Maximizing recovery of hydrocarbons from oil and gas fields represents responsible asset management and is extremely valuable to both the operator and the host country. Successful pursuit of this goal involves a complex combination of technical, commercial, organizational, and human factors. This paper describes recent progress in developing a proprietary recovery-factor-evaluation process.

Introduction

In 2002, a root-cause analysis was carried out on the basis of both externally published and internally held data to identify key success factors for increasing recovery factor in both gas and oil fields. This root-cause analysis led to the development of a robust and systematic approach to identify and describe opportunities called the Reservoir Technical Limits (RTL) system.

Since its first application, this process has provided a systematic framework to identify new recovery-improving activities across a portfolio of fields, generate clear ownership of the activities by field teams and individuals, and identify technology requirements (existing or new) to progress the opportunities. This process has proved highly effective in identifying and evaluating the practical recovery potential within these fields.

The process hinges on breaking the overall recovery factor into separate component efficiency factors so that targeted recovery-enhancing methods can be evaluated.

System Concept

The system is used to evaluate the life of-field recovery potential of oil and gas fields, and the steps required to achieve this potential, on the basis of the following key factors:

Depth of technical knowledge across multiple functions

Innovation, creativity, and awareness of latest technologies

Understanding field specificity, so that identified opportunities are properly applicable to the field under review.

The Efficiency-Factor Framework.

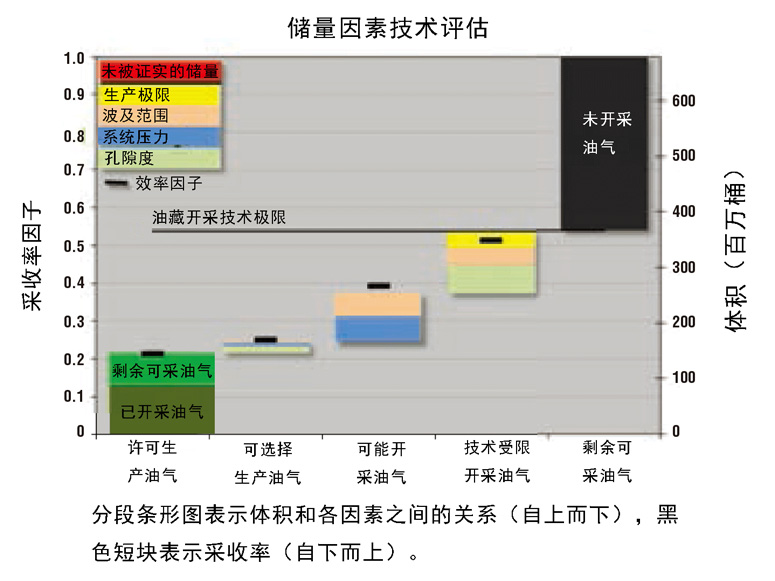

The system’s efficiency-factor framework represents the overall recovery factor for the oil field as a product of four component efficiency factors:

1. Pore-scale displacement (microscopic efficiency of the recovery process)

2. Drainage (connectedness to a producer)

3. Sweep (movement of oil into producers within the drained volume)

4. Cutoffs (losses related to end of field life or access)

Each efficiency factor is given as a fraction between zero and unity and used as a multiplier in the recovery calculation. For gas reservoirs, the same approach was adopted to identify the key component efficiency factors and operating parameters influencing recovery. There are obvious differences between oil fields, volumetric gas fields, and aquifer-drive gas reservoirs, with these subsequently reflected in the efficiency factors and parameters (described in detail in the complete paper) used to frame the recovery factor in each.

Concept Application

The current process consists of five key steps:

1. Prime

2. Establishing baseline

3. Capture

4. Rank

5. Report

These steps are carried out over two workshop sessions with the field teams and are applied to both oil and gas fields.

Session 1. Prime. This step starts with up-to-date information about current field understanding, dynamic performance, and possible future activities needing to be collated.

Establishing Baseline. Before thinking of ways to improve recovery, the team needs to calibrate their forecast of what the current development scope will recover to adequately define the foundations for identifying new opportunities.

The system’s conceptual framework is used to split the overall recovery into the different component efficiency factors to achieve a good understanding of the “base” case. This involves a consensus on what the field has delivered to date and how, as well as what will have been delivered by the end of the current development plan on the basis of previously committed activities.

Available field data should be used to calibrate individual component efficiency factors. Field knowledge and understanding provided by the field team are then used to evaluate the contribution of each of these efficiency factors to the base recovery factor.

Once characterized, the base-case recovery factor is benchmarked against a screened set of analogs. This identifies whether the recovery factor is high, normal, or low compared with analog fields, giving an idea of the likely potential for recovery-factor improvement.

Capture. This step is based on a structured conversation aimed at identifying the various activities that may be employed to push each efficiency factor toward its maximum potential. With the system’s conceptual framework, the participants generate a list of potential new opportunities. Opportunities are defined as activities with the potential to increase the recovery factor beyond what is achievable in the current development plan. Opportunities for incrementally increasing the recovery are explored, relating each to a specific efficiency factor.

This marks the end of Session 1 of the review. The interval between the two sessions is used as working time, typically 2–3 weeks, to evaluate the different opportunities in more detail ahead of Session 2.

Session 2. Rank. Each of the opportunities identified in Session 1 is described in a consistent manner to include the opportunity name, activity involved, time scale, which efficiency factor is being modified, incremental resource likely to be added, estimates of cost, key risks, actions needed to begin opportunity progression, technology challenges, and current status of progress. For each opportunity, the key risks to delivery are identified and the associated risk management activities are highlighted.

The identified opportunities are discussed and ranked on the basis of criteria of feasibility, risk, timing, viability, and technology. As a result, each opportunity is assigned to one of the following categories:

Options: opportunities that are well-defined, are viable, carry a low risk, and can be implemented within the short term (less than 1 year) if selected for progression on the basis of subsequent technical and commercial analysis.

Possibilities: opportunities that carry a higher risk, are potentially economic with existing technology or with incremental technology development, and are split according to likely time scale as medium-term (i.e., less than 5 years) or long-term (more than 5 years).

Barrier Opportunities: opportunities with a technical, operational, or commercial barrier preventing their current progression. These are currently unfeasible or uneconomical and can progress only with a step change in technology, cost, or commercial framework.

Quality Control. The identified opportunities are quality controlled to ensure that they are consistent and reasonable when compared with other fields. This is performed in two ways: first, with an internal consistency check (within the field under review), and second, with an external consistency check through comparison with performance data from analogous fields.

The internal consistency check is carried out on the basis of the efficiency framework through evaluation of the overall recovery factor in two distinct and independent ways.

1.The identified opportunities are associated with incremental volumes that they are expected to deliver once implemented, regardless of whether these are ranked as Options, Possibilities, or Barrier Opportunities. These volumes are summed together with the volumes already produced, then divided by the in-place hydrocarbon volume to obtain the theoretical recovery factor for each opportunity set if it were to be implemented.

2. The same opportunities aim to improve one or more of the component efficiency factors. As a result, each opportunity is associated with one or more efficiency factors, and estimates are made of how much these would be increased once the opportunity is implemented.

Input from the field team and challenges from the external technical experts are crucial at this stage. This is repeated for each opportunity in the Options, Possibilities, and Barrier Opportunities categories. The resultant efficiency factors are then used to calculate the new recovery factors for each opportunity set.

The aim is to compare the recovery factor calculated with these two independent approaches. This quality control of the opportunity set is aided by the use of the internal consistency check built into the system tools.

Recovery factors derived from the sum of the opportunity volumes (a top-down approach) should be similar to those obtained from the efficiency-factor increments (a bottoms up approach). The input volumes and efficiency factors are dynamically linked to a summary plot in the system tool.

The external consistency check is then completed, referring to the company’s extensive Reservoir Performance Benchmarking toolkit. The gas benchmarking process is based on a proprietary database of more than 800 producing gas fields and reservoirs. The toolkit allows the recovery factors from the system review to be compared with those from identified analog fields.

Report. This stage consists of two main activities: first, closing out the system workbook, incorporating all of the identified opportunities and associated volumes; second, drawing up a resource-progression work plan, covering all opportunities with clearly defined timelines and accountability for activity. The finalized workbook is submitted to the central subsurface-function team in order to maintain the global system database.

Resource Progression. The system’s software suite and supporting documentation facilitate the process and enable the outcome of the review to be captured, analyzed, and presented in a consistent manner. Once a review is completed, the field team creates and updates their resource-progression hopper and the resulting opportunity set is progressed through a defined resource-progression work plan incorporating all identified opportunities with clearly defined timelines and actions to progress.

石油圈

石油圈