As E&P companies continue to prioritize and invest in unconventional resources, service companies are following suit, pursuing rapid development and evolution of completion technologies to meet operators’ increasing demands. In particular, longer laterals and more complex well designs are driving the adoption of dissolvable technologies, which continue to mature as companies learn how and where they should be used to achieve the best results. Frac plugs that help to improve fluid efficiency when they’re pumped downhole are also leading to reductions in water usage, an important challenge in the Eagle Ford and Permian basins.

Amid these ongoing technical innovations, operators have also made it clear to service providers that further cost reduction is absolutely essential in the current market. “It can no longer be just about what a technology can provide for the operator. It has to be, how does that impact the cost of a barrel produced?” said Mark Villarreal, Director of Sales for Enventure.

To help achieve that cost reduction, many operators are turning to in-basin sand for their fracturing operations. This switch, which can reduce proppant costs by more than 50%, has been gathering steam for more than a year, but Wood Mackenzie estimates that half the US proppant market is already local sand. Particularly in areas like the Permian, sand is plentiful. In Eagle Ford, Oklahoma and Haynesville, local sand providers try to keep up with demand until new mines open up.

In the Eagle Ford, especially, “operators want to move to in-basin,” Scott Forbes, Research Manager, US Upstream Costs with Wood Mackenzie, said. In fact, he noted that local sand prices in the Eagle Ford are now about double what prices are in the Permian. “It’s just because of supply and demand,” he explained, adding that the shortage has been exacerbated by an uptick in activity in the Eagle Ford in recent months. The handful of local mines in South Texas don’t have the production capacity to meet local demand.

“But I see that changing in the very near future,” he said. “There are two or three new mines opening up in South Texas, basically as we speak. There may be another one or two later in the year… I see the cost eventually adjusting to something similar to what we see in the Permian today.”

Haynesville local sand prices are hovering somewhere in between Eagle Ford and Permian prices. “They’re pumping some big jobs in the Haynesville right now. There are some local mines, but not enough to drive the prices down yet,” Mr Forbes said. “By year-end, enough new mines will have opened up so that prices will be lower and stabilize.”

While the switch to in-basin sand has been positive for E&P companies seeking immediate cost reductions, the move has put a squeeze on northern white sand providers. Although these companies continue to provide sand to all plays, significantly to northern plays like the Bakken and Marcellus, their outlook will be challenged in the foreseeable future, according to Mr Forbes. “Right now, during this transition period, northern producers are still selling a decent percentage of the demand and supplementing where there’s not enough local sand. Even though the preference is rapidly moving to in-basin product, they’re still moving product into those areas. But as the local mines get built out, it’s going to create even more challenges for northern providers.”

Further, these companies are limited in terms of pricing adjustments they can make, simply because the bulk of their costs are driven by transportation, which are unlikely to decrease. “That puts the northern guys in a real predicament because they’ve already reduced the pricing for producing the sand to just cover costs. The rail and transloading costs make up the majority of the pricing,” he explained.

Going forward, these companies may try to sell more of their sand into Canada, or even other countries outside North America, Mr Forbes said.

Another cost-reduction approach that operators are favoring now is the unbundling of completion materials. “The pumping company traditionally provided all the sand, logistics, chemicals and fuel for fracking, but operators are pulling that away,” Mr Forbes said. The self-sourcing trend has been gaining momentum for the last few years, and results – in terms of efficiency, control and cost savings – have been so great that operators are now moving rapidly to this model. “Going forward, you’ll see pumping companies becoming more providers of just horsepower and personnel, except in niche situations.”

Another trend that is rapidly emerging is electric fracking. By powering frac fleets with electricity instead of diesel, the industry stands to gain not only savings on diesel costs but also improved efficiency, Mr Forbes believes. “Whether you’re looking at pumping hours per day or stages pumped per day, you could see a 15% to 20% improvement,” he said. Other benefits include reductions in footprint, emissions and noise levels at the frac site.

There are few providers of these so-called “clean fleets” at the moment, and the amount of capital required to invest in these fleets means a significant industry transition would take some time. However, he believes that transition will happen. “It’s already starting.”

Isolating, Opening Individual Perforation Clusters

In the Permian, the opportunities and demand for effective refrac technologies continue to increase as operators seek to boost production by re-treating existing wells. “We have learned that simple ‘pump and pray’ techniques do not deliver economical results,” said Chris Johnson, Product Line Director for Baker Hughes, a GE company (BHGE). “You have sections of your horizontal that will take more fluid at a lower pressure. Therefore, you’re not able to effectively stimulate the entire horizontal during the re-completion.”

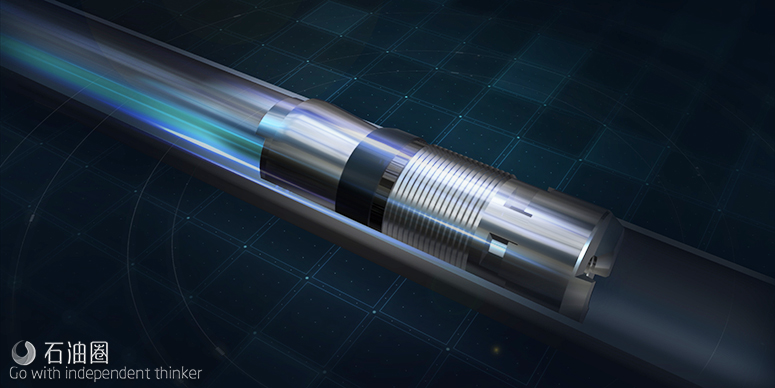

The company’s OptiStriker straddle packer system was developed to isolate individual clusters to better deliver fluid and proppant, especially to areas that may have been untreated or undertreated during the initial frac job. In Ector County, Texas, the system was used to deliver re-stimulation chemicals and open up individual perforation clusters. In this 15-stage well, each stage was an individual cluster, and every cluster had a different breakdown pressure.

The treatments aimed to increase production, and the operator suspected that most of the perforations had been plugged through years of production. Treatments were performed at 5-8 bbl/min and delivered 30 bbl of phenol acid mix to each stage. The surface treating pressures went to a maximum of 5,600 psi. “On one set of perforations, the injection was established, but the pressure never broke down, so the entire stage was treated at a high pressure,” Mr Johnson said.

Using 2 7/8-in. jointed tubing, “we were basically able to move from one stage to the next in just under 16 minutes on average.”

In another application in Yoakum County, Texas, the system was used to deliver fracture stimulation below damaged casing. The well was being completed using plug-and-perf techniques, but treatments were stopped due to a leak at a casing connection at the kick-off point. “The casing was squeezed, but there wasn’t a lot of confidence that it would be able to hold frac pressures,” Mr Johnson said.

To finish the remaining frac stages, the OptiStriker system was deployed as it would allow treatments to be pumped down the tubing, so the high pressures of the fracture treatment would not be exerted onto the repaired casing. “We did five stages in a single trip and delivered roughly 60,000 lb of proppant each stage,” Mr Johnson said. “We spaced the system out in 51-ft increments to mimic having a plug below each one of those perforations.” Treatments were pumped down 3.5-in. tubing at pressures between 5,000-8,000 psi at 30 bbl/min.

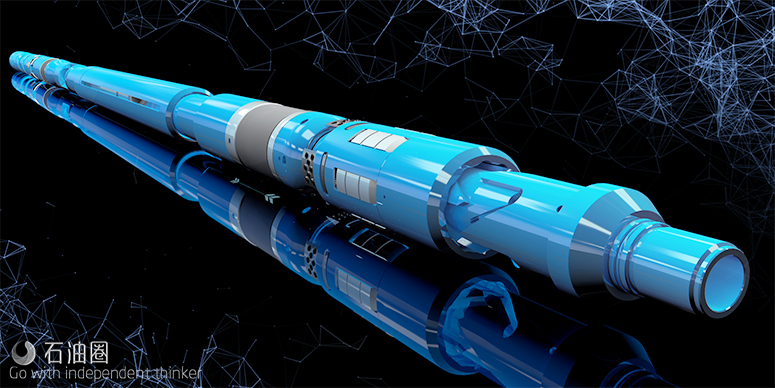

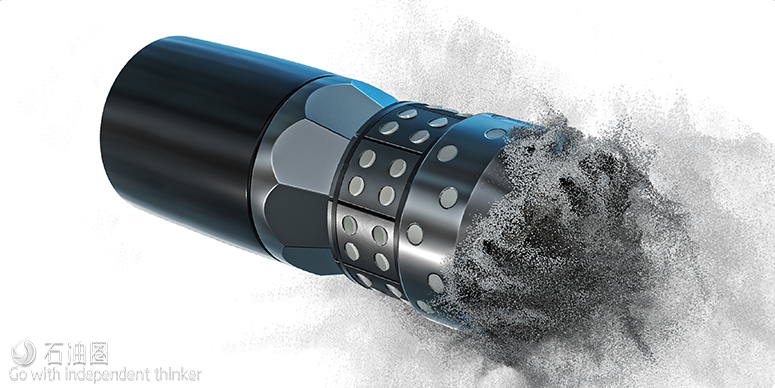

BHGE has also developed the SPECTRE disintegrating frac plug and MILLITE lightweight frac plug to address different technical challenges during plug-and-perf operations. SPECTRE is a fully disintegrating frac plug that is designed for applications with temperatures as low as 100°F (37°C). Adoption of this technology has been seen in major basins across North America, according to BHGE.

“It wasn’t until about 2018 that you started seeing chemistries, metallurgies and elastomers being developed and brought to the market that could meet the applications of low-temperature, low-salinity level fluids like you would find in the Permian,” Mr Johnson said.

In one Permian project, a full wellbore of 49 SPECTRE plugs were run. Following the installation, coiled tubing was deployed just a day post frac operations, and all but six of the plugs had fully disintegrated. Drill-out time on the remaining plugs averaged under 30 seconds, according to BHGE. Compared with plugs that were run on two adjacent wells, the SPECTRE plugs helped to save approximately 27 downhole cleanout hours.

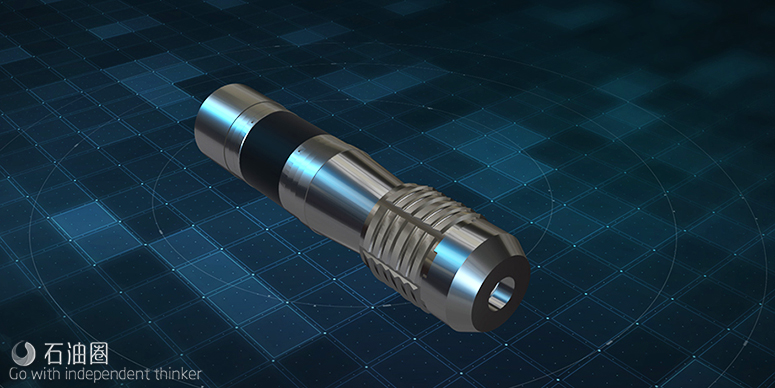

BHGE is also in the process of bringing to market the MILLITE frac plug, which is engineered out of alloy material that is 70% lighter than the heavier slip parts found on composite frac plugs. “It’s very short in length – 13 in. overall – which makes it one of the shortest plugs on the market,” Mr Johnson said.

Further, the plugs are wear- and preset-resistant, even during high run-in speeds. “We have multiple examples where the plug contacted sand that wasn’t properly displaced before run-in or over-torqued casing collars. When brought back to surface, it showed the plug did not preset.”

An additional benefit of the MILLITE frac plug is the reduction of motor stalls, which “weaken the thru-tubing motors and increase the chance of downhole failures. That costs time and money to trip out of hole and change the bottomhole assemblies.”

In one project in Colorado, an operator utilized the MILLITE plug in a well with 10,800-ft MD and a 4,400-ft lateral section. The plug-and-perf completion plan called for 22 plugs to be set at regular intervals. Because these plugs are wear- and preset-resistant, they were deployed at a maximum speed of 750 ft/min. After fracturing, all 22 MILLITE plugs were drilled out without any motor stalls or short trips. This reduced intervention time and minimized coiled-tubing cycling costs.

These lightweight frac plugs have been used so far in the Permian, Eagle Ford, Haynesville, Mid-Continent, Marcellus and DJ Basins.

Increasing Willingness to Experiment with Dissolvable Technologies

Although oil prices have rebounded since their surprise dip in late 2018, operators largely have not indicated a willingness to relent on their cost focus. “Operators are driving hard on the efficiency of what they do and looking to lower costs without compromising their operations,” Todd Broome, Group Manager, Unconventional Completions with Halliburton, said.

In this environment, many operators who may have been reluctant to try dissolvable plugs before are now starting to experiment with the technology. And others who have sporadically tried it before are now adopting it on a more regular basis, Mr Broome said. “It’s a technology that’s being tried in a lot of areas to see where it works best.”

Halliburton’s Illusion Spire dissolvable frac plug evolved out of the standard Illusion frac plug, by reducing its overall length by 32% and increasing its internal diameter by 45% for greater pump-down efficiency and improved flowback.

“It has an element that allows less fluid bypass as it’s being pumped down, which means less fluid is needed to get it into place. That greater efficiency also means less water use,” Mr Broome said. This can be especially important in the southern basins like Eagle Ford and Permian, where most wells are completed using plug-and-perf methods. “That means a lot of water gets used. So the more efficient you are at pumping the assembly down, the better off you are,” he said.

The plug also offers the core advantage of being dissolvable – it goes away on its own without needing to be milled out. “You might have to make a cleanout trip to remove sand or proppant left in the wellbore, but the speed at which you can do that versus milling is a lot faster with the dissolvable plugs.” This is especially true in long laterals where you can’t put much weight on bit toward the toe, Mr Broome emphasized.

The Illusion Spire dissolvable frac plug has so far been deployed in the Northeast, Permian, Mid-Continent and South Texas. According to Halliburton, it has been able to save various operators 15-20 minutes per stage, adding up to an approximately half-day reduction in pumping time and up to 3,000-5,000 bbl of fluid saved per wellbore, in many cases.

石油圈

石油圈