The oil and gas industry’s goals of reducing nonproductive time (NPT) and increasing production of unconventional resources are driving the evolution of hydraulic fracturing technologies. Especially as operators start to hit the natural physical limits of unconventional production, the need to optimize the fracking process has grown stronger, James West, Senior Managing Director for Oil Services, Equipment and Drilling with EvercoreISI, said. The optimization process differs by play, but overall, companies are looking for better well and fracture placement, as well as different sizing and staging of frac clusters.

Efforts have also focused on improving equipment durability to handle more intense fracking operations, Mr West said. This includes advances in engine technology and transmission technology. More companies are also implementing predictive analytics in their equipment to better align maintenance schedules. The next round of technology advancement, he added, is expected to address frac pumps, which wear out the fastest due to the corrosive materials pumped through them.

“Average equipment life has gone from a cycle of seven or so years to an average of four to five years,” Mr West explained. On top of that, current pricing levels do not yet support a return on equipment above most companies’ cost of capital, primarily due to the heavy maintenance expenses.

In this article, Drilling Contractor speaks with several companies about their recent fracking technology developments, which also include innovations in proppant and diverter technologies.

Simplicity and durability

In 2018, companies are looking for a simpler, lower-cost means of creating fractures that leaves no doubt as to what well stages have been treated, Ian Bryant, President of stimulation hardware provider PackersPlus, said. The company is field-testing completion systems that will deliver high stage counts in both cemented and open hole without the need to mill out plugs or ball seats.

The company’s TREX QuickPORT IV sleeve – released commercially in January 2016 – seeks to address what Mr Bryant believes is industry’s realization that perforation clusters actually cause inefficient reservoir stimulation. In recent years, oil and gas companies had turned to multiple perforation clusters in each well stage, hoping that they would get even fluid distribution by varying the size or density of the perforations. “Although, on paper, you have 120 to 150 entry points or fractures, that really isn’t the case,” he explained. The inefficiency in perforation clusters – which creates multiple entry points in a stage to create fractures – results in perforations towards a well’s heel getting most of the treatment, he said.

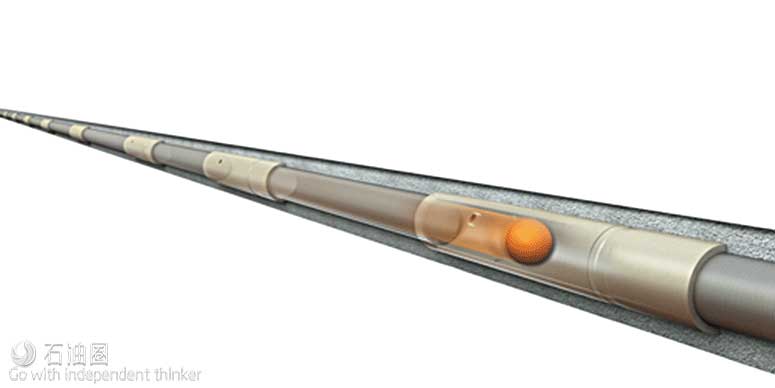

Using squeeze technology – a combination of completion engineering and material science – to play within the tools’ elastic limits, the QuickPORT IV sleeve can open up multiple entry points in a wellbore with one ball, allowing for more even distribution of fluids in a wellbore. Its jets are reinforced with tungsten carbide to ensure that entry points aren’t washed out during stimulation. “If you have casing with just regular steel, perforations that initially take fluid tend to wash out during stimulation, so perforations further down the well don’t take further treatment,” Mr Bryant said.

The technology was deployed in the Permian Basin in November 2017. An operator was experiencing difficulties using wireline and coiled tubings for plug setting and perforating operations in laterals with measured depths over 20,000 ft. Beyond that length, the operator was concerned about providing sufficient weight on the drilling bit to mill out plugs, as well as getting wireline and coiled tubing to bottom to set plugs, to mill out and to clean out in longer laterals. The operator also had lost expensive perforating equipment downhole on three occasions.

By running four stages of QuickPORT IV limited-entry cement sleeves at the toe of a well – right next to plug-and-perf stages – the operator saved approximately 14 hours on location, according to PackersPlus. The sleeves also allowed the operator to cut time and cost spent to deploy and mill plugs through long lateral distances.

Lower cost, greater durability

One of the key drivers Weir Oil & Gas sees for future fracking technology developments is reducing the total equipment maintenance cost. “The big thing we see changing today is the harshness of the cycle,” Bryan Wagner, Director of Engineering and Product Management for Weir’s pressure pumping team, said. “They’re pumping more sand now and at higher pressures for longer. That takes its toll on equipment.”

At the same time, there’s been a strong push across the board to reduce cost during this downturn. “But the push was not just about paying less for equipment but really about finding more efficient ways to do the job they’ve always done,” Mr Wagner said. “The downturn forced the industry to spend a lot of time understanding how uptime and reliability of equipment and efficiency affect their bottom line and ability to weather oil price downturns.”

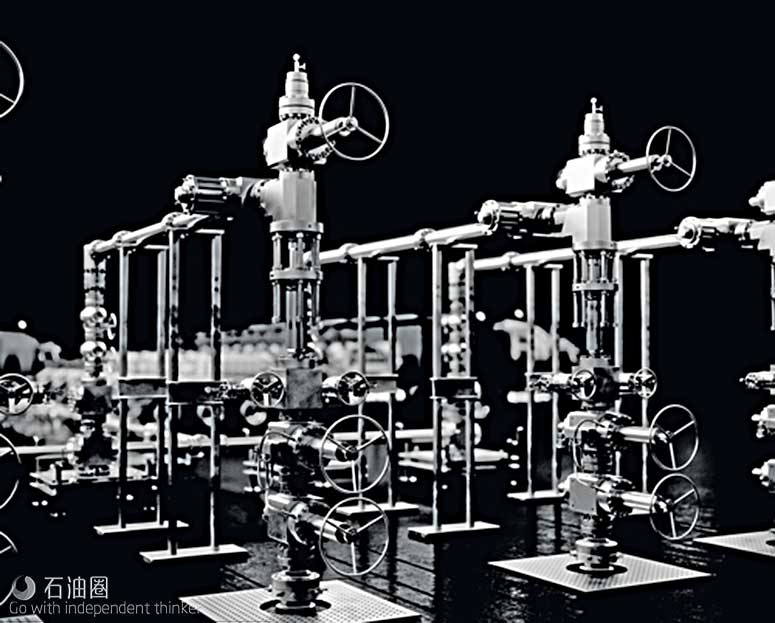

Seeking to meet this need, Weir announced at the 2017 Offshore Technology Conference (OTC) the Simplified Frac Iron System, designed to reduce the amount of iron and equipment at a fracking site. The system includes preassembled components on a modular skid design. At the end of each skid is a single connection, which reduces assembly time and the number of field technicians needed. It also features redundant 7-in. SPM isolation and directional valves, one of which includes a hydraulic actuator for safe, remote operations. By reducing the amount of pipe connections from 100 to 12, the potential for leak paths was eliminated by 88%. An internal 2017 computational fluid dynamics analysis of the Weir configuration concluded that the system could achieve approximately 70% less pipe erosion compared with other designs. This year, the company is releasing the first 7-in. plug valve and 7-in. check valve for the system. Mr Wagner said these valves are the very first fit-for-purpose 7-in. 15,000-psi frac application valves for the main line.

“It is a true 7-in. valve running traditional iron up into the frac stack. The current solution is 3- or 4-in., which means you have to have multiple lines that convert down to smaller valves in order to consolidate down to the main line,” Mr Wagner said. “The 7-in. allows you to truly consolidate down to one line. The benefit to the customer is less equipment onsite, reduced footprint, less potential leak points and reduced NPT.”

On the pressure control side of its business, Weir is designing products around the need to reduce NPT onsite and prevent potential leaks. This includes a one straight line (OSL) frac system, Russell Hamilton, Director of Engineering and Product Management, Pressure Control, said. The company introduced this technology in Canada last year and is now launching it in the US market.

The system, which consists of a vertical zipper manifold, OSL frac connection and a frac stack, reduces the number of connections required at the manifold to just one, from the three to six that are typically required. The frac connection complements the vertical zipper manifold by making the connection from zipper manifold to frac tree in one large-bore connection, reducing equipment footprint, NPT and labor costs while improving safety, Mr Hamilton said.

This year, the company plans to release several new sealing and plug valve technologies to prevent leaks, allowing for safer and longer operations, and an updated version of its legacy 2250 XL pump, along with new fluid end technology. The firm will also release an EXL swivel seal for its swivel product line, as well as proprietary elastometers for plug valve seals, union seals and safety iron seals to address produced water and chemicals in fluid.

Further, Weir is working with its customers to help them use their data more effectively, by allowing customers to interface with Weir’s algorithms to make their current systems smarter, Mr Wagner said. “We are working with our customers and using our advance knowledge of vibrations and what goes on during component failures to enable our customers’ existing systems to perform significantly more functions than they could previously.”

石油圈

石油圈