Porter’s Five Forces framework is one useful strategic tool to evaluate potential opportunities and threats/risks for the oil and gas industry. The five key factors of this model are: Competitive rivalry, Threat of New Entrants, Threat of Substitutes, Bargaining Power of Buyers, Bargaining Power of Suppliers.

Competitive rivalry

The competitiveness of oil and gas industry and especially in the upstream sector of the industry is significantly intensive. There are three different type of players in the upstream sector of the upstream sector, these are:

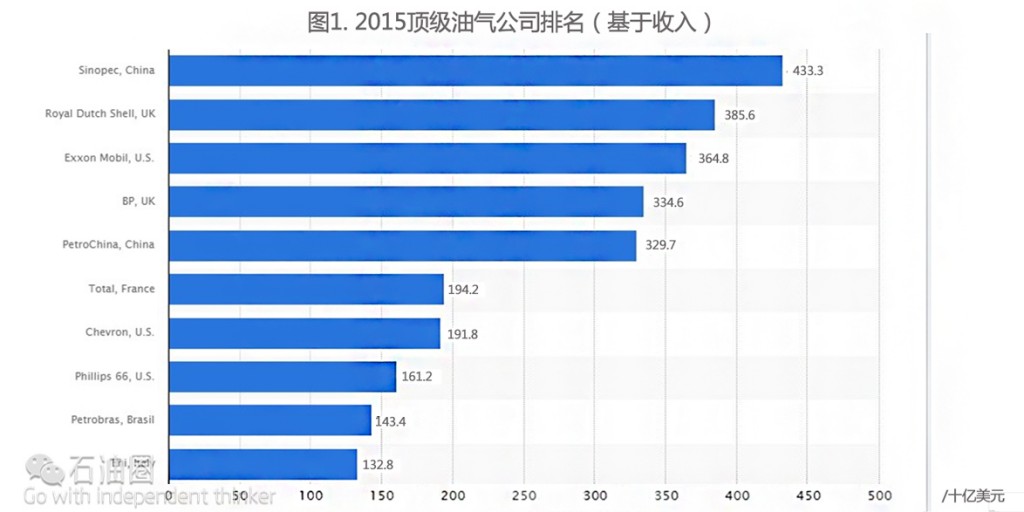

The big IOCs or as we call it Integrated Oil and Gas Companies (private sector), based on the below graph these are:

• Royal Dutch Shell 385.6 billion dollars revenue for 2015

• Exxon Mobil from USA 364.5 billion dollars revenue for 2015

• BP from UK 336.4 billion dollars revenue for 2015

• Total from France 194.2 billion dollars revenue for 2015

• Chevron from USA 191.8 billion dollars revenue for 2015

• Phillips 66 from USA 161.2 billion dollars revenue for 2015

• Eni from Italy 132.8 billion dollars revenue for 2015

Top oil and gas companies by revenue 2015 ranking | Statistic. (n.d.). Retrieved February 19, 2016

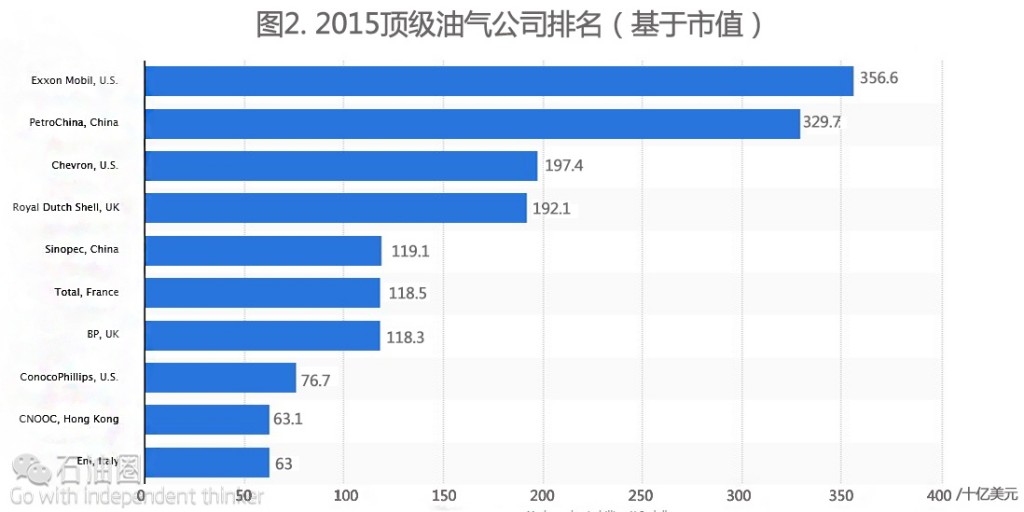

The above list based on the company revenues for 2015 in billion dollars. It is known, that the best indicator to observe the size of a company is its market capitalization. Based on the below graph the biggest private fully integrated oil and gas companies for 2015 were:

One other category of companies are the private oil and gas companies which are operating only to upstream sector of oil and gas industry (Exploration and Production). Based on the below graph the biggest private Oil and Gas Exploration and Production Companies for 2015 are:

Finally, the last group of companies which control more than 90% of the proven oil and gas reserves are the National Oil Companies. Some of these major companies are:

1. Saudi Aramco, Saudi Arabia

2. National Iranian Oil Company (NIOC)

3. China National Petroleum Company (CNPC)

4. Petroleos de Venezuela (PDVSA)

5. Rosneft, Russia

6. Gazprom, Russia

Threat of New Entrants in Oil and Gas Industry

The factors that affect the newest companies to enter oil and gas business, especially the upstream segment are:

• Huge capital required

• National Oil Companies control more than 90% of the proven oil and gas reserves

• Increase of the internal competition within the industry

• The big oil and gas companies can increase their R&D spending which will give them a boost regarding innovation and improve existing technologies. This strategy will give them a competitive advantage over new oil and gas companies which now enter the industry. Also, to mention that this whole strategy of the big IOCs can force the new competitors to spend more money

• The big IOCs or as we call it Integrated Oil and Gas Companies which can easy compete with new competitors due to economics of scale

• Oil and Gas prices volatility

• Oil and Gas Reserves are usually located in war zones or geographical areas with geopolitical conflicts or political instability

• National and international law restrictions which can affect the new entrance of a company in the oil and gas business

Threats of Substitutes in Oil and Gas Industry

The main alternatives sources to oil and gas for producing energy which used for electricity, transportation, heating, etc. are:

• Nuclear Energy

• Coal

• Hydrogen

• Biofuels and other renewables sources such as solar and wind energy

These alternative sources of energy can replace a high amount of hydrocarbons use in the global energy mix according to their performance, quality and price of course. This strategy requires a big amount of investments in R&D and producing procedures, so the possibility for substitutes to dominate the global energy mix until 2040 is very small.

Bargaining Power of Buyers in Oil and Gas Industry

The main buyers of oil and gas products are:

• Refineries

• National Oil Companies

• International Oil and Gas companies

• Distribution companies

• Traders

• Countries (USA, China, Japan, countries of the EU, etc.)

The bargaining power of buyers in oil and gas industry is relatively small due to the nature of this industry. Buyers are interested in the price and the quality of a product. It is known, that global oil benchmarks determine the oil price, the main oil benchmarks are:

• Brent Blend

• West Texas Intermediate (WTI)

• Dubai/Oman

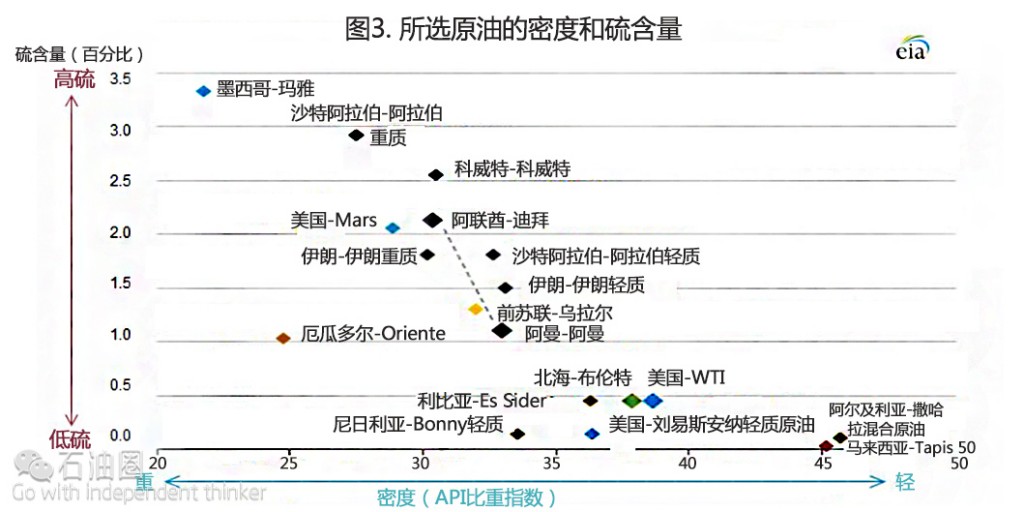

So it is obvious from the above that the buyers cannot affect the oil prices. Higher bargaining power have the buyers only which consume enormous amounts of oil and gas such as EU, China, USA, Japan, and India in comparison with other countries. Finally to mention that the only bargaining power of buyers in the oil industry is only what quality of the oil they will buy.

As we observe from the above graph, the buyers can choose from variety types of oil according to their quality characteristics (density and sulfur content), but all of them are pricing to the three known oil benchmarks that we have mentioned before. Also, until the consumers can use an alternative energy source instead of oil, the bargaining power of the buyers will be significant low.

Bargaining Power of Suppliers in Oil and Gas Industry

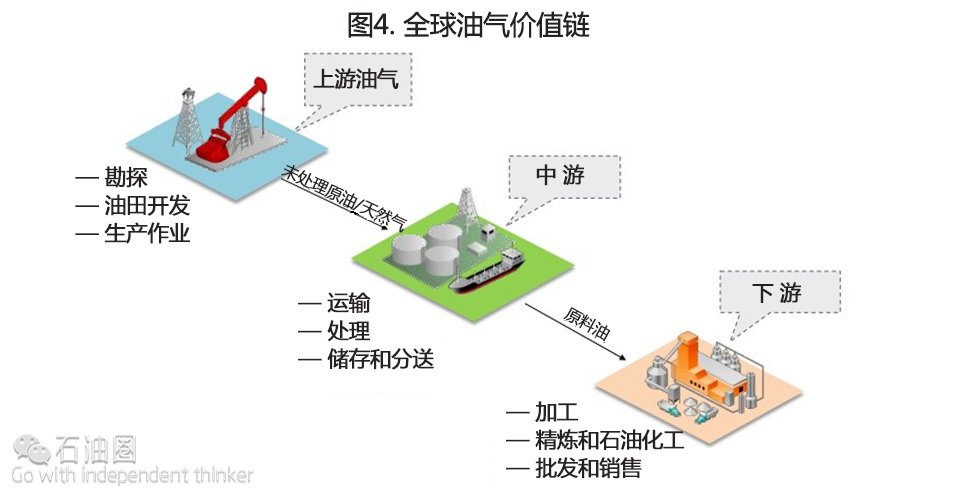

Some big suppliers in the oil and gas industry are fully integrated oil and gas industry (International and National Oil Companies) which are active in the whole value chain of oil and gas sector.

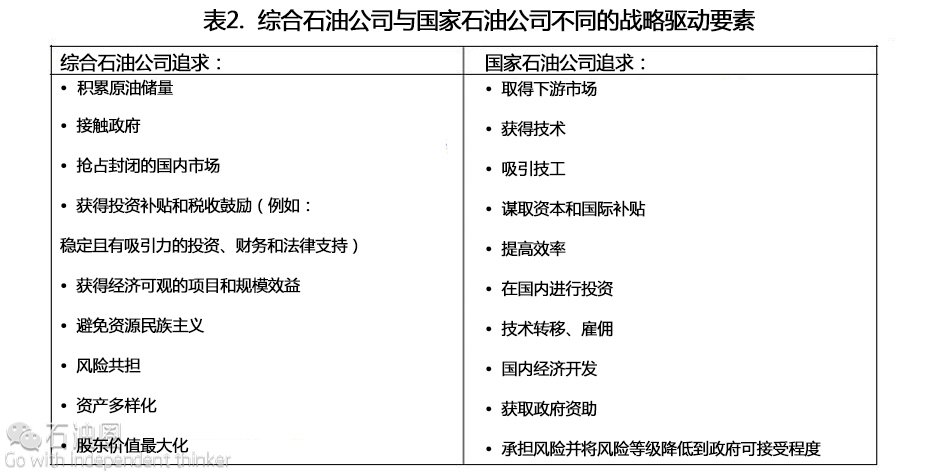

These companies can be the big International oil companies such as Chevron, Shell and Exxon Mobil or National oil companies such as Saudi Aramco, Gazprom, and Petrobras. The ability of those companies to affect oil prices and the industry is high due to their business involvement on all of the business segments of oil and gas industry, so their bargaining power is significantly greater than the buyers. Another great player in the side of the suppliers are the oil rich countries (as they call them oil producing countries) or else OPEC has a significant bargaining power. OPEC nations own at least 70% or the world’s oil proven reserves. Although these oil reserves have one of the lowest cost producing price between the oil industry in contrast with oil producing from oil sands and deep-water oil fields which are expensive regarding costs of production.

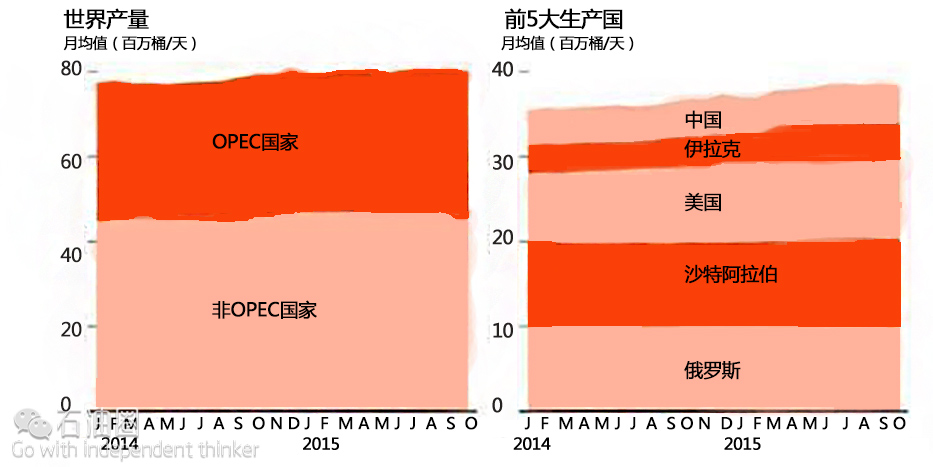

Based on the above graph from Reuters it is obvious that OPEC controls and more than the 30% of the world oil production per day which gives the ability to this organization to affect the global oil prices significantly by cutting or adding more production, so this give them also more bargaining power.On the other hand, some countries like Iran, Venezuela, and Mexico luck in any new oil and technologies due to the control of their oil sector from their oil stated companies. So this situation can drive countries such as Mexico to become importers of oil due to the fall in oil production because in the case of Mexico the oil and gas sector of this country was close to the international oil companies until 2014. In the case of the Venezuela, the national oil company was used as a political tool from the political elite of the country from 2000 and beyond, specifically was used to fund large, rich social project. This situation has driven the economy of Venezuela and of course the government budget to increase its dependence on oil revenues. At the same time, Venezuela has closed its oil sector to foreign oil and gas companies with result to be close to bankruptcy at the beginning of 2016.Some general characteristics for National Oil Companies are:

• Unlike the IOCs, the NOCs are governmentally controlled, and they usually manage a country’s hydrocarbons resources.

• Having been given the privilege to the domestic reserves, the aim of the NOCs is, differently than the IOCs, not monetization, but:

• serving the national interests,

• supporting the local economies and

• even protecting the territorial environments

The future for IOCs and NOCs is likely one in which they will both compete and co-operate, but their bargaining power will be significant high until an alternative source of energy will be discovered in the future which can replace hydrocarbons.

石油圈

石油圈