In plays with multiple prospects, decision-makers put themselves at a significant disadvantage by using economics on a standalone basis to justify development for each prospect. In the clustered-development approach, the geologic dependence between prospects is combined with the aggregation of prospects to determine the economic viability of a grassroots development offshore. Although easily visualized, economic evaluations of clustered developments typically do not consider the geological dependencies and development synergies that exist. Modeling these synergies has a significant effect on the economic evaluation of developments.

Geologic Dependency

In assessing the economic effect of the dependencies between prospects, breaking the chance of geologic success into a shared element and a local element is mandatory. The geologic-chance elements shared between all related prospects will be referred to as either the shared or play chance. Those geologic-chance elements that are independent between each related prospect are referred to as the prospect/success ratio (PSR). The probability of geologic success for any individual prospect will be defined as the play chance multiplied by the PSR.

When evaluating a new region, having a high degree of dependence within the geologic chance-of-success components will effectively derisk the play relative to total independence. A key learning from the authors’ play analysis is that an optimal drill order always exists. The well that will have the largest effect on the play chance is typically the optimal well to drill first. Industry practice often is focused on a well decision rather than a play decision. Consequently, the well with the highest chance of geologic success (Pg) or the largest risked mean recoverable resources typically is drilled first. Ideally, prospects should be drilled in a location that best addresses the play-chance elements.

Effect of Aggregation on Size Dependency

Geological successes are not all commercial or economic successes. A two-step process is used to determine the chance of commercial success leading to a development. The first step is assessing the total chance of Pg. The second step is to run the cash-flow model to determine the minimum commercial field size (MCFS) for each prospect, assuming a standalone development and a clustered tie-in to an existing development. The product of the two is the chance of commercial success. Viewing a play as an individual prospect vs. as an aggregate of prospects will affect decision making materially in the determination of the size threshold for commercialization. An assumption has been made that each prospect can be represented by the same cash-flow model (i.e., the same distance from prospect to central processing facilities).

One of the major factors in economic assessment of unconventional plays has been the understanding that development decisions are based on the average program outcome, not on individual well outcomes. In resource plays, the mode or most-likely single-well outcome (from a frequency perspective) typically is uneconomical. Resource plays that are active today are those in which the program’s average per well mean outcome is economical. As the number of wells being aggregated increases, the variance (P10/P90 ratio) decreases and the distribution tends toward a normal distribution.

The mode of the log-normal shifts toward the mean as the number of wells being aggregated increases. In a log-normal distribution, the mean will always exceed the median, which will always exceed the mode. In a normal distribution, the mode equals the median, which equals the mean. This same understanding can be applied in modeling clustered developments in greenfield plays.

Case Study

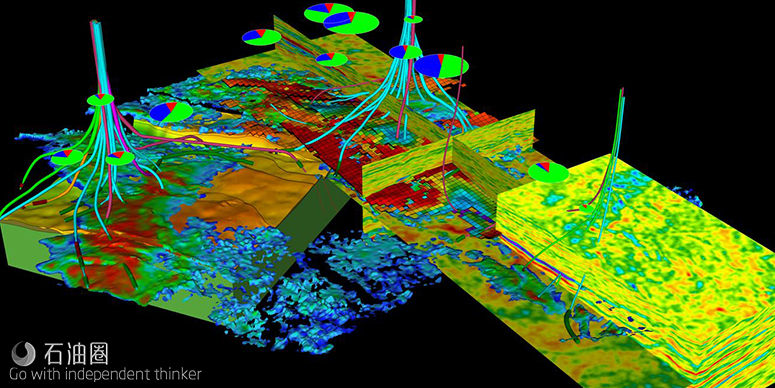

To illustrate the effect of the clustered-development approach on the economic-evaluation and decision-making process, a case study of three prospects in a deepwater setting is presented in the complete paper. In practice, the prospects likely would have different resource-volume distributions and local geologic-chance factors. For the case study in this paper, however, both parameters are assumed to be the same for all prospects. This simplification is meant to keep the focus on the process rather than on the details of the individual prospects. Likewise, the case study is not defined beyond being in a deepwater setting because the process is applicable in any setting, onshore or offshore.

The cash-flow model used to generate the economics assumes a royalty and tax fiscal regime. While the cash-flow model will affect the economic results, it is considered to be independent of the process of evaluating clustered developments being presented in this paper and is not emphasized. The process being presented will work with other fiscal regimes, such as a production-sharing-contract model.

The traditional industry approach, in which a new region is evaluated on the basis of one discovery large enough to support the infrastructure development.

An analysis wherein the development decision is made on the basis of a clustered development with no consideration for the effect of geologic dependence.

A clustered development with geologic dependence between the prospects. The development decisions are then based on what might be found when all three prospects are considered. The authors advocate this third approach, and it is discussed next.

Clustered Tie-In Development Methodology With Shared Play Chance. The authors consider that the deepwater case study is in a play-segment extension of a proven play with a high shared play chance of 80% associated with migration risk. For economic analysis, the assumption is made that dry-hole analysis will be inconclusive of the shared play chance factor and all three prospects will be drilled. This conservative approach for the case study is adopted deliberately because it still will demonstrate that consideration for the shared play chance will add value to the economic analysis.

For the clustered tie-in development methodology with shared play chance, economic evaluation is similar to that adopted when prospects are assumed to be geologically independent. A Monte Carlo simulation with 60,000 iterations was used to simulate the possible outcomes using the prospect geologic-resources distributions of the three prospects but now also considering the shared play chance between prospects.

A nine-branch decision tree is needed this time, rather than the eight-branch decision tree used in the second of the three evaluation models, to summarize the simulation results because total failure can now happen in two separate ways: the play does not exist or all dry holes are caused by local prospect-specific factors even though the play exists.

The main results of the decision tree show that the chance of multiple developments is now 22.4% (compared with 19% when not considering the shared play chance). The decision tree also shows that the chance of no developments is 63.3% (slightly higher than 62.9% when not considering the shared play chance). These results are consistent with expected outcomes when modeling geologic dependencies between prospects. Good news leading to success in one prospect will increase the chance of success in the other dependent prospects, increasing the chance of multiple developments (and increasing the success-case resource volumes). However, bad news leading to a dry hole in one prospect increases the chance of a dry hole in the other dependent prospects, increasing the overall chance of failure for the program.

The probability of having at least one development has increased with the use of clustered development because of the lower threshold on individual prospect discovery sizes that can be developed. The chance of multiple developments has increased significantly with a clustered-development strategy. Considering the shared play chance increases the number of developments in the success case but reduces the chance of commercial success because of the geologic dependencies.

Significant improvement in expected-value and success-case metrics is seen for the mean number of developments, mean oil estimated ultimate recovery, and mean DNCF at 8% when the standalone strategy is abandoned. The clustered-development approach also shows economic improvement when considering shared play chance caused by a larger number of discoveries developed in the success cases with only a small reduction in the overall chance of development.

石油圈

石油圈