One of the hottest topics in the oil and gas industry is how to take advantage of new and exciting technologies developed for other business sectors. Despite the many upsides, there are an equal number of challenges involved with technology transfer. Perhaps the most important is how to predict the value of a technology and the best way of deploying it.

Some of the most successful cases in which outside technologies became mainstays in the oil and gas industry are nanotechnology from the medical field, sensors from the defense industry, and high-powered electronics from the computer business.

At the SPE Research and Development Technical Section luncheon held at the 2015 ATCE in Houston, a panel shared its insights on finding the next successful crossover technologies. The experts also discussed the pitfalls that accompany this effort. The hidden difficulties include taking a technology that works well but is too difficult to manufacture efficiently.

“A lot of people who are involved in innovation are more geared toward a scenario where we build something very, very cool, but we build it at very small quantities,” said Partha Ganguly, a director of technology innovation at Baker Hughes.

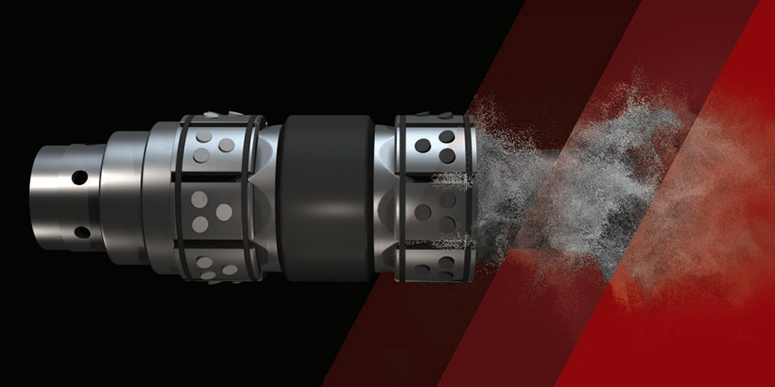

Ganguly said that for a new, or new-to-the-industry, technology to be successfully commercialized, the product must be produced in high numbers. Baker Hughes’ dissolvable fracturing balls is a prime example. The product, which eliminates the milling requirements in horizontal well completion, was introduced in 2011 and has since been used in 90,000 hydraulic fracturing stages across North America.

The company has also introduced a new dissolvable fracturing plug, which further eliminates the need for intervention milling and speeds up the time to first oil or gas. By next year, the company expects to have sold 10,000 units.

John Barratt, chief executive officer of the Oil & Gas Innovation Center, highlighted the importance of the adoption of technologies from other industries. Based in Palo Alto, California, the firm specializes in identifying technologies that have the potential to cross over into the oil and gas industry.

Barratt said companies that properly investigate outside technologies can benefit from accelerating their own development efforts by understanding what defines the cutting edge. Another advantage is that such efforts promote creative thinking and early access to new technology that may present a competitive edge. There is also a cost savings incentive.

“The average technology company that we profile or identify has consumed USD 5 million to USD 10 million of somebody else’s money,” he said. “The mere fact of leveraging that technology saves your company a lot of money.”

Among the technologies that are most likely to make a big difference in the near future for the oil and gas industry is additive manufacturing, better known as 3D printing. Rick Lucas, chief technology officer of Ex One, said companies using 3D specialty firms such as his to make parts are seeing between 50% and 90% in cost savings.

Companies are also learning that a 3D-printed part may have twice the performance life of a machined part and, equally important, they are not price-constrained when it comes to a part’s design.

“When you think of conventional processes or traditional manufacturing, as complexity goes up for a part, so does the cost. What is nonconventional about additive manufacturing is that is not the case,” he said. “It is a straight line; a part can be very complex and yet it doesn’t add additional cost.”

The business of 3D printing is a rapidly evolving one and the buzz continues to grow as the technology advances. Lucas said that not long ago, his company’s 3D printing machine was capable of producing 5 ft3/hr of parts.

Today, it can produce 15 ft3/hr of parts, which means that the company is delivering more parts for roughly the same amount of capital.

Another benefit of the technology is its ability to restructure long and costly supply chains that must cross continents and oceans. A 3D printing supply chain is likely to be localized, especially in the US, where many of the leading 3D companies and research centers are based. This localization lowers both the carbon footprint and the cost of distribution. However, it also may cause disruption for the traditional oilfield manufacturing sector as demand shifts to 3D manufacturing companies.

石油圈

石油圈