As lower oil prices plague markets worldwide, the Kingdom of Norway — which generates about a quarter of its GDP from the oil and gas sector — has also been affected.

Latest IMF forecasts peg Norway’s GDP growth at 1.3% in 2016, a slip from the 2.2% recorded in 2014.

As per Moody’s credit review, the country’s credit outlook remains intact in the near-to-medium term, as it draws on the strength of its strong governance framework, albeit with longer-term concerns.

Moody’s mid-year report states: “The hydrocarbon sector, which accounts for approximately 20% of national GDP, has been undergoing structural changes, including reduced investment and lower oil prices that are weighing on the Norwegian economy and the government’s fiscal position. Although these developments do not have immediate implications for Norway’s creditworthiness, the structural shifts in the sector raise some long-term concerns regarding the viability of the reliance on the hydrocarbon sector, and necessitate adjustments in the economy and government budget.”

Nordic Government Pension Fund Global (GPFG)

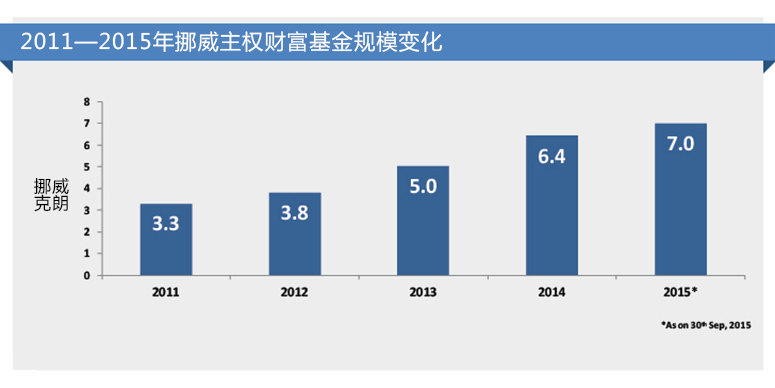

Norway has historically preserved her oil riches through the Government Pension Fund Global (GPFG) — the largest sovereign fund in the world — financed by taxes levied on oil companies. The fund’s size recently surpassed NOK 7 trillion, or more than 200% of the country’s GDP. The government’s fiscal spending is backed by returns generated on the fund, and therefore, remain cushioned from volatility in the oil markets.

Short-term Remedial Measures

In the short-term, the country’s strong government policy framework should cushion growth despite the crash in oil prices.

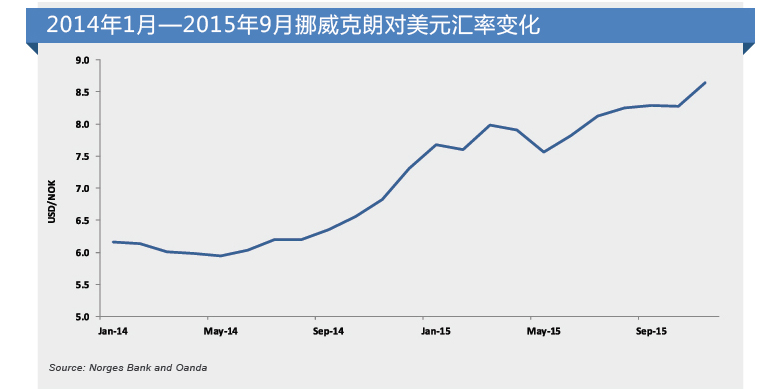

The business environment for Nordic companies has dampened due to an expected decline in oil investments (estimated to drop by c.9% in 2016 over 2015) and GDP growth. Nonetheless, the Norwegian economy stands to benefit from the ongoing krone depreciation as a means of boosting the performance of non-oil sectors. Historically, Norway’s non-oil sectors have been characterized by stronger currency and higher wage levels. In order to weather the current oil-price storm, the Norwegian government has already cut its benchmark rates twice (with the possibility of another cut soon) and also announced increased spending and tax relaxations in its budget.

Key Metrics That Are Vulnerable in the Long-term

However, sustained low oil prices in the long-run would necessitate major adjustments to Norway’s government budgeting protocols.

As a direct consequence of sustained low oil prices, Norway’s oil investments could be cut substantially, impacting key economic metrics such as wage levels in both oil and non-oil sectors, private consumption, and consequently, the region’s economic growth prospects in general.

Norway boasts of strong key economic metrics such as a GDP per capita that exceeded the EU-28 average by more than 60% in 2014, budget surplus at more than 7% of GDP since 2005 and government assets net of debt in the form of sovereign fund worth more than NOK 7 trillion. However, the country’s household debt stood at unsustainably high levels (c.220%) of disposable income in 2014 and could become a major challenge in the event of an oil shock.

Norway’s banking system is heavily reliant on market funding as compared to domestic funding sources, funding that could be inaccessible as the oil imbalance grows. A potential failing, to say the least. As per an IMF report (Sep 2015), market funding among Norwegian banks comprised 60% foreign funds and 40% domestic funds.

Will the Slump Hit Hard?

It could be challenging for Norway to adapt to a low oil price benchmark in the medium-to-long run, which would entail foregoing growth, enacting major fiscal and government policy changes, as well as regaining competitiveness in traditional non-oil sectors.

As reflected in the words of Oystein Olsen, Governor of Norway’s central bank: “The shift to an oil-driven economy with a high wage capacity has been a comfortable journey. The journey forward, where the oil service industry must downscale and other trade-exposed industries must grow, will be more challenging.”

石油圈

石油圈