Algeria is the leading natural gas producer in Africa, the second-largest natural gas supplier to Europe, and is one of the top three oil producers in Africa. Algeria is estimated to hold the third-largest amount of shale gas resources in the world. However, gross natural gas and crude oil production have gradually declined over the past decade, mainly because new production and infrastructure projects have repeatedly been delayed.

Algeria is the leading natural gas producer in Africa, the second-largest natural gas supplier to Europe outside of the region, and is one of the top three oil producers in Africa. Algeria became a member of the Organization of the Petroleum Exporting Countries (OPEC) in 1969, shortly after it began oil production in 1958. Algeria’s economy is heavily reliant on revenues generated from its hydrocarbon sector, which account for about 25% of the country’s gross domestic product (GDP), more than 95% of export earnings, and 60% of budget revenues, according to the International Monetary Fund (IMF).

Oil and natural gas export revenues amounted to $35.7 billion in 2015, down 41% from $60.3 billion in 2014.2 The average price for crude oil produced in Algeria in 2015 was $52.79 per barrel, down 47% from 2014. Foreign exchange reserves, which peaked at $194 billion in December 2013, tumbled to $153 billion in late 2015.

Crude oil and gross natural gas production have gradually declined in recent years, mainly because of repeated project delays resulting from slow government approval, difficulties attracting investment partners, infrastructure gaps, and technical problems. In the past four licensing rounds, there was limited interest from investors to undertake new oil and natural gas projects under the government’s terms, awarding only 4 of 31 blocks in the 2014 bid round.4 An auction originally scheduled for late 2015 was canceled because of the failure of previous rounds.

Algeria (Figure 1) 5 is estimated to hold the third-largest amount of shale gas resources in the world. The U.S. Energy Information Administration (EIA) estimates that Algeria contains 707 trillion cubic feet (Tcf) and 5.7 billion barrels of technically recoverable shale gas and oil resources, respectively. Some industry analysts are cautious about the prospects of Algeria becoming a notable shale producer. To develop these resources, Algeria will face many obstacles including the remote location of the shale acreage, the lack of infrastructure and accessibility to sites, water availability, the lack of roads and pipelines to move materials, and the need for more rigs because shale wells deplete quicker.

The 2013 militant attack on the In Amenas gas facility prompted security concerns about operating in Algeria’s remote areas, particularly in the south. Any major disruption to Algeria’s hydrocarbon production would not only be detrimental to the local economy but, depending on the scale of lost production, could affect world oil prices. Because Algeria is the second-largest natural gas supplier to Europe outside of the region, unplanned cuts to natural gas output could affect some European countries.

Algeria relies on its own oil and natural gas production for domestic consumption, which is heavily subsidized. Natural gas and oil account for almost all of Algeria’s total primary energy consumption. Prices for oil products (diesel, gasoline, and liquefied petroleum gas) and natural gas in Algeria are among some of the cheapest prices in the world.7 The IMF estimates that the cost of the implicit subsidies on oil products and natural gas (both in the intermediary and final-use stages) amounted to $22.2 billion in 2012, or 10.9% of GDP.8 The 2016 budget law includes increased prices for gasoline, diesel, natural gas, and electricity for the first time in more than a decade as the Algerian government copes with falling revenue.

Natural gas accounted for 93% of power generation in Algeria in 2013, according to the International Energy Agency (IEA).10 Algeria’s government is attempting to reduce the country’s dependence on natural gas in the power sector by increasing the share of electricity generated by renewable energy. However, even if Algeria’s share of renewables consumption increases, the country is still expected to increase its consumption of natural gas as well.

The Algerian Energy Ministry of Energy and Mines has set ambitious goals for electricity generation, aiming to generate 40% of Algeria’s electricity from renewable sources by 2030.

Energy sector management

Algeria’s national oil and natural gas company, Sonatrach, dominates the country’s hydrocarbon sector, owning roughly 80% of all hydrocarbon production. By law, Sonatrach is given majority ownership of oil and natural gas projects in Algeria.

Algeria’s oil and natural gas industries are governed by the Hydrocarbon Act of 2005. The initial legislation established terms that guided the involvement of international oil companies (IOCs) in upstream exploration and production, midstream transportation, and the downstream sector. The original 2005 legislation was more favorable to foreign involvement than its predecessor, which was passed in 1986. However, amendments to the bill were made in 2006, and some of the favorable terms were reversed. In the 2006 amendments, Algeria’s national oil company, Entreprise Nationale Sonatrach (Sonatrach), was granted a minimum equity stake of 51% in any hydrocarbon project, and a windfall profits tax was introduced for IOCs.

In recent years, Algeria has experienced difficulties attracting foreign investors, particularly at licensing rounds. In the most recent licensing round in 2014, only 4 of 31 blocks were awarded. Some analysts believe that the lack of fiscal incentives to attract foreign investors to new projects, coupled with past Sonatrach corruption allegations, were to blame. Algeria’s precarious security environment has also been a concern for investors.

In 2013, Algeria revised parts of the hydrocarbon law in an attempt to attract foreign investors to new projects. Amid declining hydrocarbon production and stagnant reserves, the Algerian government has stated it needs foreign partners to increase oil and natural gas reserves and explore new territories, such as offshore in the Mediterranean Sea and onshore areas containing shale oil and natural gas resources. The 2013 amendments introduced a profit-based taxation, as opposed to revenue-based taxation and lowered tax rates for unconventional resources. The amendments also allow for a longer exploration phase for unconventional resources (11 years compared to 7 years for conventional resources) and a longer operating/production period of 30 years and 40 years for unconventional liquid and gaseous hydrocarbons, respectively (compared to 25 years and 30 years for conventional liquids and gas, respectively). The amendments, however, do not change Sonatrach’s mandated role as a majority stakeholder in all upstream oil and natural gas projects.

Sonatrach owns roughly 80% of total hydrocarbon production in Algeria, while IOCs account for the remaining 20%, based on data from Rystad Energy. IOCs with notable stakes in oil and natural gas fields are: Cepsa (Spain), BP (United Kingdom), Eni (Italy), Repsol (Spain), Total (France), Statoil (Norway), and Anadarko (United States). Sonatrach’s substantial assets in Algeria make it the largest oil and natural gas company not only in the country, but also in Africa. The company operates in several parts of the world, including: Africa (Mali, Niger, Libya, Egypt), Europe (Spain, Italy, Portugal, United Kingdom), Latin America (Peru), and the United States.

Security risks

Militant groups operating in North Africa and the Sahel have presented security risks to oil and natural gas installations in the region. In January 2013, a militant group stormed Algeria’s In Amenas gas facility, resulting in several causalities and a temporary suspension of natural gas production at the facility.

Concerns over Algeria’s security environment resurfaced on January 16, 2013 when a militant group attacked the In Amenas gas facility (Figure 2)13, resulting in several worker and militant causalities. The attack reportedly damaged two of the facility’s three processing trains, each of which has the capacity to process 3 billion cubic meters per year (Bcm/y), or 106 billion cubic feet per year (Bcf/y). Natural gas output at In Amenas was first partially restarted at the end of February 2013 at one of the three trains with the second train returning to service two months later. The third train is still out of service, but is expected to restart in 2016.

The In Amenas gas processing facility, located near the Libyan border, is jointly operated by Sonatrach, BP, and Statoil. After the incident occurred, BP and Statoil withdrew their staff from In Amenas and the In Salah gas facility (located 373 miles to the west of In Amenas), setting back plans to boost output at both projects.

Natural gas output at In Amenas averaged 6.1 Bcm/y through September 2015.15 Prior to the attack, In Amenas output averaged 7.8 Bcm/y (or 275 Bcf/d) of dry natural gas, accounting for almost 10% of Algeria’s dry natural gas production and almost 16% of exports in 2012.16 Natural gas plant liquids (NGPL) are also produced at the In Amenas fields and averaged 43,400 barrels per day (b/d) in 2012, although nameplate capacity is around 60,000 b/d, according to MEES.17 Despite the absence of some personnel, production at In Salah remained relatively unchanged at 8.2 Bcm/y (290 Bcf/y) in 2013, compared with the previous year.

Petroleum

Reserves and exploration

Algeria holds the third-largest amount of proved crude oil reserves in Africa, all of which are located onshore because there has been limited offshore exploration. According to Sonatrach, about two-thirds of Algerian territory remains largely underexplored or unexplored.

According to the latest Oil & Gas Journal estimates released in January 2016, Algeria held an estimated 12.2 billion barrels of proved crude oil reserves, an estimate that has been unchanged for many years.18 All of the country’s proved oil reserves are held onshore because there has been limited offshore exploration. Most proved oil reserves are in the country’s oldest and largest oil field, Hassi Messaoud, located in the eastern part of the country, near the Libyan border. Hassi Messaoud is estimated to hold 3.9 billion barrels of proved and probable recoverable reserves, followed by the Hassi R’Mel field (3.7 billion barrels) and the Ourhoud field (1.9 billion barrels), according to the Arab Oil & Gas Directory.

According to Sonatrach, roughly two-thirds of Algerian territory remains underexplored or unexplored. Most of these areas are in the north and offshore. There is potential to expand oil production in areas that have already been exploited as well, particularly in the Hassi Messaoud, Illizi, and Berkin basins. According to Sonatrach, the Hassi Messaoud-Dahar province contains about 71% of the country’s combined proved, probable, and possible oil reserves, while the Illizi basin, the second-largest area, contains about 15%. The Illizi and Berkine basins have been home to many discoveries since the 1990s and still hold significant potential.

Production and development

Algeria produced almost 1.7 million b/d of total petroleum and other liquids in 2015, which includes crude oil, condensate, natural gas plant liquids, and refinery processing gain.

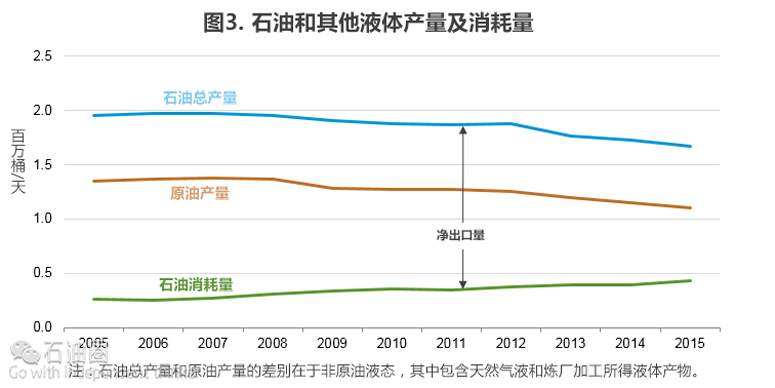

Algeria produced an estimated average of 1.1 million b/d of crude oil in 2015 (Figure 3), slightly lower than the previous year. Combined with almost 600,000 b/d of noncrude oil liquids, which are not included in its OPEC quota, Algeria’s total oil production averaged almost 1.7 million b/d in 2015.

Algerian oil fields produce high-quality light crude oil with very low sulfur content. Sonatrach operates the largest oil field in Algeria, Hassi Messaoud, which typically produces 500,000 b/d of crude oil, or more than 40% of Algeria’s total crude output.21 Other large producing areas in Algeria include the Ourhoud and the Hassi Berkine complex. Algeria’s largest oil fields are mature. Field expansions and enhanced oil recovery techniques have kept the country’s oldest fields at a steady rate of production, but this trend is slowly starting to reverse. As a result, EIA projects that Algeria’s crude oil output will gradually decline at least in the short and medium term.

Algeria does not have any major crude oil projects scheduled to come onstream. There are smaller oil projects scheduled to come onstream (Timimoun), along with additional output from existing fields (Gassi Touil-Rhoude Nouss and Hassi Messaoud), but the amount of production is expected to fall short of what is needed to offset natural decline rates at older fields.

The latest notable fields to start production were El Merk and Bir Seba. Production started at El Merk in early 2013, and output of crude oil, condensate, and liquefied petroleum gas (LPG) averaged roughly 135,000 b/d in 2015.22 Bir Seba production came online in October 2015, producing 20,000 b/d with a goal of reaching 40,000 b/d by 2020.23 Although new production is coming online in these fields, the new volumes will only partially offset declines in other existing fields.

Crude oil exports

Most (about 76%) of Algerian crude oil exports are sent to Europe.

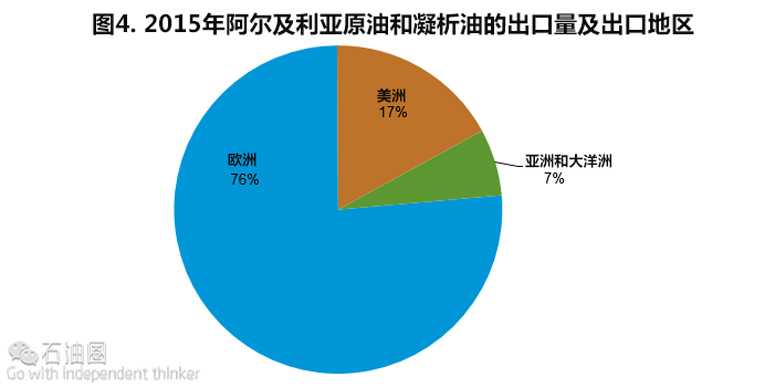

Algeria exports mostly light crude oil. The country’s main crude grade is the Sahara blend, which is a blend of crudes produced at fields in the Hassi Messaoud region. In 2015, Algeria exported approximately 540,000 b/d of crude oil, including condensate, according to EIA estimates based on Lloyd’s List Intelligence (APEX tanker tracking).

Most of Algeria’s crude oil exports are sent to Europe (76%), with the remainder sent to the Americas (17%) and Asia and Oceania (7%) (Figure 4).

The United States was one of Algeria’s largest markets for crude oil for almost a decade until 2013. U.S. crude oil imports from Algeria have substantially declined in recent years. The United States imported 31,000 b/d of crude oil from Algeria in 2015, which is down from its peak of 443,000 b/d in 2007. The growth in U.S. light, sweet crude oil production from the Bakken and Eagle Ford shale plays has resulted in a sizable decline in U.S. imports of crude grades of similar quality, like Algeria’s crude oil.

Refined petroleum products

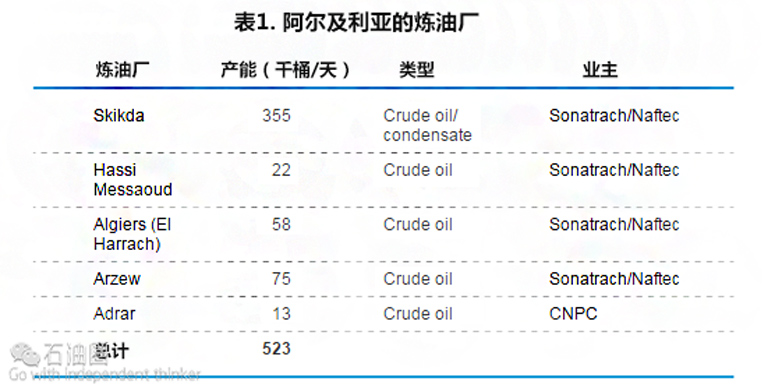

Algeria has five oil refineries with a total nameplate capacity of about 523,000 b/d. Most of Algeria’s domestic petroleum consumption, which is estimated to have averaged 433,000 b/d in 2015, derives from domestically refined products. Algeria’s petroleum consumption has increased by an annual average of 6% over the past decade.

Algeria has five oil refineries with a total nameplate capacity of 522,800 b/d (Table 1)25, according to the Oil & Gas Journal.26 The country’s largest refinery, Skikda, is located along Algeria’s northern coastline, and it is the largest refinery in Africa. The refinery has the capacity to process 355,300 b/d of crude oil and condensate, accounting for more than half of Algeria’s total refinery capacity. Skikda processes the Saharan blend, which derives from the Hassi Messaoud oil fields. Algeria’s two other coastal refineries, Algiers and Arzew, have the capacity to process 58,100 b/d and 75,000 b/d, respectively. The country’s inland refineries, Hassi Messaoud and Adrar, are connected to local oil fields and supply oil products to nearby areas.

Most of Algeria’s domestic petroleum consumption, which averaged 433,000 b/d in 2015, derived from domestically refined products. Algeria’s petroleum consumption has increased by an annual average of 6% over the past decade (2006 to 2015). Algeria typically produces a surplus of refined petroleum products, which is exported to global markets. From January 2015 to November 2015, the United States imported an average of 108,000 b/d of refined products from Algeria.

Oil pipelines and export terminals

Algeria uses multiple coastal terminals to export crude oil, refined products, LPG, and NGPL. These facilities are located at Arzew, Skikda, Algiers, Annaba, Oran, and Bejaia in Algeria and La Skhirra in Tunisia. Algeria’s domestic pipeline network facilitates the transfer of oil from interior production fields to coastal infrastructure. The most important pipelines carry crude oil from the Hassi Messaoud field to refineries and export terminals. Algeria does not have any transcontinental export oil pipelines.

Natural gas

Reserves and exploration

Algeria holds the world’s eleventh-largest amount of proved natural gas reserves and the third-largest technically recoverable shale gas resources. In May 2014, Algeria’s Council of Ministers gave formal approval to allow shale oil and shale gas development.

According to Oil & Gas Journal, as of January 2016, Algeria had 159 trillion cubic feet (Tcf) of proved natural gas reserves, the eleventh-largest natural gas reserves in the world and the second-largest reserves in Africa, behind Nigeria. Algeria’s largest natural gas field, Hassi R’Mel, was discovered in 1956. Located in the center of the country to the northwest of Hassi Messaoud, it holds proved reserves of about 85 Tcf, more than half of Algeria’s total proved natural gas reserves. According to the Arab Oil & Gas Directory,10 Hassi R’Mel accounted for three-fifths of Algeria’s gross natural gas production in 2012. The remainder of Algeria’s natural gas reserves are located in associated and nonassociated fields in the southern and southeastern regions of the country.

Algeria also holds vast untapped shale gas resources. According to an EIA-sponsored study released in June 2013, Algeria contains 707 Tcf of technically recoverable shale gas resources, the third-largest amount in the world after China and Argentina. The Ghadames Basin, encompassing eastern Algeria, southern Tunisia, and western Libya, was identified as a major shale gas basin in the assessment. In May 2014, Algeria’s Council of Ministers gave formal approval to allow shale oil and shale gas development. The Council of Ministers estimated that it would take 7 to 13 years to confirm Algeria’s potential shale resources.

Production and development

Algeria’s gross natural gas production was 6.6 Tcf in 2014, a 4% increase from the previous year. Production has steadily declined over the past decade as output from the country’s large, mature fields is depleting. There are several new projects planned to come online, but they have repeatedly been delayed.

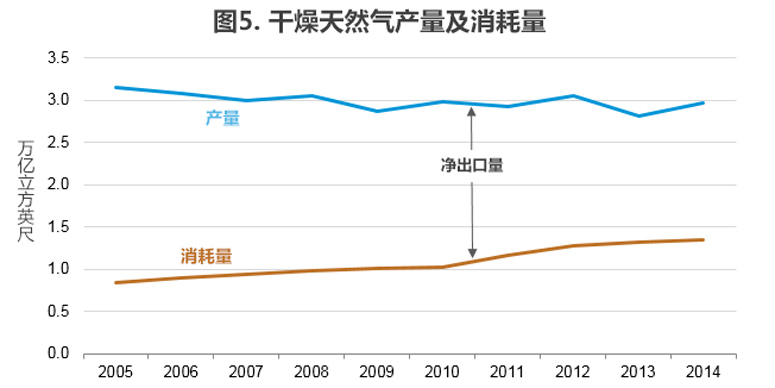

Algeria’s gross natural gas production was 6.6 Tcf in 2014, a 4% increase from the previous year (Figure 5). Algeria’s gross production had been falling since its peak of 7.1 Tcf in 2008. The increase in 2014 reflects the return of lost production at the In Amenas gas facility.

In 2014, 45% (2.9 Tcf) of gross natural gas production was marketed, 43% (2.9 Tcf) was reinjected into wells to enhance oil recovery, and 2% (0.1 Tcf) was vented or flared. Dry natural gas production (a subcategory of marketed gas that occurs when associated liquid hydrocarbons are removed) was 3.0 Tcf in 2014, of which 1.3 Tcf was consumed locally and approximately 1.5 Tcf was exported.

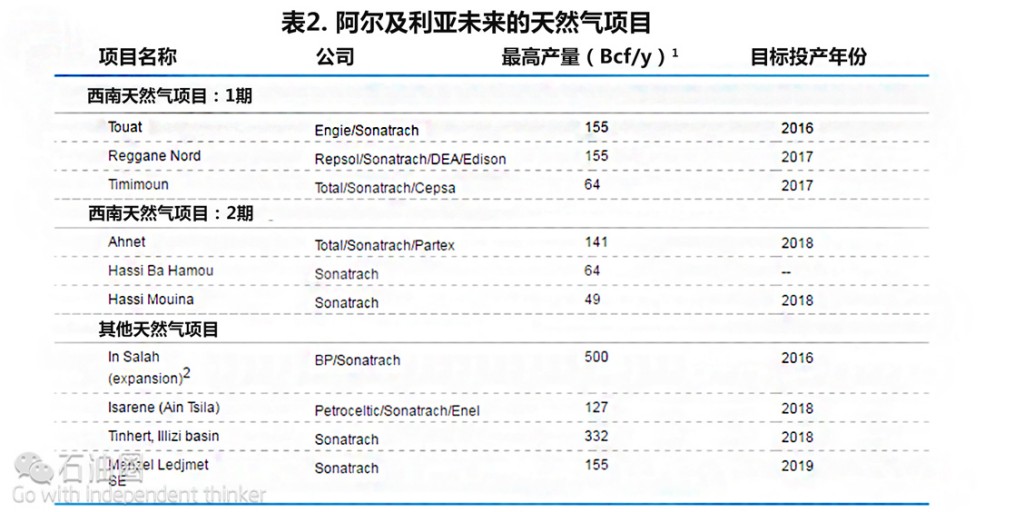

Algeria has been planning to bring on stream several new natural gas fields to compensate for the loss of production from mature fields, but many of these projects have been delayed by several years, mostly because of delayed government approval, difficulties attracting investment partners, infrastructure gaps, and technical problems (Table 2).

Algeria is in the process of developing its Southwest Gas Project, which includes Reggane Nord and Timimoun, which are expected to start production three years behind schedule in 2017, and Touat, which is scheduled to come online in 2016. The Repsol-led Reggane Nord project consists of developing six fields and is expected to reach a peak production rate of 155 Bcf/y.29 The Timimoun project, led by Total in partnership with Sonatrach and Cepsa, is expected to reach a peak production of 64 Bcf/y, and the Touat project is projected to reach a peak production of 155 Bcf/y.30 The Southwest Gas Project entails the construction of natural gas-gathering facilities, a natural gas treatment plant, and a pipeline to the Hassi R’Mel gas hub, called the GR5 pipeline. The planned infrastructure will connect the remote Southwest natural gas fields to the Hassi R’Mel region and allow for the commercialization of other fields in the south as well. The development and commercialization of the Ahnet natural gas project in the south will also depend on the new infrastructure.

The Southwest Gas Project is very important for Algeria’s ability to meet contracted exports and its expected growth in domestic demand. Gross natural gas production in the country will most likely continue to steadily decline in the short term, but it may recover in the medium term if planned projects come online and offset natural declines. Output from the Southwest Gas Project and other proposed projects (some of which are not included in the table) have the potential to increase Algeria’s output by 1 Tcf/y or more after 2018. However, these projects are contingent on attracting investors and building new infrastructure or upgrading older infrastructure.

Midstream and downstream infrastructure

Algeria exports natural gas via pipelines and on tankers in the form of liquefied natural gas (LNG). The country has three transcontinental export natural gas pipelines: two transport natural gas to Spain and one transports natural gas to Italy. Algeria’s LNG plants are located in the coastal cities of Arzew and Skikda. Algeria was the first country in the world to export LNG in 1964.

Domestic pipelines

Algeria’s domestic natural gas pipeline system transports natural gas from the Hassi R’Mel fields and processing facilities, owned by Sonatrach, to export terminals and liquefaction plants along the Mediterranean Sea. There are three main domestic pipeline systems: Hassi R’Mel to Arzew, Hassi R’Mel to Skikda, and Alrar to Hassi R’Mel. The Hassi R’Mel to Arzew system is a collection of pipelines that move natural gas from Hassi R’Mel to the export terminal and the LNG plant at Arzew. The system also includes an LPG pipeline. The Hassi R’Mel to Skikda system transports natural gas from the Hassi R’Mel fields to the Skikda LNG plant, and the Alrar to Hassi R’Mel system transports natural gas produced in the Alrar and the southeastern region to the Hassi R’Mel processing facilities. Sonatrach is building the GR5 Southwest fields to the Hassi R’Mel pipeline to monetize natural gas reserves in fields discovered in southwestern Algeria.

Transcontinental pipelines

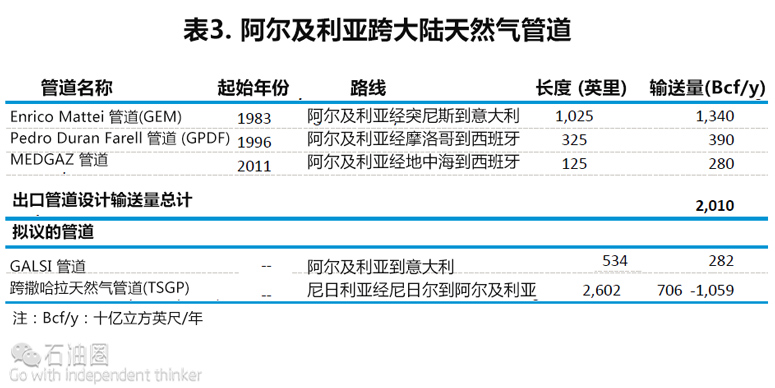

Algeria has three transcontinental export natural gas pipelines: two transport natural gas to Spain and one transports natural gas to Italy (Table 3)31. The largest pipeline, Pipeline Enrico Mattei (GEM), came online in 1983 and runs 1,025 miles from Algeria to Italy via Tunisia. GEM’s capacity is more than 1.3 Tcf/y and it is jointly owned by Sonatrach, the Tunisian government, and Eni. The Pedro Duran Farell (GPDF) pipeline started in 1996 and travels 325 miles to Spain via Morocco. GPDF’s capacity is about 390 Bcf/y. The newest pipeline, MEDGAZ, came online in 2011 and is owned by Sonatrach, Cepsa, Endesa, Iberdrola, and GDF Suez. MEDGAZ stretches 125 miles onshore and offshore, from Algeria to Spain via the Mediterranean Sea.

Planned transcontinental pipelines

Algeria plans to develop two additional transcontinental export pipelines, although both projects have suffered delays, and it is highly uncertain whether both pipelines will be built. The Gasdotto Algeria Sardegna Italia (GALSI) pipeline is planned to transport natural gas to Italy via a pipeline with a subsea section. Initially, its capacity is expected to be 282 Bcf/y. The pipeline project has gone through feasibility studies, and there are concerns about logistics, costs, pricing formulas, and long-term contractual commitments. The Trans-Saharan Gas Pipeline (TSGP) is proposed to run slightly more than 2,600 miles to deliver natural gas from Warri, Nigeria to Algeria (via Niger), which will then link to the MEDGAZ route to Spain, although this link may be changed in the future. However, security concerns about militant groups across remote areas in the Sahel, in addition to growth constraints to Nigerian natural gas production, have presented considerable downside risks to investors interested in financing the project.

Liquefied natural gas (LNG) plants

Algeria became the world’s first LNG producer in 1964 when the Arzew LNG facility came online. In 2014, Algeria was the world’s seventh-largest exporter of LNG, exporting about 5% of the world’s total exports. Algeria has four liquefaction LNG units located along the Mediterranean Sea at Arzew and Skikda, with a total design capacity to process 44 Bcm per year of natural gas.

Natural gas exports

Algeria exported about 1.5 Tcf of natural gas in 2014. Approximately 90% of Algeria’s natural gas exports were sent to Europe in 2014, making it the region’s second-largest natural gas supplier.

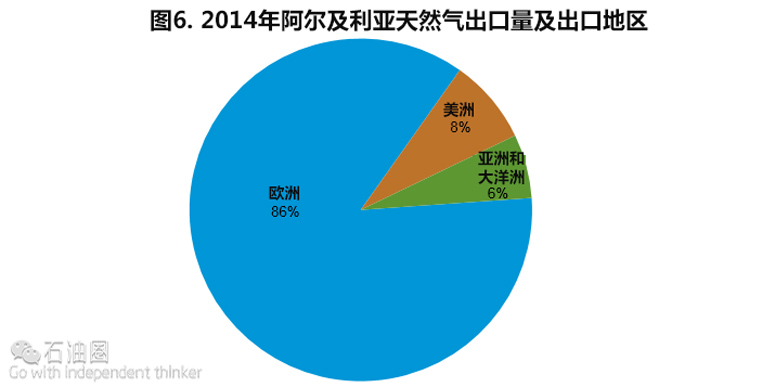

Algeria exported approximately 1.5 Tcf of natural gas in 2014, of which approximately 910 Bcf was transported via pipelines and 578 Bcf by LNG tankers.33 Algeria is Europe’s second-largest natural gas supplier outside of the region, after Russia. In 2014, more than 87% of Algeria’s pipeline exports were sent to European countries, and the remainder 14 was sent to Morocco and Tunisia as payment in lieu of transit fees (Figure 6)34. Also, 84% of Algeria’s LNG exports were sent to Europe with the remainder going to markets in Asia and Oceania.

Algeria’s natural gas exports have gradually declined over the past decade, as gross production decreases and domestic consumption increases. Despite new LNG export infrastructure and increased capacity, Algeria’s LNG exports have declined over the past few years, although an increase in production in 2014 led to an increase in exports as well. Algeria is facing pressure to boost natural gas output with new projects to meet growing domestic demand and to fulfill long-term contractual obligations to export natural gas to Europe.

Electricity

Algeria’s public utility, Sonelgaz, is pursuing a large-scale investment program to almost double electricity generation capacity in the next few years. However, Sonelgaz faces some challenges as energy subsidies continue to affect its finances and as natural gas output has declined. Most of Algeria’s planned capacity additions are from natural gas-fired power plants.

Algeria’s electricity generation capacity reached 15.2 gigawatts (GW) at the end of 2014, up from 12.9 GW at the end of 2012 and 11.4 GW at the end of 2011, according to Sonelgaz, the country’s public utility in charge of electricity generation and distribution.

Sonelgaz brought additional capacity online to keep up with demand needs. In the past, Sonelgaz imposed rationing to balance electricity supply and demand. In 2012, the government enforced power cuts that provoked public protest in the summer months.

Net electricity consumption was 45 billion kilowatthours in Algeria in 2014. Algeria’s electricity consumption has increased by an annual average of roughly 8% from 2008 to 2014. Most generation capacity comes from natural gas-fired and combined-cycle power plants, although the share of renewable energy in Algeria’s generation mix is growing but still limited. According to the Electricity and Gas Regulation Commission (CREG), the country’s electricity and natural gas market regulator, the national electricity system consists of an interconnected network that distributes power to northern and southern parts of the country. About 99% of Algeria’s population is connected to the national grid.

Algeria’s power demand peaks during the summer months and reached a new peak of 12.4 GW in August 2015.37 Sonelgaz plans to add more than 12 GW of generating capacity by 2017—18. The focus of the generation expansions are eight combined cycle gas turbine (CCGT) power plants to total 10 GW, which began commissioning in 2015. Algeria also added 256 MW of solar capacity in 2015, which is part of a 400-megawatt (MW) solar capacity program that started in 2013.38 Also, Sonelgaz commissioned a 12 turbine, 10 MW wind farm at Adrar in 2014, which is a pilot project for a wind capacity program that plans to bring 639 MW online by 2023.39 The Algerian Ministry of Energy and Mines has set ambitious goals for electricity generation, aiming to generate 40% from renewable sources by 2030.

One of Sonelgaz’s main challenges is the ability to finance new generation projects amid fixed electricity prices, which have an impact on the company’s finances. Additionally, energy subsidies in Algeria have resulted in budget deficits. Another challenge is natural gas supply. Most of Algeria’s planned capacity additions are natural gas-fired units; meanwhile, Algeria’s gross natural gas production has been declining as new projects slated to boost output have repeatedly been delayed.

石油圈

石油圈