The movers and shakers of the upstream world descended on New Orleans this week for one of the biggest investor conferences of the year, hosted by Scotia Howard Weil.

Although New Orleans’ finest dining establishments were booked each night with company dinners, the mood was anything but festive. Somber realism was the main course with only a few dashes of wishful thinking sprinkled in here and there. In fact, this year’s event may have been the most solemn in the conference’s 44-year history.

Schlumberger’s keynote set the tone on the oil service demand conversation: the market is bleak, companies are on the brink, and there is no snapback coming. For the other service CEOs presenting, cost cutting and financial solvency talk dominated the prepared remarks. The theme of “we’ll control what we can” was pervasive. Almost all management teams scoreboarded their downsizing achievements.

Listening to the oil service and drilling contractors, it is clear that all the operators are asking of them is “how are you going to lower my cost per barrel?”

In the slides ahead are several key takeaways from our review of dozens of service/drilling presentation slide decks this week…

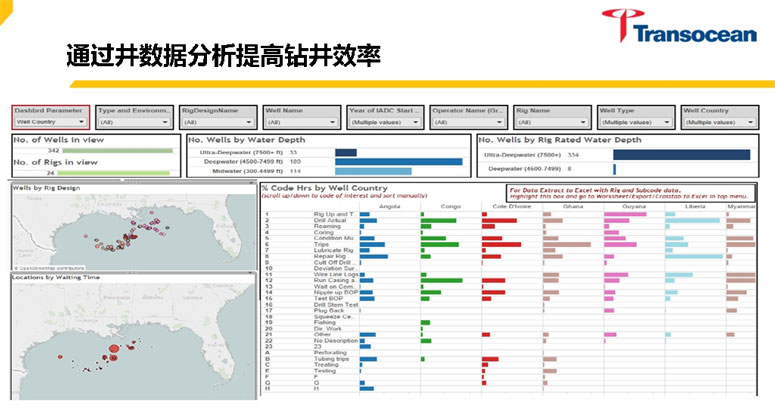

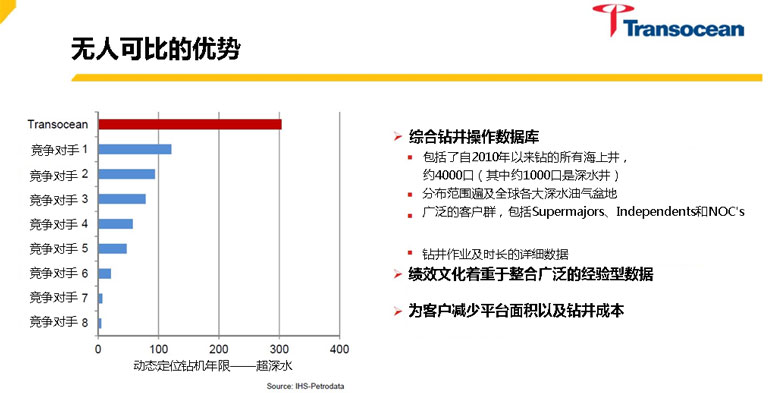

Transocean Highlighted A Database Of Thousands Of Wells They Built To Reduce Costs…

BigData Analysis Allows Transocean Teams To Benchmark Operating Performance By Region And Rig Type

Like Many Others, Frank’s International Is Focusing On The Things They Can Control

Controlling What We Can

• Over $25 MM of savings in 2015 and an expected benefit in excess of $60 MM annualized beginning full year 2016

• Reduced workforce by 20% since year-end 2014

• Reduced pipe and connector inventory by over 25%

• Closed 12 U.S. Onshore bases and 2 international manufacturing facilities

• Continuing lean initiatives at Frank’s Business System (FBS)

-The operating model by which we run our company

-Linked to our Strategic Plan will enable us to execute the plan

-Provides the tools to build and execute actionable plans through sustainable processes

-With exceptional people, actionable plans and sustainable processes, FBS will yield superior stakeholder returns

-15 events involving over 200 employees in 2015, 12 additional planned in 2016

Cash Flow Neutrality In 2016 Would Be A Win For The World’s Largest Contract Driller, Nabors Industries

2016 Goal to Operate Business at Free Cash Flow Neutral or Better

• Manage / reduce costs

• Optimize capital spending

• Free cash flow neutrality prior to working capital benefit

Repurchase Senior Notes within RCF Maturity Window

• Discount to par lowers total net debt

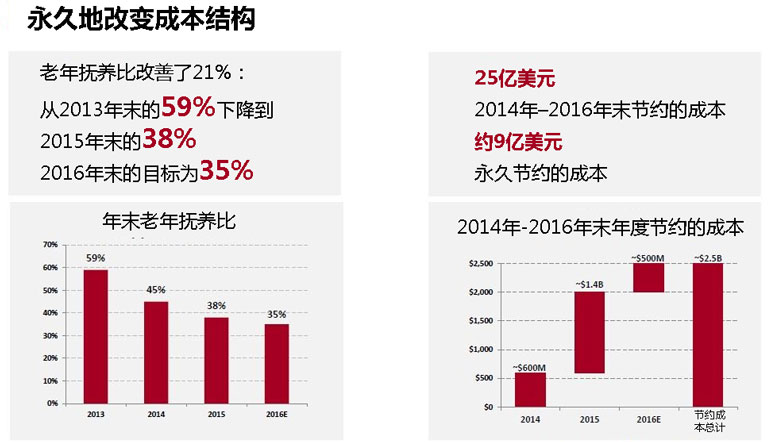

Weatherford Restructuring For The Long Haul

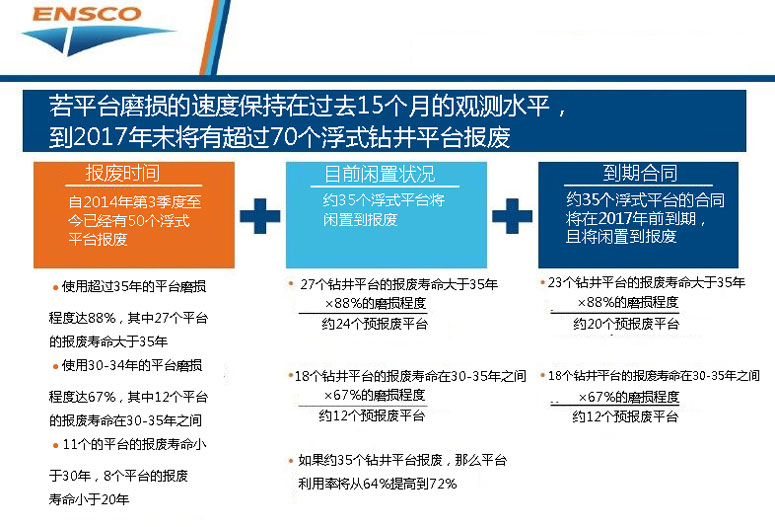

Will This Be Enough To Balance The Oversupplied Floater Market?

Key Points to Remember

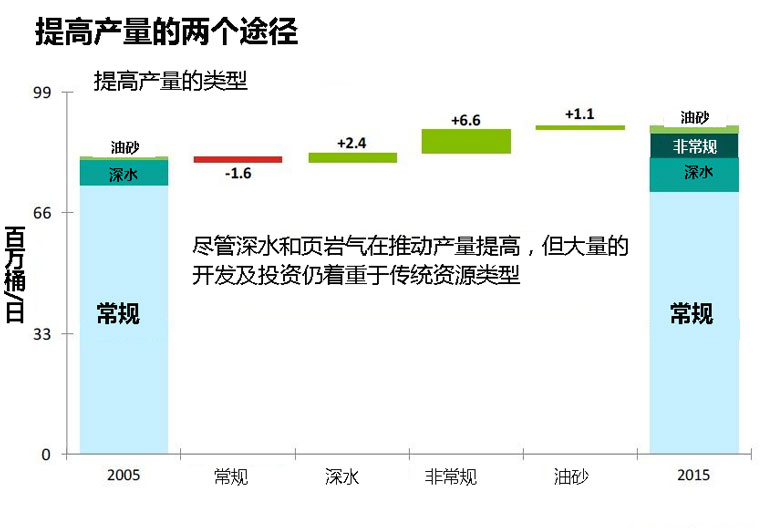

1. Deepwater production is 8% of global supply

2. Offshore reserves are a critical part of major E&P portfolios

3. Excessive costs/inefficiencies crept into sector during the $100+ oil environment

4.Industry is proactively responding to commodity price pressures

5. Breakeven commodity prices for offshore programs are declining

6. Unprecedented decline in E&P spending will lead to supply side challenges – the longer the duration of the pullback, the greater the chance of significant upward movements in commodity prices

ENSCO Sees Service Sector Making Strides To Lower Costs Via Partnerships

Recent strategic combinations/alliances among service companies to drive greater efficiencies and lower the breakeven commodity prices for projects:

•Schlumberqer/Cameron – strategic innovation, efficiencies and cost reductions in deepwater projects; driving down breakeven commodity price levels

•GE Oil & Gas/McDermott – improve design/planning of offshore oil and gas field developments

•OneSubsea/Subsea 7 – enhance project delivery, improve recovery and optimize the cost and efficiency of deepwater subsea developments

•FMC Technoloaies/Technip – overhaul subsea field operations to drive efficiencies

•Baker Huqhes/Aker Solutions – develop technology for production solutions that will boost output, increase recovery rates and reduce costs for subsea fields

•Schlumberqer/OneSubsea/Helix – optimize the cost and efficiency of subsea well intervention systems

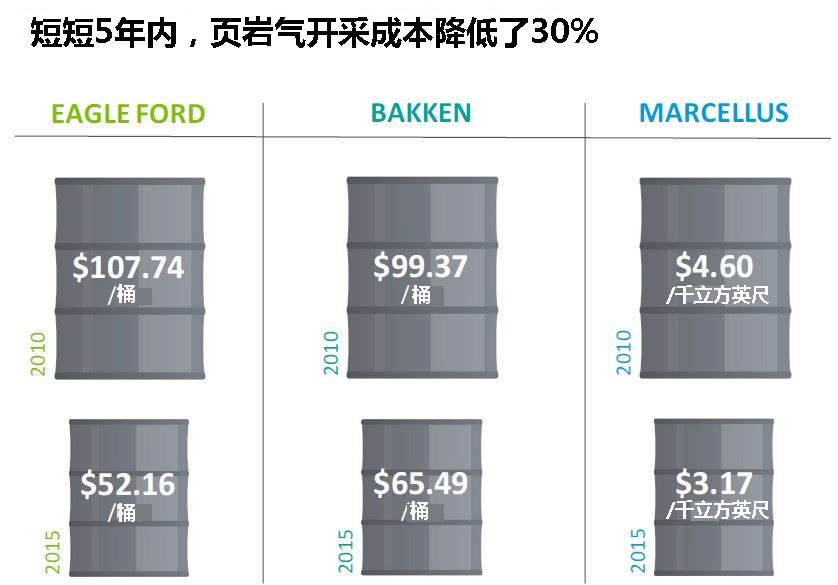

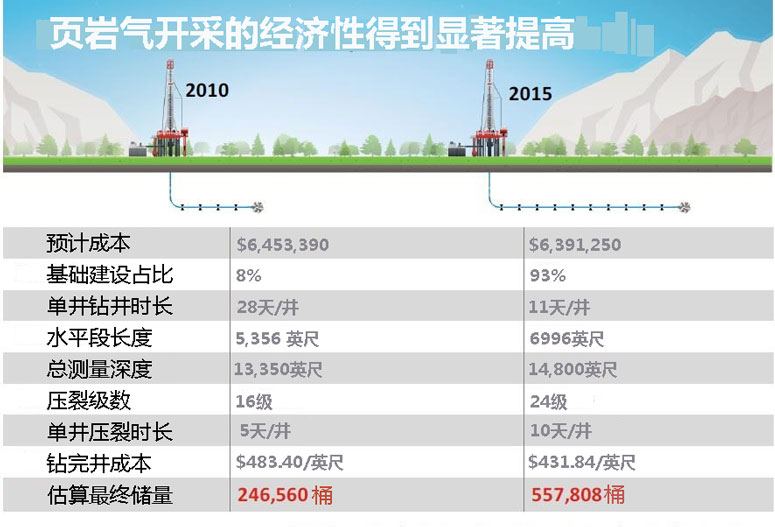

This Slide From NOV Highlights The Importance Of Lowering Costs In Deepwater & Unconventional Plays

Shale Science Has Come A Long Way Fast As NOV Showed…

Translating Into Lower Breakevens

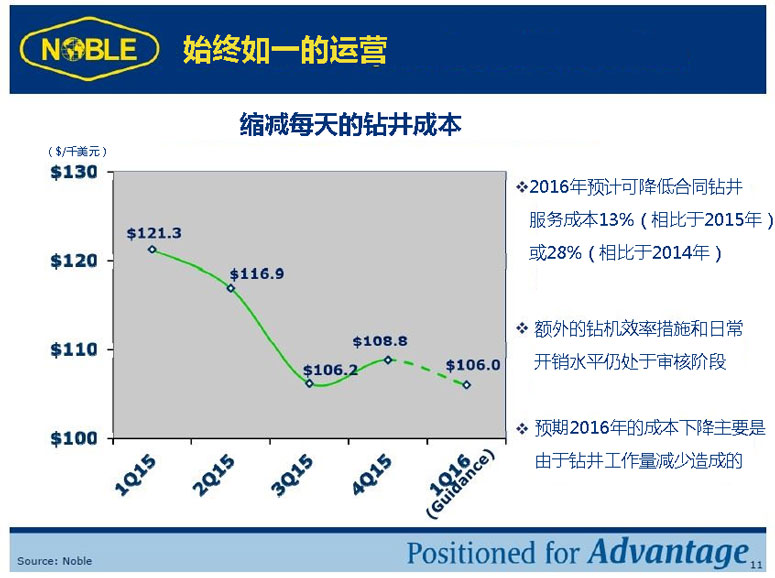

Offshore Driller Noble Corp. Highlighted Falling Operating Costs

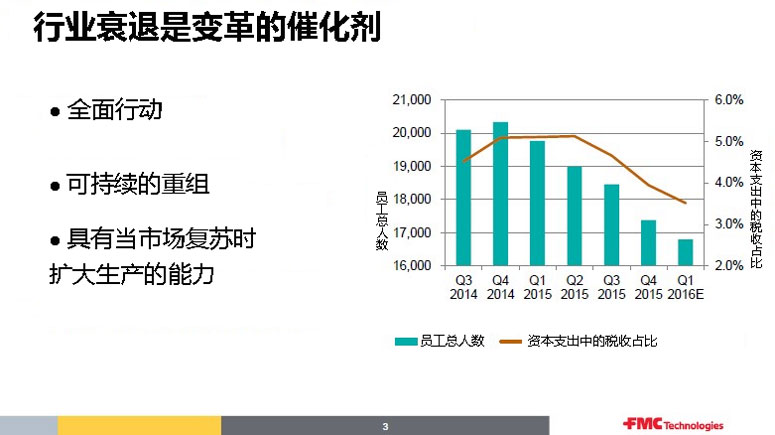

FMC Has Steadily Downsized Almost Every Quarter Of The Downturn

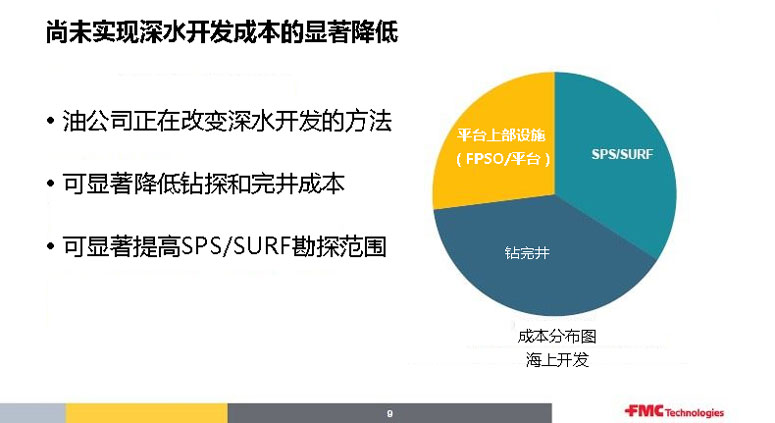

FMC Sees Meaningful Room For Improvement In Offshore Cost Structure

O&G Investors & Management Teams Hitting The Town At Last Year’s Conference

正如NOV所言,页岩气技术已经得到迅猛发展并在油气开发的历史中迈出了重要的一步。

正如NOV所言,页岩气技术已经得到迅猛发展并在油气开发的历史中迈出了重要的一步。

石油圈

石油圈