For EOG, $40 is becoming the new $70. This morning, the company discussed a new strategy to make unconventional oil development in US plays like the Eagle Ford and the Permian Basin competitive on a global scale at current oil prices. Specifically, EOG has identified a decade of premium unconventional oil drilling inventory that will generate double digit returns at $30 oil.

Backed into a corner by lower cost producers in a global price war, EOG essentially just yelled a battle cry at OPEC on behalf of US shale, implying they will make unconventional oil just as cost effective as OPEC barrels.

EOG Resources is light years ahead of its peers in shale science and acreage quality, and its ambitions may not be repeatable industry-wide, although others will certainly try. EOG is to shale what Saudi is to OPEC – uniquely advantaged relative to other peers/members.

Friday morning, EOG Resources CEO Bill Thomas launched a new “premium location” concept, which is essentially next level high-grading (focusing on the core of the core). Thomas’s plan aspires to make shale work in the new oil price paradigm, and competitive in the new world oil market.

The difference between EOG’s new premium location model and standard high-grading comes down to replacement potential and sustainability. While high-grading is often seen as temporary – accelerating exhaustion of the core – Thomas argues his new premium location plan is a permanent change in the development of light tight oil resources. The company is not viewing this shift as simply a temporary bridge to a time when higher oil prices return.

Utilizing massive quantities of data, 10 years of shale science, best-in-class rock quality, and exacting resource targeting, EOG believes it can grow the expansive premium location drilling inventory it has already identified faster than the company can drill it. If it works, EOG will be able to increase oil production at a globally competitive cost per barrel in the future even if oil prices don’t recover much from current levels.

This is a step change in light tight oil strategy, made necessary by the downturn and a free global oil market where share comes down to producers’ cost. EOG’s new way of thinking does not disappoint, at least in theory. It reveals a strong understanding of what it will take for shale to survive with low extraction costs acting as a key determinant of oil prices.

Of course, EOG’s plan is just that, and now its intentions and claims will have to be proven. Over the next 12-18 months, we’ll learn how effective EOG can be in execution.

Can US Shale Become A Globally Competitive Low-Cost Oil Producer?

On Friday morning, EOG CEO Bill Thomas said: “Our goal is now squarely set on being one of the lowest-cost producers in the competitive global oil market, and we are well on our way to reaching that goal.” This statement serves as a rallying cry for shale in the global oil price war, where low-cost, conventional producers are taking back market share.

The 2015 downturn changed how EOG management thinks about shale and its position in a global context. No longer is it enough to be a top tier US independent with low costs in the horizontal peer group. Now survival for US shale producers requires competing against all the low cost producers in the global market. And focusing on premium locations is how EOG plans to do it.

Premium Locations: EOG Resources Has A Decade Of Drilling Inventory That Works

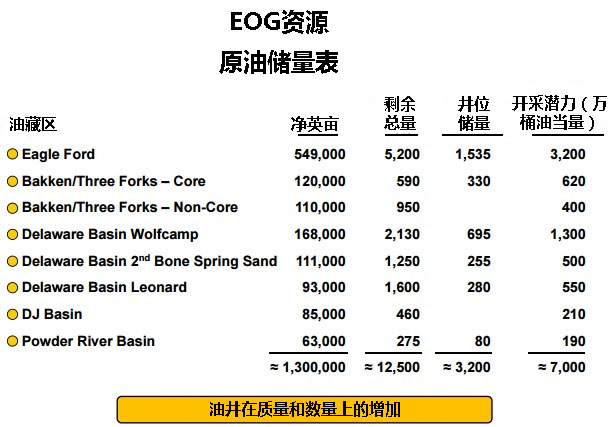

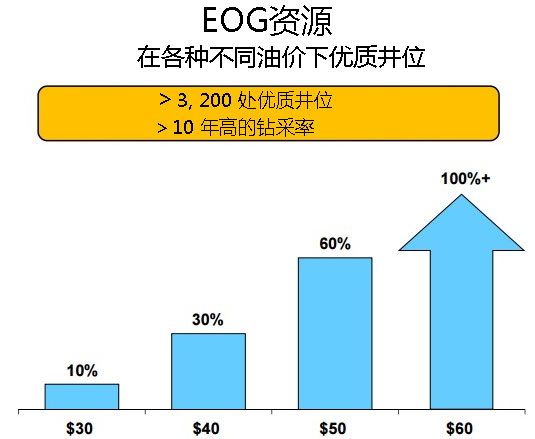

EOG has identified more than 2 billion barrels of oil equivalent resource, and over a decade of drilling inventory (3,200 wells) that can generate returns of 10% at $30 oil, 30%+ at $40 oil, and 100%+ at $60 oil. The company is shifting into premium drilling mode, concentrating on the core-of-the-core in top plays.

In 2016, EOG will direct capital only towards premium inventory. The wells EOG will drill in 2016 will be twice as good as those drilled in 2014 and a 50% quality uplift from 2015. At its current pace (which will average 11 drilling rigs turning to the right in 2016), the company has 12 years of drilling potential.

Importantly, EOG believes it can replenish this premium inventory for years to come, identifying new targets faster than it can drill. And that’s what’s really new here. EOG’s confidence is grounded in rock quality, technical advancements, and mountains of data. The company has captured premier acreage in each play – that’s widely accepted knowledge. Then, spurred by the urgency of downturn survival, EOG has been applying new petrophysical techniques, seismic techniques, extensive core data, and learnings from a decade of horizontal experimentation to identify the best targets (often extremely narrow windows) in each play.

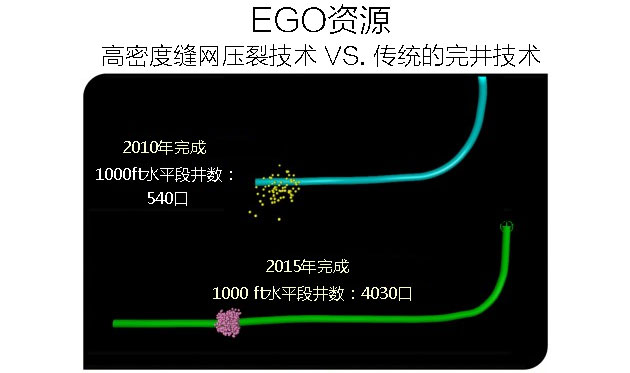

Precision targeting is a key part of the strategy. EOG has an exacting targeting method that starts with mapping petrophysical properties and then narrowing the targets. In the Eagle Ford, EOG used to land wells in 150 ft. windows, now they are steering in a window as narrow as 20 feet.

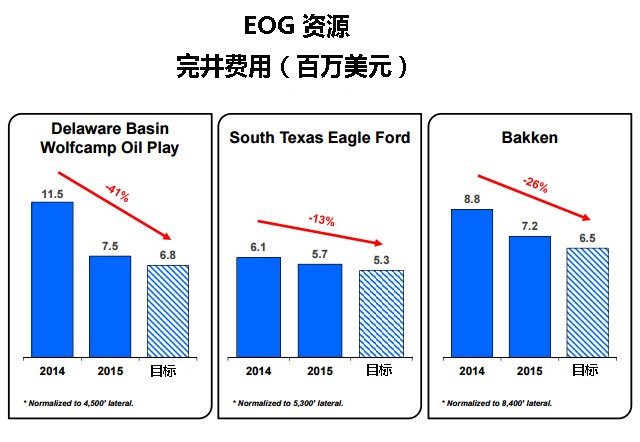

Finally, continued optimization of completions (including frac enhancing complexity to contact more surface area) and continued reductions in well cost are helping as well.

Shale In 2016

In addition to the new strategy, some key takeaways from EOG’s 2016 plan:

• EOG expects to complete approximately 270 net wells in 2016, compared to 470 net wells in 2015, with total company crude oil production expected to decline only 5 percent versus 2015.

• For 2 yrs in a row, EOG has now cut its capital budget by more than 40%. 2016 spending will be $2.4-$2.6bn, down 45% to 50% year-over-year.

• Non-premium inventory is still high quality. A large portion will be converted to premium through technology over time. What can’t be converted will be part of property sales or trades.

• EOG is delaying the work schedule on some frac spreads from 7 to 5 days a week in order to maintain more fleets so they will have the ability to ramp in the future.

• EOG won’t be fooled again by a temporary oil price uptick like in spring-2015, so the company plans to wait on any activity increase until it is convinced any future increase in oil price is sustainable.

石油圈

石油圈