Over the past few years,the world has witnessed a surge in new petrochemical capacity announcements, led by the Asia-Pacific and Middle East regions. Both regions continue to build up petrochemical capacity to satisfy demand,as well as increase their downstream product portfolios. Another strong contender is the US,which has announced more than $130 B in petrochemicals project construction. The US plans to add millions of tons per year of new petrochemical capacity on the back of cheap,readily available shale gasfeedstock. This two-part series will examine the global petrochemical landscape,new project developments and regional outlooks.

The global petrochemical sector will continue to see strong growth through the end of the decade. However,the crash in energy markets has shifted the outlook from bullish to cautiously optimistic. Many newconstruction projects remain in the works. The most significant expansions will be in developing countries in the Asia-Pacific and Middle East regions. These regions are investing heavily in petrochemical production units to supply increasing demand, as well as to diversify product portfolios. Some of the strongest growth is seen in the US, where cheap natural gas is fueling over $130 B in new petrochemical capacity.

Meanwhile,a decline in the oil-to-gas spread is making even oil-based naphtha crackers in regions such as Western Europe and Northeast Asia more viable than they have been in years. Ethane cracking operations in regions such as the US and the Middle East still maintain a price advantage against cracking naphtha,but the gap has shrunk considerably. This has provided naphtha cracking operations with fresh life, as feedstock costs have dropped dramatically over the past 18 months.

Through 2016, the global petrochemical outlook varies significantly between regions. Part 1 of this petrochemical outlook series will provide an overview on the present state of the petrochemical industry, as well as new project developments and regional outlooks for the petrochemical construction sector. Part 1 will provide a petrochemical overview for Africa, the Middle East and the US. Part 2 will examine the petrochemical landscape in Asia-Pacific, Canada, Europe and Latin America.

Active projects

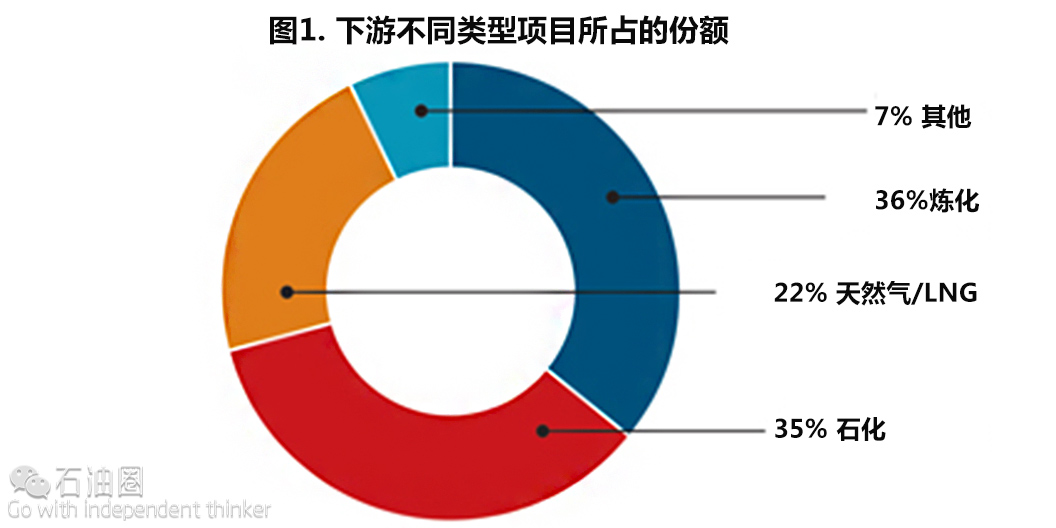

At present, Hydrocarbon Processing’s Construction Box score Database is tracking over 2,000 downstream projects worldwide. This equates to nearly $1.6 T in possible investments through 2030. As shown in Fig. 1,the petrochemical sector makes up approximately 35% of total active projects, or just over 700 projects worldwide.

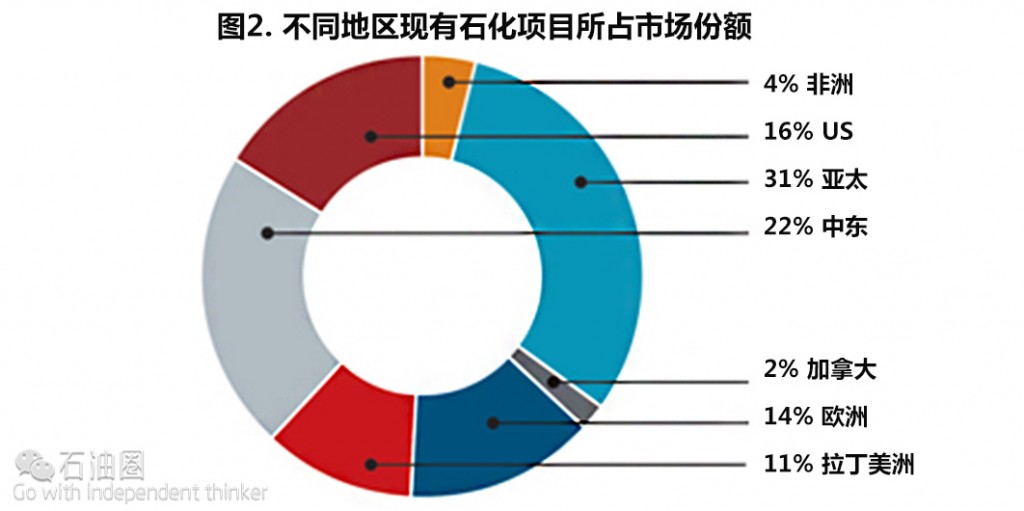

Within the petrochemical construction sector, the Asia-Pacific region continues to maintain the greatest amount of total active projects (Fig. 2). These projects are led by petrochemical capacity additions in China and India. The Middle East contains the second-highest number of active petrochemical projects, with nearly 160 projects. The region has invested heavily in building up its downstream products portfolio. This includes multibillion-dollar investments in the construction of mixed-feed crackers, as well as ethylene derivatives capacity. Saudi Arabia, Kuwait and Oman will be instrumental in adding millions of tons per year of additional petrochemical capacity by the end of the decade. With the easing of Western sanctions, Iran also has ambitious plans to build up its petrochemical infrastructure.

At 16% of active petrochemical project market share, the US has seen tremendous growth in new project announcements over the past few years. With the onset of the shale oil and gas boom, the abundance of cheap natural gas has boosted US project announcements to the forefront of new petrochemical investments. These investments include a spike in ethane cracking and ethylene derivatives capacity, as well as the addition of millions of tons per year of methanol, ammonia-urea and propane dehydrogenation (PDH) capacity.

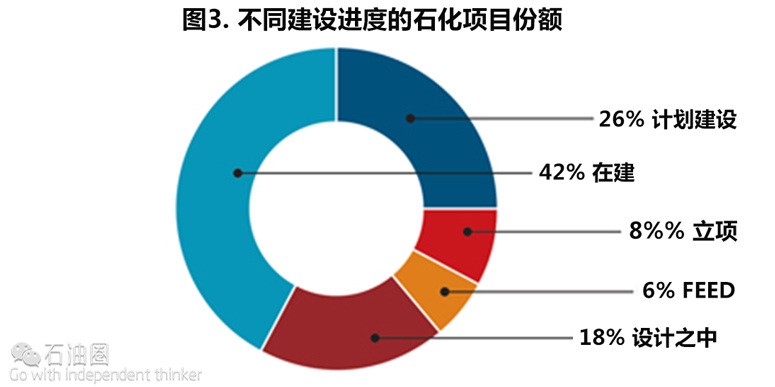

When active petrochemical projects are broken down by activity level, nearly 60% are in the preconstruction phase(Fig. 3). The majority of petrochemical projects in the preconstruction phase are in the Asia-Pacific and Middle East regions. These two regions account for approximately 56% of petrochemical projects in the preconstruction phase. The US and Europe (which includes Eastern Europe, Russia and the CIS), trail the Asia-Pacific and Middle East regions, with a total of 15% market share each.

When projects under construction are reviewed, the outcome is much the same. The Asia-Pacific and Middle East regions also comprise the majority of petrochemical projects presently under construction. Total market share for projects under construction in the Asia-Pacific and Middle East regions stands at 33% and 23%, respectively.

New projects

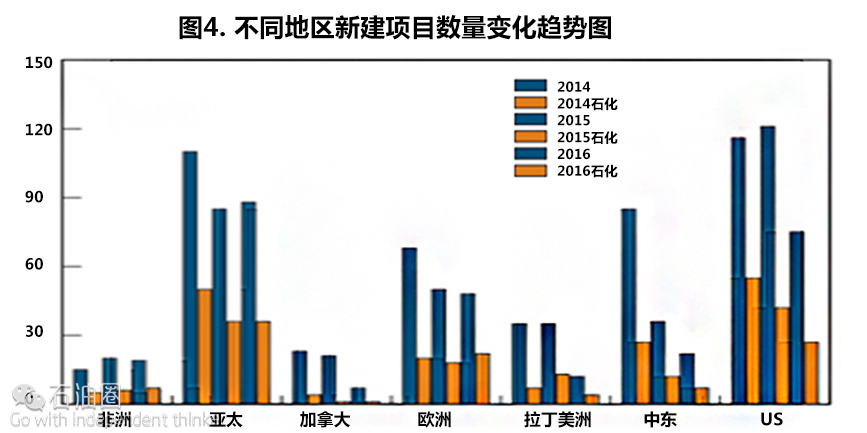

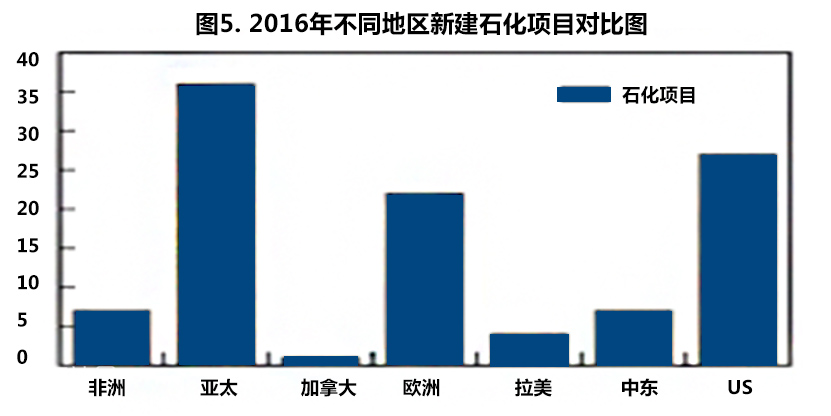

Total new downstream project announcements have decreased over the past few years. In turn, newpetrochemical project announcements have witnessed a reduction since 2014. Over the past three years, new petrochemical announcements have fallen from nearly 170 in 2014, to 130 in 2015, to just over 100 in 2016. This represents a 38% decrease in new petrochemical project announcements globally over the past three years (Fig. 4).

Although new petrochemical project announcements have decreased, the world has witnessed over 400 new petrochemical projects announced within the past three years. This represents a total CAPEX of more than $80 B.

Delays,holds,cancellations

The drop in oil prices has had a dramatic effect on not only the petrochemical construction sector, but also the global downstream oil and gas industry as a whole. Since June 2014, the downstream hydrocarbon processing industry has witnessed over $130 B in project cancellations, holds or delays. This amount includes projects that were put on hold, delayed or abandoned due to the drop in oil prices, government sanctions, the inability to secure financing or supply contracts, increased CAPEX, public opposition or a combination of reasons.

Of the $130 B in project holds/cancellations, approximately 27%, or $35 B, were in the petrochemical sector. These projects included large CAPEX projects such as Qatar’s Al Karaana and Al Sejeel petrochemical complexes, CHS Spiritwood’s fertilizer plant in North Dakota, the Gdansk petrochemical complex in Poland, and SOCAR’s OGPC project in Azerbaijan.

Regardless,each region is investing in developing petrochemical infrastructure. These developments include expansions,restarts,upgrades and the construction of grassroots facilities.

Africa

The majority of major capital-intensive petrochemical projects are located in Egypt and Nigeria. Due to strong domestic demand for polymers and petrochemicals, Egypt is investing more than $7.5 B on the construction of two petrochemical complexes. Egypt’s Carbon Holdings is investing $7 B on the Tahrir Petrochemicals complex. The facility will be located in Ain Sokhna. Once completed, the complex will house the world’s largest naphtha cracker. The plant will produce up to 1.5 MMtpy of ethylene, as well as ethylene derivatives. Completion is scheduled for 2019.

Roughly 270 km north of Ain Sokhna, Sidi Kerir Petrochemicals Co. (Sidpec) is building a $600-MM, 200-Mtpy petrochemical complex in Port Said. The facility is expected to begin operations in late 2018.

In Nigeria, petrochemical capacity additions revolve primarily around the growing agriculture industry. This includes multibillion-dollar projects by Brass Fertilizer, Indorama and Dangote Industries Ltd. In total, more than 6 MMtpy of ammonia-urea capacity is expected to go online by mid-2018.

Middle East

In the next five years,the region will witness a substantial increase in its petrochemical capacity. This increase will include the construction of new mixed-feed crackers, as well as ethylene derivatives capacity. Total CAPEX in the Gulf region’s petrochemical sector is expected to reach $60 B to $80 B. Saudi Arabia, Kuwait and Oman will be instrumental in increasing petrochemicals production from 147 MMtpy to nearly 200 MMtpy by 2021. CAPEX could reach even higher should Iran start to develop its ambitious petrochemical plans.

Saudi Arabia will lead the way in the Gulf region’s petrochemical capacity additions. The country will invest over $60 B in downstream petrochemical projects through the end of the decade. This investment will include capital-intensive megaprojects such as PetroRabigh’s Rabigh II expansion, the Sadara complex (the mixed-feed cracker is expected to begin operations by 2Q 2016),the Jubail methyl methacrylate and poly methacrylate plants, the Waad Al Shamal Phosphate and Ma’aden ammonia projects,and Saudi Basic Industries Corp.’s oil-to-chemicals project.

Kuwait is investing more than $30 B in its clean fuels and new refinery (Al-Zour) projects. Within the 615-Mbpd Al-Zour refinery, Kuwait Petroleum Co.’s subsidiary, Petrochemical Industries Co., will integrate the $10-B Olefins III project. The plant will consist of a 1.4-MMtpy ethane cracker and derivative units. Operations are expected to start by 2020.

Oman is also investing heavily in its petrochemicals sector. Major projects include the $4-B Liwa Plastics project, the Sohar purified terephthalic acid (1.1 MMtpy) and polyethylene terephthalic (500 Mtpy) complex, and the Salalah ammonia plant.

Finally, Iran is seeking more than $70 B in investments to triple its petrochemical capacity by mid-2020. The country’s goal is to increase petrochemicals production capacity from 60 MMtpy to 180 MMtpy within a decade. This includes over 70 unfinished petrochemical projects within the country, including new high-density polyethylene, monoethylene glycol, polyethylene and sulfuric acid units, as well as new ammonia, urea and methanol plants. If Iran’s ambitious plans are to come to fruition, the country will need to attract foreign players with technical and construction experience to complete these projects.

US

The US petrochemical sector is in the midst of one of the largest industry expansions to ever occur in North America. Total announced investments in capacity expansions, upgrades, plant restarts and greenfieldfacilities has eclipsed $130 B.

The biggest impact to the US petrochemical construction sector is a surge in ethane cracking and ethylene derivatives capacity. The US will add more than 8 MMtpy of new US ethylene capacity by 2019. This first wave of capital investment in ethylene capacity growth totals nearly $20 B. A second wave could add another 8 MMtpy of ethylene capacity by the early 2020s. In total, new ethylene capacity investments could top $50 B by 2022.

The US shale gas boom has also propelled methanol production to the forefront of the US petrochemicalsector. From 2015 to 2019, the US plans to add nearly 15 MMtpy of new methanol capacity. Total methanol capacity could top 30 MMtpy by 2025, should all projects be completed. That scenario is unlikely due to the drop in methanol prices and the slowdown of China’s economy (China consumes about 40% of the world’s methanol demand). More than 3 MMtpy of new US methanol capacity has started operations in the past year, and an additional 4 MMtpy is under construction or has broken ground.

Finally, the US has seen a surge in new ammonia-urea capacity. Over $16 B in new ammonia-urea plant projects have been announced. The majority of this new capacity will be located in the Midwest, near agriculture demand centers. Over 5 MMtpy of new ammonia-urea capacity is set to go online in 2016, with another 6.8 MMtpy slated to start operations by 2019.

Part 1

To summarize Part 1, many new petrochemical construction projects remain in the works, despite the drop in oil prices. The most significant expansions will be in developing countries in the Asia-Pacific and Middle East regions. These regions are investing heavily in petrochemical production units to supply increasing demand and to diversify product portfolios. Some of the strongest growth is seen in the US, where cheap natural gas is fueling more than $135 B in new petrochemical capacity.

Meanwhile, a decline in the oil-to-gas spread is making even oil-based naphtha crackers in regions such as Western Europe and Northeast Asia more viable than they have been in years. Ethane cracking operations in the Middle East and the US still maintain a price advantage against cracking naphtha, but the gap has shrunk considerably. This has provided naphtha cracking operations with fresh life, as feedstock costs have dropped dramatically over the past 18 months.

New petrochemical project announcements have declined over the past three years, from nearly 170 in 2014 to just over 100 in 2016. This represents a 38% decrease in new petrochemical announcements globally during this period. Although new project numbers are down, the world has witnessed over 400 new petrochemical projects announced within that same time frame. This represents a total capital expenditure of more than $80 B.

Asia-Pacific

The region has seen a slowdown in new project announcements over the past few years. Regardless, the region continues to dominate in total active construction projects in all sectors of the downstream industry. This includes new petrochemical capacity, as well. Over the past year, the Asia-Pacific region has led in new petrochemical project announcements (Fig. 1), followed closely by the US.

China continues to invest heavily in chemical production capacity. According to Hydrocarbon Processing’sConstruction Boxscore Database, total capital expenditures for announced petrochemical projects in China have eclipsed $50 B through 2020. This includes the construction and expansion of new petrochemicalfacilities, such as China National Offshore Oil Corp. (CNOOC) and Shell’s Nanhai expansion project; Fujian Petrochemical Co.’s Fujian petrochemical complex; and SP Olefins’ Taixing ethylene facility (China’s first gas-cracking ethylene plant);as well as alternative/unconventional supply routes, such as coal-to-olefins (CTO), methanol-to-olefins (MTO) and propane dehydrogenation (PDH) projects. However, these plants were conceived and built during a time of high crude oil prices. Now that oil prices have fallen dramatically, MTO and PDH plants are facing fierce competition from naphtha-based petrochemical production. Regardless, China’s MTO capacity is set to increase from approximately 1 MMtpy in 2014 to over 6 MMtpy by 2017. The country has also begun operations on over 4 MMtpy of CTO plants, with an additional 6 MMtpy to 7 MMtpy going online by 2018. PDH plant construction is even more robust, with approximately 14 new PDH units planned or under construction. These units represent over 10 MMtpy of additional propylene capacity.

Although China is the largest consumer of plastics in the Asia-Pacific region, the fastest demand growth is seen in India. According to Vikram Sampat, vice president and head of aromatics for Reliance Industries, India’s petrochemical growth will average between 8%/yr and 10%/yr through the end of the decade. With such immense demand growth, additional petrochemical capacity has been announced throughout the country. India plans to add over 3 MMtpy of new ethylene capacity by 2020. This would raise the country’s domestic ethylene capacity to just over 7 MMtpy. Total capacity could increase even higher by the early 2020s, should Hindustan Petroleum Corp. Ltd. and GAIL greenlight their $5-B greenfield petrochemical complex in Andhra Pradesh.

Additionally, Indian Oil Co. has announced over $5 B in new petrochemical investments through 2022. This includes additional polypropylene capacity at Paradeep and the Baroni refinery,and an expansion of its Panipat cracker to 1.3 MMtpy by 2020. The country is also increasing polyethylene terephthalate and purified terephthalic acid capacity,as well as other downstream petrochemical derivatives. This increase includes the construction of billion-dollar fertilizer projects. Even with the additional petrochemical capacity scheduled to be commissioned,India will still need to rely on imports to satisfy demand.

In Malaysia, work continues on the ambitious Refinery and Petrochemical Integrated Development (RAPID) project. The project, which is Phase 2 of the Pengerang Integrated Petroleum Complex project, will include a 300-Mbpd refinery, a petrochemical complex with a combined capacity of 7.7 MMtpy of various products, and an LNG regasification terminal. RAPID is estimated to cost $16 B, while the associated facilities will cost more than $11 B. Major contracts have already been awarded and operations are expected to begin by late 2019.

South Korea is investing in its downstream sector, with a focus on petrochemical and refining expansion projects. One of the most notable projects is S-Oil’s Residue Upgrading Complex Project (RUCP). The project is part of the company’s strategic growth initiative, which includes refining and petrochemical integration. The RUCP will convert heavy fuel oil into high value-added gasoline and olefins. The project consists of the simultaneous construction of the RUCP and an olefin complex. The two projects will act as an integrated complex. The RUCP will supply its production as feedstock to the olefins plant. The two projects are expected to be completed in 1H 2018.

In 4Q 2014, SK Gas broke ground on an $830-MM PDH unit in Ulsan. The 600-Mtpy unit is being built by project partners SK Advanced (a subsidiary of SK Gas), Kuwait Petrochemical Industries Co. and Saudi Arabia-based Advanced Petrochemical Co. Commercial operations are expected to begin in 1H 2016. Additional South Korean petrochemical projects include Hyundai Chemicals’ Daesan petrochemical complex expansion to produce 1 MMtpy of mixed xylenes, and Korea Petrochemical Industry Co.’s (KPIC) Onsan Naphtha Cracking Center (NCC) expansion in Ulsan. KPIC plans to nearly double ethylene production at the NCC, from 470 Mtpy to 800 Mtpy. Operations are expected to begin in 1H 2017. Once completed, KPIC’s ethylene production market share in South Korea will increase from 6% to 10%.

Vietnam is investing heavily in refining capacity to eliminate a domestic shortage of refined fuels. The country is developing several large-scale projects. The majority of these new refineries will incorporate petrochemical units. The $9-B Nghi Son refinery and petrochemical complex will be Vietnam’s second domestic refinery. The 200-Mbpd refinery will integrate aromatics and polypropylene facilities. Operations are scheduled to begin by 2018.

Nearly $35 B of additional refining capacity is planned in the country, but work on these facilities has been moving slowly. These plants will also integrate multiple petrochemical units. The $3.2-B Vung Ro refinery and petrochemical complex will produce benzene, toluene, mixed xylenes and polypropylene, but the project is not on schedule to meet its 2017 startup date. The $22-B Nhon Hoi refinery and petrochemical project’s scope included nearly 5 MMtpy of olefins, polyolefins and aromatics production, but has been delayed indefinitely. In early 2016, Qatar Petroleum pulled out of the $4.5-B Long Son petrochemical complex project. The project partners will postpone the project until a new partner is chosen.

Canada

The majority of new capital investment in Canada’s petrochemical sector is focused on adding derivative capacity to maximize existing crackers. The most notable petrochemical projects in the region are located in Alberta. These include Nova Chemicals PE1 facility in Joffre and Williams Energy Canada’s new PDH plant in Redwater.

The PE1 project is part of Nova Chemicals’ NOVA 2020 growth strategy, which includes major projects at the company’s Joffre and Corunna sites. At the time of this publication, the $1-B PE1 project was nearly 80% complete. The project will expand the Joffre site’s polyethylene facility by adding a third polyethylene reactor, which will produce between 475 Mtpy and 550 Mtpy of linear low-density polyethylene. This represents a 40% increase in the site’s polyethylene capacity. Startup is expected to take place in 4Q 2016.

Nearly 150 mi north of Joffre, Williams is planning to build a 525-Mtpy PDH plant. The project, located at Williams’ Redwater complex in Alberta, will be the first of its kind in Canada. The PDH plant will process offgas, a byproduct of the oil sands upgrading process, into polymer-grade propylene. If completed, the project is expected to begin operations by 2020.

These two projects are examples of Alberta’s efforts to incentivize petrochemical producers to create a petrochemical industry in the province. Alberta has announced financial incentives worth over $350 MM to operators for the construction of petrochemical plants that utilize methane or propane feedstocks. The Alberta government hopes that the new incentives will help spur the development of new petrochemical capacity in the region. Time will tell if these new incentives will achieve the province’s goals of increasing new downstream investments.

Europe

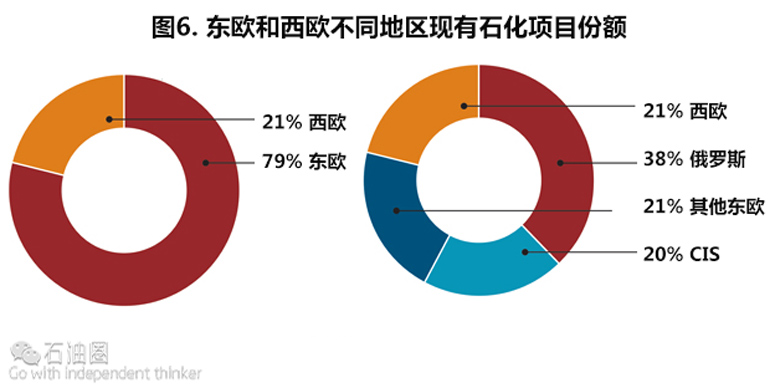

Active petrochemical project construction in Europe is led by petrochemical capacity additions in Eastern Europe. As shown in Fig. 2,Eastern Europe controls nearly 80% of active petrochemical project construction in the region. This is lead primarily by projects in Russia and the Commonwealth of Independent States (CIS).

The CIS has seen some of its ambitious petrochemical plans halted, however. This includes capital-intensive projects such as KPI’s Atyrau gas-to-chemicals complex in Atyrau, Kazakhstan; and SOCAR’s petrochemical complex near Baku, Azerbaijan, which was part of the country’s OGPC mega-project. SOCAR has announced that it will instead spend approximately $1.3 B to upgrade the existing refinery and petrochemical complex, as well as continue work on the Sumgait petrochemical plant revamp located north of Baku.

Regardless,the CIS is progressing with multiple projects to increase petrochemical production capacity. This includes the Kiyanly petrochemicals complex and Garabogaz fertilizer plant in Turkmenistan, the Ustyurt gas chemicals plant in Uzbekistan (completed in late 2015), as well as additional ammonia-urea plant projects in Azerbaijan, Turkmenistan and Uzbekistan. In total, over $7 B will be invested to increase petrochemical capacity in the CIS by 2019.

The bulk of petrochemical capital expenditure in the region is located in Russia. Russian chemical company Sibur has set its sights on completing the ZapSibNeftekhim petrochemical complex (ZapSib-2) project. The project, located 3 km north of Sibur’s polymer site in Tobolsk,was greenlighted in early 2015. The project will consist of a 1.5-MMtpy ethane cracker and ethylene derivative plants. Once completed, the complex will be the largest polymer production site in Russia.

Rosneft subsidiary Far East Petrochemical Co. (FEPCO) is planning to build the largest integrated refiningand petrochemical complex in the country’s Far Eastern Federal District near the city of Nakhodka. The complex will consist of a 12-MMtpy refinery, which will supply feedstock to the grassroots petrochemical complex. Once completed in the early 2020s, the facility will supply the local market in the Russian Far East, as well as utilize its proximity to Asian markets to satisfy demand for petrochemicals.

According to the European Chemical Industry Council (CEFIC), EU chemical output in 2015 was nearly flat, registering only a 0.3% growth year-over-year. The CEFIC has forecasted a modest 1% growth in European chemical production in 2016. EU petrochemical producers witnessed good margins at the start of 2016 due to strong demand for ethylene derivatives, supply constraints and low feedstock prices. These trends have kept EU petrochemical capacity utilization above 80% for the past six months, but the long-term forecast for EU’s petrochemical industry is wrought with challenges. This includes stiff global competition, and energy and regulatory costs.

Latin America

Both Central and South America saw tremendous growth over the past decade. From 2004–2015,the growth in Latin America’s middle class was instrumental to the region’s increased demand for refined fuels. Multiple forecasts show that the region will see a nominal increase in demand through the rest of the decade. Latin American countries have been hit hard by the drop in oil prices, especially the countries that depend heavily on oil export revenues. The drop in revenues has left little money to fund capacity expansions in the refining and petrochemical industries. In the short term,these countries would rather satisfy demand through imports than invest in major expansions or grassroots facilities, which can be multi-billion-dollar endeavors.

This trend does not mean that the region is void of petrochemical projects. One of the most ambitious projects in the region has just begun production. The $5.2-B Etileno XXI project, a finalist for Hydrocarbon Processing’s 2015 Top Project award, represented the first major private sector petrochemical project in Mexico in 20 years. The greenfield complex, located in Nanchital near Coatzacoalcos, Veracruz, Mexico, was developed by Braskem Idesa and features a 1-MMtpy ethane cracker, two high-density polyethylene plants (750 Mtpy), one low-density polyethylene plant (300 Mtpy), and storage, waste treatment and utility facilities.

The facility began operations in March 2016, and will be instrumental in meeting the increasing demand for polyethylene in Mexico. A glaring gap exists between Mexico’s potential for polyethylene production and its inability to meet surging demand. Approximately 65% of polyethylene demand is satisfied through imports, and the gap continues to grow each year. The Etileno XXI project is forecast to replace $2 B of polyethylene imports used as a feedstock for the agricultural, automotive, construction and consumer industries.

Trinidad and Tobago is the world’s largest exporter of ammonia and the second-largest exporter of methanol. The country has 11 ammonia plants and seven methanol plants. The country is investing $1 B in the construction of a new methanol and dimethyl ether (DME) production complex. The project is being developed by a consortium consisting of Mitsubishi Gas Chemical, Mitsubishi Corp. and Mitsubishi Heavy Industries, along with Massy Holdings and state-owned National Gas Co. of Trinidad and Tobago. The project was greenlighted in September 2015 after additional financing was secured. The facility will be located in La Brea and have a total capacity of 1 MMtpy of methanol and 20 Mtpy of DME. The plant is expected to begin operations by 1Q 2019.

Further south, Brazil’s petrochemical future looks bleak. Refining and petrochemical expansion plans have been severely cut back due to cost overruns, downstream revenue losses, massive debt, economic weakness and government corruption scandals. According to the Brazilian Chemical Industry Association (ABIGUIM), demand for chemical products in Brazil has decreased nearly 8% over the past year. This represents the largest decline in 25 years. The drop in crude oil prices has decreased naphtha feedstock prices, but this has done little to spur new investment.

In Peru, there is continued support for a greenfield petrochemical complex to be located in the country’s southern region. The $3.5-B Arequipa petrochemical project would process natural gas feedstock piped from the Camisea gas fields located in central Peru. The project would be supplied with feedstock from the $5-B natural gas pipeline presently being built by Odebrecht. If built, the petrochemical complex will produce approximately 1.2 MMtpy of polyethylene.

Finally, Bolivia is the key natural gas supplier in the region. Domestic natural gas production reached 21.4 Bcmy in 2014, according to BP’s Statistical Review of World Energy 2015. Production is more than enough to satisfy domestic demand, making exports a national priority. The increased production of domestic natural gas is fueling the country’s ambitious plans to substantially increase petrochemical capacity. Bolivia’s national oil and gas company, YPFB, has instituted a new expansion program to become self-sufficient in value-added hydrocarbon products by 2022. The country is nearly completed with Phase 1 of the strategic national plan. The nearly $2-B plan (Phase 1) included the:

Rio Grande liquid separation plant—completed in 2014

Valle Hermoso refinery expansion—completed in 2014

Rio Grande LNG plant—completed in 2015

Gran Chaco liquid separation plant—completed in 2015

Bulo ammonia urea plant—under construction, completion set for 3Q 2016.

The Bulo ammonia-urea plant will be Bolivia’s first petrochemical complex. The plant will produce over 420 Mtpy of ammonia and 645 Mtpy of urea. These supplies are destined for the domestic market. Operations are expected to begin in July 2016.

Both the Rio Grande and Gran Chaco liquid separation plants are crucial to provide feedstock to the country’s petrochemical chain. The Gran Chaco separation plant will be the main supplier to the country’s proposed $1.7-B Gran Chaco petrochemical plant. The complex will contain propylene/polypropylene plants,as well as an ethylene/polyethylene complex. If built, the propylene/polypropylene facilities are likely to begin operations in the early 2020s,with the ethylene/polyethylene plants to begin construction shortly thereafter. Additional petrochemical projects,which are presently being evaluated for their feasibility,have been announced in Bolivia.

石油圈

石油圈