Much of what the industry knows about operating in the North American unconventional oil and gas plays has come through trial and error — not a bad way to learn in most circumstances, but hard to justify in a climate of intense pressure to cut exploration and production costs.

In the drive for greater efficiency, drilling and completions teams are looking for ways to optimise well spacing, fracturing stage spacing, perforation cluster density and the distribution of frac fluids and proppants.

Making informed decisions depends on detailed information on downhole flow. Such data is most often collected with production logging tools run on coiled tubing or with the assistance of a well tractor.

These techniques provide valuable but limited information — a series of snapshots of what is happening in the well at a specific time and location — and are operationally challenging.

In the case of coiled tubing deployment, for example, the well behaviour may be significantly altered by the well-choking effect of the coil itself.

The cyclical, often intermittent flow in many of the long horizontal wells in the US shale makes it difficult to accurately interpret well data acquired through traditional logging techniques, says Neil Gardner, vice president of marketing and technology at Ziebel.

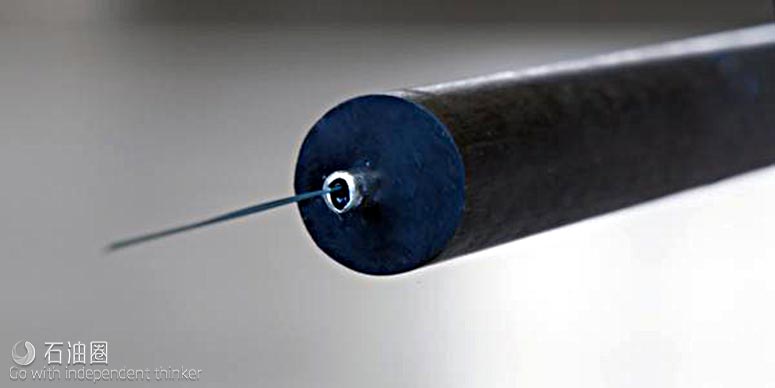

The Norway-based company manufactures a well intervention system built around a 15 millimetre diameter composite carbon rod that contains multiple optical fibres.

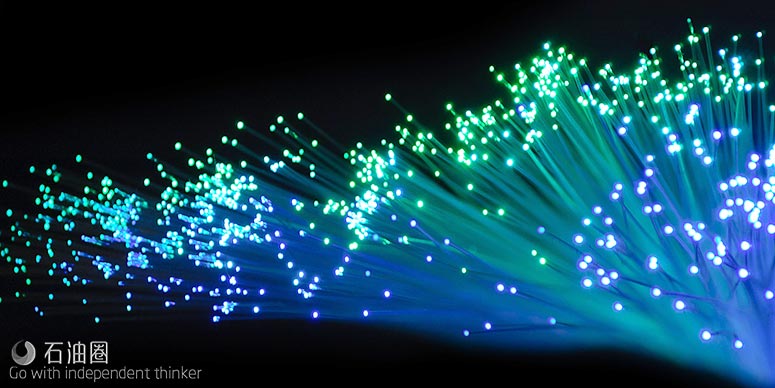

When deployed in a wellbore, the rod functions as a sensor, using a combination of distributed temperature and distributed acoustic sensing to generate real-time information along its entire length.

Ziebel commercialised the rod in 2008, but the company is relatively new to the unconventionals market, having launched its current flow allocation service in North America in 2015.

At the time, Gardner says, the company believed demand for its services would grow as operators put more resources into refracturing maturing wells.

The “refracking” trend has been slow to materialise, he says, but the company’s Z-System is proving to be well suited to the needs of shale operators looking to optimise their completion strategies.

The distributed fibre optic (DFO) measurements allow operators to monitor the results of fracking and to ascertain which zones and perforation clusters have been effectively stimulated.

In a typical deployment, the carbon rod is placed in the well for 48 hours while the fibre optic sensors measure temperature and acoustic vibrations.

“That tells you where the flow is coming from,” Gardner says. “You can actually pick up the vibrations of the fluid coming into the well.”

The rod sits in the centre of the flow path. “So, any disturbance or fluid moving in will show as a small strain, or movement of the rod,” he says.

“We can spot fluid coming in and can tell the operator which one of his perforation clusters is flowing. We can see that fairly clearly in the images and data we bring back.”

The data helps an operator gauge the effectiveness of a completion design and alter it accordingly.

“He’s spent a lot designing a frac, put in a certain number of perforation clusters, pumped in a lot of fluid and proppant, and not all of it may be doing any good,” Gardner says.

The fibre optics system “gives operators a chance to evaluate their completion strategy and ask, have we got these clusters too closely spaced? Are we putting in too many clusters per stage?”.

To get answers, operators have traditionally relied on the more labour-intensive approach of drilling multiple wells with varying numbers of perforation clusters per stage, then comparing the results.

“This is much quicker way to optimise a completion strategy,” he says.

“We are shortening the learning cycle. A lot of the learnings in the shale unconventionals world have been small, incremental changes learned with time. By using real-time data from downhole, you can accelerate the learning curve.”

Well spacing

In addition to flow allocation, the fibre optic-embedded rod provides interference testing between wells.

“That’s another variable in completion strategy – how close to you space neighbouring wells?” Gardner says.

Space them too far apart, and fracking doesn’t extend throughout the targeted zones. If too close to each other, one well can “steal” production from a neighbouring well, or cause it to exhibit unanticipated behaviours, he says.

By deploying the rod in a well and shutting production off and on in neighbouring wells in sequence, engineers can observe how activity in one well affects that in another, and determine how best to design subsequent drilling programmes.

“Again, it’s giving operators an opportunity to take a more scientific approach to their completion strategies.”

The oil price slump has refocused some exploration in the North American shale market.

When Ziebel brought its technology to the US, Gardner says, the Eagle Ford play was hot, in more ways than one.

The region’s high-temperature reservoirs prompted the company to launch a research and development effort to build a version of the Z-System that could handle temperatures up to 350 degrees Fahrenheit (175 degrees Celsius), from its current upper limit of 275 degrees Fahrenheit (135 degrees Celsius).

The industry focus has shifted somewhat from the Eagle Ford, where wells tend to cost more, to the Permian region, where reservoir temperatures are lower.

That has made the high-temperature rod a less urgent need, although the project is still in development.

“It’s not a limitation of fibre optics,” Gardner says. “It’s a limitation of the carbon composite we use to make the carbon rods.”

The greater challenge now is distance. Bakken operators are routinely drilling horizontal sections that stretch to 8000 to 10,000 feet, almost twice as far as the current Z-System can travel in the horizontal.

“We are limited because of friction,” Gardner says. “That’s also the case for coiled tubing — there’s also a limit to how far coiled tubing can go.”

Ziebel has set its sights on developing an extended-reach version of the Z-System for the unconventionals market.

One R&D initiative focuses on a battery-powered well tractor to pull the rod. Such tools are already available today, Gardner notes, but the existing mechanics, hydraulics and batteries are not yet up to the task.

“The conversion of electrical power to mechanical power is very ine?icient. You’re looking at possibly 20% at best, so your batteries run out before you get any significant distance.”

Ziebel has identi?ed a possible solution with Norwegian company Well Conveyor, which is currently developing a more e?icient tractor that boosts the total energy conversion to more than 60%, he says.

An alternative extended-reach solution involves incorporating an electrical cable within the composite carbon rod and using that to power a traditional well tractor from surface.

“That demands building a different type of rod and modifying a few parts of our equipment,” he explains.

Ziebel designed an offshore prototype, but the system would have been too large and heavy to be used in North American land operations.

The truck-mounted deployment units, which now include a 3.5-metre diameter reel, would have to be scaled up to the point where it would no longer be possible to get through highway underpasses in the US.

Another issue is the complexity and cost of incorporating copper into the carbon composite rod required to reach the toe of the longest horizontal wells.

For the electrified rod to be viable, he says, “we have to go for a lighter rod with less copper in it, and we have to try to minimise the size of the surface equipment”.

Ziebel hopes to have one of the two options ready for field testing next year. “This extended-reach rod will really make us a major player in unconventionals,” Gardner says.

“The operators would like to see the data from the rest of the well. For one thing, it would answer the question is there any real benefit in drilling these 8000-foot-plus laterals?”

For now, he says: “We are looking forward to building a second land unit for the US. We know there’s growth in the unconventionals market in North America.

“We’ve been running since 2015 with one land unit in the US, and from the second quarter of 2018 we will have a second unit. So we’re reaching new customers. The value of what we do is getting through.”

石油圈

石油圈