芝加哥大学的能源政策研究所(EPIC)是一家以数据为导向、跨学科、评价客观且值得信赖的研究机构,以研究攻克世界上最复杂能源困局而蜚声海内外。该机构的客观评价意在限制能源行业对环境与社会消极影响的前提下,确保行业自身实现良性可持续发展。

石油市场的短期前景真是狼藉一片,近期的原油价格波动已经触及全球经济危机爆发以来的最高水平,贸易商、投资商与行业本身共同见证了正在“上演”的两大主流变化:美国页岩产业如火如荼地快速发展,从2010年的一穷二白发展到2015年的全球第六大石油供应源;沙特阿拉伯决意放弃全球石油市场经理的角色。石油圈原创,石油圈公众号:oilsns

上述两个方面是短期内的主要症结,但与远期窘境相比就是小巫见大巫了。这两大趋势如果进一步发展将有可能颠覆当前的能源行业格局。石油圈原创,石油圈公众号:oilsns

首先,种种迹象表明当前在交通运输原油消费市场方面的竞争态势正在日趋紧张。在美国,民众消费石油总量中超过70%是用于汽车、卡车、轮船和飞机,而全球相应平均消费比例是64%,数值略低。此外,至少在过去的100年内,石油一直占据着燃料消费的主体地位。

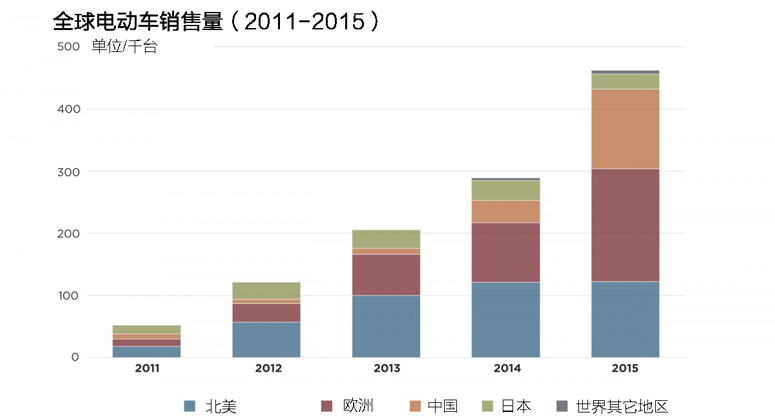

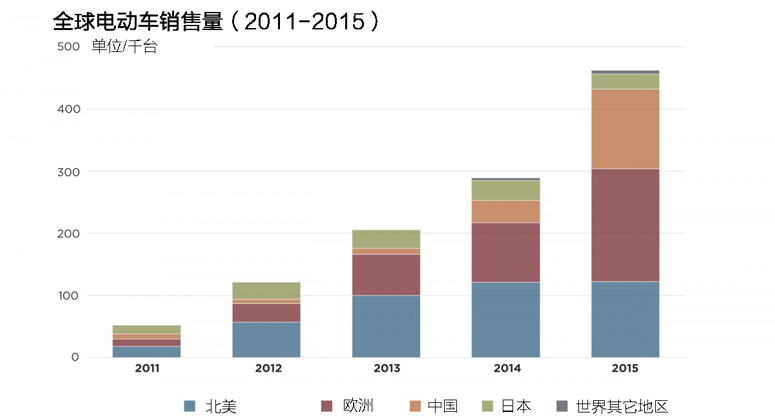

但是根据过去几周的大数据来看,这种传统模式正在悄然发生变化。法兰克福学派的一份最新报告显示,去年全球电动车销量增长了60%,自2011年以来的总销量突破了110万台。虽然电动车的售价较高、续航里程较短且充电耗时较久,但在油价持续下跌的背景下,2015年的销售业绩还是有着长足的进步。令人难以置信的是,销量增长主要来源于中国市场的支撑,销售额与2014年相比几乎翻了两番。

中国电动车市场的火爆对全球石油行业而言无疑是一次沉重打击,原本希冀中国市场经济的发展能够带动国际石油市场的复苏,没曾想到事与愿违。去年,中国汽车总销量是2000万台,电动车销量所占百分比虽然不足1%,但是事情一旦开始转变,速度将是不可估量的。瑞银集团投资银行本月早些时候发布研究报告指出,燃料电池价格的不断下降与燃料附加税的日益上涨将使电动车与传统型汽车相比较会更具竞争力,预测价格优势会在2021年的欧洲与2025年的中国凸显出来。与此同时,阻碍电动车发展的续航里程与充电耗时等问题正在逐步解决当中。通用汽车与特斯拉计划今年推出续航里程达200英里的全电动汽车,售价为3万美元。

在美国,尽管较低的石化燃料价格限制了电动汽车的销量,但是彭博新能源相关报告指出电动车行业在2015年仍旧吸引了近十亿美元的投资,与2010 ~2013年间的平均引资水平相当。尽管如此,但显然世界发展仍然需要大量石油的支持,只是石油供给源可能会发生巨大变化。

在美国页岩油气行业的早期阶段,油气藏平均采收率只有5%。现今,一些较易开发页岩油气藏的采收率可以接近12%。但是BP首席经济学家Spencer Dale于2月份在芝加哥大学的一次演讲中指出,保守而言,未来五年内这些油气藏的采收率很有可能达到甚至超过25%。按照这一预言推算,未来美国页岩油资源量将是目前总量的三倍。

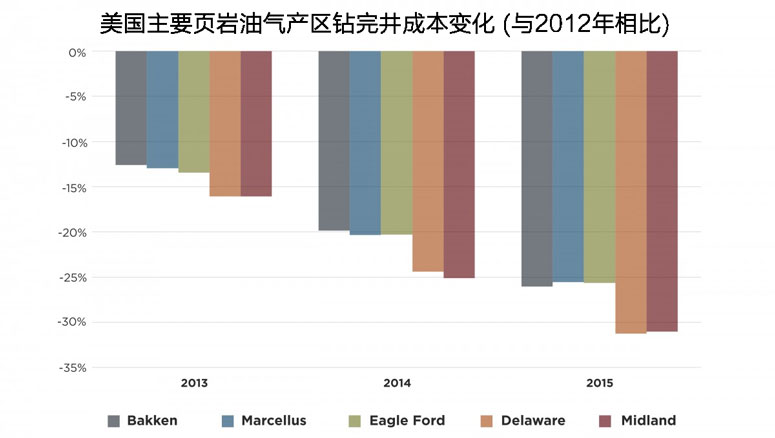

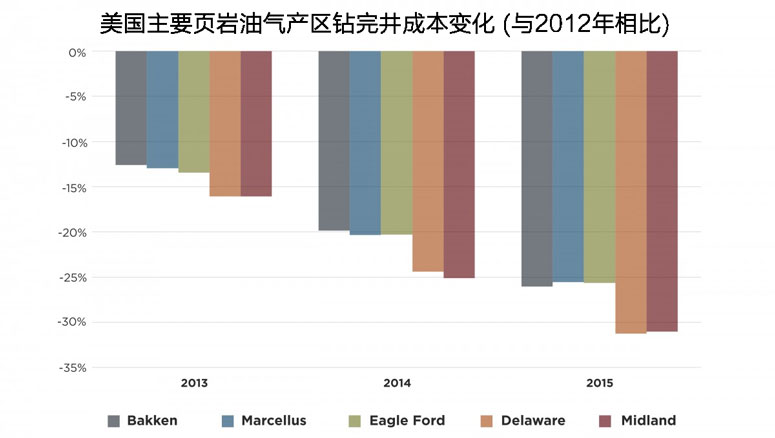

将来用于页岩油气藏的开发经营成本也会大幅降低。根据能源咨询公司HIS研究成果(备注:IHS 是一家全球性的信息公司,在全球 30 多个国家/地区拥有超过 5,500 名员工。IHS 是一家领先的全球供应商,致力于为能源、国防、航天、建筑以及汽车工业的客户提供关键技术信息、决策支持工具以及相关服务),美国主要页岩油气产区的钻完井成本与2012年水平相比已经下降了25~30%。虽然业界各方的估值差距较大,但是彼此基本达成共识:如果油价保持在70~80美元/桶,美国页岩油产量会增加0.5~1.0百万桶/年。石油圈原创,石油圈公众号:oilsns

研究结果显示,交通运输系统对石油的依赖度下降,潜在性的全球石油供应端快速扩张。这一切变化意味着什么?首先,它可能意味着包括加拿大油砂、深海油气藏、北极石油在内的世界范围内资本密集型石油资源将被打入冷宫。当前,这些资源的石油供给量约占世界总量的10~15%。

如果形势真的像这样发展下去,长期原油价格势必会继续下降。此外,通过缩短全球石油投资周期,建立新的市场结构可以一定程度上抑制油价剧烈波动,这意味着油价将变得更加稳定。对全球环境而言绝对是利好消息,因为加拿大油砂等项目属于全球碳密集度最高的上游油气业务之一,项目开发对环境负面影响巨大。

最后,这种市场动态转变对石油工业结构将产生直接影响。深水油气藏与油砂等碳密集型大型项目是众多国际石油公司资源投资板块的重要组成部分。例如,在2015年底,对壳牌和埃克森美孚来说,合成原油和沥青等资源占据了公司液态探明储量的三分之一。此外,壳牌、埃克森美孚、道达尔、英国BP与雪佛龙等国际公司都将深水油气藏领域作为短期内产量与效益增长的关键点。这些公司中的大部分目前正着手涉足页岩气行业。对于一些元老级的石油巨头,未来的发展道路将愈发具有挑战性。

对于我们许多人来说,石油行业刚经历的若干年跌宕光景从历史角度来看可谓是前无古人,后无来者。然而,事实上,石油市场崩解的序幕才刚刚开启……石油圈原创,石油圈公众号:oilsns

作者/Sam Ori 译者/姚园 编辑/Wang Yue

The Energy Policy Institute at the University of Chicago (EPIC) is a trusted source of objective, data-driven and interdisciplinary research and analysis of the world’s most complex energy challenges. Our diverse insight works to ensure energy markets deliver access to reliable, affordable energy while limiting environmental and social damages.

The near-term outlook for oil markets is a mess. Price volatility recently reached its highest level since the global financial crisis as traders, investors and the industry as a whole try to sort through the significance of two big changes: the rapid rise of the upstart U.S. shale industry, which grew from essentially nothing in 2010 to being the world’s sixth largest source of oil supplies in 2015; and Saudi Arabia’s decision to abandon its role as market manager.

These are important issues for the near term, but they pale in comparison to a much bigger set of long-term issues. Two mega-trends are gaining steam that together have the potential to truly upend the energy industry.

First, signs of serious competition to oil in its most important market—transportation—are beginning to emerge. In the United States, more than 70% of the oil we consume is burned in our cars, trucks, ships and aircraft. The figure globally is only slightly less, at 64%. And for at least the past 100 years, oil has been the only game in town when it comes to mobility fuel.

But based on a slew of data emerging over the past few weeks, that might be about to change. According to a new report from the Frankfurt School, global electric vehicle (EV) sales surged by nearly 60% last year, bringing the total number sold since 2011 to just over 1.1 million. That’s right—despite their higher purchase price, limited range and longer refueling times, electric vehicles took a massive step forward in 2015 even as oil prices collapsed. Incredibly, most of the growth came from China, where sales almost quadrupled compared to 2014.

The notion of explosive EV sales in China should be supremely worrying for a global oil industry that is counting on that country to account for half of future demand growth. And while sales today represent only a tiny portion of the broader auto market—EVs were less than 1 percent of the 20 million passenger vehicles sold in China last year—things could change very quickly. Research released earlier this month by investment bank UBS argued that falling battery prices and high fuel taxes will make EVs cost-competitive with internal combustion engine cars in Europe by 2021 and in China by 2025. Meanwhile, many of the biggest barriers to widespread electrification like cost and range are beginning to fall. Both GM and Tesla plan to introduce all-electric models with 200 miles of range for roughly $30,000 this year.

Even in the United States, where lower fuel prices have put a dent in EV sales, the industry still attracted almost a billion dollars of financial investment in 2015 according to Bloomberg New Energy Finance—pretty much right in line with the 2010 to 2013 average.

Despite all of this, there is no doubt that the world is still going to need a lot of oil. But the sources that provide that oil may be about to change dramatically as well.

In the early stages of the U.S. shale industry, resource recovery factors averaged just 5% of the oil in place. Today, some of the best projects in shale sweet spots achieve recovery factors approaching 12%. But BP Chief Economist Spencer Dale, at a talk at the University of Chicago in February, suggested that a 25% recovery factor in the next five years might not only be possible, it might be conservative. Reaching that level would nearly triple U.S. shale oil resources.

在美国页岩油气行业的早期阶段,油气藏平均采收率只有5%。现今,一些较易开发页岩油气藏的采收率可以接近12%。但是BP首席经济学家Spencer Dale于2月份在芝加哥大学的一次演讲中指出,保守而言,未来五年内这些油气藏的采收率很有可能达到甚至超过25%。按照这一预言推算,未来美国页岩油资源量将是目前总量的三倍。

The cost of recovering that resource is also likely to fall sharply. Already, according to energy consultancy IHS, drilling and completion costs in the key U.S. shale plays have fallen by 25% to 30% from 2012 levels. While estimates still vary widely, a consensus is emerging that U.S. shale production can grow by between 0.5 and 1.0 mbd annually with oil prices at roughly $70 to $80 per barrel—far less than the $100 per barrel assumed as recently as 2014.

The result: less reliance on oil in transportation and a potentially rapidly-expanding supply of oil in the middle of the global cost curve. So what does all this mean? For one thing, it probably means that the world’s dependence on capital-intensive oil supplies such as Canadian oil sands, ultra-deepwater, and Arctic oil is set to diminish. Today, these resources account for roughly 10% to 15% of global oil supplies.

If that is the case, long-run oil prices should be lower. Moreover, by shortening global oil investment cycles, this new market structure could eliminate some of the most severe kinds of oil price volatility, meaning prices should be more stable. It would also almost certainly be a net benefit for the climate, as oil sands projects are among the world’s most carbon-intense upstream developments.

Lastly, this shift in market dynamics has direct implications for the structure of the oil industry. Capital-intense megaprojects in ultra deepwater and oil sands are a significant portion of the resource portfolio of the largest international oil companies. For example, synthetic crude and bitumen accounted for more than a third of proved liquids reserves for both Shell and ExxonMobil at the end of 2015. And Shell, ExxonMobil, Total, BP and Chevron CVX -0.88% all cite global deepwater as a core competency that is key to near-term production and revenue growth. Many of those same companies have also been slow to break into the shale industry. For some of the world’s largest and oldest oil companies, the future looks increasingly challenging.

For many of us, the last several years in the oil industry have seemed like a period of change almost unrivaled in history. In fact, the disruption in oil markets is just beginning.

未经允许,不得转载本站任何文章:

石油圈

石油圈