斯伦贝谢CEO Paal Kibsgaard在业内一直以坦诚著称。近日,在新奥尔良霍华德韦尔能源大会上,Kibsgaard发表了讲话。下面是「石油圈」从他的发言中截取的几点关键信息,想必对于油气从业者来说非常受用。

来自 | Schlumberger

编译 | 甲基橙 白小明

我将从以下四个主题来展开我的演讲。我们认为,对于油气业各大公司来说,现阶段以最快速度恢复公司实力非常重要。

首先,我们需要投入更多的勘探开发费用,来满足未来几年不断增长的油气需求;

第二,我们需要在整个油气供应链中持续进行研发和员工培训的投入(R&E);

第三,我们需要探索新的商业模式,促进作业公司与供应商之间更加密切的技术合作和商业合作;

第四,我们需要建立更加综合性的技术平台,优化现有技术。

在过去几年里,我们已对上述四大议题进行了反复的讨论,今天再次拿出来讨论已不再新鲜。但鉴于这些议题非常重要,我们需要的不仅仅是讨论,而是通过分析,探讨出与这些主题有关的行业发展趋势。今天,我将与你们分享我们的最新分析情况以及未来它们对斯伦贝谢的影响。

1. 更多的勘探开发投入 满足未来几年不断增长的油气需求

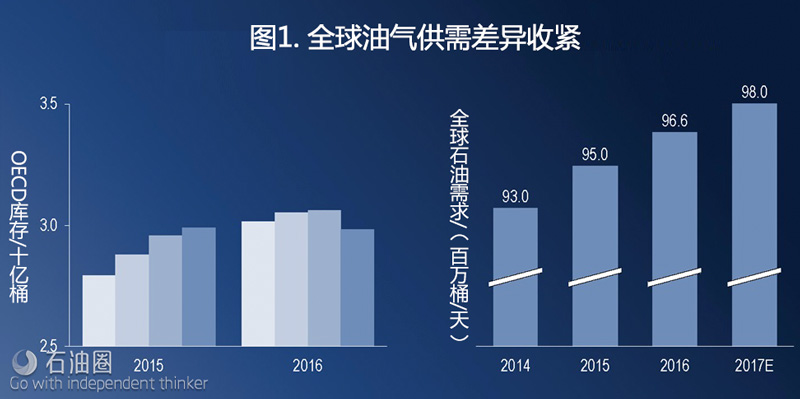

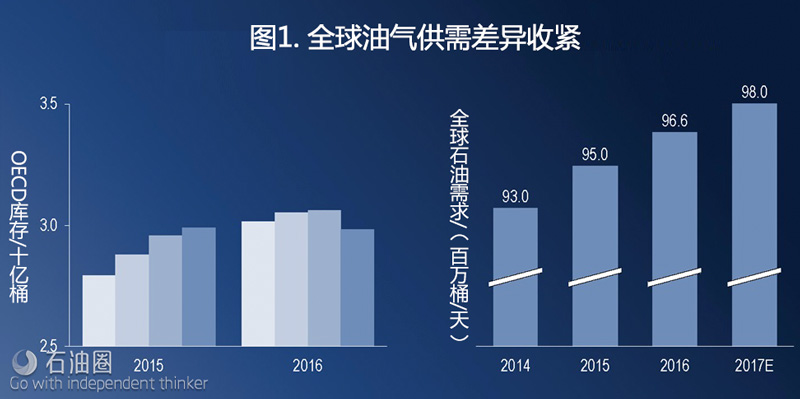

过去一年里,我们一直相信石油市场会有好转,2016年7月份OECD石油储备开始下降,也验证了这一点(图1)。目前OECD石油库存量约为30亿桶,OPEC和非OPEC国家同意削减产量,此举在一段时期内将加速库存的下降,支撑油价的进一步增长,并导致勘探投资的增加。预计全球石油需求将继续增长,在2017年后接下来的几年,每年的需求增长在100~150万桶/天之间。

近阶段,Brent油价徘徊在50~55美元/桶,由于去年第四季度的OPEC产量创历史新高,全球供需平衡暂未达到,市场仍受近期库存削减的影响。

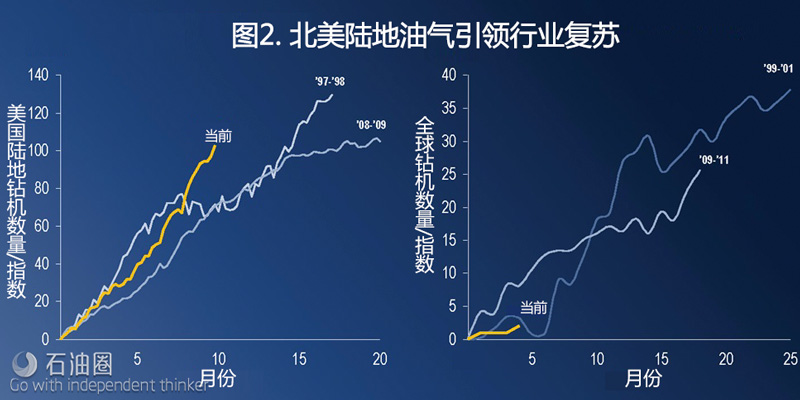

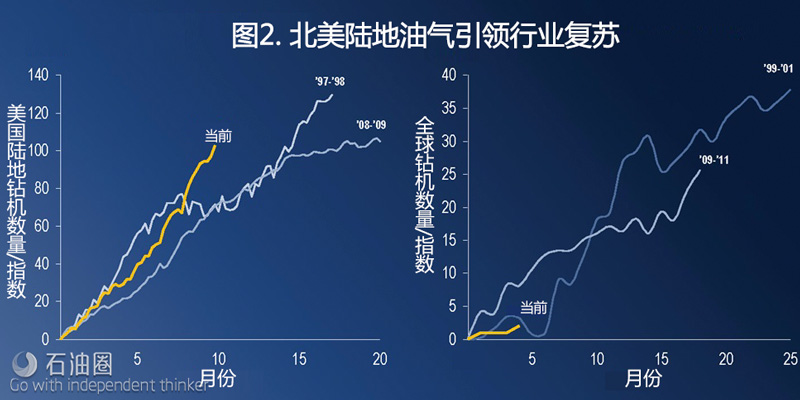

与2016年相比,北美是全球唯一的投资活动明显增加的地区。假如北美陆地区块活动继续增长强劲,美国原油产量将在2017年及未来几年增加,但北美非常规油气生产的增加并不能解决全球油气供应下降的局面(图2),原因有以下三点:

首先,Tier 1区域以外的整个财务周期仍充满挑战,但行业的资产负债表和现金流量表现良好,吸引了贷方和私募股权投资者的青睐。

其次,勘探开发作业公司都表示,尽管过去几年,页岩盈亏平衡成本大幅下降,但油服业仍将面临成本通货膨胀的损失。

第三,若未来像二叠纪盆地出产的轻质油成为全球油气生产增长的唯一来源,那么轻油就会供过于求,相应的炼油厂所需要的重质油供应短缺。这可能导致Brent和WTI原油价差扩大,也可能导致北美作业公司的另一个经济风险。

目前来看,在全球范围内,除中东、俄罗斯和北美地区之外,预计其他地区的投资额将大幅下降。2017年勘探开发地区的产油量仍将达5000万桶/天,与2014年相比将下降50%。

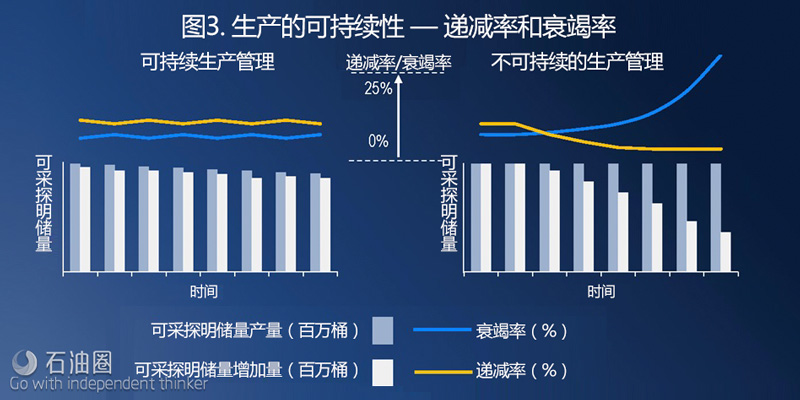

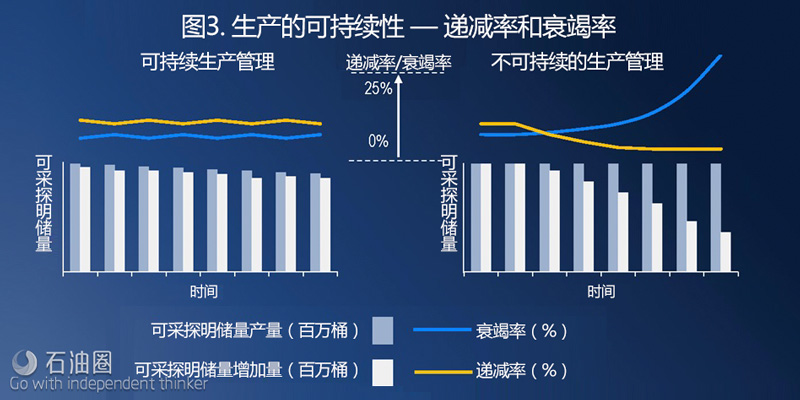

市场对产油量非常关注。即使在连续三年勘探开发投资下降的情况下,产油量也可以继续维持,但仔细分析基础数据不难发现,目前的产量稳健只是假象,未来产量并不可持续(图3)。

判断生产供应的可持续性只能通过分析可采探明储量和衰减/消耗率之间的相互作用来确定。认真分析中东、俄罗斯和北美地区以外的许多国家的潜在生产和储备数据可以看出,衰竭率的确在迅速增加。

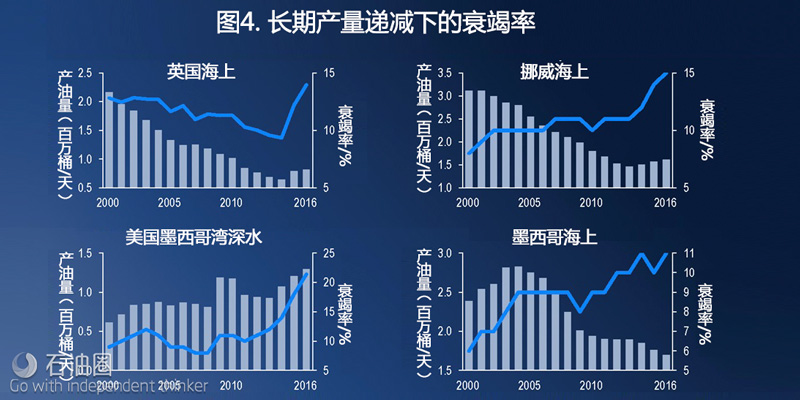

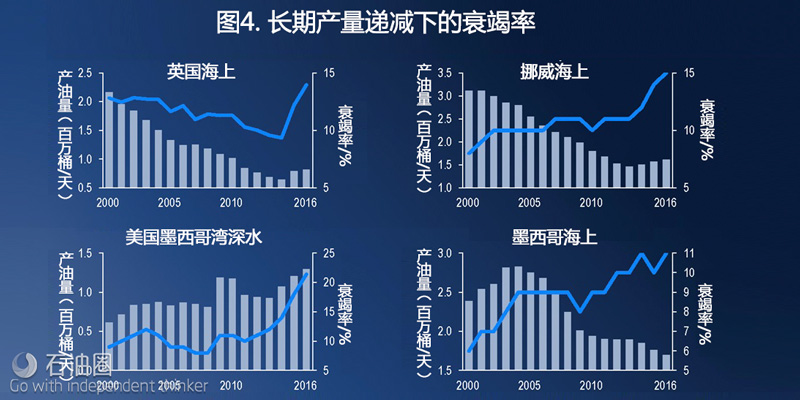

在过去三年,挪威、英国和美国墨西哥湾大陆架的生产一直保持平稳甚至略有上涨,这反映了这些地区的产量正在发生逆转。尽管E&P支出大幅下降,但这一降幅被解读为生产的反弹(图4)。

比如,墨西哥海上油田的衰竭率也在增加,但不像其他三个区块那么快,这主要是由于实际的生产在下降,在一定程度上抑制了油田的衰竭。然而,图中四个主要区块开采率在15~20%之间。在未来几年内,除非大幅增加全球勘探与生产投资,不然行业将面临原油供应紧张的问题。

2. 加大研究和员工培训的投资

接下来,让我们来分析鼓励投资创新研究和以业绩推动技术发展的重要性。在勘探与生产行业,大部分研发硬件和软件技术都来自供应商。

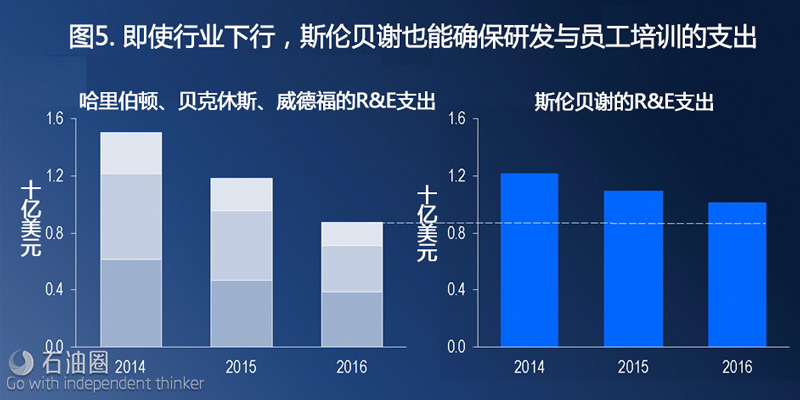

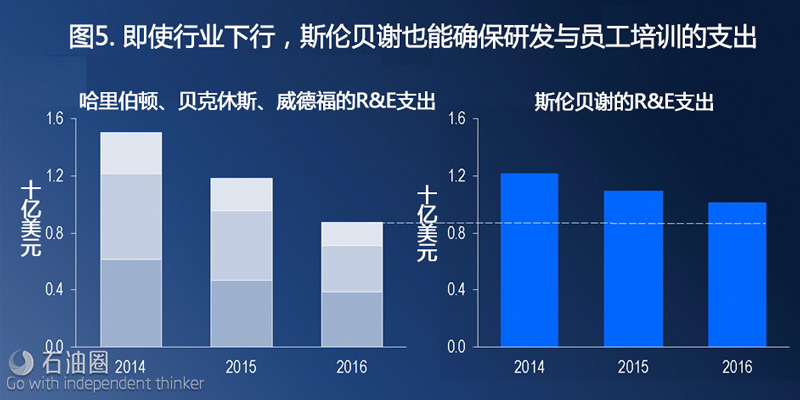

然而,受限于过去两年的现金流和成本压力,与2014年相比,斯伦贝谢2016年的投资水平下降了40%以上。

即使在行业下行周期内,我们承诺我们将尽最大努力保持我们的技术研究投资和员工培训不变。2016年,斯伦贝谢的研发和员工培训费用仍然接近10亿美元,这超过了我们三个竞争对手的研发投入总和(图5)。

在我们参与竞争的业务领域,我们一直采用开拓性的方法提高服务效果,我们持续投入资金进行产品和服务的研发创新,持续为客户提高项目绩效。在无须采用开拓性方法的业务领域,我们则将焦点转向不断满足更高的绩效标准上。

3. 探索新的商业模式

虽然许多油公司正在通过采取新的采购方式来应对当前的财务挑战,但也有一部分公司正在朝着相反的方向寻求突破,他们更加专注于技术合作,并扩大更密切的商业对接,探索新的商业模式。

我认为,当务之急是加强勘探开发作业公司与先进油服公司之间的业务合作。因此,我们需要与新的合作伙伴一起,建立纵向一体化战略的商业模式。我们要加大综合服务管理,利用我们全面的技术和专业知识来确保项目的质量安全和效率。

在过去15年中,我们开发了SPM,并逐步扩大了它的规模、复杂程度和数量,目前我们每天管理11个项目、约23.5万桶的石油生产,我们也拥有跨越世界各地的管道业务,同时,我们也开发了更多的创新模式,比如我们最近创建了一个特殊的风险基金,为客户提供项目投资的新途径。

通过这个新的风险投资基金,我们拓展了我们的产品业务,比如与Ophir和OneLNGSM的Fortuna项目、与Sound Energy的Tendrara项目,以及最近在Borr Drilling的投资(图6)。

4. 打造综合性的技术平台

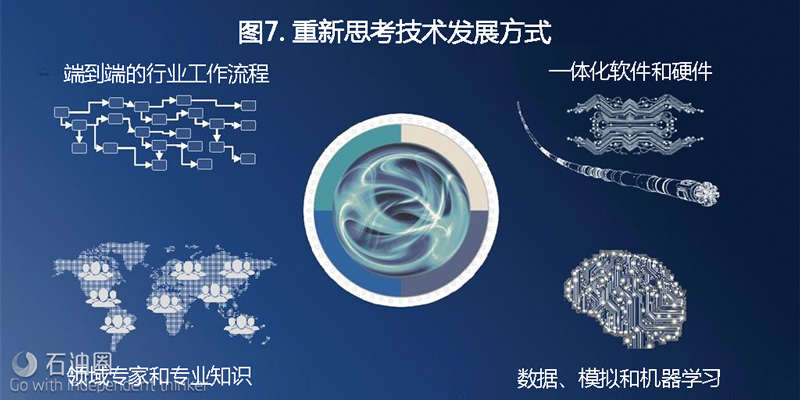

最后,打造更广泛和更综合性的技术平台。只有通过深刻反思当前的技术发展方式以及业务运营方式,我们才有可能实现这一目标。

首先,新的技术平台需要处理完整的行业工作流程,例如钻井的各个方面。综合性的技术解决方案还需要能识别和模拟整个工作流程中的每个流程每个任务,然后将其与所有可用数据一起整合到一个全新的技术平台上。

这不是一个简单的任务,深层知识,完整的软件和硬件所有权,数据分析、建模、高性能计算和最新的机器学习技术都是成功的关键(图7)。

如今,斯伦贝谢已经掌握了大部分技术手段,我们与Google和微软公司合作,将油田技术系统提升到一个新的水平。

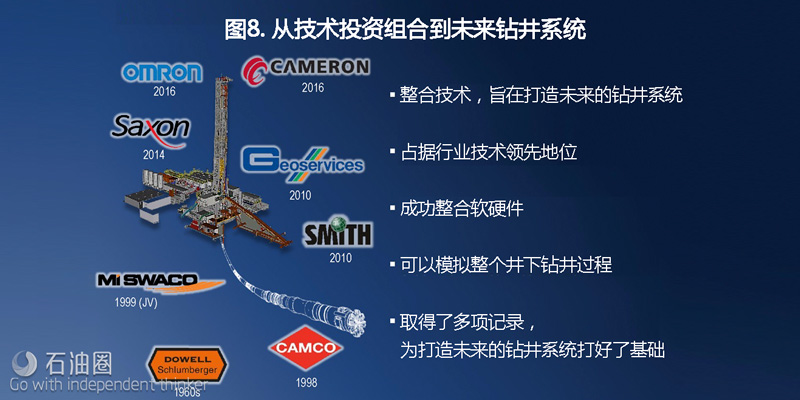

为了说明这一点,我想介绍一下在过去6-7年中我们如何建立钻井一体化,以及我们是如何使用这个业内领先的技术平台的。

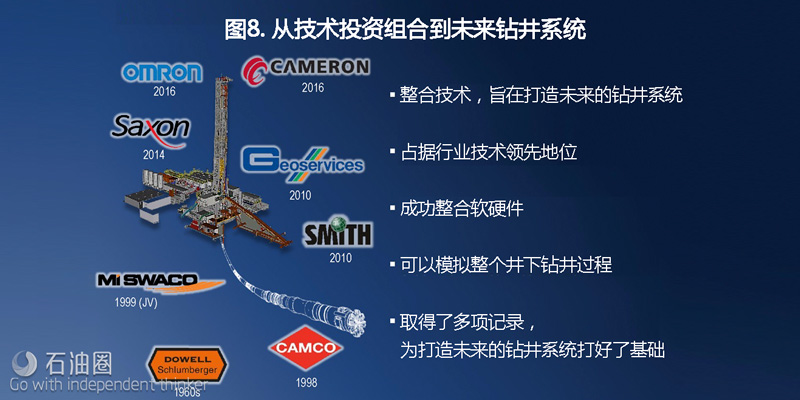

如图8所示,在20世纪60年代初,斯伦贝谢首次进入定向钻井领域,通过并购活动和有机研发投资相结合,一步步进行业务拓展。

2010年,通过收购Smith和Geoservices,我们进一步扩大了我们的井下钻井产品服务,这也使我们在钻头、钻井液、钻井工具和地面数据测量方面保持行业领先地位。

在北美陆地,就水力压裂和多级完井技术来说,合资公司一直占据着行业第一的位置。通过提供完整的井下硬件产品,我们开始利用数据和模拟技术来完成每年数百万英尺钻井的分析。另外,通过收购Cameron,我们拓展了在防喷器、管道处理等领域的业务。

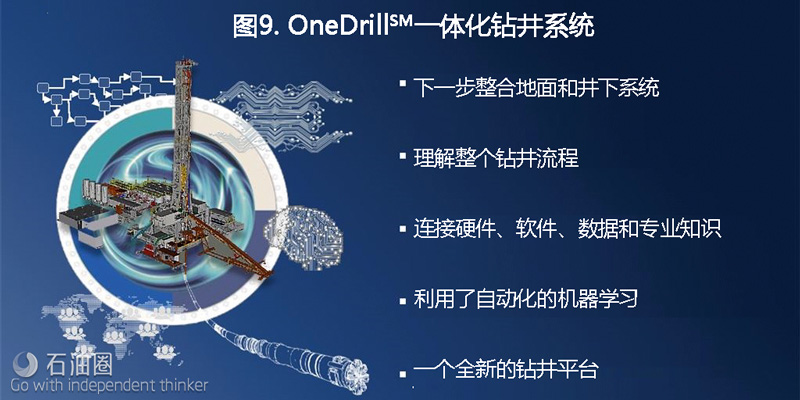

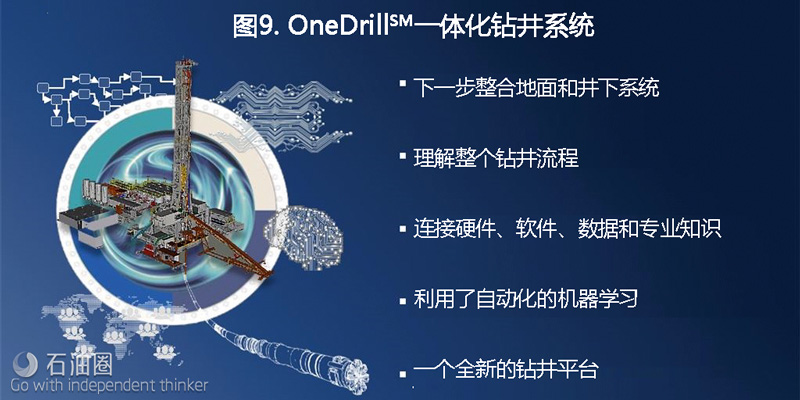

近来,越来越多的大数据分析和机器学习技术被用于业务的自动化,给钻井业务带来了新模式。比如,我们即将在今年下半年在美国大陆、沙特阿拉伯和厄瓜多尔市场推出OneDrillSM一体化钻井系统,就是运用新模式的典范(图9)。

在OneDrillSM一体化钻井系统发展的同时,我们也在基于与OneDrillSM相同原理的基础上开展了许多其他技术系统。最近,我们与Weatherford共同投资北美地区的一体化完井系统OneStimSM,将作为未来水力压裂和完井技术系统的孵化基地(图10)。

总之,整个行业目前需要更高的勘探和生产支出,需要投入更多的研发和员工培训费用,需要探索新的业务模式和更加综合性的技术平台。我认为以上四点是确保整个行业恢复其原有实力和提高公司核心竞争力的关键。斯伦贝谢将保持行业的领先地位,并为行业的发展做出自己的贡献。

到目前为止,我们已看到,2017年行业已经面临了一些挑战,特别是在国际市场上,季节性的勘探开发活动下降明显,新的投标定价压力也进一步加大,厄瓜多尔持续的财务问题对我们第一季度的业绩造成了负面影响。

不过我们仍然对斯伦贝谢的未来充满信心,对行业前景非常乐观,因为我们在认真分析目前的行业形势,并制定相应对策,积极解决。虽然前路充满了挑战,但这也为那些拥有新思路并勇于实践的公司带来了发展机会!

Let me start by thanking Scotia Howard Weil and Bill Sanchez in particular for the invitation to speak here today. I always enjoy coming back to New Orleans and participating in this conference.

This morning I will cover four topics that we believe are critical for the industry to restore its strength and advance its capabilities after one of the most devastating downturns on record.

First, is the need for higher E&P spending to meet growing hydrocarbon demand over the coming years.

Second, the need to protect and encourage continued investments in research and engineering (R&E) throughout the entire oil and gas value chain.

Third, the need for new business models that foster closer technical collaboration and commercial alignment between operators and the supplier industry.

And fourth, is the need for broader and more integrated technology platforms capable of delivering revolutionary improvements to system performance by replacing the fragmented and evolutionary technologies of today.

Over the past couple of years, I have spoken regularly about the importance of these subjects so in some ways today’s agenda items are not new. However, given the importance we put on these topics we are doing more than just talking about them. We continue to monitor the underlying industry trends relating to these topics and today I will share with you our latest analysis and what the implications are for Schlumberger.

We are also actively positioning Schlumberger in the forefront of these trends by responding to the ongoing pressures of commoditization and by actively expanding our opportunity set in a period where the industry in many ways lacks overall direction. In this respect I will also provide an update on what we are doing to navigate the challenging industry landscape by leveraging the size of our global footprint, the unique capabilities of our workforce, and most importantly the willingness and appetite we collectively have to think new and to act new.

But, before we begin let’s get the formalities out of the way.

Some of the statements I will make today are forward-looking. These statements are subject to risks and uncertainties that could cause our results to differ materially from those projected in these statements.

I therefore refer you to our latest 10-K and other SEC filings.

So let’s first discuss the need for higher E&P spending to meet the growing hydrocarbon demand.

Over the past year, we have maintained our constructive view of the oil market, which is supported by the fall in OECD oil stocks that began in July of 2016. At present OECD stocks are around 3 billion barrels as demand remains strong and supply has levelled off through a combination of lower oilfield activity and production cuts from both OPEC and key non-OPEC countries. The reporting agencies continue to increase their global demand growth estimates, which now stand between 1.0 and 1.5 million barrels per day for 2017 and the following years.

So far this year, Brent prices have oscillated between 50 and 55 dollars per barrel as the record OPEC production from the fourth quarter of last year works its way through the global distribution system, and as the market awaits the inventory impact from the recent production cuts.

At present the only region in the world showing clear signs of increased activity and investment compared to 2016 is North America land where E&P operators appear unconstrained by a sixth year of negative free cash flow.

Assuming the strong growth in North America land activity continues, US crude production is set to increase in 2017 and in the years to come, however, it is unlikely that North American unconventional production alone can address the emerging global supply deficit for the following three reasons:

First, the full-cycle financial viability outside the Tier 1 acreage continues to be challenging and the industry balance sheets and cash flows are attracting more focus from both lenders and private equity players.

Second, while the E&P operators rightfully state that break-even costs have come down significantly over the past couple of years, there is an impending cost inflation avalanche coming from the service industry, which continues to operate at unsustainable pricing levels. This inflation will ultimately end up in the financial results of the E&P operators.

Third, if the only source of global production growth in the coming years ends up being the ultra-light crude from North American unconventional basins like the Permian, this will likely create an oversupply of light oil and a shortage of the heavier crudes required for refinery blending.

This could result in a widening spread between Brent and WTI prices and potentially another financial headwind for the North America land operators.

Globally, we are at this stage expecting a third year of significant under-investment outside the Middle East, Russia, and North America land.

The 2017 E&P spend for this part of the global production base, which still makes up around 50 million barrels-per-day of production is expected to be down 50% compared to 2014. At no other time in the past 50 years has our industry experienced cuts of this magnitude and this duration.

While the market continues to focus on the headline numbers which suggest that production is holding-up well even in the third successive year of underinvestment, a closer look at the underlying data reveals that the current situation is not sustainable.

A complete picture of the sustainability of supply can only be established by analyzing the interplay between production rates reserves replacement and decline-and-depletion rates.

In summary, this morning I have covered four topics that we see as critical for the industry to restore its strength and advance its capabilities.

They are—the need for higher E&P spending, the need to protect investments in R&E, the need for new business models, and the need for broader and more integrated technology systems.

Against this backdrop, I have outlined how we are positioning Schlumberger to remain in the forefront of the evolving industry trends.

So far, 2017 has started with a number of challenges, in particular in the international markets, where a more severe seasonal reduction in activity, further pricing pressure on new tenders, and continued payment issues in Ecuador are negatively impacting our Q1 results.

However, we remain confident and optimistic about the future of Schlumberger as we continue to carefully navigate the current industry landscape, which remains very challenging but also presents significant opportunities to the players that are ready to think and act new.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈