Terms like “innovation” or “cutting-edge technology” bring to mind 3-D cameras, foldable smartphones or even ?ying cars. For the oil and gas industry, it means Big Data analytics, arti?cial intelligence and underwater robotics.

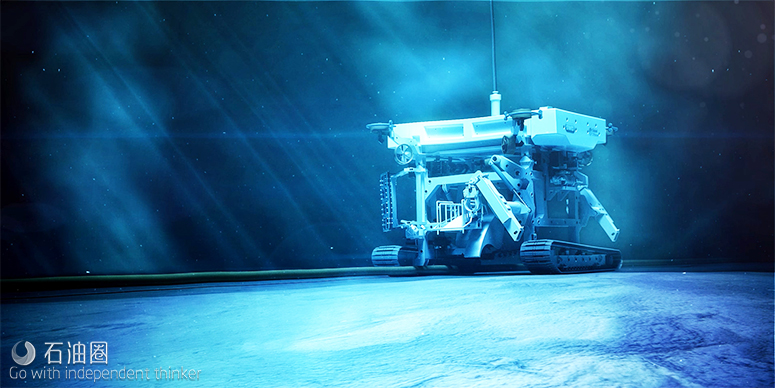

Commercial AUVs and ROVs were conceived to over-come the restriction of human divers, and these under-water robots were initially used as basic video observa-tion devices for subsea operations. Over the years, their technological evolution has enabled them to accom-plish increasingly complex tasks at water depths up to 3,000 m (9,842 ft).

Increasing global demand for oil and gas has acceler-ated the pursuit of innovative and cost-ef?cient offshore technologies. Moreover, monitoring and deployment are often challenging in harsh subsea conditions, which raises operational, environmental and technical chal-lenges. These factors have accelerated the development of new technologies in the AUV and ROV market.

Product development

TechnipFMC continues to invest in the development of ROVs to lower deployment costs and enhance productiv-ity and ef?ciency of subsea operations.

“The evolution of ROVs stems from the quest to create greater operational ef?ciencies of projects—through greater ROV productivity—a result of contin-uous product development on the technical side,” said George Shirreffs, vice president of sales and marketing at Schilling Robotics, a business unit of TechnipFMC.

“TechnipFMC has continually focused on the develop-ment of its products through features such as modular design, modern control systems and automation to max-imize the productivity of the ROV, therefore reducing projects costs.”

In the early 2000s, TechnipFMC launched its first ROV, which was an electric vehicle with a scalable control system and automation. Industry requirements led to the development of an Ultra Heavy Duty class electro/hydraulic ROV, which was followed by the introduction of a 150-hp heavy-duty ROV in 2010.

Productivity features were further improved, including a modular design to aid rapid maintenance and repair requirements and a higher level of automation. The Schilling systems were further developed to add a new Hammerhead software platform in 2012 that was an intuitive task-based system that allowed ease of oper-ation and rapid setup of the ROV system. A further development was the introduction of the Ultra Heavy Duty Gen-III (UHD-III) 250-hp ROV, equipped with an ISOL-8 auxiliary pump system that meets the require-ments of American Petroleum Institute Standard 53 for secondary BOP intervention without the need for any additional equipment. In addition, the vehicle can be optimized for construction and intervention activities and delivers dual ?uids from onboard tanks negating the requirement for multiple pumping skids.

“Our philosophy from our first manipulator in 1985 to our latest ROVs has been increasing productivity, including our lean manufacturing facility and our latest developments. However, we remain conscious of the installed base of Schilling systems. Many of our devel-opments are engineered to be backward compatible, so the productivity features we develop today can be installed on some of our older systems,” Shirreffs said.

Meanwhile, Kongsberg Maritime has added a new AUV to its fleet. Called the HUGIN Superior, it is equipped with advanced functions. “The key devel-opments and new capabilities of HUGIN Superior include improved data coverage and access, greater productivity, and improved navigation and position-ing,” said Richard Mills, director of marine robotics sales at Kongsberg Maritime.

The AUV is configured with long-range synthetic aperture sonar that generates high-resolution seabed imagery and bathymetry. This is augmented by an ultrahigh-definition color camera with a laser pro-filer, magnetometer and various chemical sniffers to detect hydrocarbons.

“HUGIN Superior can survey a football pitch in about 45 seconds or an area the size of Manhattan Island in just 13 hours without sacrificing data quality,” Mills said.

Innovative technology

From their initial development to their current form, AUVs and ROVs have seen much technological advance-ment and have become an indispensable part of offshore E&P. They have been equipped with progressive fea-tures, enabling them to operate thousands of feet away from dedicated offshore vessels to handle complex tasks.

In April, testing for underwater snake-like robots known as Eelume began in Trondheim Fjord to be deployed for seabed maintenance work at the Åsgard Field in the Norwegian Sea. Conceived by the Norwegian University of Science and Technology and supported by Kongsberg Maritime and Equinor, these snake-like robots can slither over long distances in diffi-cult-to-reach places without being tethered to a support vessel. Sensors and tools can be mounted anywhere on the Eelume. It consists of several modules that allow it to be connected in different combinations to form vari-ous types of vehicles. The underwater robot can inspect pipelines and operating valves, reducing costs from previous, more strenuous methods of subsea inspection, Equinor stated in a press release. The drone can remain under water permanently and reside in a subsea dock-ing station where its battery will be charged.

According to Equinor, “The tests performed at the Åsgard Field will be a significant step toward showing the capabilities of a resident underwater drone. In paral-lel, the technology is being further developed to contin-uously increase its capabilities and level of autonomy.”

Saipem’s Sonsub division’s HyDrone system is a mod-ular, subsea resident intervention platform directly inte-grated within the subsea ?eld and is capable of working in deep waters for an extended period without surface vessel support. The design is a development of work class ROVs to allow reliable remote interventions on complex or inaccessible subsea infrastructures.

According to Saipem, three factors are driving this technology: the need to support offshore ?elds where the challenging environmental conditions or the level of novelty of involved subsea equipment leads to increased operational complexity; the need to ef?ciently manage operational risks minimizing system downtime and envi-ronmental impact; and the need to substantially reduce costs of inspection, maintenance and repair campaigns conventionally carried out with work class ROVs oper-ated by dedicated support vessels.

“The conventional IRM [inspection, repair and maintenance] market is heavily based on vessels and ROVs,” said Matteo Marchiori, commercial manager at Saipem’s Sonsub division. “The market distress of the recent years has dramatically pushed for new opera-tional models that would cut costs, which had an enor-mous impact on technological innovation and led to solutions capable of unlocking new methodologies and operational schemes. In that respect, HyDrone allows vessel-free subsea inspections with unmanned opera-tional setup and grants better access to subsea assets.”

Houston Mechatronics has released a hybrid technol-ogy called Aquanaut, which is a multipurpose subsea robot that transforms from an AUV to an ROV, thereby eliminating the need for vessels and tethers.

“We realized one of the biggest problems of the indus-try is the cost of offshore operations, which, in most cases, is driven largely by cost of the ves-sel,” said Nic Radford, CTO of Houston Mechatronics. “Solving this problem from a robotic perspective, we designed Aquanaut, which acts like an AUV and recon?gures itself on a hovering platform capable of manipulation even in very aus-tere communication environments.”

Saab Seaeye launched a new tech-nology enabling its Sabertooth hybrid AUV/ROV to dock at remote deepwa-ter docking stations for data transfer, assignment instructions and battery charging. The underwater robotics company announced in February that its Sabertooth hybrid AUV/ROV is equipped to dock at different kinds of remote stations.

SEAMOR Marine has released the Mako ROV, a miniature work-class-sized ROV built with modular ?otation and hydraulic arm integration. SEAMOR ROVs can integrate with a wide range of third-party offshore intervention tools, including temperature sensors, addi- tional cameras, positioning systems, mul-tibeam and scanning sonars. Their compact size allows them to be deployed quickly, which is important when emergencies occur.

A recent addition to SEAMOR’s range of products is a remotely operated seven-function articulated hydrau-lic arm, which is speci?cally designed for observation class vehicles and can be retro?tted to most similar ROV systems.

“We understand that ROVs are an important tool to support the energy sector. By providing an easy-to-use vehicle that offers a wide range of customizable inte-grations, SEAMOR ROVs are an investment for any onshore or offshore facility,” said Robin Li, president of SEAMOR Marine.

Strategic partnerships

Recent collaborations between oil and gas companies and underwater robotic businesses have not just contributed to new technological innovations in the market but also resulted in increased operational and cost ef?ciencies.

Earlier this year, Ocean Power Technologies and Saab Seaeye announced a joint development and marketing agreement to pursue mutual opportunities for charging and communications systems of AUVs and ROVs.

In March Sonardyne International entered into a partnership with Shell Brasil and Brazilian research institute Senai-Cimatec, with cooperation from Petrobras, to develop AUV technology to ensure ef?-ciency in monitoring Brazil’s presalt oil ?elds.

According to a report in Unmanned Systems Technology, the goal of the project, which includes a 4-D seismic monitoring system, is to increase the autonomy of ocean-bottom nodes, enabling them to be deployed on the sea?oor for up to ?ve years ready to record the seismic and geodetic data on demand. During that period, no interventions, such as connections for data extraction or replacement of batteries, would be required and the nodes would communicate wirelessly with the AUV. These capabilities will help generate operational ef?ciencies and eliminate the various exist-ing dif?culties in deploying current 4-D seismic mon-itoring technology, which is vital to the development and production optimization of oil and gas ?elds. The new technology also will allow the reduction of both costs and operational safety risks.

“For Shell, Brazil is an important center for attracting partners and technological development, and we are sure that the partnership with Sonardyne and Senai-Cimatec will be very successful,” said Jorge Lopez, Shell R&D adviser, in a press release.

C-Innovation (C-I), an af?liate of Edison Chouest Offshore, has partnered with several oil and gas com-panies around the world to expand its ROV capabilities and provide a broad spectrum of support to subsea construction projects as well as drilling, intervention, maintenance and heavy-lift assignments.

“We engineer robotic solutions based on client needs and expect a growing underwater vehicle ?eet with portfolio expansion over the next few years,” said Michael MacMillan, operations manager at C-I.

Last year ECA Group and Petrus entered into a cooperation agreement for subsea robotics services to oil companies. After evaluating the market, the parties agreed to offer inspection and survey services to the energy industry using AUVs designed and manufac-tured by ECA Group.

Market drivers

Key factors driving the AUV and ROV market include the increasing number of offshore wells in harsh envi-ronments, escalation in demand for energy and petro- chemicals, need for ocean data and mapping, and growing capabilities of AUVs and ROVs, according to a report by Mordor Intelligence. The report states that technological advancements in offshore systems have opened up new frontiers, enabled safer operations and increased the capabilities of AUVs and ROVs. Advance-ments in technology are expected to continue engi-neering further growth in the oil and gas unmanned vehicles sector. Smart devices will enable improved operational management and better risk management while advanced materials will offer safer operations in dif?cult environments.

The report further states that “the Middle Eastern region will experience signi?cant growth in the ROV market. The offshore activity in the Middle Eastern region has seen growth since 2015, despite low oil prices. This substantial improvement in the oil price scenario is expected to boost the offshore activity in the region, in turn driving the ROV market.”

Meanwhile, Mordor Intelligence stated that Petrobras’ ?nancial crisis is expected to constrain the offshore activity in Brazil, in turn restraining the off-shore AUV and ROV market in the region. Brazil is the biggest AUV and ROV market in South America and witnesses more than 50% of the offshore drilling and production activity of South America, accord-ing to the report. However, earlier this year the new CEO of Brazil’s state-controlled oil company, Roberto Castello Branco, criticized its history of government interference and vowed to pursue policies that will boost pro?t, according to a Bloomberg report.

Annual global market reports of ROVs and AUVs show a signi?cant increase in market growth of both vehicles. According to a report by QY Research, the global market for ROVs is expected to reach $330 mil-lion by the end of 2025, growing at a compound annual growth rate of 6.3% between 2019 and 2025. Findings reveal that a number of factors will drive ROV global market growth including the increase of underwater ?elds’ expenditures, the recovery of oil and gas indus-try, new product launches, technological innovations and increasing adoption of offshore ROVs.

Douglas Westwood’s “World AUV Market Forecast” report shows a 74% increase in AUV demand for the commercial sector through 2022.

As operators continue to move into deeper waters, Westwood anticipates a signi?cant increase in AUV utili-zation for oil and gas operations. According to key ?nd-ings, “new subsea hosted AUVs that are currently being developed will allow for more cost-effective inspections and interventions of subsea infrastructure than an ROV or surface vessel carrying out the work. Other applica-tions, such as pipeline inspection, site survey, and rig move or hazard survey, will see a growing demand during the period of forecast.”

石油圈

石油圈