The unconventional boom that has swept across North America over the past decade is a testament to how gamechanging technology combined with expanded knowledge and understanding has transformed the paradigm of hydrocarbon production. Ongoing development of horizontal drilling and completion technologies and sophisticated downhole logging tools have been instrumental in increasing efficiency to make oil and gas shale plays economically viable. Today, more than 70,000 horizontal wells are producing from unconventional resource plays with massive, multistage fracturing campaigns.

Over the years, however, operators have learned that reservoir heterogeneity and low-permeability rock present challenges that can limit the potential of unconventional development. Despite the fast pace of technological advances, production log analyses reveal that conventional completion designs, including the practice of placing perforation clusters evenly along the lateral, may not be the best approach to roduction

in these plays. Production logs show that on average, 40% of the perforation clusters in a given lateral are not contributing toproduction.

Unconventional wells also exhibit rapid declines from initial production (IP) rates, sometimes by as much as 60% to 80% during the first year of operation. If early IP rates are not managed, or choked, properly, subsequent steep declines can cause long-term damage to the fracture conductivity. As the industry faces new challenges in the wake of low commodity prices and a slowdown in drilling, it is eyeing a significant new opportunity to take unconunconventional resource development to the next level: refracturing. While refracturing of the Barnett Shale generated interest in 2008–2009, the development of new diversion technologies is enabling oil and gas operators to once again consider refracturing as an economic alternative to drilling new wells.

While producers are still working to understand the mechanisms of unconventional production and how wells behave and flow, they do have a much better understanding of the subsurface than they did in the early days of a play as more wells have been drilled and data collected from these wells are pieced together. At the same time, fracture models for determining optimum treatment designs and technologies that can divert treatments to new unstimulated rock are now available and proven.

This enhanced reservoir understanding and access to technology are incentivizing operators to take a second look at refracturing as a feasible and cost-effective alternative to drilling new wells. By reinvigorating existing, often depleted, assets, companies can enhance hydrocarbon recovery while boosting cashflows.

A Unique Consortium Refracturing also provides the added benefit of protecting the depleted wells from the negative effects associated with fracture hits when drilling offset wells. Companies historically have encountered production losses from “parent wells” when an infill fracture interferes with the depleted well. By refracturing the depleted wells before fracturing the infill well, operators have successfully prevented these negative impacts and actually experienced improved production from both the infill and depleted wells.

In 2014, Schlumberger assembled a team of experienced geoscientists from the hydraulic fracturing and reservoir subsurface disciplines to determine the criteria for developing a workflow to diagnose potential well candidates for refracturing. The team formed a consortium with several of the most active operators in the oil- and liquids-rich Eagle Ford Shale. Members of the consortium are providing the necessary data to

define wells, most of them 1 to 4 years old, which would be good refracturing candidates in the play. By joining forces in this unique study, the consortium members are creating a critical mass of data, with the results of the well studies shared among the companies. This has facilitated accelerated learnings and best practices in well candidate selection and refracturing design.

The overriding objective of the project is to gain back more than 60% of the IP while spending significantly less than 40% of the IP costs. To achieve this, the refracture treatment must be moved out of the existing fracture network and into new, unstimulated rock while preventing the refracturing process from interfering with offset wells. Early results from optimized refracturing treatments on candidate wells have shown that the process can provide a timely boost in cash flow from existing well inventories by enhancing recovery of hydrocarbons.

Among the new technologies driving these results is an engineered stimulation design software that integrates geological, geophysical, petrophysical, geomechanical, and microseismic data from the reservoir into models that enable operators to history-match IP rates in order to select viable refracturing candidates and develop an optimized refracturingdesign.

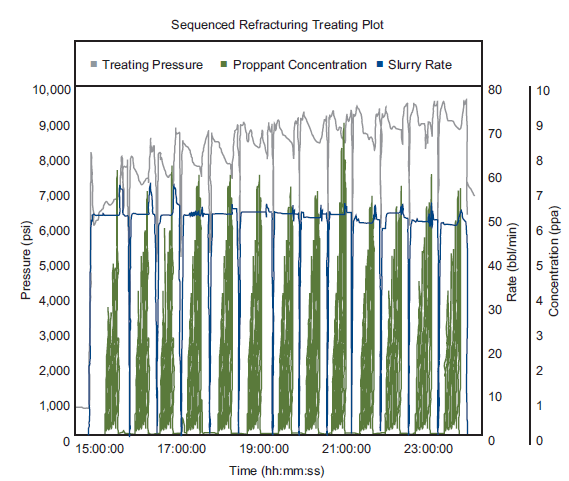

Advances in fracturing services that have made refracturing of long horizontal completions economically feasible are key components of the refracturing strategy. The new technologies enable the temporary plugging of existing fractures, effectively diverting proppant and fluid to new, unstimulated rock during a continuous refracturing treatment pumped from the surface (Fig. 1).

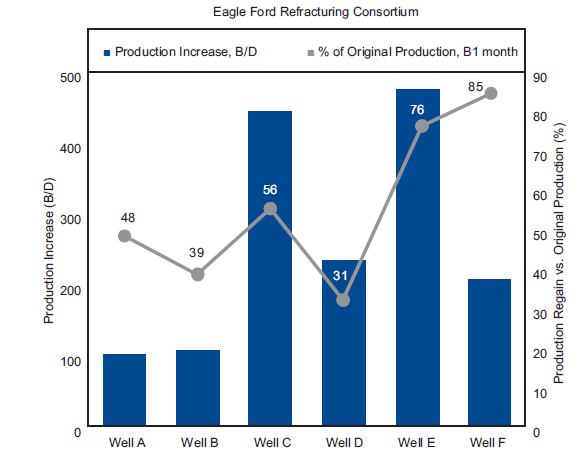

Application of the diversion technology for refracturing has resulted in production returns of more than 60% over IP rates (Fig. 2).

Fig.1:Refracturing stages and composite pills are pumped in sequence to promote diversion of fluid and proppant to rock bearing higher pressures and production potential. Increasing treating pressure and other measurements are combined to confirm occurrence of diversion.

Fig.2:Wells are listed in chronological order. Production gain is calculated using an average production rate 30 days before and after the refracturing. Regain is calculated with an average production rate 30 days after refracturing as a percentage of the best monthly production during initial production.

Five operators in the consortium have committed to refracturing a total of 15 wells in the Eagle Ford, where more than 400 wells are estimated to have very high refracturing potential. Another 800 wells in the play are considered to have good potential.

A recent refracturing treatment in the Eagle Ford boosted oil production sevenfold, from 80 B/D to 550 B/D, bringing the well up to 76% of the IP rate. Wellhead flow pressure also increased from line pressure of 120 psi to 5,800 psi, suggesting the refracturing design had been effective in unlocking new, unproduced resources. Post-fracture declines appear to be similar or somewhat better than initial declines.

Modeling the long-term impact of the refracturing operations using reservoir simulation techniques indicates that a properly executed treatment on a suitable well candidate can increase overall production by at least 20%. This improvement represents an increase in estimated ultimate recovery from a given well, and ultimately raises the value of the life of maturing unconventional assets in North America. Economic models indicate rates of returns could exceed 30%, provided that candidate wells are correctly identified and workflows are applied to optimize the execution of the refracturing design and treatment.

As the oil and gas industry looks ahead to the next decade of unconventional development, refracturing offers significant potential for enhancing recovery and optimizing field economics. New technologies combined with greater understanding of the subsurface are paving the way for revitalizing mature and depleted assets, enabling operators to increase production from existing well inventories and raising the overall value of unconventional¬reservoirs.

Going forward, collaboration between service companies and operators in combining geosciences, a process for identifying well candidates for refracturing, and innovative technology present a meaningful opportunity for the oil and gas industry to create a new business model with a risk-sharing mechanism that can change the economics of unconventional fields. The industry needs to continue enhancing the development of those technologies and techniques ensuring a full coverage of the lateral stimulation, such as refracturing from heel to toe, to significantly increase the productivity of the wells, thus lowering the total cost per barrel of oil equivalent.

石油圈

石油圈