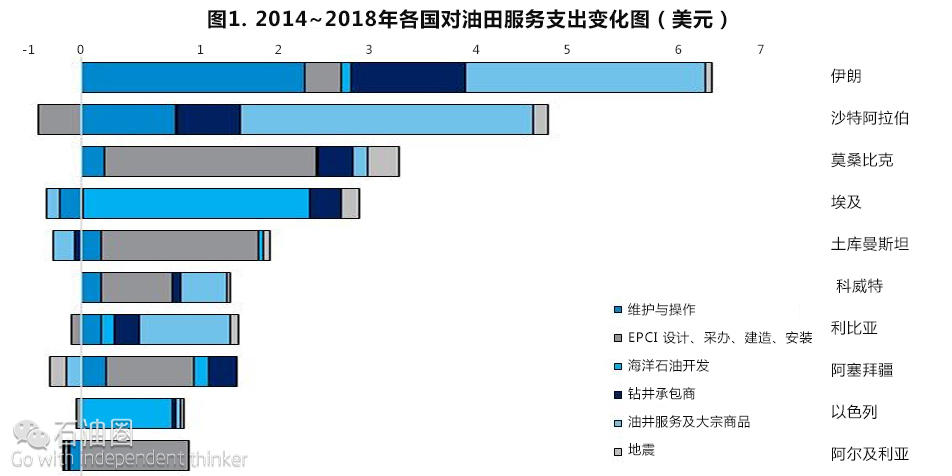

事实上,低油价并没有对封闭市场和新兴市场造成太大影响。如图1所示,全球仍有20多个国家的油服市场潜力巨大,其中,市场潜力最大的国家当属伊朗,其次是沙特阿拉伯。从2014年至2018年,为了实现增产目标,伊朗的油田服务支出将增加60亿美元。为了维持产量,除设计、采办、建造、安装(EPCI)项目外,沙特阿拉伯的大部分部门正在增加油田服务支出。由于准备开发海洋天然气,Mozambique的油服需求将会大量增加。埃及和土库曼斯坦对油服的需求主要来自Zohr、西尼罗河三角洲和Yolotan地区油田的开发。

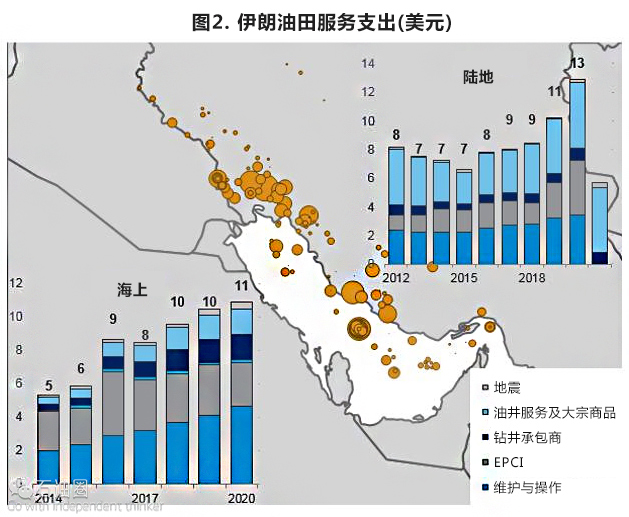

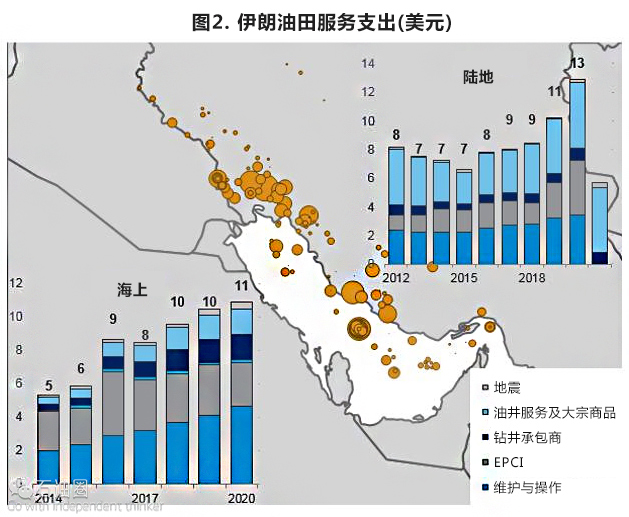

因此,在今年年初,绝大部分油服公司已将目光投向了伊朗。2016年1月份,随着制裁的解除,伊朗的石油部门正在逐渐向国外油服公司开放,逐渐公布大量需求。如图2所示,2014年,伊朗的油服市场大约为120亿美元,其中大约60%来自陆地油气田开采活动。为了增加产量,伊朗将在制裁结束之后大力寻求与油服公司的合作。伊朗政府表示,为了增加产量,2016~2020年间,伊朗在上游部门的投资将会从850亿增加至1200亿美元。截止2020年,伊朗承诺总投资将达到1500~1850亿美元或者50个中上游项目。但是根据Rystad能源服务公司的预测,伊朗的增产之路将会面临政治性风险的投资障碍和油田产量下降的挑战。他们认为,到2020年,伊朗在上游部门的投资只能达到约1000亿美元。

不难看出,1000亿美元的投资中大约有一半将投向海洋石油开发市场,其中主要涉及EPCI合同。伊朗正在尽最大努力提升产量,South Pars天然气田的5个新平台将会在2017年委托油田服务公司进行建造。新平台的不断开建,制裁期间许多老旧设施缺少资金投入,这将促使伊朗在设备维护和操作方面增加支出。此外,由于海洋开采项目即将进入预钻井阶段,伊朗将会在未来几年增加对钻井承包商、油井服务和大宗商品的需求。South Pars天然气田在未来的30个月内将陆续有22口井开钻,该地区对油田服务的需求将会在未来几年内持续增长。

相应地,伊朗的陆地上未开发油田投资较少。其中投资最多的项目是North Azadegan和Yagavaran油田,该油田已经邀请中国的公司为其提供油田服务。随着油价复苏以及国外公司回归伊朗,我们预测伊朗陆地油田的油服市场将会增加至130亿美元。South Azadegan和Arvandan地区的新油田也拥有巨大的潜力。由于产量和运输能力的增加,陆地油田服务主要集中在油井相关的业务上面,此外也涉及部分陆地EPCI项目。因此,伊朗的增产将重燃国际各大油服公司新的希望。

另一方面,各大油服公司在应对低油价冲击波的道路上,也在不断开辟新的发展模式、探寻转型发展之计,逐渐通过成熟的管理体系、丰厚的业绩积累、一流的的技术水平和多元化的市场格局积极拓展业务,似乎逐渐略显从容和得心应手。长期的低油价或可能会导致油服产业危机,对于油服公司而言,低油价的问题只能通过低成本来解决,低成本的油服公司竞争只有靠高管理水平、高运营效率和高技术水平来胜出,而提高管理、运营效率和技术水平,关键还在于准确把握石油行业特点,继续加大对封闭市场和新兴市场的业务拓展,实现油服行业的转型发展。

来自/Rystad Energy 译者/张强 编辑/Wang Yue

There is hope in the oilfield service industry despite the current downturn. Closed and abandoned service markets as well as new emerging markets can still provide opportunities for service companies. Rystad Energy expects a $30 billion growth from 2014 to 2018 to be realized for 20 countries around the world.

Low oil prices have not affected closed and emerging markets to the same degree. There are several exciting potential growth opportunities in more than 20 countries worldwide. Iran is expected to have the largest growth, increasing its purchases by more than $6 billion from 2014 to 2018 to realize its production targets. Saudi Arabia is growing purchases in most segments, except EPCI, to maintain production capacity, and Mozambique’s purchases will ramp up as the country prepares for offshore gas developments. Egypt and Turkmenistan’s purchases are mainly driven by field development at Zohr, West Nile Delta and Yolotan.

Iran has been drawing most companies’ attention this spring. After UN sanctions were lifted in January 2016, the country’s oil and gas sector has been gradually opening up again for foreign service companies, unlocking a large market potential. The total oil service market in Iran was at $12 billion in 2014, with approximately 60% originating from onshore oil and gas activities. The easing of sanctions has resulted in a sought for market for a service industry searching for growth opportunities. Iranian officials have proclaimed that they would take investments of $85-$120 billion in the upstream sector during 2016-2020 to increase crude production, according to their ambitious plans. In total, $150-$185 billion, or 50 upstream and midstream projects, could be committed before 2020. Rystad Energy foresees that production growth will face challenges due to investment hurdles and decline at existing fields, and assumes only around $100 billion of investments in the upstream sector from 2016 to 2020.

Approximately half of the $100 billion spending purchases will be directed towards the offshore market, which is expected to be at $9 billion this year and grow to $11 billion in 2020. The majority of the market consists of EPCI contracts. Five new platforms will be commissioned in 2017 at South Pars phase 20 and 21. Increased number of active platforms together with aging facilities that have lacked investments during the sanctions will force a rise in the Maintenance and Operations purchases. Demand for Drilling Contractors as well as Well Service and Commodities is picking up in the coming years since many of the offshore projects under development will go into pre-drilling. Roughly 25% of the investments are well-related costs; with 22 wells to be drilled over the next 30 months at South Pars phase 14 and additional infill drilling to commence at the producing field, these services will rise in the next few years.

The onshore oilfield service market is currently witnessing few new investments in undeveloped fields. The most notable one is the second phase of Yadavaran that aims to produce at the North Azadegan and Yagavaran oil fields, in which Chinese service companies have been invited to provide oilfield services. Combined with investments at revived producing fields, we expect the onshore service market to grow to $13 billion once oil prices recover and foreign companies are set up in the country. There is still a large potential to develop new sources of production at South Azadegan and Arvandan. Naturally, the onshore service purchases will be concentrated around the well-related purchases market, and some in onshore EPCI, given increased capacity at production and transport facilities.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈