Malaysia’s energy industry is a critical sector of growth for the entire economy and has accounted fornearly 20% of the country’s total gross domestic product in recent years.1 New tax and investment incentives, which started in 2010, promote oil and natural gas exploration and development in thecountry’s deepwater and marginal fields, energy efficiency measures, and use of alternative energysources. These fiscal incentives are part of the country’s economic transformation program to leverage itsresources and geographic location to become one of Asia’s top energy players by 2020.2 Another keypillar in Malaysia’s energy strategy is to become a regional oil and natural gas storage, trading, anddevelopment hub that will attract technical expertise and downstream services that can compete withinAsia.

Malaysia, located within Southeast Asia, has two distinct parts. The western half contains the Peninsular Malaysia, and the eastern half includes the states of Sarawak and Sabah, which share the island of Borneo with Indonesia and Brunei. The country’s western coast runs along the Strait of Malacca, an important route for the seaborne trade that links the Indian and Pacific Oceans. Malaysia’s position in the South China Sea makes it a party to various disputes among neighboring countries over competing claims to the sea’s oil and natural gas resources. Although it has bilaterally resolved competing claims with Vietnam, Brunei, and Thailand, an area of the Celebes basin remains in dispute with Indonesia. Potential territorial disputes with China, Vietnam, and the Philippines could emerge as the country’s exploration initiatives move into the deepwater areas of the South China Sea.

Several major upstream and downstream oil and natural gas projects have been commissioned in Malaysia during the past few years as part of the country’s strategy to enhance output from existing oil and natural gas fields. The incumbent and long-ruling Barisan Nasional party (BN), which won the May 2013 general election, is slated to remain in power until the next election scheduled for 2018. The BN party has a track record of promoting hydrocarbon investment, and it intends to continue boosting oil and natural gas production, reforming the energy sector to attract more investment, providing fiscal incentives to expand the use of Malaysia’s renewable energy, and developing the country’s energy infrastructure. Significantly lower oil and natural gas prices since the latter half of 2014 have negatively affected Malaysia’s export revenues and hydrocarbon investment. However, in an effort to lower its fiscal deficit, the country has reduced its energy subsidies to end users and raised economic consumption taxes in the past few years.3 Malaysia aims to diversify its fuel slate and move further downstream to become an oil and natural gas trading hub.

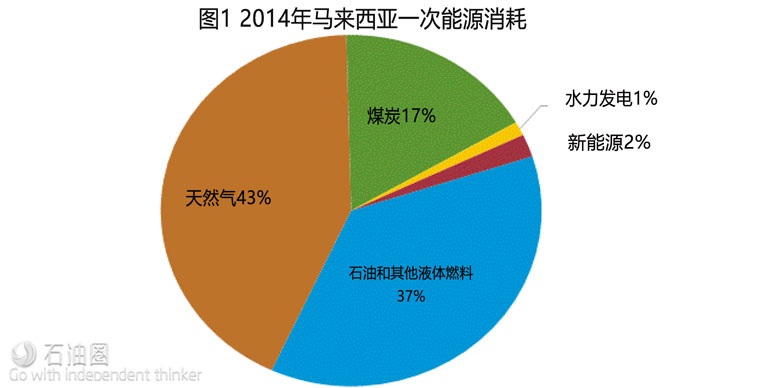

Total primary energy consumption

Malaysia is the third-largest consumer of energy in Southeast Asia. Petroleum, natural gas, and coal are the main fuels sources consumed. As Malaysia targets economic development and increased manufacturing, the country is focused on securing energy through cost-effective means and diversifying its fuel supply portfolio. Petroleum and other liquids and natural gas are the primary energy sources consumed in Malaysia, with estimated shares of 37% and 43%, respectively, in 2014. About 17% of the country’s energy consumption is met by coal. Hydropower contributes 1%, and renewable energy contributes 2% to total consumption (Figure 2). Malaysia’s heavy reliance on oil and natural gas to sustain its economic growth led the government to emphasize fuel diversification through investments in renewable energy, particularly biomass, solid waste, and solar. The power sector’s recent investment in more coal-fired power could raise the share of coal consumption in the next few years.

Petroleum and other liquids

Malaysia is the second-largest producer of petroleum and other liquids in Southeast Asia, following Indonesia. Nearly all of Malaysia’s oil comes from offshore fields.

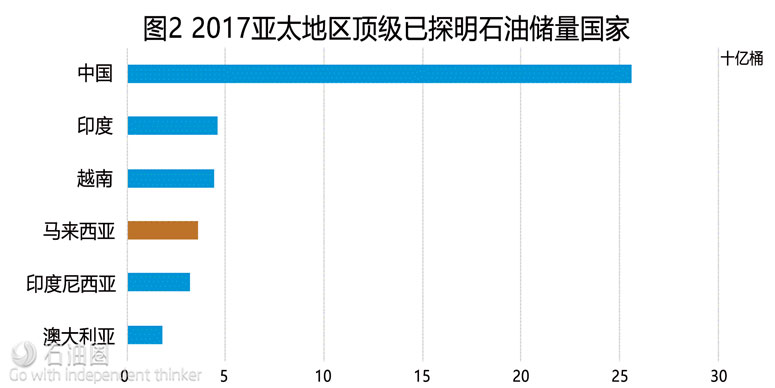

According to the Oil & Gas Journal (OGJ), Malaysia held proved oil reserves of 3.6 billion barrels as of January 2017, the fourth-highest reserves in Asia-Pacific after China, India, and Vietnam (Figure 3). Nearly all of Malaysia’s oil comes from offshore fields. The continental shelf is divided into three producing basins: the Malay basin, offshore peninsular Malaysia in the western area, and the Sarawak and Sabah basins in the eastern region. About 40% of the country’s oil reserves are located in the Malay basin and tend to be light and medium sweet crude oil grades from shallow waters, although in the past decade, more exploration and discovery of reserves have taken place in deepwater areas in eastern Malaysia.6 Malaysia’s prize benchmark crude oil fields include Tapis, (located offshore Peninsular Malaysia) and Miri, Kikeh, and Kimanis (located near Borneo Island in the eastern region).

Sector organization

Energy policy in Malaysia is set and overseen by the Economic Planning Unit (EPU) and the Implementation and Coordination Unit (ICU), which both report directly to the Office of the Prime Minister. Malaysia’s national oil and gas company, Petroliam Nasional Berhad (Petronas), holds exclusive ownership rights to all oil and natural gas exploration and production projects in Malaysia, and it is responsible for managing all licensing procedures. Malaysia’s Prime Minister directs Petronas and controls appointments to the company’s board. Petronas holds stakes in most of the oil and gas blocks in Malaysia, and it is one of the largest contributors to Malaysian government revenues, accounting for more than 20% of the country’s taxes and dividends in 2016.7 Since its incorporation in 1974, Petronas has grown to be a world-renowned, integrated international oil and gas company with upstream and downstream interests in more than 70 countries. Petronas holds equity in all upstream production- sharing contracts (PSC).

ExxonMobil, Shell, and Murphy Oil are currently the foreign oil companies producing the most oil in Malaysia. New opportunities for investment in Malaysia’s energy sector have attracted other foreign oil independents such as Repsol (Spain), Lundin Petroleum (Sweden), Roc Oil Company (Australia), and Petrofac (UK). In 2015, Indonesia’s national oil company (NOC), Pertamina, purchased 30% of Murphy Oil’s assets in Malaysia as Indonesia seeks to book upstream hydrocarbon production from overseas assets.

Malaysia’s oil and natural gas policy historically has focused on maintaining the reserve base to ensure long-term supply security while providing affordable fuel to its population through subsidized fuel sales. Prior to 2015, high international oil prices and Malaysia’s increasing crude oil import levels put pressure on government expenditures for subsidies. In response, the government began introducing subsidy reforms as part of Malaysia’s goal to lower the government’s budget deficit and lift some of the financial burden on Petronas to allow the company to invest in more in upstream activities. In July 2010, the government initiated the first subsidy reductions for gasoline, diesel, and liquefied petroleum gas (LPG) with the aim of phasing out fuel subsidies by 2015. Public sensitivities over higher fuel costs stalled the reforms until September 2013, when the government increased the price of gasoline and diesel by 10.5% and 11.1%, respectively. In November 2014, Malaysia officially ended subsidies for gasoline and diesel.

Exploration and supply

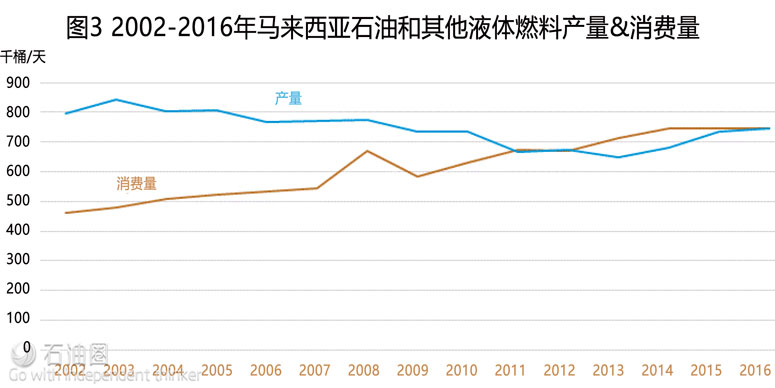

Malaysia is Southeast Asia’s second-largest oil producer behind Indonesia. Petroleum and other liquids production (including crude oil, lease condensates, natural gas liquids, biofuels, and refinery processing gains) in 2016 was an estimated 744,000 barrels per day (b/d), a 15% increase from a recent low in 2013, but down from the country’s peak production of 842,000 b/d in 2003 (Figure 4).13 More than a quarter of Malaysian crude oil production currently originates from the Tapis field in the offshore Malay basin.14 The country’s oil production had experienced overall decline as a result of maturing fields, particularly larger fields in the shallow waters offshore Peninsular Malaysia. Since 2014, production commenced from’s new Bertam oilfield in the Penyu Basin from and the large deepwater Gumusut-Kakap field. This production offset some production declines from mature fields and reversed some of the declines over the past decade. The combination of new fields coming online and increased investment in enhanced oil recovery (EOR) in mature fields has also kept oil production relatively steady.

Malaysia’s domestic oil consumption has risen while production has fallen in most years since 2003, leaving smaller volumes of oil available for exports. Petronas is working to attract new investments and to reverse production declines by enhancing output from existing fields through advanced EOR techniques and developing small, marginal fields through risk-service contracts (RSCs). Companies share the risk in these contracts: Petronas is the project owner and investors are the service providers receiving revenues for oil produced throughout the entire life of the project.

International Oil Companies (IOCs) are also making new oil and natural gas discoveries in deepwater offshore areas of Sarawak and Sabah basins. These deepwater offshore fields pose more technical challenges and require greater investment by Malaysian and foreign energy firms. In 2013, Petronas announced higher spending for exploration and production activities in Malaysia’s oil and natural gas sector to boost oil and natural gas production and to offset the current declines from aging fields. However, following the oil price slump since 2014, the NOC announced cuts to capital expenditures by $11.2 billion between 2016 and 2020.16 The lower oil price environment has slowed investment in development of Malaysia’s upstream oil assets and has resulted in international oil companies abandoning a few contracts.

Enhanced oil recovery (EOR) projects

Petronas is conducting about 10 EOR projects to extend the production life of Malaysia’s oldest oil fields. In the latter half of 2014, ExxonMobil began working with Petronas on the Tapis EOR project, which lies 118 miles off Terengganu in Peninsular Malaysia. As part of a production-sharing contract, which includes provisions for the deployment of EOR. ExxonMobil and Petronas use alternate natural gas and water injection processes to extend the life of the seven fields–Seligi, Guntong, Tapis, Semangkok, Irong Barat, Tebu, and Palas–that are part of the Tapis crude oil blend. The project is expected to extend the fields’ lives by 25 years and add up to 35,000 b/d to current production.

In 2012, Shell and Petronas agreed to invest in EOR chemical injection technology for 30 years in two EOR projects offshore Sarawak (Baram Delta offshore covering nine fields) and Sabah (North Sabah development area covering three fields).19 In 2014, Petronas expanded the Baram Delta EOR PSC to include natural gas production, which will be used both for reinjection purposes to assist in oil extraction and for direct gas sales to the domestic and international markets.20 In 2016, Shell agreed to sell its stake in the North Sabah EOR PSC to Malaysia’s Hibiscus Petroleum.

Risk-service contracts (RSC) projects

In addition to its EOR projects, Malaysia began maximizing its oil production potential in 2011 by issuing risk-service contracts for smaller, marginal fields. Petronas estimates that Malaysia has more than 100 marginal fields with about 580 million barrels of oil reserves.22 These contracts involve risks shared between Petronas (the project owner) and the contractors (foreign and domestic companies), which act as service providers. These companies receive compensation for cost and a return on investment.

Petronas has awarded six RSCs since 2011 as part of its RSC licensing rounds. At the end of 2016, five of the six RSCs had commenced production of oil and natural gas, including the Berantai fields, the Kapal, Benang, and Meranti Cluster located offshore Peninuslar Malaysia, and the Balai Cluster located offshore Sarawak.23 These fields were producing more than 30,000 b/d in 2014.24 As a result of the low oil price environment, the first two RSCs awarded in 2011 (and Balai Cluster) were discontinued in 2016.25 The sixth RSC, the Ophir oil field offshore Peninsular Malaysia, is slated to start production by the second half of 2017.

Deepwater projects

Several major projects are under development in the deepwater area offshore the Sabah state that could bolster Malaysia’s oil production over the next decade. The Kikeh oil field, operated by Murphy Oil in partnership with Petronas, was Malaysia’s first deepwater oil-producing field. The Kikeh field came online in 2007 with peak production potential at 120,000 b/d. However, estimated production in 2015 was only 15,000 b/d. The Siakap North-Petai field is a satellite field commissioned in 2014 to tie back to the Kakap field. It has a peak production rate of 35,000 b/d, which will offset some production declines from Kakap.

Another deepwater area offshore Sabah, the Gumusut-Kakap project, uses the region’s first deepwater floating production system. The Kakap field came online in 2012 with production of 25,000 b/d. New production from the Gumusut field, which commenced in late 2014, has been the key driver in crude oil production growth in Malaysia following more than a decade of overall declines. Currently, output from both fields has averaged 100,000 b/d to 120,000 b/d and could peak around 135,000 b/d.28 Project shareholders are Shell (33%), ConocoPhillips (33%), Petronas (20%), and Murphy Oil (14%). The system is connected via pipelines to the new Sabah Oil and Gas Terminal located onshore at Kimanis, Malaysia.

The Malikai oil and gas field is another deepwater find located offshore northwestern Sabah and has a peak production capacity of 60,000 b/d. Shell, the operator and a 35% stakeholder, brought Malikai online at the end of 2016. Other project partners include ConocoPhillips (35%) and Petronas (30%). The Malikai project uses a tension-leg platform and other advanced offshore drilling technologies.

Boundary disputes

Malaysia are cooperating with neighboring countries bordering the South China Sea (SCS) to exploit the area’s significant hydrocarbon potential. The country holds estimated reserves of 5 billion barrels of crude oil and liquids and 80 trillion cubic feet of natural gas in the SCS, the largest of any of the border countries (see South China Sea Analysis Brief). In May 2009, Malaysia submitted SCS territorial claims to the United Nations Commission on the Limits of the Continental Shelf. Malaysia currently disputes China’s territorial claims through its nine-dash line, a series of lines encompassing most of the South China Sea based on China’s historical territorial claims. Malaysia has not filed a legal case against China and has preferred to advance bilateral relations between the two countries.

The 20-year dispute between Malaysia and Brunei over land and sea boundaries, particularly in the Baram Delta Basin, was resolved when the two countries signed a boundary agreement in April 2009. Oil blocks L and M were ceded to Brunei, while Limbang, on the Sarawak-Brunei border, was ceded to Malaysia. Since the agreement, energy cooperation between Malaysia and Brunei has strengthened. In 2010, Petronas and the Brunei government agreed to jointly develop the two blocks offshore Borneo Island, and they signed a 40-year PSA for newly-named Blocks CA1 and CA2. Drilling commenced in 2011, along with further investment plans. The two countries signed several energy cooperation agreements in 2013 for joint development of deepwater fields, and they anticipate hydrocarbon production in the joint commercial areas to begin by 2021.

Malaysia and Vietnam had a maritime dispute in the Gulf of Thailand that stemmed from claims made in the 1970s. Based on 1992 negotiations, both countries’ national oil companies created a joint development agreement to extract the resources.32 Malaysia and Vietnam share the 775-square mile area of the PM-3 Commercial Arrangement Area (CAA) in the Malay Basin. PM-3 CAA, which consists of six fields, commenced oil and natural gas production in 1997. The production capacity of these fields is currently 60,000 b/d. Spain’s Repsol, through its 2015 purchase of Talisman Energy (Canada), holds a 35% stake and an operating interest in the Northern and Southern oil fields in the CAA. The other PSC partners–Petronas and PetroVietnam–hold a 35% and a 30% interest, respectively.33 The project partners extended the PSC for the block to 2027.

Other areas in the South China Sea, such as the Celebes Basin that borders Indonesia and Malaysia, have remained underexplored because of competing territorial claims between the two countries. Shell holds an exploration contract with Petronas for two deepwater blocks off the east coast of Sabah. However, Indonesia also awarded separate PSCs for the blocks and claims them.35 These PSCs will likely be dormant as long as territorial maritime disputes remain unresolved.

Oil pipelines

Malaysia has a relatively limited oil pipeline network and relies on tankers and trucks to distribute products onshore. Malaysia’s main oil pipelines connect oil fields offshore Peninsular Malaysia to onshore storage and terminal facilities. The Tapis pipeline runs from the Tapis oil field and terminates at the Kerteh plant in Terengganu, as does the Jerneh condensate pipeline. The oil pipeline network for Sabah connects offshore oil fields with the onshore Labuan oil terminal. This network is currently expanding following the recent launch of development projects including the Kebabangan cluster, the Malikai, Gumusut/Kakap, and Kikeh oil fields. A few other oil pipelines connect offshore fields with the onshore Bintulu oil terminal in Sarawak.

An international oil-products pipeline runs from the Dumai oil refinery in Indonesia to the Melaka oil refinery in Melaka City, Malaysia. An interconnecting oil-products pipeline runs from the Melaka refinery via Shell’s Port Dickson refinery to the Klang Valley airport and to the Klang oil distribution center.

Oil trade

Malaysia remained a net oil exporter of crude oil and petroleum products in 2016 despite the narrow gap between production and consumption in the past several years. Malaysia exports about half of its crude oil production because the crude quality (light and sweet) is attractive to the Asian markets and fetches a higher premium compared with other crude oil blends. Malaysia imports lower-cost heavy sour crude oil, about half from the Middle East and the rest from several other regions, for its refineries and domestic needs. In 2016, Malaysia imported nearly 200,000 b/d of crude oil for processing at its oil refineries.

Malaysia exported an eight-year high of 333,000 b/d of crude oil in 2016. Almost all of Malaysia’s crude oil exports are shipped within Asia Pacific, the bulk of which were sent to Australia, India, Thailand, Singapore, and Indonesia.37 Japan purchased more crude oil from Malaysia to use for power generation following the loss of nuclear electric generation after the country’s Fukushima accident in 2011, although these export volumes have now returned to pre-Fukushima levels.

The country’s imports of petroleum products have grown faster than its exports in the past few years because of weaker oil demand in other parts of Asia. Much of Malaysia’s oil product trade occurs within Asia, especially with neighboring Singapore. Gasoline is the key import product, making up about 46% of petroleum product imports and about 20% of all oil product demand. Malaysia exports about half of its diesel production.38 Malaysia’s oil demand slowed in 2015 and 2016 as a result of weaker economic growth and competition with other fuels such as natural gas and coal.

Natural gas

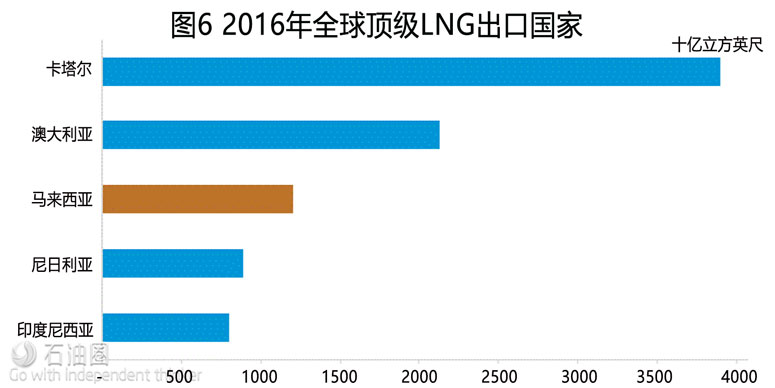

Malaysia was the world’s third-largest exporter of liquefied natural gas (LNG) after Qatar and Australia in 2016. The country’s growing domestic demand and regional gas imbalances in the past few years prompted the country to open its first regasification terminal as another supply source.

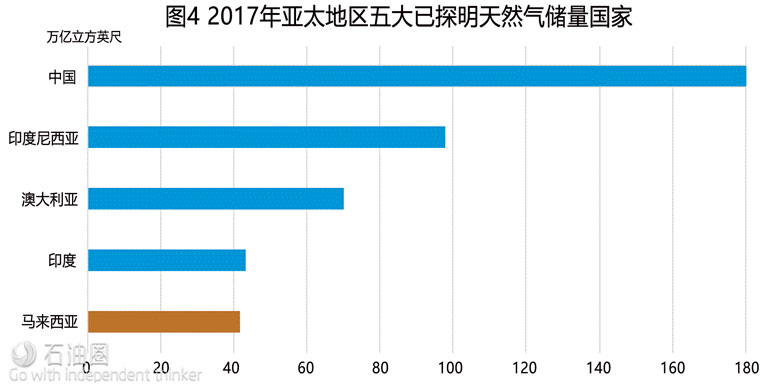

According to the OGJ, Malaysia held 42 trillion cubic feet (Tcf) of proved natural gas reserves as of January 2017, and it was the fifth-largest natural gas reserve holder in the Asia-Pacific region (Figure 5).48 More than half of the country’s natural gas reserves are located in its eastern areas, predominantly offshore Sarawak. Sarawak and Sabah have an increasing amount of non-associated gas reserves that have offset some of the declines from mature oil and natural gas basins offshore Peninsular Malaysia.

Sector organization

Similar to the oil sector, Malaysia’s state-owned Petronas dominates the natural gas sector. The company has a monopoly on all upstream natural gas developments, and it also plays a leading role in downstream activities and the liquefied natural gas trade. Most natural gas production comes from PSAs operated by foreign companies in conjunction with Petronas. Shell remains the largest gas producer and a key player in the development of deepwater fields in Malaysia.50 Other international companies that have sizeable upstream investments in Malaysia’s natural gas fields include Murphy Oil, ConocoPhillips, Nippon Oil, INPEX, and Mitsubishi.

Gas Malaysia is the largest non-power natural gas distribution company in Malaysia and the only one that can operate on Peninsular Malaysia. Sarawak Gas Distribution Company, which is 70%-owned by the government, serves Sarawak gas consumers, and Sabah Energy Corporation distributes natural gas in the Sabah state.

The Malaysian government has regulated natural gas prices for end users. Historically, it has capped the domestic rates at a levels considerably below imported LNG and prices paid by neighboring Singapore.

The Malaysian government has provided subsidies to Petronas and power producers. Overall, the artificially low natural gas prices in Malaysia have increased the government deficit, inhibited some upstream investment by Petronas, and increased domestic demand. In efforts to reduce natural gas subsidies and raise investment, the government implemented a price reform in 2011. The policy seeks to raise the natural gas price for electric power users every six months to bring domestic natural gas prices closer to prices in the international market.

Although it took no action for more than two years, in January 2014, the government began to raise natural gas prices for all consumers. By early 2017, the price had risen by 44% for electric power customers and by 68% for industrial and commercial customers over the previous three years.51 Between 2014 and the end of 2016, the concurrent fall in Malaysian LNG prices by about half to less than $6 per million British thermal units has significantly narrowed the gap between domestic and international gas prices. The government intends to further ratchet up the natural gas tariff for non-power consumers every six months until 2019, which is expected to result in a 23% increase from the January 2017 level.

Exploration and production

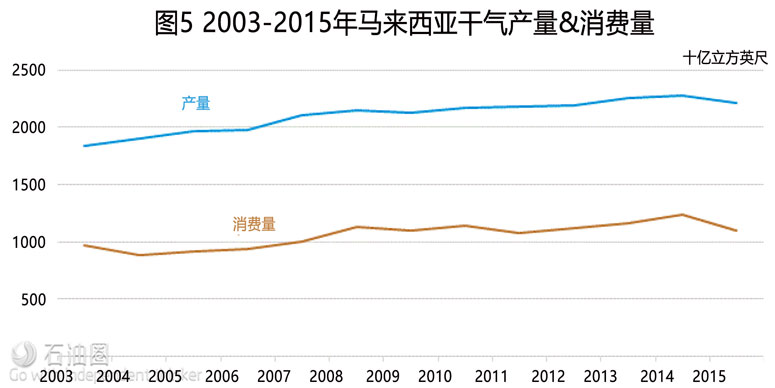

Malaysia’s dry natural gas production has risen steadily over the past two decades, reaching 2.2 Tcf in 2015. The Malaysian government estimates 2016 production rose to nearly 2.4 Tcf in 2016 as a result of projects that have come online in the past two years. Meanwhile, domestic natural gas consumption, which accounts for roughly 50% of production, has also increased over the past decade, but at a slower pace (Figure 6). In 2014, the power sector accounted for 62% of natural gas consumption, and the industrial sector accounted for 37%, according to Malaysian statistics. The remaining use was from residential, commercial, and transportation sectors.

Demand for natural gas-fired power, especially in Peninsular Malaysia, decreased in 2015 as a result of the reductions in price subsidies and the subsequent increase in coal usage as a cheaper source of energy. This drop is expected to be a near-term phenomenon because Malaysia’s coal capacity eventually cannot support the rising energy demand and environmental commitments. As a result, natural gas power demand is expected to increase again. However, gas demand for industrial development is likely to remain strong going forward as the government pursues greater economic development.

Rising domestic energy demand, particularly in Peninsular Malaysia, and LNG export contract obligations are placing pressure on the country’s gas supply and driving Malaysia to actively seek investments for reservoir development. Several ongoing projects will expand natural gas production in Malaysia over the near term. Exploration and development activities in Malaysia continue to focus on offshore Sarawak and Sabah. Over the long term, Malaysia needs to attract higher levels of investment and technical capabilities to develop deepwater fields and those containing high levels of carbon dioxide and sulfur.

Malaysia-Thailand Joint Development Area

One of the most active and prolific areas for natural gas exploration and production is the Malaysia- Thailand Joint Development Area (MTJDA), located in the lower part of the Gulf of Thailand and the northern part of the Malay Basin. The area is divided into three blocks, A-18, B-17, and C-19, and is administered by the Malaysia-Thailand Joint Authority (MTJA), with each country owning 50% of the MTJDA’s hydrocarbon resources. According to the MTJA, 27 natural gas fields were designated by 2014, including nine fields each in Block A-18, Blocks B-17 and C-19. Production at Block A-18 started in 2005 and has a contracted level of about 290 billion cubic feet per year (Bcf/y) of processed natural gas. Block B-17 and Block C-19 came online by 2010. From 2010 to 2026, Blocks B-17 and C-19 are contracted to deliver 120 Bcf/y for the first 10 years then 90 Bcf/y for the remaining 6 years. Overall, average natural gas production from MTJDA was slightly higher than 400 Bcf/y in 2015 and 2016.55 Block B-17-01 is expecting development of its gas fields in 2017, with first gas deliveries in 2018.56 MTJA continues to explore the area to discover more hydrocarbons.

Projects in Sarawak and Sabah

Most of Malaysia’s natural gas production is offshore Sarawak and supports LNG exports from Bintulu. Petronas and other oil companies have made several discoveries of natural gas reserves since 2010 and commenced production from several fields, offsetting some of the declining production from mature gas basins in Peninsular Malaysia and in the shallow water blocks in Sarawak. Historically, Shell and Petronas have been the key developers of upstream assets supplying the MLNG liquefaction terminals. Shell and Petronas signed three more oil and gas PSCs with Petronas in 2012 and stepped up drilling efforts to continue developing natural gas and condensate production offshore Sarawak. The PSCs cover blocks SK319, SK318, and 2B in the Central Luconia Basin.

Two natural gas fields in Sarawak (NC3 in block SK316 and Kanowit field in block SK306) began production to serve as feedstock gas for the new liquefaction terminals commissioned in 2017. Block SK316 holds three key fields that will supply the newly commissioned ninth train of the existing MLNG terminal. Petronas began producing natural gas from the first field (NC3) at the end of 2016 and expects to bring the other two fields (NC8 and Kasawari) online by 2020.58 However, Petronas is considering selling up to 49% of the Kasawari gas project, which contains an estimated 3.2 Tcf in deepwater natural gas resources. The Kasawari field has elevated levels of carbon dioxide, so development requires advanced technologies. Petronas is seeking a skilled partner who can efficiently develop the Kasawari field in a more competitive gas price environment.59 Output from the Kanowit field began at the end of 2016 and is the initial feedstock for Malaysia’s first floating liquefaction terminal. The Kanowit field is part of the larger Kumang Cluster, which began producing natural gas in 2011.

Newfield Exploration, which recently divested its Asian upstream assets, made a significant gas discovery in the SK-310 PSC offshore Sarawak in 2013. The company claimed the find could boost gas resources by 1.5 Tcf.61 In 2014, SapuraKencana Petroleum, a Malaysia oil services company, purchased Newfield’s Malaysian upstream assets and now holds 30% of the SK-310 Block, while Petronas and Mitsubishi have 40% and 30% shares, respectively. SapuraKencana reported that it plans to bring the PSC’s first field, B15, onstream towards the end of 2017 and the B14 field around 2020.62 In addition, SapuraKencana announced a significant gas reserve discovery in the PSC for block SK408 in 2016, signaling more near- term natural gas development potential in Sarawak.

The state of Sabah also holds reserves that are already under production or are scheduled to come online by 2020. A consortium consisting of Petronas (40%), ConocoPhillips (30%), and Shell, the operator, (30%), are developing three contiguous natural gas and condensate fields, including Kebabangan, Kamunsu East, and Kamunsu East Upthrown Canyon (KBB Cluster) in the northwestern Sabah state. The KBB cluster is estimated to hold 4.7 Tcf of gas.64 KBB production began in late 2014, and the KBB floating platform has a design capacity of 300 Bcf/y for natural gas, 80,000 b/d for crude oil, and 22,000 b/d for condensate.65 The platform acts as a hub for the development of these deepwater gas fields and ties in the Malikai crude oil field that came online at the end of 2016.

Other upstream developments offshore Sabah include the Kinabalu Non-Associated Gas project and the Rotan field in Block H. The Kinabalu project contains two natural gas fields and is scheduled to come online in mid-2017.67 Rotan and adjacent fields, operated by Murphy Oil in partnership with Pertamina of Indonesia and Petronas, have an estimated 1 Tcf of reserves. These fields are located far offshore from existing infrastructure on the coast of Sabah and are slated to supply Malaysia’s second floating liquefaction terminal by 2020.

Pipelines

Malaysia has one of the most extensive natural gas pipeline networks in Asia, totaling about 1,530 miles. The Peninsular Gas Utilization (PGU) project, completed in 1998, expanded the natural gas transmission infrastructure on Peninsular Malaysia. The PGU system spans 1,550 miles and has the capacity to transport 730 Bcf/y of natural gas.69 Other gas pipelines run from offshore gas fields to gas processing facilities at Kertih. A number of pipelines link Sarawak’s offshore gas fields to the Bintulu LNG facility. However, limited gas distribution coverage exists in much of the Sarawak and Sabah states.

The Sabah-Sarawak Integrated Oil and Gas Project, installed in 2014, includes the 318-mile onshore Sabah-Sarawak Gas Pipeline (SSGP) and can transport about 365 Bcf/y of gas from Sabah’s offshore fields to the Petronas LNG complex in Bintulu for liquefaction and export. Some natural gas from the terminal is also reserved for fueling downstream industrial projects and for power generation in Sabah.Other pipelines link natural gas fields located offshore Sabah to the Labuan Gas Terminal.

The Association of South East Asian Nations (ASEAN) is promoting the development of a Trans-ASEAN Gas Pipeline system (TAGP) aimed at linking ASEAN’s major gas production and consumption centers by 2020 through a network of gas pipelines. Because of Malaysia’s extensive natural gas infrastructure and its location, the country is a natural candidate to serve as a hub in the ongoing TAGP project, which currently has 2,250 miles in place of the proposed 2,800 miles of pipelines.71 Malaysia began exporting natural gas to Singapore through a pipeline in 2000. Singapore currently has two contracts to import 84 Bcf/y of gas from Malaysia, but its imports dropped to 44 Bcf in 2015 because Singapore imports natural gas through its new LNG terminal. Natural gas pipelines between West Natuna, Indonesia and Duyong, Malaysia were installed in 2002, and Malaysia began importing natural gas from Indonesia in 2009. In 2015, Malaysia imported around 90 Bcf of natural gas from Indonesia.72 The Trans-Thailand-Malaysia Gas Pipeline was commissioned in 2005 and allows Malaysia to transport natural gas from the Malaysia- Thailand JDA to its domestic pipeline system.

LNG trade

Malaysia remains a key global LNG exporter as the third-largest exporter after Qatar and Australia in 2016 (Figure 7). Malaysia is developing sizeable reserves in its eastern region and has expanded its export capacity in 2017. However, growing natural gas supply shortages in demand centers in Peninsular Malaysia have prompted Petronas to construct the country’s first LNG import terminal in this western region to augment natural gas supply from pipelines.

LNG exports

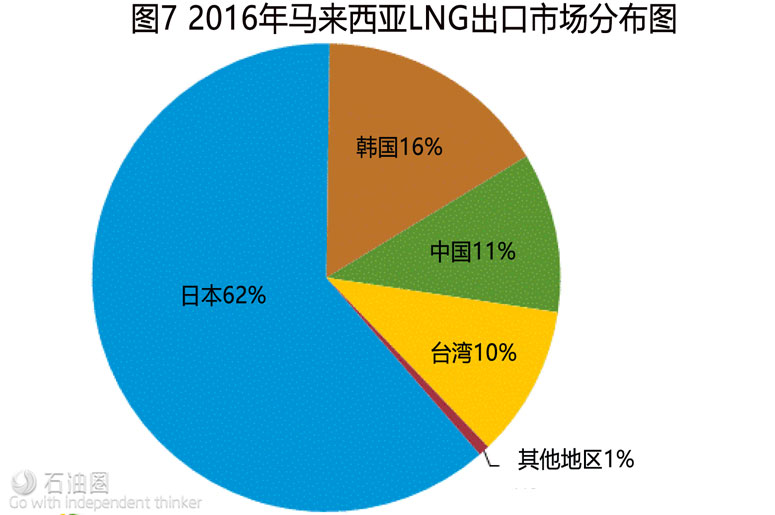

In 2016, Malaysia shipped about 1.2 Tcf/y of LNG and accounted for 10% of LNG exports worldwide. Key importers of Malaysia’s LNG are Japan (62%), South Korea (16%), China (11%), and Taiwan (10%) (Figure 8). Most of Malaysia’s LNG is sold through medium- or long-term supply contracts with traders or utilities in these countries. Malaysia also has sold LNG cargoes to Petronas LNG Limited, a trading company based in Malaysia, which ships spot LNG cargoes to many locations around the world。

The Malaysia LNG (MLNG) complex located at Bintulu in the state of Sarawak is the main hub for Malaysia’s natural gas industry and is operated by Petronas. Petronas owns majority interests in the facility’s three LNG processing plants (Dua, Tiga, and Satu), which are supplied by the country’s offshore natural gas fields. MLNG is one of the largest LNG complexes in the world, with nine production trains and a total liquefaction capacity of 1.4 Tcf/y.74 Petronas began operating the facility’s ninth train in January 2017. Japanese financing has been critical to the development of Malaysia’s LNG facilities. The complex at Bintulu also hosts Shell’s gas-to-liquid (GTL) project, which currently has a capacity of 15,000 b/d of petroleum liquids. Petronas commissioned the ninth train of Bintulu LNG at the beginning of 2017.

Petronas proposed two floating liquefaction terminals offshore Sarawak and Sabah to capture greater economic value from the country’s smaller, more remote gas fields. These plants would have the flexibility to serve the export or domestic markets and are transportable to other locations. Both terminals will add another 131 Bcf/y of liquefaction capacity. The Petronas floating LNG (FLNG) Satu project, located off Sarawak near the Petronas LNG complex, has a capacity of 58 Bcf/y and is contracted to use natural gas from the Kanowit field for at least five years. Petronas FLNG Satu, which is the world’s first floating liquefaction terminal, commenced commercial operations in early 2017.76 Petronas plans to market some of the natural gas from the facility to the domestic market, but it has not signed any purchase contracts so far.

PFLNG-2, the country’s second proposed offshore LNG terminal, intends to monetize natural gas production from the Rotan field and other fields in Block H, northeast of Sabah in the South China Sea. The terminal has a design capacity of 73 Bcf/y, but it is uncertain whether the facility will serve domestic demand in Peninsular Malaysia or serve as exports to other Asian markets. Petronas made a final investment decision on the project in early 2014. However, the low price environment and Petronas’ subsequent announcement to reduce capital expenditures in the near term has caused the NOC to delay commencement of Petronas FLNG-2 by two years to 2020.78 (Table 2).

LNG imports

Although Malaysia is one of the world’s largest LNG exporters, the country currently experiences a geographic disparity between natural gas supply and demand. The Western Peninsular Malaysia demands more natural gas to fuel the power and industrial sectors, while the eastern states of Sarawak and Sabah, located on Borneo Island, produce natural gas. To meet gas needs in Peninsular Malaysia, Petronas is developing regasification terminals to secure supply from the global gas market.

Malaysia’s first regasification terminal, Lekas LNG, began operating in 2013. Lekas LNG is located near Malacca and has a capacity of 184 Bcf/y. Malaysia imports about 70 Bcf of LNG annually, and ships only small amounts from its own production at the MLNG liquefaction terminal.80 Petronas and Dialogue Group agreed to develop a terminal in Johor, Pengerang LNG. The regasification terminal, which is linked to the NOC’s RAPID project, is slated to provide natural gas feedstock to the refining and petrochemical complex and to a proposed power plant at the site. Pengerang LNG is under construction and scheduled to come online by 2018. Several other regasification projects have been proposed in the past few years, but some were cancelled (Table 3).81 Gradual natural gas price prices and competition with coal and oil for power supply have slowed natural gas demand and the progress of other proposed terminals in the past few years.

Petronas signed agreements with Brunei and Australia’s Gladstone liquefaction project to supply some of its domestic gas demand over the next decade. The NOC has also purchased some natural gas from the spot market. Petronas plans to source some LNG from its new liquefaction projects coming online in the eastern part of the country, although it has not signed any purchase contracts for the supply.

石油圈

石油圈