众所周知,油价的高低受多种因素的影响,不只是供需,还包括美元指数、市场预期等。本文从历史角度、多种维度出发,剖析油价走向,以及当前油市出现的问题。

作者 | Allen Brooks

编译 | 宁采臣 卡夫卡 王洋

前段时间,当全球油价下跌至五个月来最低点时,原油价格战的警钟开始鸣起。当时油价发生变化主要是由于贸易商、投机商和套期保值者越来越怀疑石油出口国(OPEC及非OPEC支持者)所做出减产180万桶/天的决定。由于石油出口国通过削减产量、减少全球石油库存从而使全球油价攀升的这一举措缺乏说服力,原油价格下滑。

几天前,当油价可能下跌至40美元/桶,或者甚至更低时,恐慌情绪促使OPEC生产国不得不作出继续减产的协定。世界石油市场的主要参与者:OPEC、沙特阿拉伯和俄罗斯等国家释放出信号,它们将尽其所能来推动油价走高。

这次石油价格战非常重要,它需要世界三大石油生产国中的两家联合在一起来提高油价。在联合之后油价反弹之前,人们担心石油减产协议并不能使全球石油市场重新达到平衡。事实上,即使油价超过50美元/桶,却仍然要比年初声明过的每桶低2美元,这显然不是OPEC、沙特阿拉伯、俄罗斯或其他非OPEC出口国家所希望的。

如表1所示,5月初油价是3月份以来最低的油价,市场担心OPEC成员国是否会遵守减产协议。石油出口国希望看到的是2017年头两个月交易油价重新回到或者接近50美元/桶左右。

今年影响油价的不仅仅是对市场调整步伐的预期。在这一点上,IEA的五月月报得出结论:OPEC和11个非OPEC国家减产前的产量仍然能被市场吸收,库存需要一段时间来反映供应量减少的情况。它进一步指出,为了达到OPEC近五年平均库存水平目标值,石油市场正在加速调整,库存量正在减少,2017下半年仍有许多工作要做。这一观察结果与OPEC的5月份月度石油市场报告的观点一致。如果他们希望全球油价上涨到60美元/桶,就需要对沙特阿拉伯和俄罗斯施加巨大压力,OPEC和非OPEC国家达成一致,延长减产协议。

OPEC及其合作伙伴面临的挑战之一是克服影响油价的其他市场力量,包括积极的和消极的力量。例如,美元价值的变化影响商品价格,尤其是石油价格;油价面临的压力也来自投机者的未来交易油价。这些压力既可以促进油价上涨,也可以抑制油价上涨。

传统上来说,美元对其他货币汇率的波动影响着全球商品的交易价格。原油在全球范围内是以美元进行交易的。当美元贬值时,原油的外汇价格就越低廉,这刺激了全球的石油需求。同样,当美元升值时,国外买家发现石油更加昂贵,需求受限。这种模式在石油长期历史上就已经存在。

如表2所示,自1973年以来,美元走势疲软,油价相应上涨,这持续了很长一段时间。但是,在20世纪80年代和90年代上半叶,美元贬值,油价却小幅上涨。在20世纪70年代,油价在此期间并没有增长很多的原因很大程度上是由于全球石油产量巨大增加,加上1973-1974年阿拉伯石油禁运和1979年伊朗革命导致石油供应减少。由此造成的全球经济衰退和世界石油供应量增加,一并限制了油价上涨的幅度。

2002-2011年,美元走势疲软,油价大幅上涨,曾经一度高达100美元/桶多。这些年恰逢“大宗商品超级周期”,在中国和印度经济快速增长的推动下,全球商品需求似乎出现了爆炸式增长,同时人们担心行业能否将足够的新用品投入市场以满足未来的预期需求。

然而,现在美元和油价之间这种强烈的相关性似乎已经减弱了。

表3显示了2017年初以来油价及美元的走势。1月至2月期间,油价整体趋势节节攀高,美元货币初始下跌,随后上涨;至3月,油价及美元走势均呈下降趋势;这种新态势一直持续至5月。这是否意味着无法再通过预测美元贬值与否判断油价的走势呢?从理论上讲,这样的预测仍将有效。但两者相互关系的瓦解表明,其他因素对油价的影响更甚于美元。

投机者和石油交易商是影响今年油价的主要势力,他们期待油价变化,无论上涨亦或下跌。在过去7年里,投机者们在油价峰值时,大量建仓,随着油价下跌,他们随即削减仓位。从表4和表中的红色箭头可以看出,原油期货持仓量随着峰值后原油价格下跌而下降,恰恰印证了这一点。无可厚非的是,这些石油交易商和投机者在油价下跌时抛售股票,在最大化利益的交易活动中打了一场漂亮的擦边球。某种程度上,随着投机者和石油交易商建仓,我们可能会忽略其对油价的影响。

2017年迄今为止,石油交易商和投机者的原油期货建仓量巨大有目共睹,这反映了他们对更高油价趋势的看好。反观2014年末沙特阿拉伯弃守支持OPEC至今,我们可以看到,投机者们在2015年初预测油价回暖并建立了长线仓位。

油价确实出现了反弹,但无法维持其较高水平,随着其稳步下跌,2016年2月油价走低态势成为定局。在油价下跌期间,投机者们不断建仓,因此,2016年2月至5月油价上涨时,投机者们盈利颇丰。从那时起至2016年11月,投机者们持仓的变化反映了油价的走势。11月至12月,随着油价上涨,投机者们持仓量增加;2017年初期,投机者们大举增持期货;但随着投机者们开始削减仓位,油价上涨停止,价格在大幅下降之前也开始摇摆不定。

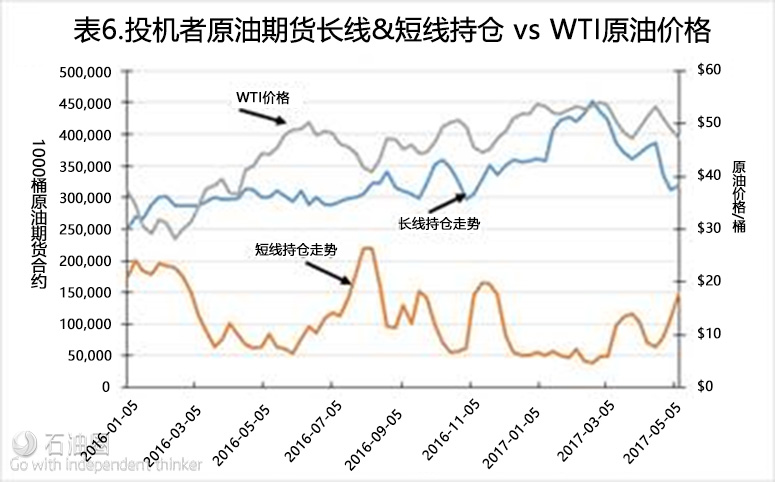

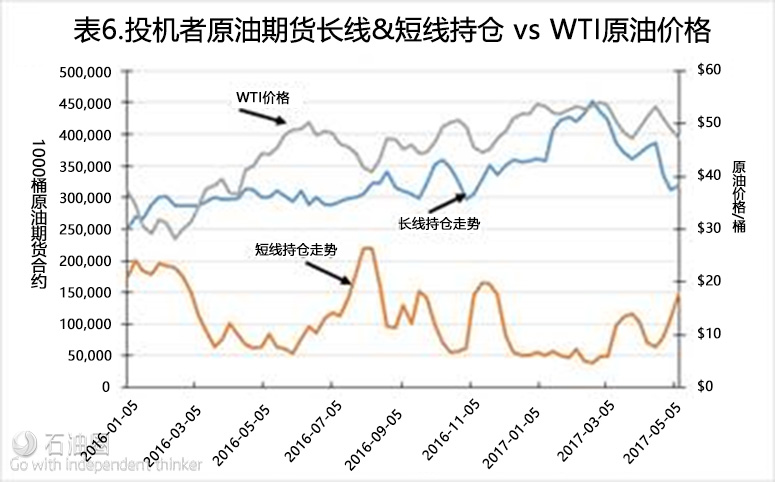

表6显示了投机者的短线持仓情况,这在一定程度上反映了投机者和石油交易商态度的转变。

维也纳5月25日召开的会议上,沙特阿拉伯和俄罗斯共同宣布支持OPEC将减产协议延长九个月。OPEC和非OPEC出口商们付出了巨大努力,将徘徊于47美元/桶的油价推升至高于50美元/桶。他们一直在讨论如何让所有出口商同意将减产协议延长九个月并加大减产规模。通过对美国原油库存连续六周的密切关注,IEA称,尽管困难重重,2017年第一季度油市将重现再平衡。而美国原油产量将首次下滑的预测也缓解了原油定价情绪。

值得深思的是,尽管采取了所有措施来阻止油价下跌,并将其推升至50美元/桶以上,但这仍然未达到沙特阿拉伯、俄罗斯和OPEC的预期水平。对沙特阿拉伯而言,油价在2018年初回归至60美元/桶对沙特阿美公司(Saudi Aramco)实现首次公开募股的成功至关重要。

当前的油价走势是否表明一些行业人士未能关注的结构性问题,我们无从可知。但是以上图表若能让你对行业走势有着新的看法和认知,便已足够。一家之言,欢迎讨论。

In the oil patch, the price drums are being banged. Everyone has their hand cupped to their ear trying to decipher the message. Higher prices! Higher prices! That’s what everyone is hearing. Those drums started beating that message rapidly more than a week ago when global oil prices fell to a five-month low. As oil prices started crashing, the price action was explained by traders, speculators and hedgers who were increasingly doubting the resolve of oil exporters, principally OPEC and its non-OPEC supporters, who had agreed to cut their output by a combined 1.8 million barrels a day. As this lack of conviction grew that exporters, by cutting their output, would be able to drive down global oil inventories thus allowing world oil prices to climb, crude oil prices fell.

Recently, when it appeared oil prices might fall to $40 a barrel or possibly even lower, the fear factor drove the OPEC producers most impacted by lower global oil prices to react. The key players in the world oil market – OPEC, Saudi Arabia and Russia began beating the drum to send the message that they would do what was necessary in order to drive oil prices higher.

The need for this drum beat became so important that it required two of the world’s three largest oil producers, whose economies are significantly dependent on oil prices, to appear together in an effort to talk up the oil price. Before the rebound in oil prices that followed the joint presentation, concern was that the oil production cut agreement was failing to rebalance the global oil market. In fact, even as oil prices crossed above the $50 a barrel mark, they still remained nearly $2 a barrel below where they started the year. That was certainly not what OPEC, Saudi Arabia, Russia or the other non-OPEC exporters were counting on when they agreed to limiting or reducing their oil output last November.

The low oil price in early May, as shown in Exhibit 1, was below the prior low established in March when market concerns focused on whether OPEC members were complying with the production cut agreement. What oil exporters wanted to see was a return to where oil prices traded during the first two months of 2017, closer to the mid-$50s a barrel.

What is impacting oil prices this year is more than just expectations about the pace of the market rebalancing. On that point, the May Monthly Oil Report (MOR) from the International Energy Agency (IEA) concluded, “It has taken some time for stocks to reflect lower supply when volumes produced before output cuts by OPEC and eleven non-OPEC countries took effect are still being absorbed by the market.” It further pointed out that while the oil market rebalancing is “accelerating,” and inventory volumes are being drawn down, in order to reach the five-year average inventory levels that OPEC is targeting, “much work remains to be done in the second half of 2017.” That observation, consistent with the view of OPEC in its May monthly oil market report, put great pressure on Saudi Arabia and Russia to lead the OPEC/non-OPEC combine in getting to an agreement to extend the production cuts if they wished global oil prices to rise to the $60 a barrel target.

Part of the challenge for OPEC and its partners is overcoming the other market forces that are influencing oil prices, both positively and negatively. For example, what is happening with the value of the U.S. dollar has an impact on the price of commodities, especially oil. There is also the pressure on oil prices that comes from the actions of speculators who trade options on future oil prices. Those pressures can either help boost oil prices or act to depress the efforts to raise them.

Traditionally, movements in the value of the U.S. dollar against other currencies impact the prices of commodities that are traded globally. When the value of the dollar falls, it makes crude oil, which is traded worldwide in U.S. dollars, cheaper in foreign currencies and stimulates global oil demand. Likewise, when the dollar’s value increases, foreign buyers find oil more expensive, limiting demand. That pattern has been observed over long periods of oil history.

As shown in Exhibit 2, since 1973, it is easy to see extended periods when the U.S. dollar was weak and correspondingly, oil prices rose. In particular, note what happened to the value of the dollar during the 1980s and first half of the 1990s. As the dollar’s value fell during that period, oil prices rose slightly. A reason why oil prices didn’t increase more during that time is largely explained by the huge expansion of oil output globally in response to the explosion in oil prices during the 1970s following the Arab oil embargo of 1973/74 and the loss of oil supplies due to the Iranian revolution in 1979. The resulting global economic recession and increase in world oil supplies combined to limit the magnitude of improvement in oil prices.

If we look at the weakness in the dollar value during 2002-2011, we see that oil prices exploded, rising well above $100 a barrel for a significant portion of that time. Those years coincided with the commodity super-cycle when global demand for all commodities seemed to explode, driven by the rapid economic growth of China and India, along with concerns about the ability of the industries to bring sufficient new supplies to market to meet projected future demand. Now, however, it seems that this strong correlation between changes in the value of the U.S. dollar and oil prices has weakened.

Exhibit 3 shows the oil price and the value of the U.S. dollar so far this year. During the first two months of 2017, oil prices rose while the dollar’s value fell initially, but then rose. During March, the oil price fell as did the value of the dollar, the opposite of what would have been expected. This new relationship has continued through April and May. Does it mean this relationship is no longer working? Theoretically, it should still work, but the breakdown of the correlation suggests other factors are having a more powerful impact on oil prices than just changes in the value of the U.S. dollar.

One of the more powerful forces impacting crude oil prices this year has been speculators and oil traders. These are people who are trading futures contracts in expectation of changes in future oil prices, either up or down. One of the patterns that has proven quite accurate over the past seven years has been the tendency for speculators to build peak oil holdings just as oil prices reach a peak before declining. Examining Exhibit 4 (prior page) and the chart’s red arrows showing when oil prices fell compared to the level of oil futures holdings demonstrates this correlation. One would suggest that these traders and speculators have done a very good job in maximizing their trading activity – selling their holdings just as oil prices fell. What may be missed to some degree is what influence the traders and speculators had on oil prices, as they built their positions.

So far in 2017, these traders and speculators have built the largest holdings ever seen. That phenomenon reflects both the high level of optimism traders and speculators had/have for higher oil prices. So far, that bet has not been as successful as the amount of capital they have wagered would imply. When we look at what has happened with speculators’ long oil futures holdings and oil prices since the Saudi Arabia decision to abandon supporting OPEC oil prices in late 2014, we see how, early in 2015, speculators anticipated an oil price recovery and built their long futures holdings. Oil prices did rebound, but couldn’t sustain the higher level and began falling almost steadily until the February 2016 oil price low was established. During that decline, speculators slowly built their long holdings, thus benefitting from the February to May 2016 oil price rise. From then until November 2016, the changes in speculator long holdings mirrored the pattern of oil prices. Starting in November and continuing through December, holdings grew as oil prices rose. Early in 2017, speculators began aggressively adding to their futures holdings, but the oil price increase stopped and then prices went sideways before falling, which came immediately after the speculators started unwinding their positions.

speculators’ short holdings as shown in Exhibit 6. It was partially in response to this shift in sentiment among speculators and traders that motivated Saudi Arabia and Russia to jointly announce their pledge to work for a nine-month extension of the current oil production cut agreement when OPEC met May 25th. A decision that was the outcome of the meeting.

It has taken an incredible amount of effort by OPEC and non-OPEC exporters to push oil prices from the $47 a barrel range back above $50. These exporters have talked about working to get all the exporters to agree to the nine-month extension and possibly to increase the size of the oil production cut from what they have been undertaking. The IEA’s comments about the rebalancing of the oil market in the first quarter of 2017, despite the need for additional work, combined with the sixth weekly draw in closely-watched U.S. crude oil inventories and the first decline in estimated U.S. oil production also helped improve oil pricing sentiment. What is important to contemplate is that it took all of these efforts to stop the erosion in oil prices and boost them back above $50, still quite a ways below where Saudi Arabia, Russia and OPEC want them to be. For Saudi Arabia, getting oil prices to $60 a barrel by early 2018 is important for the success of their planned IPO of Saudi Aramco. Does the current oil price action suggest there are structural issues at work within the global oil market that people are not either paying attention to, or do not comprehend? Time will tell.

未经允许,不得转载本站任何文章:

-

- Linda

-

石油圈认证作者

- 毕业于南开大学传播学专业,以国际权威网站发布的新闻作为原始材料,长期聚焦国内外油气行业最新最有价值的行业动态,让您紧跟油气行业商业发展的步伐!

石油圈

石油圈