The energy-industry downturn has created a huge surplus of helicopters, a sharp turnaround from two years ago when oil-and-gas companies were forced to share rides to and from far-flung oil platforms.

Operators such as CHC Group Ltd. and Bristow Group Inc. that ferry workers and cargo on behalf of the energy industry said they have been surprised by the severity of the downturn, and don’t see any prospects for recovery until next year at the earliest.

The slump comes at a tough time for big helicopter makers such as Airbus Group SE and Textron Inc. that are introducing new models, and others such as General Electric Co., which paid $1.8 billion last year for Milestone Aviation Group, the largest helicopter-leasing company by sales.

Industry executives said a fifth of the 1,900 helicopters serving the oil-and-gas industry world-wide are idle or underemployed, and expect this overcapacity to worsen before it improves.

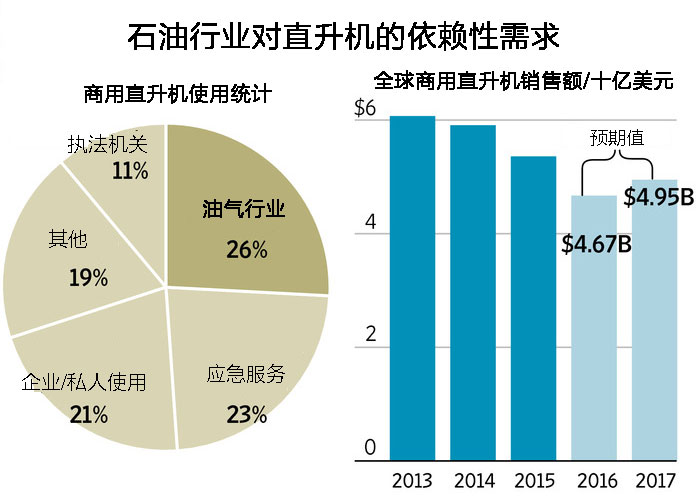

Helicopters used by the oil-and-gas sector account for 26% of the global commercial fleet, according to Agusta Westland, a unit of Finmeccanica SpA.

Helicopter operators also have tried to diversify, expanding into search and rescue missions, medical and VIP flights.

But John Mannion, a Houston-based industry consultant, said there is limited scope for redeploying helicopters to other markets or uses because customers differ in their preferences for aircraft types and configurations. For example, some aircraft are kitted out with new radar equipment, making it easier to land and take off from oil platforms in bad weather. Helicopters that primarily fly over water are also equipped with flotation devices to keep them afloat in the event of an emergency landing. Mr. Mannion said the industry will have to look–for the first time–at options for storing unsold helicopters. Manufacturers said limited indoor storage facilities in hangars had created a need for alternative solutions. Mr. Mannion said the alternatives included shrink-wrapping or Heli-Cells–inflatable climate-controlled canopies originally developed to protect expensive classic cars.

Era Group Inc., one of the largest helicopter operators in the Gulf of Mexico, has said it may cancel or defer almost three-quarters of its orders, including deals with Lockheed Martin Corp.’s Sikorsky unit and Agusta Westland. Market leader CHC, which went public two years ago, has seen its market value wiped out after peaking at $1.3 billion, and the company was delisted from the New York Stock Exchange in January. It has hired multiple advisers to examine restructuring a heavy debt load.

Moody’s Investors Service last week downgraded CHC deeper into junk territory.CHC has been cutting costs, reducing its workforce and paring its fleet, but remains optimistic it can weather the storm. “Despite the prolonged nature of the current downturn, we believe the long-term market fundamentals supporting our industry remain intact,” CHC Chief Executive Karl Fessenden said on an investor call earlier this month.Shares in Houston-based Bristow, the second-largest global operator by sales, are down 77% from their peak.

“The length and severity of this downturn is worse than initially expected, but that is why we have always kept lower levels of leverage and lower numbers of leased helicopters as part of our business model,” said Jonathan Baliff, Bristow’s chief executive, in a statement. Increased exploration when oil was above $100 a barrel led operators and a new breed of leasing companies to place orders for dozens of new helicopters able to fly faster and farther for clients such as Royal Dutch Shell PLC and Statoil ASA.

Demand for new helicopters was so high at the end of 2013 that it had created yearslong waiting lists for the largest models, even with factories running at full rate. The fastest growth in recent years had been in the so-called super-medium category, $30 million machines able to carry 12 to 18 workers 200 hundred miles or more to far-flung platforms off the coasts of Norway, Brazil and West Africa. Airbus and Agusta Westland have also rolled out faster and larger models designed to serve fields farther from shore.

Energy companies are now paring production and slashing exploration budgets, forcing helicopter operators to cut staff, streamline operations and shelve or cancel new helicopter orders.”It’s a challenging market to be launching any new aircraft, especially one targeting oil and gas,” said Ed Washecka, chief executive of Waypoint Leasing Services LLC, one of the new-breed companies that sprang up to rent helicopters to the industry. Dana Fiatarone, vice president of Sikorsky’s commercial unit, said it could take three to five years to burn off the excess capacity.

Lockheed Martin, which paid $9 billion for Sikorsky last year, expects the unit’s commercial sales to slide to $375 million this year from a peak of $1.5 billion in 2013. While Lockheed’s interest was driven primarily by Sikorsky’s military helicopters, executives were also drawn by the commercial market.One bright spot for manufacturers is that toughening global safety rules could hasten pushing out older helicopters in favor of newer models.

Textron’s new Bell 525 is due to be delivered to its launch customer next year, and has been designed so that every passenger is just one seat from its safety-exit windows, closer than rival rotorcraft. Such design changes that add safety features could make new helicopters more attractive to customers.

石油圈

石油圈