Tie-backs and seafloor pumping improve economics in deepwater developments

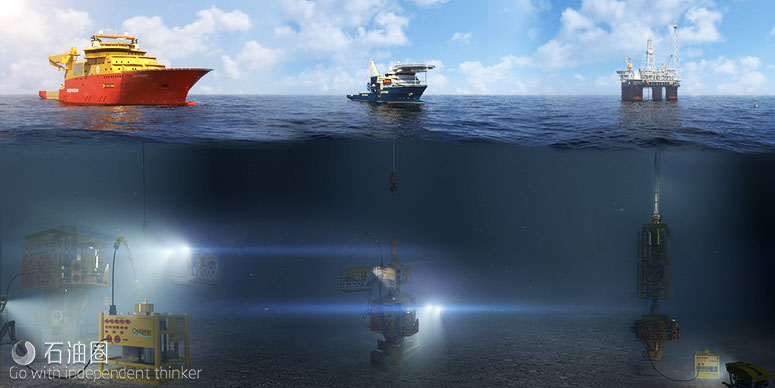

Reduced commodity prices have eliminated many options to improve deepwater project economics. Seafloor boosting, as an enabling technology for tie-back developments, has emerged as the most effective means to achieve, and sustain, economic flowrates from new discoveries. However, these tie-backs require different considerations than recently installed, hub-based, seafloor boosting systems, and require a unique approach and new technologies.

During periods of elevated oil prices, many options are examined to optimize production from deepwater discoveries. These include waterflooding, miscible gas injection and other EOR/IOR methods. While showing improved recoveries in some cases, these options are capital-intensive and carry significant technical risk. Lower commodity prices have provided clarity. Project development teams, which are actively working through the various options, are slowly concluding that tie-back developments are the key, remaining development method to meet today’s stringent economic criteria.

Tie-backs present an attractive lower-cost alternative for deepwater developments. Current commodity prices make it difficult to justify the large host developments that entail building a new FPSO, spar or TLP. These large capital investments are justified only for mega-discoveries, in areas where there is no available infrastructure. For most discoveries, the strategies now focus on reduction of development costs and making the best use of existing assets. Despite the difficult business environment for new greenfield developments, leases have fixed expiration terms, and some level of exploration drilling continues.

A tie-back option utilizing a multi-phase pump, termed a multi-phase pump tie-back (MPTB), is particularly attractive in terms of reduced capital costs and improved rates/recovery. One way to look at MPTB is that it represents an alternative to a host development in many ways. An MPTB is able to create the low wellhead pressures, similar to a local host, but at a much lower cost. Rather than a host alternative, instead, multi-phase pumping is often viewed as an upside to a no energy-added, bare pipe tie-back development. In fact, MPTB’s are an intermediate step between a host and a bare pipe tie-back.

Tie-backs that utilize multi-phase pumping are attractive for sustaining flowrates and adding reserves. Some of the recent seafloor pumps installed in the GOM are single-phase pumps. However, tie-backs are more likely to need multi-phase pumps, due to the higher reservoir GOR’s and bubble point pressures encountered. In addition, a lower wellhead pressure is desired to lower BHP and increase flowrates/recovery. Multi-phase pumping also helps in flowline sizing, as a smaller pipeline is possible, improving stability and slugging characteristics versus a larger-diameter flowline that would be considered to reduce early-life backpressure on the wells.

MULTI-PHASE PUMPING

Subsea pumping has evolved to be a reliable, widely used, artificial lift method for offshore production. Currently deployed systems extend from single-phase to multi-phase and cover a wide power range (1 MW–6.4 MW). A good review of multi-phase pumping technologies is available in published literature. Although a detailed discussion of multi-phase pumping is beyond the scope of this article, it is important to highlight the three primary types of subsea pumps: 1) rotodynamic; 2) twin-screw; and 3) the electrical submersible pump (ESP) form of rotodynamic pumps. Multi-stage rotodynamic pumps have been installed most widely in subsea applications, and will be the focus of much of the discussion regarding new and emerging cost-reduction capabilities for tie-back developments. As will be shown, subsea pumps have been applied over a wide range of applications, from single-well pumping systems to multi-phase well caisson-ESP systems to large, dual-pump stations used in association with hub developments.

Rotodynamic pump systems

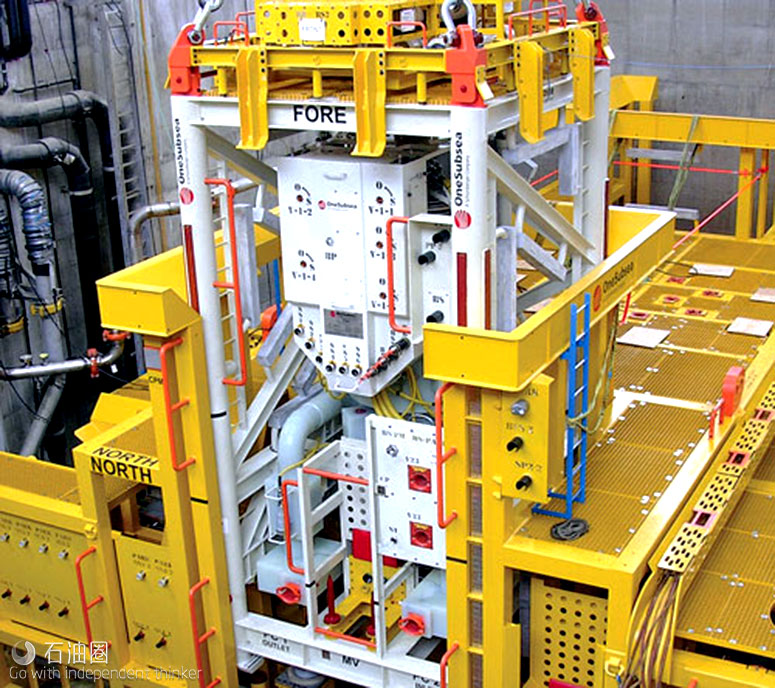

Helicoaxial, centrigual and hybrid rotodynamic pumps represent the clear majority of the installed subsea boosting systems. While much can be said related to multi-phase pumping for subsea applications, this discussion will focus on important new capabilities relevant to tie-back developments. These include new HPHT-rated seafloor pumps and high-boost pumps. Pump burst casing pressures of 15,000 psi are now available, and the pump/motor/seal system has been qualified to 350°F. This opens new areas of the GOM to MPTBs, as many recent deepwater discoveries have been in HPHT reservoirs. The Barracuda project, operated by Petrobras, represents the deployment of a new generation of high-boost multi-phase pumps which, on the test stand, demonstrated a boost of 2,350 psi at GVF of 60%. There are several vendors providing multi-phase pumping options that are deployable or being qualified.

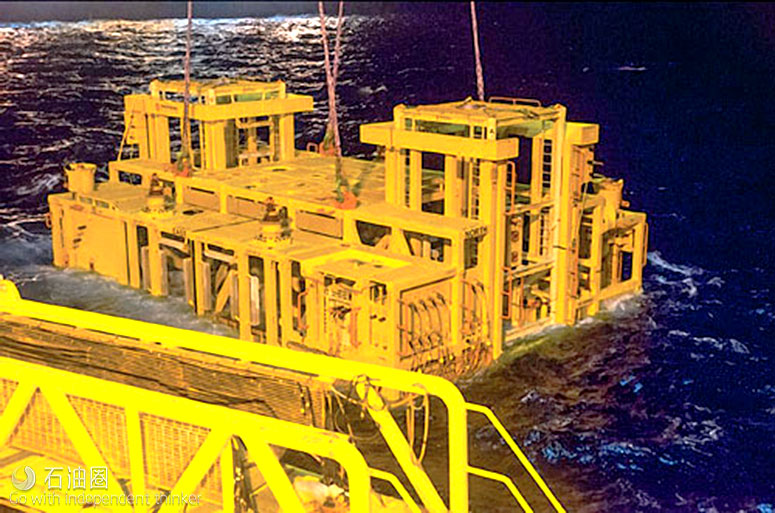

Over the past year, several key, hub-based, seafloor pumping systems have been deployed. In the GOM, Exxon Mobil deployed two single-phase pumps from OneSubsea for the Julia field, Fig. 1. Chevron also deployed three similar pump stations for the Jack/St. Malo (JSM) project, Fig. 2. The Julia development is a 15-mi tie-back to the Chevron JSM semisubmersible host FPU. In December 2016, Subsea Integration Alliance announced the longest deepwater MPTB project, which will be developed by Murphy E&P for its Dalmatian field, in the GOM. This will be a 22-mi tie-back to Chevron’s Petronius compliant tower platform. It is anticipated that these types of tie-back developments will dominate the GOM for the upcoming decade. Emerging cost-reduction methods will open a path to development for even smaller discoveries.

ESP-based subsea pumping systems

Seafloor boosting options that utilize wellbore-type ESP systems have been applied in several ways for subsea pumping. ESPs have been skid-mounted and installed in short caissons. Skid-mounted ESPs have been installed by Petrobras in Brazil and in Cascade-Chinook field in the GOM. A skid-mounted ESP provides lower intervention costs than ESPs installed in subsea caissons, but so far, the skids have been quite large. Caisson-installed ESPs have been utilized in Brazil and the GOM. A large-diameter caisson, in the 200-to-300-ft depth range, is installed to house a high-horsepower ESP string. The volume provided by the caisson provides an advantage in terms of separation/surge capability, when the caisson is operated as a gas-liquid separator. The caisson also can be operated in unseparated mode, with all flow pumped by the ESP. In this case, the caisson provides an advantage in conditioning the flow before the pump and slug damping. The downside to the currently deployed caisson-ESP system is the large intervention cost (rig intervention), low ESP reliability and poor separator efficiency under some conditions.

In recent years, ESP systems have advanced in their ability to handle gas, moving them into the realm of multi-phase pumps for subsea applications. As demonstrated by large-scale testing, gas-handling ESP stages, placed at the inlet of the ESP pump, can prevent gas lock-up to GVFs of 60%, and effectively pump a multi-phase mixture in the 0–40% GVF range. ESP systems provide a key advantage for tie-back developments by minimizing topside modification. ESPs do not require a barrier oil system and hold the potential for lower costs. However, the reliability of these systems continues to be in the 1-to-3-year MTBF range, which is far less than for rotodynamic seafloor pumping systems.

Twin-screw pumps

In some cases, a twin-screw pump (TSP) has been deployed. TSPs have an advantage when pumping heavy oil, and are widely used onshore, due to their ability to handle high gas volume fractions (GVF). In a recent study, TSPs were shown to effectively pump at GVF’s of 95%, when a small amount of liquid is cooled and re-circulated.

石油圈

石油圈