Reimagining supply-chain collaboration in a low-oil-price environment

By Filipe Barbosa, Jeff Hart, Gregory Santoni, and Thomas Seitz

A new approach to collaboration, within a company, between suppliers, and across the industry, could unlock savings that would increase profitability and safety.

Upstream capital projects represent the largest category of an oil and gas company’s spending. Even when oil prices were above $100 per barrel, the rising cost of these projects was putting companies under pressure. And in the new low-price oil environment, those companies are finding that many projects on their drawing boards are no longer viable. Many are making changes to reduce their capital spending, but more are needed.

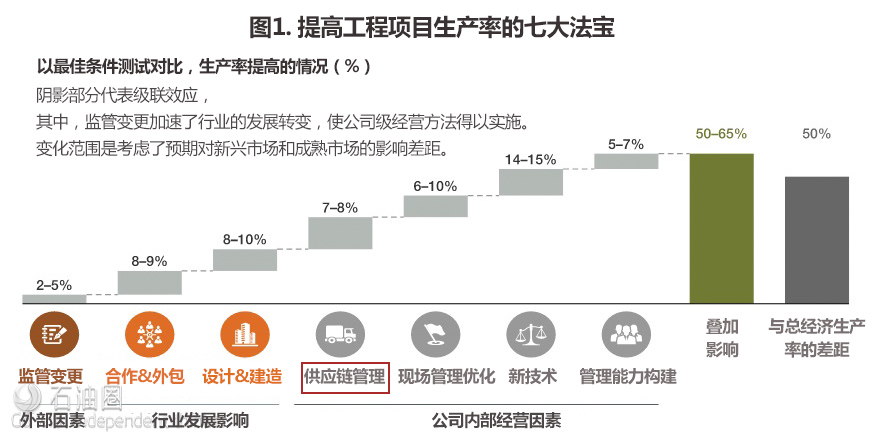

Recent McKinsey research demonstrates that there are seven levers available to companies to improve construction project productivity, and using them in combination can improve productivity by as much as 50 to 65 percent (Exhibit 1). Given the magnitude of the cost and delivery challenges confronting them today, oil and gas companies should consider all these levers.

Several of these approaches, such as better on-site execution, are already familiar to the oil and gas sector. However, there are several others that are less familiar but could help substantially reduce project costs. One of these is greater collaboration between players in the capital projects supply chain.

The goal of greater collaboration would be for oil and gas operators; engineering, procurement, and construction management EPC(m) firms; and the industry’s Tier 1 equipment suppliers to work together to define functional requirements for the types of equipment commonly used across the industry. Harmonized functional requirements and interfaces would provide the basis for standardizing the designs of equipment installed on new projects. This could generate substantial improvements in project costs, completion times, and safety.

Escalating project costs: Turning back the tide

Since the early 2000s, the oil and gas industry has seen a substantial rise in the cost of major projects. Inflation accounts for part of the increase, but about 70 percent is self-inflicted.

Oil and gas companies have tended to design and build installations from scratch for each new project instead of using common designs or off-the-shelf equipment packages. They also base bespoke specifications for equipment on their individual experiences, varying life cycle operational needs, and safety data, rather than on established performance-parameter requirements. This has led to complicated and unique material specifications and manufacturing procedures, including multiple special inspections, repeated testing, and one-off documentation requirements, all of which increase costs.

The result has been a layering of requirements that extends well beyond those set by the traditional industry-standards bodies: the American Petroleum Institute (API) and the International Standards Organization (ISO). Consequently, the complexity surrounding oil and gas projects has become so great that—even before it could bid for a new customer’s work—one equipment manufacturer had to devote two full-time engineers for over six months just to review the customer’s specifications.

The opportunity: The $90 billion to $240 billion prize

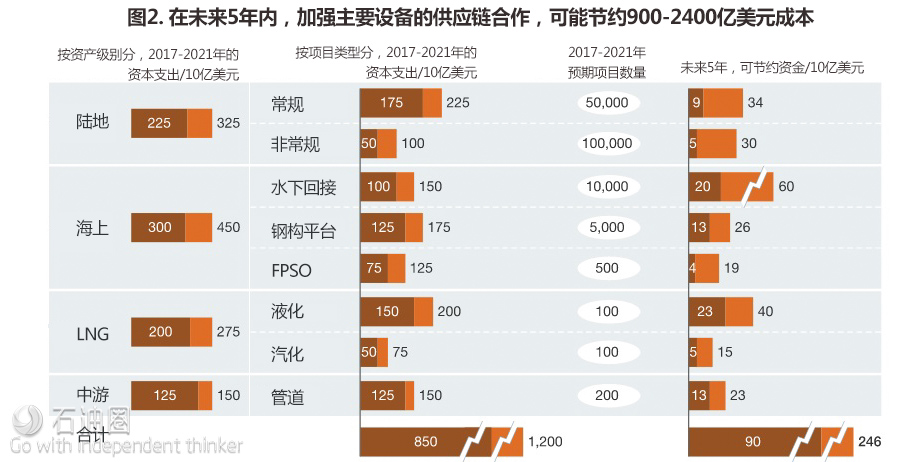

Over the past two years, we have worked with a group of 40 oil and gas companies convened by the World Economic Forum (WEF) to identify opportunities to improve collaboration in the oil and gas supply chain. Our analysis shows that collaboration could unlock five-year industry-wide savings of $90 billion to $240 billion on purchases of commonly used exploration and production equipment (Exhibit 2).

This would represent an approximately 20 percent total cost reduction for the industry. The reductions in project execution time could also be substantial, ranging from 20 percent to more than 40 percent.

Success cases exist that validate this opportunity:

• Selected oil and gas companies, in cooperation with the International Association of Oil & Gas Producers (IOGP), have launched multiple joint industry projects to harmonize performance, safety, and design requirements. These projects have shown a potential cost savings of 25 to 50 percent on Christmas trees and 10 to 30 percent on ball valves, as well as schedule reductions of more than 40 percent.

• Honeywell UOP has delivered more than 1,600 modular equipment units globally, including 515 modular gas plants.

• Manufacturers such as General Electric and Chart are building small-scale modular and plug-and-play liquefied natural gas (LNG) trains as alternatives to large, fully customized LNG facilities. JGC’s small-scale LNG train can be completed within 30 months after planning begins.

• Subsea equipment manufacturer TechnipFMC is developing its own standardized stock equipment that is 30 percent less expensive than customized equipment and can be delivered in less than half the time.

Besides reducing costs, reusing equipment packages can increase sharing of best practices and operational learnings across the industry. In addition, using the same designs across a company (or, more broadly, across the industry) can improve the tracking of safety and reliability performance (by yielding more data for each design), which can in turn lead to better practices.

A roadmap for the future: Three steps operators can take starting today

1. Identify internal opportunities for a requirements-based approach

Today most companies have a complex web of standards and specifications and a constrained understanding of when and where to apply each. Instead, companies should develop a common reference infrastructure, focus on requirements instead of detailed specifications, and provide clear guidance on usage.

This should not be done across the entire portfolio—rather for equipment that is common across projects, geographies, or basins. An oil and gas company with a large portfolio of projects, such as deepwater or LNG developments, should focus on medium- and low-value equipment packages that can be used in multiple projects. This would include helicopter pads, storage vessels, and safety-related equipment packages.

Some companies are moving toward simplification and standardization by adopting an interdisciplinary, systems engineering mind-set. This is a step in the right direction, but it may produce organizational hurdles: multiple, competing decision makers (for example, engineering, project managers, business partners, and country leads), a tendency to solve for the optimal technical solution versus one that is “good enough,” and a culture in which customization is rewarded.

2. Collaborate with suppliers to enable supplier-led solutions

Oil and gas companies should develop a more collaborative approach to working with key suppliers such as subsea equipment providers (for example, Tier 1s) and engineering and construction companies. Rather than dictating detailed component designs and product specifications, companies should engage with their suppliers to solve challenges together, as well as tap into their design expertise to meet specific functional requirements. However, doing this at scale will require moving beyond the current zero-sum game between operators and contractors to one based on benefits for all.

The automotive and high-tech industries have demonstrated how supply-chain partnerships can reduce costs and improve output with the right incentives for design planning and processes, ultimately creating substantial value for all the partners. For example, semiconductor companies led the standardization of specifications for the size of silicon wafers, beginning with the two-inch wafers of the 1970s, and created an industry organization (SEMI) that today generates high-profile standards, including wafer dimensions and materials; factory efficiency and reliability; equipment interfaces; and environmental, health, and safety standards.

3. Cooperate across the oil and gas industry

The next stage in a collaborative approach would be for oil and gas companies to cooperate on common design solutions, building on the joint industry projects with IOGP. This would require intercompany collaboration on specific modules and pieces of equipment to develop common designs that could be used across the whole industry. Since competitors working together may raise potential antitrust concerns, companies will need to follow appropriate legal requirements and communicate the benefits of working together.

The key objective would not be to standardize at the level of the most stringent requirements, but to identify equipment that can be made commonly and find common ground on requirements that can satisfy all companies, optimizing for cost, schedule, and risk. Individual oil companies can then tailor specifications for more extreme or unique requirements.

After a decade of increasing costs and complexity, it is time for the oil and gas industry to reimagine the capital project supply chain. The value of supply-chain collaboration has been and continues to be proven, and the future holds the possibility of making major projects profitable, even at oil prices where that was previously thought impossible.

石油圈

石油圈