Responsible consolidation of surface locations and facilities is a focus in this play

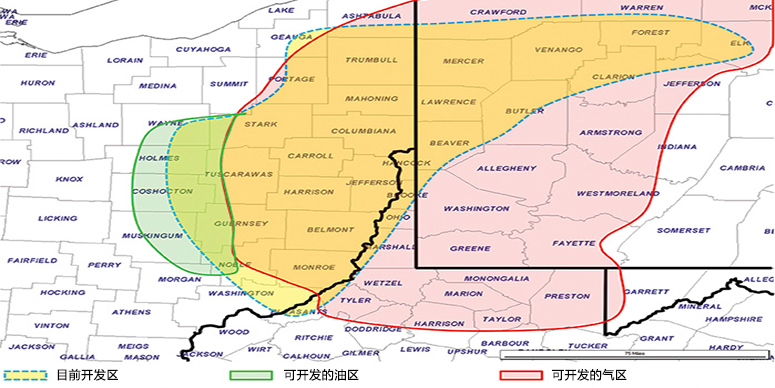

The Appalachian Basin province portion of the Utica Shale has received substantial attention from operators interested in producing hydrocarbons that are physically located near downstream markets. This Ordovician-age, black shale generally has a 1 percent to 3 percent total organic carbon (TOC) content, and the portions with greater than 2 percent are generally considered the “sweet spots.” The vast majority of the play (see Figure 1) is associated with thermally mature shale-containing gas, but about 14 percent of the sweet spots are located in areas with less mature hydrocarbons. These areas are collectively known as the “oil window.” Larger than the oil window, but smaller than the dry gas extent, is the portion of the acreage that produces natural gas and natural gas liquids.

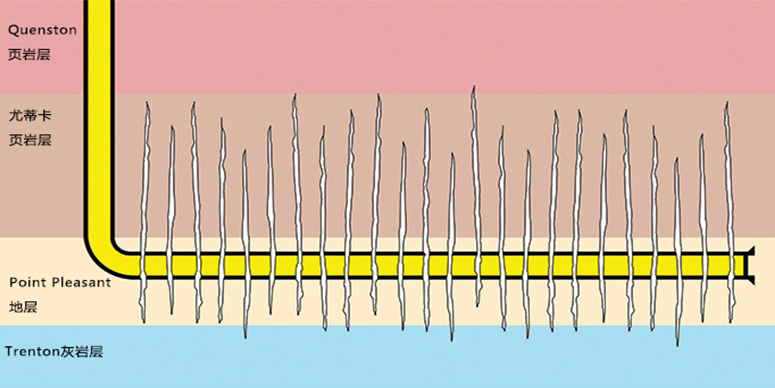

The Point Pleasant formation directly underlies the Utica Shale and is often the formation that is actually penetrated when attempting to target hydrocarbons via hydraulic fractures that span both horizons. The Point Pleasant is most often a series of interlaminated limestone and shale with somewhat higher porosity and permeability than the Utica Shale. Not only can it contribute to a portion of the overall production, but it can effectively function as a temporary storage “pressure sink” for hydrocarbons that are sourced in the Utica.

Though activity in the play increased substantially from 2010 through the first half of 2012, the fervor has somewhat abated, for a number of reasons:

• The pure oil window in central Ohio has not yet adequately demonstrated that it can repeatedly produce commercial quantities of liquid hydrocarbons. In addition, the total acreage in this category with TOC greater than 2 percent is somewhat limited.

• The dry gas window is simply not commercial under current commodity pricing scenarios for natural gas. Existing Marcellus Shale exploration, development and infrastructure are directly competing for the same “close proximity,” natural gas market.

• Portions of the play that have yielded high initial production rates of natural gas liquids (primarily ethane and propane) have been newsworthy. Unfortunately, local infrastructure related to processing ethane and propane is currently severely limited, and the cost to transport these products to Gulf Coast processing facilities can approach or exceed the current commodity pricing structure. Several local projects are under way to remedy local ethane and propane handling infrastructure shortages, but the extended timeframes required to activate these midstream ventures place stress on current drilling and completion scheduling.

• Wells in the portion of the play that produce large volumes of natural gas liquids also generally produce high volumes of natural gas. Natural gas pipeline construction in the area has not yet caught up to the capacity that is expected of 2013 development drilling and completion activities.

Hydraulic Fracturing Processes Employed

Best completion practices have been imported into the area from other unconventional plays across North America in an attempt to shorten the overall industry learning curve. Because most Utica Shale reservoirs exhibit ultra-low permeability—values are often in the nanodarcy or low microdarcy range—the number of fracture initiation points per unit of horizontal lateral length is high, on the order of 18 to 22 points per 1,000 feet. This means a lateral could have as many as 3.7 to 4.3 stages/1,000 feet with four or five exit points/stages.

Stokes’ law suggests that pumping a proppant such as sand with a specific gravity (SG) of 2.65 in slickwater with a SG of 1 and viscosity of approximately 1.8 would likely result in sand settling at or below the lateral. Though the practice could conceivably result in adequate propping of the Point Pleasant, propped coverage of the Utica Shale portion of the lithostatic column could be severely limited.

Many operators have circumvented this problem by specifying hybrid fracturing fluids that contain high apparent viscosity non-Newtonian systems as a portion of the total fluid package. The high apparent viscosity assists in carrying sand uphill, above the lateral and into the Utica Shale itself (see Figure 2). Fluid volumes range from approximately 5,000 barrels (bbl) per stage to as much as 11,000 bbl per stage, and pump rates range from 60 to 90 bbl per minute.

During the acreage delineation process, far-field fracture mapping is often used to determine fracture azimuth (and therefore the optimum lateral orientation), degree of upward penetration into the Utica, fracture half-length and preliminary estimates of optimum parallel lateral spacing.

Likely Trends

During these current acreage delineation efforts, surface locations are somewhat scattered over the acreage’s extent.

As field development efforts move to the forefront of operators’ planning efforts, more attention may be given to responsibly consolidating surface locations and facilities in this play than has been given in others across North America. During development activities, the probable trends appear to favor:

• Four or eight horizontals drilled from one surface pad. One fracturing fleet of between 14,000 and 21,000 hydraulic horsepower remains on the pad until all stages on all wells have been completed, along with appropriate auxiliary equipment.

• Central water processing facilities for every 24 to as many as 48 wells. This includes storing and transferring source water, recycling and treating produced water, and provisions for responsibly handling and/or disposing of any water that is not recycled.

• Short-term proppant storage and handling facilities that minimize airborne and noise pollution.

In the shorter term, most operators are focusing on determining which portions of their acreage are most suited for further development. Extensive “manufacturing mode” may not make sense for many companies until further infrastructure—fractionation, natural gas liquids storage, gas processing and pipeline—goes online in late 2013 and 2014. Meanwhile, there is quite a bit of process optimization that needs to be accomplished in the Utica Shale.

石油圈

石油圈