DUG Eagle Ford: Hydraulic Fracturing Panel Discusses New Technologies, Techniques

E&P

Hydraulic fracturing is one of the most important techniques to impact the oil and gas industry over the past several decades. But while it obviously works to open cracks in the rock to improve recovery, no one really knows what’s going on down there; they can only theorize.

At Hart Energy’s recent DUG Eagle Ford conference, a technology panel focused on fracturing and some of the new techniques being used to continue to improve the technology.

Smarter wells

CEO of Reveal Energy Sudhendu Kashikar kicked off the session by arguing that operators can gain fracture intelligence on every well in a manner that’s simple, accurate and affordable.

“After drilling and completing thousands of wells, there is still significant uncertainty in the industry about spacing and completion designs,” he said, adding that existing technology does not enable full optimization and is intrusive, complicated and expensive.

His approach is disarmingly simple—mount a pressure gauge on a monitor well while an adjacent well is being fractured. The result is an IMAGE Frac fracture map. The method requires no wellsite personnel and is nonintrusive and affordable, he said.

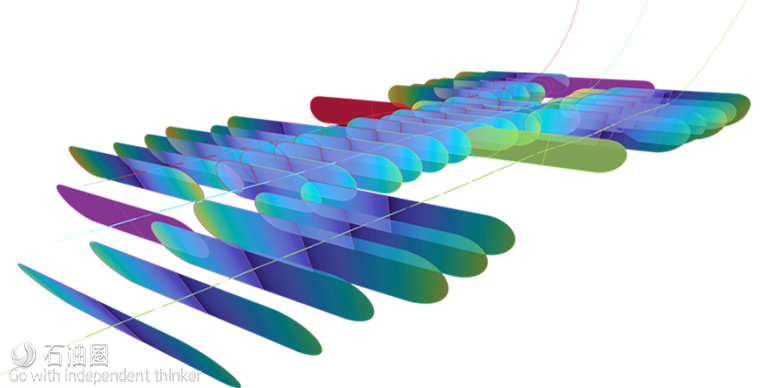

The idea behind pressure-based fracture mapping is to first establish a monitor stage. The operator sets a bridge plug and then fractures the monitor stage. After the fracture is completed, the wellhead is shut in and equipped with a high-resolution pressure gauge.

Assuming a plot of three wells, the next phase is to monitor stage 1 in the second well while fracturing stages 1 to 15 in the first and third wells. In the next phase wells 1 and 3 undergo monitoring of stage 15 while stages 2 to 28 are fractured in well 2. In the final phase stage 28 of well 2 is monitored while stages 16 to 28 are fractured in wells 1 and 3.

Multiple deliverables are available, including FracSCAN, ProppantSCAN and PerfSCAN.

The system can be used for a variety of studies. In one example the operator was comparing slick water to gel. The system showed that the slick water provided good cluster efficiency, while the gel fracture was dominated by a single cluster. It’s also been used to evaluate the efficiency of different diverters.

Overall, Kashikar hopes to go from science wells to fullfield implementation of the system. He claimed that the simple, accurate and affordable system will help operators update their completion and design spacing and manage geological and financial risk while obtaining actionable, relevant-time answers.

Engineered completions

In a similar vein, Dale Logan, vice president of reservoir technologies for C&J Energy Services, described a service that helps operators manage engineered completions. Called LateralScience, the system uses an equation factoring in weight on bit, rpm, rotary torque, ROP, differential pressure, standpipe pressure and mud flow rate. The result is a plot that looks like a well log and measures the hardness of the rock along the wellbore. Logan listed common questions that he gets asked about the service:

- How does measuring mechanical specific energy (MSE) compare to sonic geomechanics?

- Does well productivity really vary as the lateral varies?

- Do engineered completions really deliver better wells?

In a Marcellus example, he showed that the service compares very well to sonic geomechanics in most cases, and in one case where it didn’t compare well it was because the operator had trouble getting valid sonic measurements in that well.

To test well productivity variability, the system was tried on a well that had production log information available. The well was completed in a 29-stage geometric pattern, and it turned out that about half of the stages were homogeneous, while the other half were heterogeneous.

In another example, production logs indicated that of the 86 clusters in the well, only 59 were contributing to production. The more poorly performing stages correlated well to the rock hardness data.

To answer the final question, the company studied a group of wells in the Wolfcamp Formation in the Permian Basin. Two metrics were used to determine the efficiency of the engineered completions: boe/month/ lateral ft and boe/month/pound of proppant. The conclusion was that the wells with the engineered completions showed significant performance improvements over those completed geometrically.

Logan concluded that LateralScience does compare favorably to sonic geomechanics, lateral variability results in variations in fracture propagation, MSE variations correlate with production and engineered completions really do deliver better wells.

Dissolving balls

Bill Warfield, extrusion manager for Magnesium Elektron, discussed dissolvable fracture balls and the considerations that operators need to be aware of when selecting them. His company’s fracture balls are cast, extruded and tested in-house and can be tailored for strength and ductility depending on the application.

Magnesium will dissolve in the presence of water and chlorides, both of which are present in a wellbore. But the speed at which it dissolves is also controlled by pressure and temperature. The company manufactures four different product lines that accommodate varying wellbore conditions and make tradeoffs between strength and ductility.

Overall, Warfield said understanding temperature, chloride content and the differences between alloy types is the secret to a successful completion.

Diverters

One of the many challenges in a fracturing job is trying to ensure that the fluid cracks as much rock as possible and doesn’t just create one giant fracture. The industry uses diversion technology to try to prevent this from happening.

Jason Baihly, commercial and risk assessment manager for integrated production services for Schlumberger, discussed his company’s diversion product, known as BroadBand Shield. Baihly noted that the industry has been using some sort of diversion technology for 70 years and that there have been 200 patents awarded in the last 40 years. Diverter materials have included rock salt, benzoic acid flakes, various types of balls and dissolvable particulates.

Schlumberger studied a group of wells in the Eagle Ford Shale to compare “parent” and “child” wells and discovered that even though the child wells usually had been completed with more proppant, they were not performing as well as the parents.

The company’s diverter technology uses multiple materials and particle sizes so that the large particles bridge at narrow points in the fracture and the small particles create a far-field diversion pack. This should help stop runaway fracture growth in the child wells and interference with the parent wells’ fracture networks.

Baihly noted that the diverter is pumped before the proppant stages and usually accounts for 8% to 15% of the total proppant volume. In one Eagle Ford example production from the parent well improved after the child well was pumped.

In summary, he noted that child wells are becoming a growing problem but that billions of dollars in upside can be unlocked through capturing their full production potential. He also noted that Schlumberger believes so strongly in this technology that it’s willing to not get paid unless the child well’s performance improves.

石油圈

石油圈