Oil and gas professionals and the managers who hire them have very different expectations about how a recovery in the hard-hit industry will play out, according to a new survey.

Workers and hiring managers remain far apart on key issues, from anticipated salary levels to the incentives that will coax engineers back to the oil patch, according to the first Global Energy Talent Index produced by recruitment firm Airswift and Energy Jobline, an online job board.

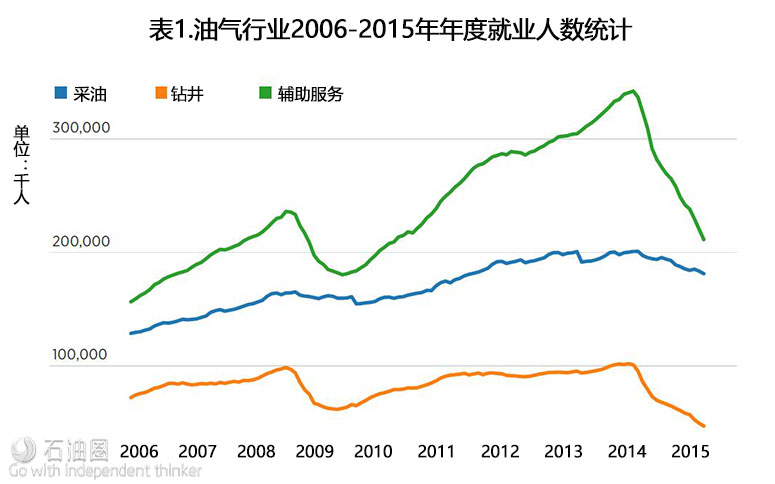

This gulf in expectations comes amid a widely anticipated labor shortage as a prolonged downturn has exacerbated problems with the industry’s demographics, which skew older. The slump has pushed many of the industry’s aging workers into retirement and soured engineering students on the oil and gas industry.

Some oil companies in the regions driving an early recovery in drilling activity report they are having a hard time finding labor.

“There will be, we believe, a more acute shortage than there’s ever been in any other upturn when it comes back,” Airswift CEO Peter Searle told CNBC.

That will have a “massive impact” on things like salaries and company benefits.

There is always some disconnect between hiring managers and candidates, according to Janette Marx, chief operating officer at Airswift. The questions facing oil and gas firms today are how wide that disconnect has grown and how important it will be to bridge the gap in the recovery.

“If hiring managers believe there’s an abundance of people out in the market, then they’re not going to change the way they recruit or the way they attract people, which will cause issues with the amount that they need to hire,” Marx told CNBC.

“If job seekers are thinking that their salaries should be at a certain level, yet the market’s paying something else, then it’s how long will they stay at their current job or stay unemployed for before they actually adapt to the current market?”

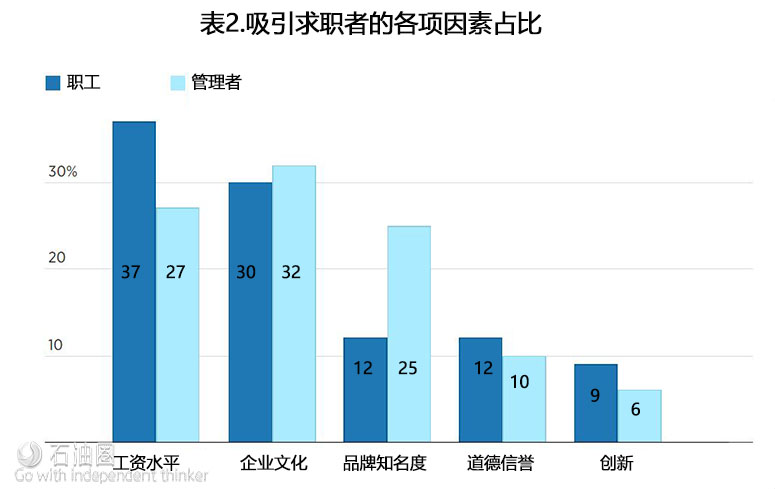

According to the survey, a quarter of hiring managers think brand recognition is integral to attracting employees, but just 12 percent of professionals say it’s important to them.

“When it actually comes down to it, there will be a war for talent and companies can’t just rely on who they are,” Searle said.

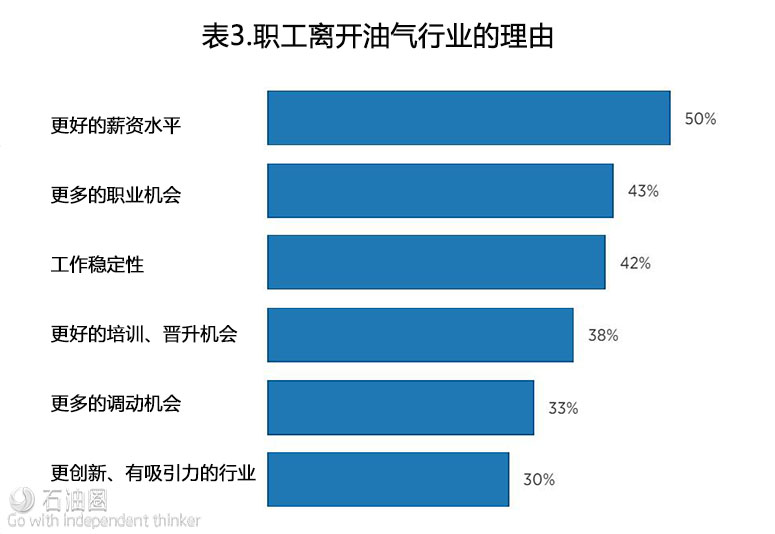

The top draw for workers is base salary, but managers appeared to underestimate how important this was. Job location, opportunities for professional development and the chance to work on challenging projects also ranked high among workers.

Syed Biabani worked for BP for 22 years, most recently as vice president for business development and licensing at BP Biofuels. He was laid off after BP determined that the second-generation ethanol fuel Biabani’s team was developing was no longer cost competitive in light of lower oil prices.

The right opportunity — one in which he is positioned to help change the world — could draw Biabani back to the energy sector, he said, but it would be a tough sell.

“Never say never, but I think generally it would take quite a bit for the oil and gas industry to take me back, because of the structural shifts that have occurred,” he said.

“Suddenly the world is different, but alternative energy is still very close to my heart.”

Biabani is now an investor and board member for big data start-up Zdaly, where he says he gets the intellectual stimulation he craves. He also has a new sense of freedom, he says, noting he was speaking to CNBC while shopping for plant supplies at Lowe’s, something he’d never be able to do midday while working at BP.

Biabani’s experience reflects some areas where workers and hiring managers are on the same page. Roughly a third of survey respondents in both groups view corporate culture as a draw. They were also roughly aligned on the capacity for a company to drive innovation and its ethical reputation.

There is other good news for energy firms looking to lure back laid-off workers: Nearly three-quarters of surveyed workers said they would return to their company.

Still, many are also looking for job security and would consider taking less pay in another sector that afforded them that peace of mind.

Workers are more optimistic about when the recovery will begin. Forty-four percent of professional respondents think the recovery will happen in the next 12 months, while just 31 percent of managers saw a rebound during the same period.

It could be a while before washed-out workers get an offer. Most hiring managers anticipate hiring fewer than 10 people in the next six months to 18 months.

One way managers plan to deal with the anticipated labor shortage is to recruit from outside the industry. More than 60 percent said they would do so.

“I think that stat surprised us because in the past, it was only oil and gas professionals that they would hire,” Marx said. “Now they’re saying and seeing that they’re going to have to expand their horizons and hire outside of the experienced typical oil and gas professional.”

That may be all the more necessary given another finding in the survey: The most attractive energy sector oil and gas workers were interested in transitioning to is renewables. There is ample opportunity in the quickly growing alternative energy space.

Global employment in renewable energy grew 5 percent to 8.1 million in 2015, according to the International Renewable Energy Agency.

Even though working in the renewable space is less financially rewarding, young people in particular see it as the growth sector within the energy industry, according to Searle. It also gives them an opportunity to work within an area of energy with less stigma than fossil fuel production, Marx added.

石油圈

石油圈