Every industry has a market cycle in which the industry goes through periods of growth and decline. The oil industry is no exception; it is a cyclical industry by nature. Its history is full of booms and busts, periods of exponential growth as well as periods of unexpected downturns such as the current one.

In times of booms and busts that the oil industry experiences, a very crucial question that must be answered in order to be able to plan for the next step correctly is, “Where exactly in the oil market cycle are you at any point in time?” Whether you are an oil and gas company’s CEO or a normal employee, a trader or an investor, a crude oil producer or a consumer, an oil and gas young professional or a university student, knowing the right answer to that question is very vital.

Its importance comes from the fact that it helps you make the right decision and carefully prepare for what is coming. It saves you time and money. And to make it clearer, the answer to the question above could be the difference between winning and losing. Unfortunately, the answer to such question is not as simple as many think. It involves the evaluation of very complex parameters that play a prominent role in setting the direction of the oil market.

In this article, you will be presented with the answer to the question above based on an accurate evaluation and analysis that takes into consideration the most crucial parameters in the oil market- namely oil fundamentals, speculations, and the cycle of market emotions.

Where exactly in the oil market cycle are we right now?

It has been almost two years since the oil market started to experience a downward trend that has negatively impacted the oil and gas industry. But given the fact that the oil industry is cyclical by nature, the current downturn will not remain here forever and oil prices have to reverse course eventually. In fact, this trend is happening right now, and oil prices have reversed course. But where exactly are we right now?

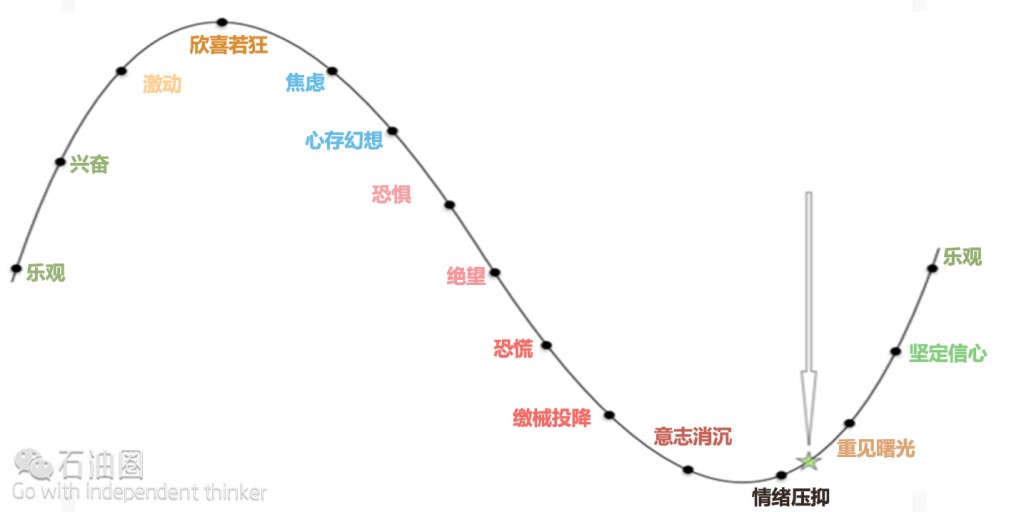

Oil Market Cycle and Corresponding Emotions

In general, we have reached a bottom for oil prices and the down market is behind us now. That happened in January 2016, when oil prices dropped to $27 a barrel level. Right now we are in a stage in the oil market cycle between depression and hope, and here are three justifications for this claim based on oil fundamentals, speculations, and the cycle of market emotions.

1- Oil Market Fundamentals

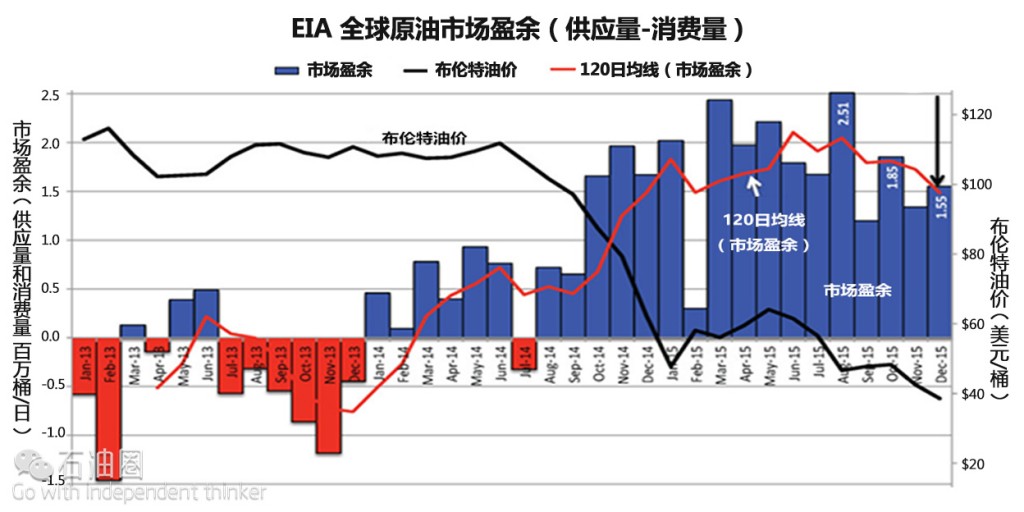

Oil market fundamentals represented by supply and demand are the main and the most important factor that determine the direction of the oil market and oil prices. When oil prices started to fall back in June 2014, fundamentals were poor and the average global over-supply (supply minus demand) was close to 1 million barrel a day. The global crude oil supply was at average of approximately 93 million barrel a day, while demand was lagging behind at average of approximately 92.25 million barrel a day.

Global over-supply continued increasing until it reached its highest level of approximately 2.51 million barrel a day in August 2015. That was mainly due to the decision of major producers not to cut their output aimed protecting their market share and the fact that many projects that were in the development phase prior to the downturn and came online during that time. Industry players were also in a denial state and were determined to continue pumping with a hope that the market will recover fast. All those factors along with a weak global demand contributed to continuous increase in the global over-supply.

But since the oil industry is a cyclical industry, the negative effect of the market cycle has to take place. In fact, it did in the second half of 2015 which was a period characterized by panic, capitulation, despondency, and a more realistic approach in dealing with the new reality. During that period, global over-supply was easing and market balance was improving. The supply surplus decreased from (2.51 mmbpd) in August 2015 to (1.55 mmbpd) in December 2015. A decline of approximately 1 mmbpd in supply surplus was caused by a slow growth in supply and a slight growth in demand.

At that time, and regardless of the notable improvement in fundamentals, the oil market was at its worst state emotionally. Pessimism was dragging oil prices down, and it succeeded. Oil prices fell to $27 a barrel level. During that time, the oil industry was at a stage in the oil market cycle that is between despondency and depression.

Market players were desperate for anything that could give them a hope, and the oil output freeze deal between major OPEC and non-OPEC producers was that spark of hope regardless of its actual effectiveness in improving fundamentals. The output freeze deal protected oil prices from falling further and helped in creating a market state in which hope started to gradually replace pessimism and that helped oil prices to rebound.

Today, oil prices are at levels above $40 a barrel. Non-OPEC crude oil supply for 2016 is forecast to decline by 0.73 million barrel a day to average 56.39 million barrel per day according to OPEC Monthly Oil Market Report for April 2016. The main decline in oil production will be coming from US, UK, Colombia, and China’s onshore mature fields. The pace of decline will increase more as we go into the second half of 2016 due to deferring of major new projects as a result of reduced cash flow in 2016.

With a slow and a continuous decrease in oil supply and a positive signs of growing demand, oil market fundamentals are moving in the right direction and point toward a more market balance in the second half of 2016.

According to what the fundamentals illustrate above, the oil market right now is at a stage between depression, represented by forecasts that still predict the worst to come in an attempt to pull the market down, and a hope that helps the market recover slowly. And this clearly supports our claim.

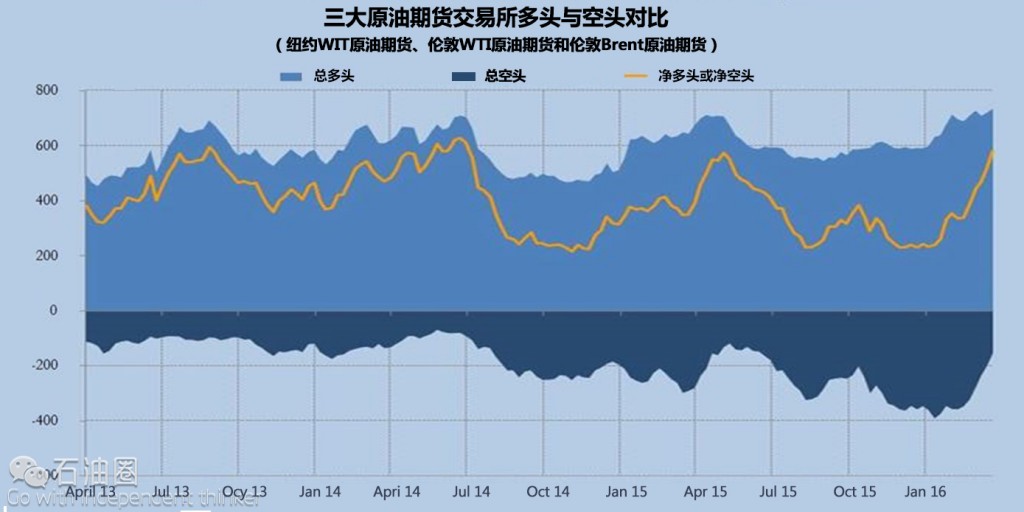

2- Oil Speculations

Oil speculation is the second most prominent factor that drives oil prices after fundamentals. Speculation is the act of trading in an asset -in this case crude oil- which has a high risk of losing all or most of the initial outlay, in expectation of a substantial gain.

The current downturn- and in particular the latest decline in oil prices to levels below $30 a barrel in early 2016- proves that speculators play an important role in driving the oil prices when volatility in fundamentals is high. In late 2015 and early 2016, and regardless of a slight improvement in fundamentals, speculators rushed in to record short positions- consequently pushing oil prices down below $30 a barrel. Their action was mainly due to the pessimism that was taking place in the oil market rather than critical thinking. It is obvious that market cycle emotion was the ruling paradigm at that time.

But now this is no longer the case. In fact, the rally since February 2016 has been partly driven by speculations following the oil output freeze deal and in anticipation of an output freeze out of Doha’s meeting this month. Since then, oil speculators have unwound many of their short positions and piled into net-long positions in a sign that the tide has reversed.

This trend shift is a sign that speculators are growing confident in the oil market and that the down market is behind us. But not all traders and speculators agree on this, some still doubt that the down market is behind us and still expect the worst to come. Such market state supports our claim of where in the oil market cycle we are right now. As we have mentioned earlier that we are in a stage between depression and hope, and this is what is happening right now. Many oil traders will still expect the worst ahead until we go further into the hope state. That will take some time, but it will eventually happen. And when it does, they will realize it, but unfortunately it will be late.

3- The Cycle of Market Emotions

The market cycle’s emotions exist and if allowed, they can take inventors and traders on a roller coaster ride and become their worst enemy. Emotions, if allowed to influence investors’ decisions, they can trigger irresistible and irrational impulses to sell or buy at exactly the wrong time leading to a catastrophic loss. But emotions are not completely bad for investors if they are utilized in the right way.

In fact, emotions can be an important signal of the current market state and, if understood well, they can help investors predict what is coming next. For instance, in late 2015, many oil speculators were too pessimistic about the oil market to the point that some of them expected oil prices to fall to $10 a barrel. The irresistible pulse at that time was to sell and go short. And the bad move was to expect prices to stay at that level for quite long. But many did, and it was because they allowed their emotions to influence them.

On the other hand, the smart move at that time was to expect oil prices to fall below $30 a barrel as a result of the huge influence of pessimistic speculations on oil prices, but not to expect it to stay for a long period or even fall to unrealistic price level. In fact, when emotions are too high on one direction, investors should be ready to shift trend, because at the highest level of pessimism, hope should emerge.

According to this logic, we have reached the highest level of pessimism for this downturn and that was during January and February 2016. Since February until today, we have seen a shift in emotions from a complete pessimism to a mix of hope and depression. And this trend is gradually growing which supports our claim of where in the oil market cycle we are today.

Based on the discussion of the three parameters’ outlined above, it must be clear by now that we have reached a bottom for oil prices and that down market is behind us. It should also be clear that we are now at a stage between depression and hope. But that does not mean things will improve faster. In fact, the upward trend toward a boom for this market cycle will be a long one. This is mainly due to the nature of the current competition that exists between Saudi-led-OPEC and shale oil producers.

石油圈

石油圈