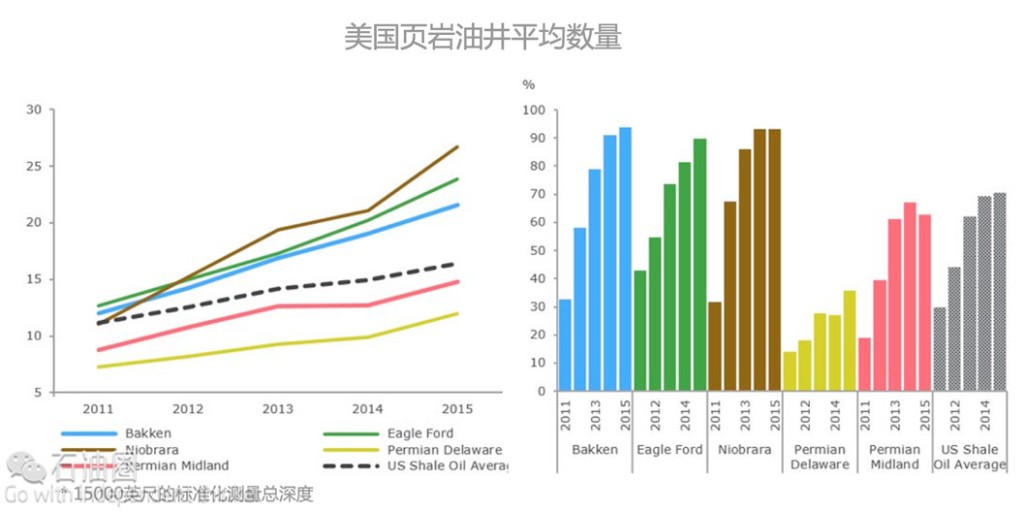

Advanced drilling techniques are increasing the speed, depth, and number of wells that can be drilled by a single rig in a year.

Drilling rig efficiency continues to rise at extremely fast rates, that have been accelerated by low oil prices forcing companies to fight for survival.

Substantial reservoir and geological data mean that shale oil is becoming more efficient, more accurate, and will have the inevitable effect of increasing Shale’s price response.

Many of these techniques can be utilized across the world, and will increase drilling efficiency for nearly every producer.

As the price of oil (NYSEARCA: USO) has collapsed, the number analysts discussing how long it will last has grown exponentially. How quickly the price collapse occurred, and how long it has lasted has befuddled many, but I believe that many more people understand how the market has fundamentally changed than a year ago. To argue that the oil price will rise to $100, you would need to make the assumption that the dynamics of the oil market have not changed. However, looking a little deeper into the shale industry, it can be better understand why it Saudi Arabia’s strategy has changed.

Shale Oil Is Becoming A Low Cost Source

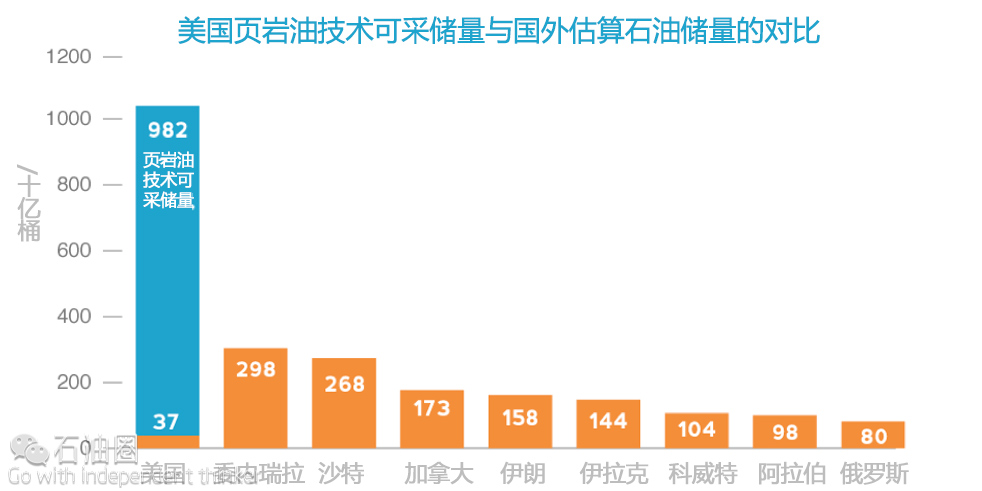

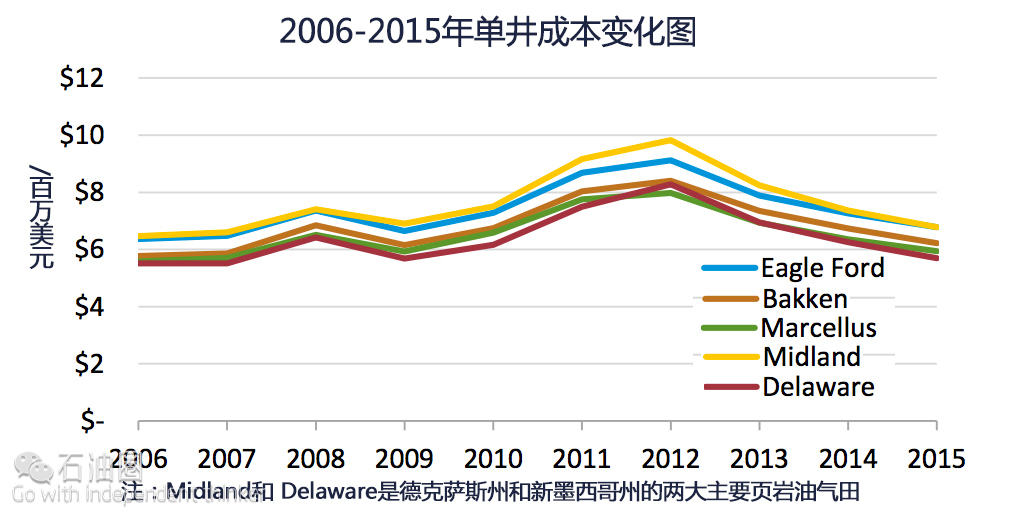

I have written several articles over the last few weeks on my view of Saudi Arabia’s strategy regarding the crude market. For interested readers, they are found here and here. The strategy to maximize profit potential from their assets was the primary focus, and in those articles, I reviewed in depth why Saudi can, and likely will, attempt to maintain a price cap on oil. Shale oil is one of the primary reasons that the oil price will remain low for a longer period – in my view as much as 4-5 years. Simply put, shale oil is easy to find, the reservoirs are extraordinarily congruent across massive areas, and experimental drilling/completion techniques are driving efficiencies up, and prices down. Similar geology across entire basins means that innovative techniques that work for one company can be applied elsewhere. With so many groups pushing to decrease costs, and with the incredible ingenuity shown by American shale companies, prices will continue to drop.

Drilling Rig Efficiency

As prices have dropped, rigs have been placed on standby by the hundreds. In a Darwinian manner, the most inefficient rigs were idled, while the most efficient rigs remained in service. Furthermore, new drilling techniques are allowing those same rigs to drill faster, deeper and farther. While the number of rigs has dropped substantially, the number of wells drilled will have been reduced by a much thinner margin. Drilling techniques allow drilling of multiple wells from a single pad and multiple laterals from a single well bore. Advanced completions allow those same wells to produce at much higher rates.

Over time, we can see that drilling efficiency is increasing at a faster rate each year. To be sure, driven more over the past two years through low prices, but the trend had existed from the start of the shale boom. Drilling efficiencies will continue to increase in the future, driving down the cost of production, improve the supply response to rising prices, and forcing Saudi Arabia and OPEC to accept lower prices. Mark Mills describes the scenario well in his Shale 2.0 article.

In recent years, the technology deployed in America’s shale fields has advanced more rapidly than in any other segment of the energy industry. Shale 2.0 promises to ultimately yield break-even costs of $5-$20 per barrel-in the same range as Saudi Arabia’s vaunted low-cost fields.

Wrap-Up

So what about the laws of diminishing returns? Shale oil is, comparably, at the low end of efficient industries. It is young, and recovery rates started around 3% and had risen to 15-20% over the last decade. When compounded with the idea that rigs are drilling faster, deeper, and more accurately, we can see that there continues to be much more room for growth in recovery rates. There is an incredible amount of oil sitting in U.S. shale plays, unlocking it will be a decades-long process of continuous improvement.

The availability of substantial reservoir and geological data, enhanced drilling techniques, and the pressure of low prices have sped the shale industry’s push for efficiencies – and we haven’t even discussed enhanced fracking techniques yet. And, while a more efficient industry at the moment means a slower rate of decline when prices rise it will lead to a rapid return to production.

Summary

Fracture stimulation costs have been dropping since 2012 and continue to drop.

Significant changes to the size of fracture stimulations are leading to gains in nearby wells via well connectivity.

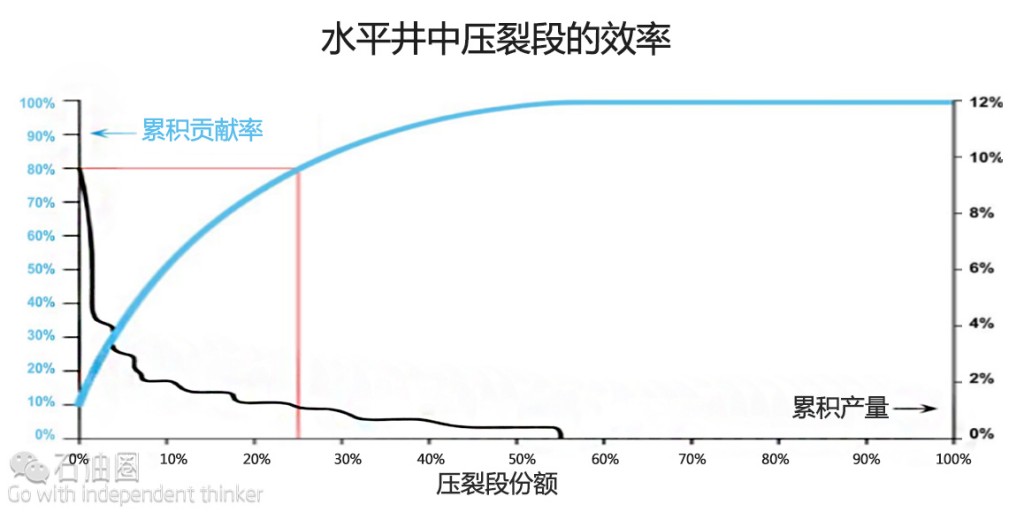

With less than 25% of frac stages currently effective, there still remains a monumental amount of growth in efficiency. Big data could deliver much more shale production.

Part one of this series, found here, covered how technological advancements have altered the world of drilling for oil (NYSEARCA:USO). Reviewing the accelerating efficiency of drilling rigs in the U.S., the article argued why we can expect exploration and development costs for shale oil to continue to decline, and discussed why this has forced Saudi Arabia to alter its oil market strategy. In this, the second part, we will take a look at how fracking and stimulate drilled wells is allowing higher production rates, more ultimately recoverable reserves, and reduced costs through progressively larger and better designed Fracture techniques.

Fracture Design Trends

Over the years, there has been constant change in the products used in fracture stimulation:

Improved acid solutions are more efficient at removing debris around the perforations than previous generation acids. Better scale inhibitors are reducing maintenance work on wells and improving productivity. Proppant used to hold the cracks and fissures in shale rock open to allow fluids to flow are improving in effectiveness – thus increasing permeability from the wellbore

Improvement in products led to increasing efficiencies, with fracture costs peaking in 2012 before starting on a long downward trend.

In addition to product changes. Improved drilling pad design has also led to substantial savings down the supply chain. As many more wells are drilling from a single pad, wells can be fracked in shorter intervals. Significant economies of scales are causing frac spread efficiencies to rise in step with drilling rig efficiencies, and costs are coming down with them.

Larger Fracks Mean More Cost-Effective Production

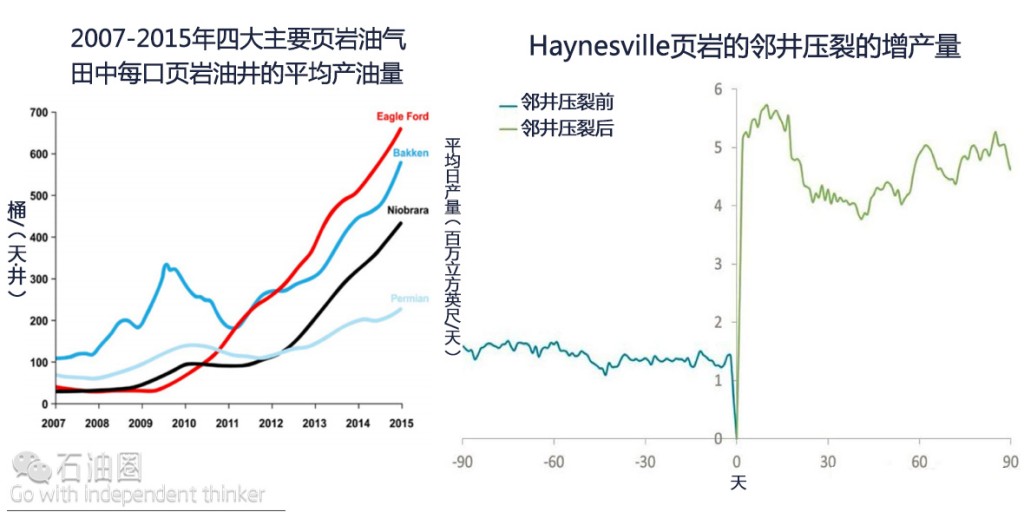

There has been a trend over the last few years of larger and larger frac designs. We are now seeing fracks so large that they are stimulating many connected wells and increasing output across all those wells. From 2013-2015, the average weight of proppant doubled for a typical well. This change means we can expect more productivity, and longer durations of high production due to increased proppant penetration. New fluids are helping proppants to penetrate more evenly, and deeper into fractures, thus elevating the available surface area and inevitably increasing the recoverable reserves.

Increasing Flowrates

So how much impact has been made by these design changes? A substantial amount. The last decade has seen average production rates skyrocket in every basin except the Permian (which has nearly quadrupled since 2007). The combination of better geological understanding, better technology, and low prices have put many oil companies in a position where innovation is a matter of how – not when or if. Rising production rates mean fewer wells must be drilled to achieve the same production rates. In addition to first round fracks producing significantly higher production rates, re-fracking and offset fracking is allowing older wells to produce at higher rates.

“When refracs work, they are among the most profitable opportunities for energy producers and the large inventory of potentially refracable wells presents an irresistible opportunity” – Oil and Gas Investor Quoting Peter Pullikan

The Future of Fracture Stimulation Design

Better fracture stimulation design could provide relative leaps forward in production capacity. While the technology to fracture multiple bores, better pad layout, larger frac design, and the innovations in re-fracking and offset fracking provide avenues for continuous improvement. The industry could see sudden leaps in completion design efficiency through improvements in fracture stage effectiveness. Even with millions of research dollars, and thousands of stimulated wells, current technology still only manages a 20-25% success rate with fracture stages.

As big data will transform the geological and reservoir aspect of drilling, so will it affect fracture design. Enhanced frac techniques are allowing for increased production rates. There is room for a leap forward in well productivity that could allow a much smaller drilling and completion fleet in U.S. shale to produce ever more volumes of oil at lower prices. Massive availability of capital led to a transformation of the sector, and low oil prices will now force the industry to innovate at an even faster rate. It is a fight for survival; consumers will be the biggest beneficiary as the new era of low oil prices is likely here to stay for a while.

石油圈

石油圈