In the case studies below, the evaluation of viability was done using the financial model. In the first example, the operator used the results to determine whether it wanted to re-enter an existing producing well or whether it wanted to drill a new well. In the second example, the operator wanted to keep costs below a fixed level, to achieve a desired payback.

CASE STUDY 1

An operator had been drilling vertical wells in a known reservoir. The wells were usually, but not always, productive and produced at low volumes of between 10 bpd and 50 bpd. Some of the wells in the area were capable of up to 200 bpd. In an effort to increase cash flow from the field, the operator wanted to consider underbalanced CT Drilling and needed to evaluate the economics. The reservoir has vertical fractures that are known to be productive, but they can be missed by vertical wells. Thus, a horizontal wellbore in the right direction is a valid approach, provided the cost can be kept within economical limits.

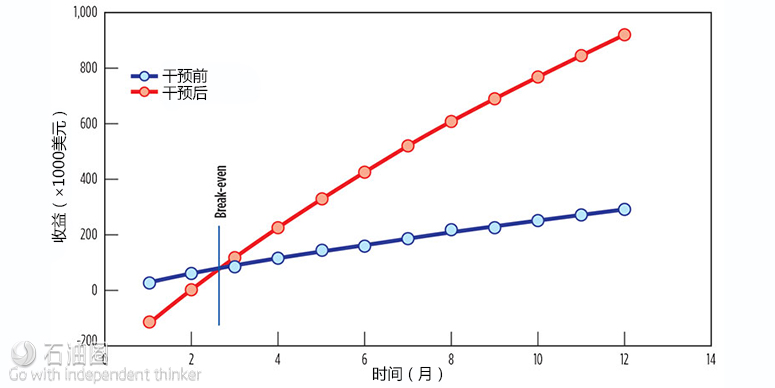

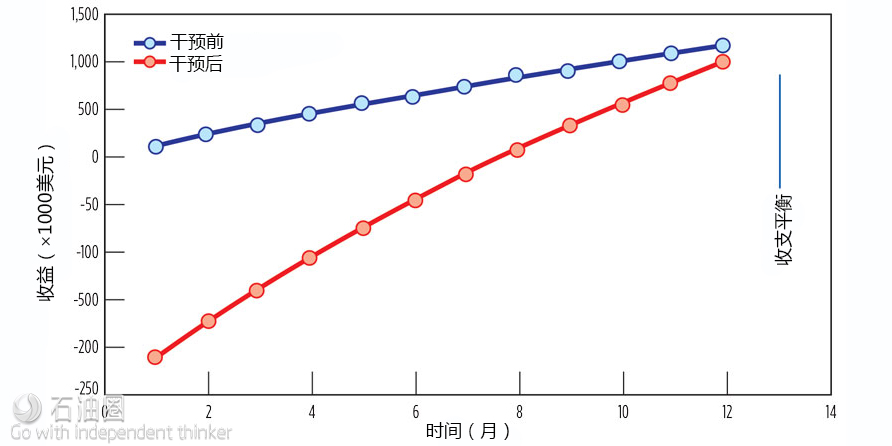

In this example, two different scenarios were considered as a best-case (Fig. 1) and a worst-case option, Fig. 2. In both cases, the total intervention cost was taken to be $250,000, with an existing well production of 25 bpd and PIF of four for the best case, and an existing well production of 10 bpd and PIF of three for the worst case. In both cases, the decline curve reduced the initial production to 50% after the first year. An oil price of $45/bbl was used.

Using this information, and taking into account its field devlopment plans, the operator decided that in this case, it was not worth re-entering an old well, due to the extra cost of a casing exit and the interruption of cash-generating production of an existing producing well, albeit at a low level. It was felt that it would be better to invest the available cash in a new well, designed from scratch, to be horizontal, using underbalanced coiled tubing drilling.

CASE STUDY 2

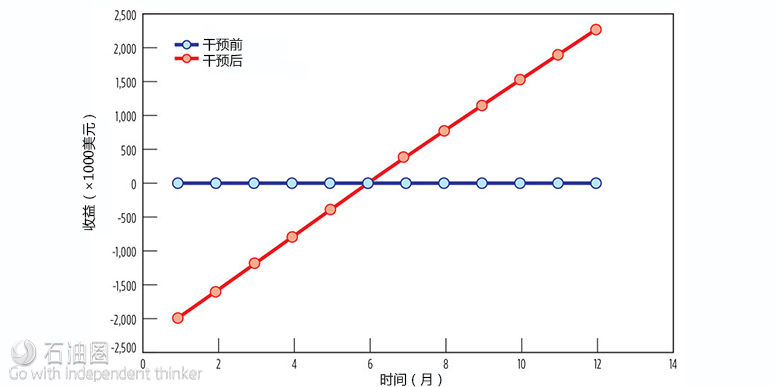

In this example, the operator already had a horizontal drilling program but was experiencing problems that were putting the project over budget. Engineers were evaluating coiled tubing drilling as a way to solve severe lost circulation problems when drilling the wells conventionally. In the formation being drilled, up to 1,000 bbl of drilling fluid could be lost in a 12-hr period, which later on had to be produced before the well went online. The objective was to reduce the losses, reduce the risk of differential sticking, and reduce the time taken to bring the well on production once drilling was complete.

Given that the initial production capability of the wells was on the order of 1,000 bpd, and the payback needed to be on the order of six months, with an oil price of $50/bbl, it is possible to determine that the well cost needed to be kept below $2.2 million to achieve the result required. Underbalanced coiled tubing drilling is of particular help in these circumstances, when compared to jointed pipe drilling, because it reduces the risk of the lost circulation problems. They can be dealt with easily, when they do occur, and as a result, the uncertainties of the project are reduced.

LOOK BEFORE YOU LEAP

These examples are intended to show how the effective evaluation of drilling opportunities can be fine-tuned better than by just comparing the AFE to a single, long-term production rate. This can lead to the adoption of more advanced technologies for wells that might appear marginal from first sight, but which ultimately will increase long-term returns.

Preparation and planning are key to many operations, and payback analysis is one of the tools available. The take-away is that simple mental arithmetic is not refined enough to inform a decision about whether to do an intervention or not. Yet, at the same time, it is not necessary to have a sophisticated financial model, if only because the unknowns will outweigh greater precision of a more complex model. There is a need for an easy way to get a feel for sensitivity of the economics, based on a number of variables.

Not every well will be viable, but if more wells can be identified and evaluated before any money is spent on them, all the better. The technique does depend on assumptions, and these will become more accurate as more experience is gained.

CT drilling can extract more production from existing wells, reduce project unpredictability, and therefore economic risk, and contribute to increased, efficient long-term extraction of hydrocarbons that is unmatched by other technologies.

Finally, a phenomenon that is more powerful than loss aversion is the fact that we hate being less successful than our neighbors, so let’s hope they haven’t also worked out how to get that extra production while you haven’t.

石油圈

石油圈