中等油价时代,国家石油公司(NOC)该如何重新出发,重新占据行业制高点?

来自 | EY

编译 | 白小明

1. 新兴经济体的NOC转型迫在眉睫

目前,持续增加的油气供应与疲软的全球石油需求冲突连连,造成全球油市供应过剩,油价已跌去了2014年峰值的近55%。近期OPEC与非OPEC产油国达成冻产协议,通过设定“地板价”,给原油市场打了一剂强心针,然而,当前我们依然看不到这一措施能够给油价的长期格局带来什么影响。

由于许多新兴经济体非常依赖石油收入,骤跌的油价造成了连锁反应,对政府预算、主权债务投资、经济发展刺激措施等产生了深远影响,更重要的是,对补贴支持和社会福利计划也将产生巨大影响。这将增加国家石油公司(NOC)的压力,也将逐渐改变NOC与国家(其主要股东)之间的本质关系。

(新兴经济体,是指某一国家或地区经济蓬勃发展,成为新兴的经济实体。目前并没有一个准确的定义。英国《经济学家》将新兴经济体分成两个梯队:第一梯队为中国、巴西、印度和俄罗斯、南非,也称“金砖国家”;第二梯队包括墨西哥、韩国、南非、菲律宾、土耳其、印度尼西亚、埃及等“新钻”国家。)

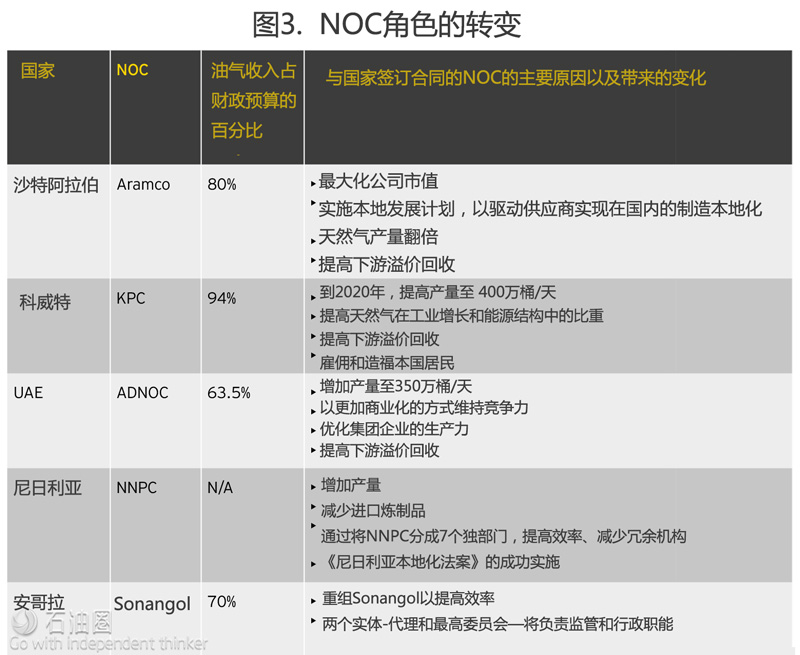

那么改变这种“与国家签订合同”的方式将如何影响国家石油公司(NOC),以及随后将对整个油气行业产生什么样的影响呢?

其次,在当今这个被称为石油经济没落的时代,随着合同的改变,政府想要从NOC那里获得什么,以实现可持续的收入来平衡国家财政?对于严重依赖石油收入的大多数新兴经济体,疲软的油价已使其财政收入大幅下降,大大减缓了其投资经济建设的能力。

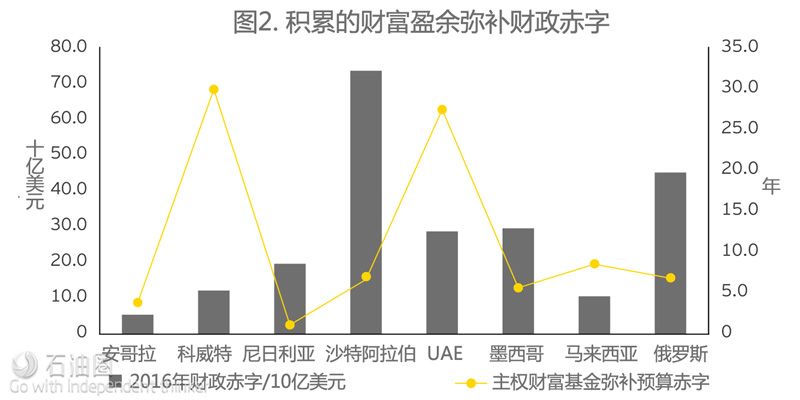

由于采取了紧缩政策,与前些年相比,大多数中东和北非国家的支出水平总体下降了一些,但其财务损益平衡价格仍然普遍高于油价,这就导致许多国家预算仍出现赤字。虽然一些国家已经使用了在油价高涨时期存下的政府储蓄,但如果在接下来的几年里,油价持续低迷,这种做法面临的困难将越来越多。

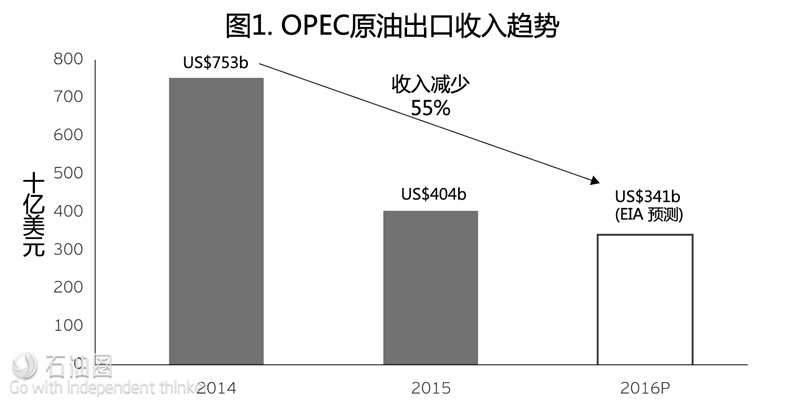

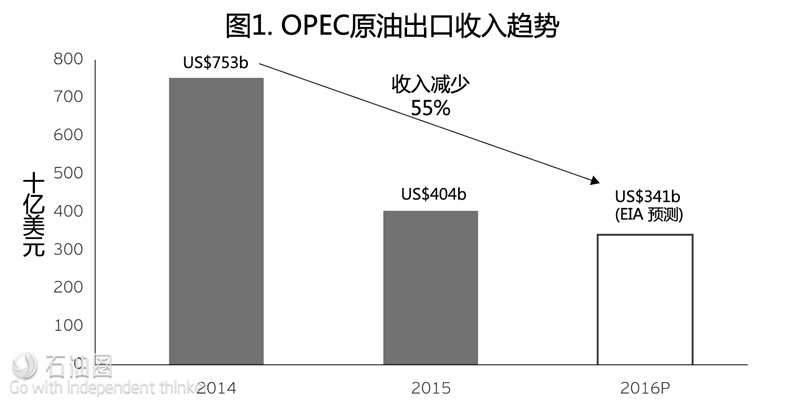

由图1可知,EIA曾预测,OPEC成员国年度石油出口收入连续减少3年,到2016年为3410亿美元(未按通货膨胀调整)。这一数据比2015年减少16%,处于过去10年的最低位。2015年的经常账户赤字达到近20年来的新高1000亿美元,而2014年则盈余2380亿美元。

从全球范围看,尤其是那些高度依赖油气资源经济体的NOC,急需制定长期计划,以履行其对国家的义务,计划的内容要远远超越短期的战略对策。同时,这些NOC的经营方式、组织架构,以及其对国家的贡献也在发生变化;这一转变如此深远,几乎与过去数十年国有化过程差不多,目前正处在其历史的决定性时期。

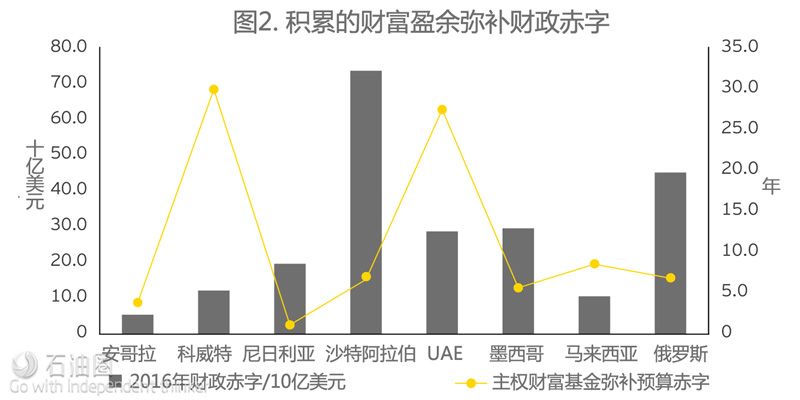

图2展示了某些国家在弥补赤字方面的弱点,这其中的一些国家正积极试图从IMF和世界银行获得贷款。这也引起大家对其他一些国家可能出现弥补赤字困难的关注,因为油价可能需要更长的时间方能重上70美元/桶的水平。

因此,需要采取更优的战略,引入国家预算本身,大幅改变高成本的补贴计划,可能还要改变NOC的核心功能。

沙特的《愿景2030》,便是这些改变如何影响NOC以及高度依赖石油国家的典型案例。沙特的财政储备预计可以弥补6年的赤字,而持续出现的收入差额,已迫使沙特积极涉足国际债券市场以增加债务来弥补部分赤字,并取得了一定成效。

2. NOC扮演的角色–“与国家签订合同”

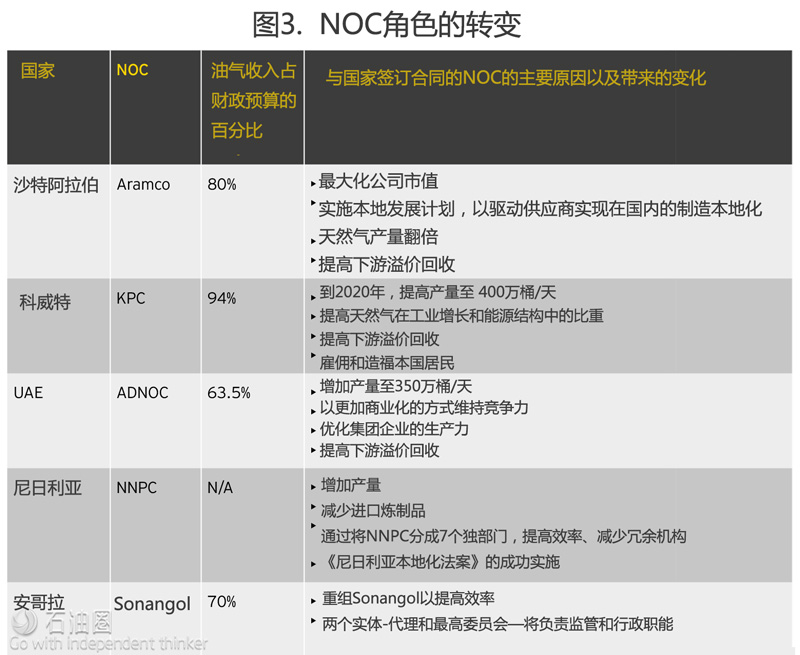

NOC是全球油气市场的主要参与者,拥有全球58%的油气储量和56%的产量。他们通常在新兴市场经济体扮演主角,管理着国家的资源开发和能源安全。从NOC定义可以看出,油气驱动经济的繁荣,得益于国家的油气资产货币化的效率,其油气收入占其国家的总收入贡献比率较高。

然而,NOC的角色远不止这些,根据国家不同,他们可以是政策制定者、监管者、贸易实体或者同时兼有这些角色。

另外,在许多新兴油气驱动市场,NOC也作为经济和社会发展的引擎,承担着一些显性和隐性的责任,如国家基础设施发展和社会福利计划。例如,哈萨克斯坦国家石油公司(KMG),已经在努力使国家融入到全球经济,确保公司的扩张和发展能够转化为国家总体经济的增长。

NOC没有标准的角色和功能,它们作为主要的创收者、雇主、投资者,其政治、社会和经济重要性已经随着时间,与最初和政府签订的合同内容相比,其业务领域有所拓展延伸,功能超越了单纯的油气生产,其政治、社会和经济重要性已大大提高。

在对石油收入依赖性较低的国家,NOC将着眼于优化多元化的经济体。但对于高度依赖石油收入国家的NOC,情况大不相同。

这些国家面临着更多的威胁,首先是油价的持续下跌,导致其石油收入减少了2014年的一半还多;其次是替代能源需求增长比较缓慢,将把到达石油峰值时代的时间延长至25年以内。在这种情况下,有必要采取更加开放的政策,重新定义NOC的角色和功能。

另外,不管对石油的依赖程度高低,我们有必要将NOC更多地定义为“国家公司”,而非“国家石油公司”。

从这个角度来说,国家石油公司的投资策略需要更多地考虑经济的多元化,同时考虑维持和增加油气产量。

例如,一些NOC积极投资太阳能来生产蒸汽,然后注入到油井,提高产量,而不是采用高价的天然气来火烧油层提高产量,天然气则可以用于制造附加值更高的产品。

也可以通过进口天然气(甚至是太阳能)和出口原油,来满足国内长期的能源需求。额外的收入可以重新投资到非石油的商业机构,这些企业一旦成立后即脱离母公司,以提高国内生产总值(GDP)。

“国家公司”的目标是最大化其国内投资和合同战略的协同效应。如此,通过积极发展多种经济,增加税收收入,可以帮助NOC以不同的方式履行与国家间的合同。从这个角度来说,在这个石油经济可能没落的时代,通过举债或股本融资不大可能实现可持续的新的预算平衡。

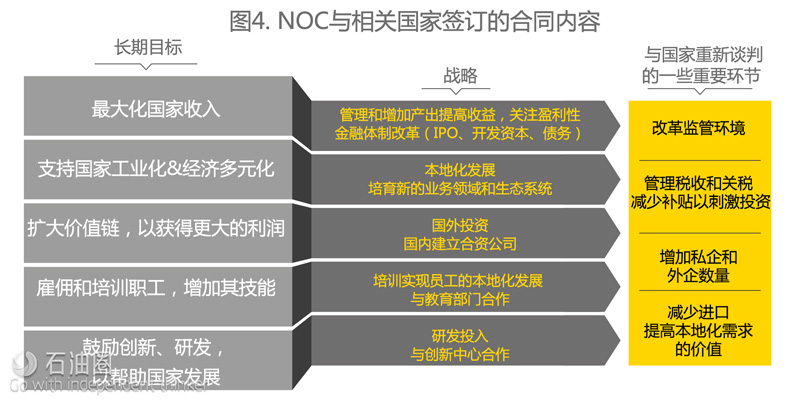

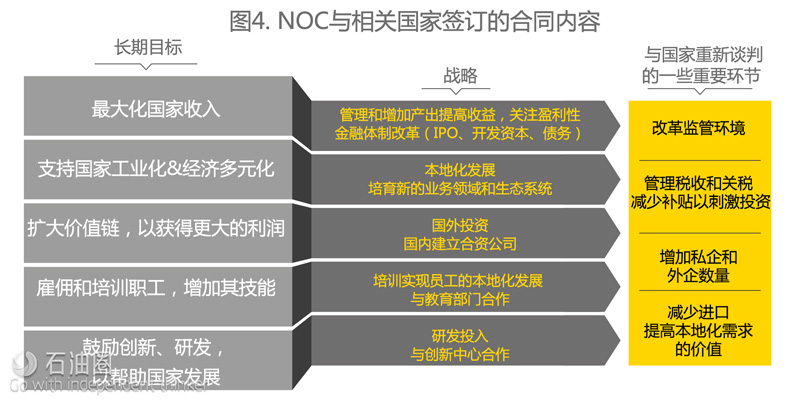

图4展示了一个考虑了NOC义务和一些关键要素的框架,随着“与国家签订的新合同”的敲定,这些内容需要讨论和重新协商。在新油价环境下,为了维持稳定和发展,当前的工作重点在于NOC面临的期望。我们把对NOC的期望视作新的“财务责任”制度,其中清晰地强调了NOC的盈利性和收入的质量。

3. NOC及未来的财务责任

低油价导致许多新兴市场国家采取了财务紧缩措施。尽管采取了措施,但持续的低油价将使这些国家的财政平衡变得脆弱。许多国家艰难地采取了一些应对措施,当然这也是其应尽的财务责任,例如:

1. 减少甚至取消对燃料和能源价格的补贴

2. 降低各级别政府雇员的工资

3. 削减投资开支

4. 短期实现油气产量的最大化,以部分抵消低油价带来的损失

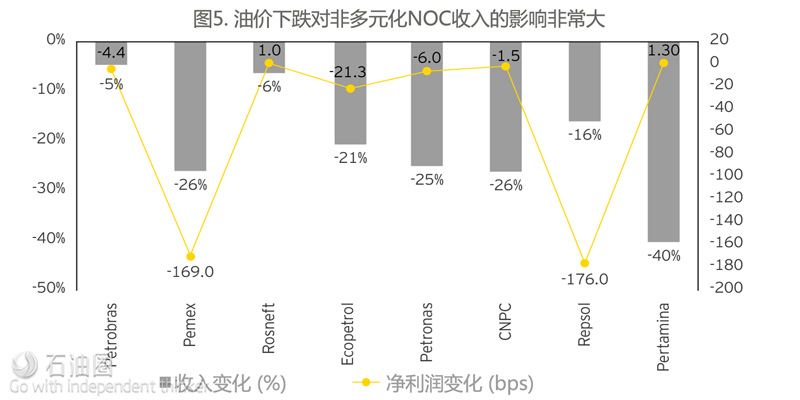

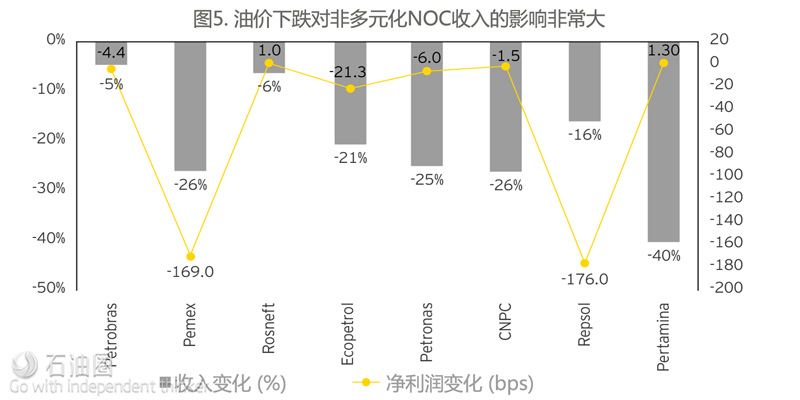

全球范围的油价大跌,使高度依赖石油的新兴经济体的收入和税收大幅缩水,并带来了巨大的预算压力,尤其是仅靠NOC收入、多元化发展较弱的国家受油价下跌影响更大。

我们看到许多政府前所未有地考虑部分私有化或将NOC上市,以增加资本,寻求提高资本充足率和项目融资的方式。

(资本充足率是一个银行的资本总额对其风险加权资产的比率。国家调控者跟踪一个银行的CAR来保证银行可以化解吸收一定量的风险。资本充足率是保证银行等金融机构正常运营和发展所必需的资本比率。各国金融管理当局一般都有对商业银行资本充足率的管制,目的是监测银行抵御风险的能力。资本充足率有不同的口径,主要比率有资本对存款的比率、资本对负债的比率、资本对总资产的比率、资本对风险资产的比率等。)

经济的多元化水平,以及油气行业对国家GDP的相对贡献率,是所要采取紧急行动的关键。

4. 重新定义NOC的战略:“从体量到价值”的转型

当桶油成本降至低于2014年峰值时,NOC很快意识到,他们需要转变发展模式,从一味扩张转型为提高公司核心竞争力上。

NOC通常专注于公司规模和项目预算,而将资本动用程度及已动用资本的使用效果,作为次要考虑因素。在当前融资困难的大环境下,NOC需要将工作重点放在最大化资产的可持续价值上,换句话说,就是花小钱办大事。虽然从扩大规模到提高价值的转变对国际石油公司(IOC)来说并不是一个新概念,但对于国家石油公司(NOC)来说,却是最近才提的比较多的概念。

虽然可以从不同的角度来衡量NOC的企业价值,但从常见的财务角度来说,它是指一个企业产生的现金流的质量,以及能够获得的资本收益。

企业价值仅仅是资金平衡等式的一部分,包括NOC能够为自己的国家增加的价值,以及这些价值如何再投资到国家的财富再分配、创造就业、基础设施等。

例如,如果沙特阿美石油公司顺利通过IPO,那么他就可以实现价值收益的最大化,这也会让它成为近年来采纳这种理念的最大受益者。

虽然每家NOC有自己特定的问题,但大多数NOC普遍遇到的问题是资金限制的现实性,以及NOC“商业化”其业务的紧迫性。在这种情况下,NOC不得不探索新的运营模式:

1. 聚焦于提高商业灵活性,涵盖企业运营涉及到的整个产业链的部门

2. 确保做出的决定,能够最大限度、可持续地从整个生态体系中获得收益

由CFO领导的财务部门,由COO或者固定资产负责人领导的运营部门,也将经历巨大变动。如图7所示,对CFO的预期包括提高业务的商业性。CFO,以及大部分财务部门需要积极与业务部门合作,确保资金的分配是最优的,以提高关键业绩指标如ROCE和ROI。另外,越来越有必要在整个业务范围考虑核心业务对EBIT的影响。

同时,COO以及核心资产运营部门,需要在整个资产团队范围,在考虑运营可靠性的同时考虑利润/损失(P/L)理念,以完善运营价值方程。

NOC只有全面协调发展,如通过建立卓越投资和卓越运营的文化,以及通过打破整个价值链上的传统束缚,才有能力以最佳的效率,实现最大化收益的目标。

为了解决这些问题,NOC,特别是中东和北非的NOC,成立了新的投资委员会,其主要任务在于以极高的效率,在整个商业活动中分配资金。这一举措带来的最具影响力的结果之一,是通过如下方式,专注于CAPEX组合:

1. 发现并取消没有经济效益的项目

2. 重新定位,重新分类项目,以寻求如何利用协同效应开展业务

3. 在整个投资组合中,减少重复投资

随着投资预算的减少,不同项目类型间以及同一类型不同项目间的选择机会更少了,需要一个完善的、一致的价值评价基础。

简单来说,虽然对于NOC,其最普遍的价值标准通常是其能产生的净现金流,然而,收益质量将重新定义其真正价值。

NOC只有成功实现企业价值最大化,以及对国家贡献的最大化,才能将卓越投资和卓越运营成功融入到其文化中。

5. 探索NOC转型之路

总的来说,NOC转型之路已经显而易见。随着向“商业型NOC”的方向发展,未来数年将是NOC转型的关键时期,他们需要全面着手公司的资本改革。

然而,行业改革并非易事。对于有能力最大化其收益质量和对国家贡献的NOC来说,如果未来想取得成功,需要深度理解和践行图8的内容。

NOC必须改变其与政府的关系,以求在全球油气市场和其政府内保持关键角色。通过改变来最大化利润和提高资金效率,NOC方可保全自身,并在这个原油供应过剩的时代取得发展,但要摆脱石油,想必还有非常远的路要走。

From volume to value: the transformation of National Oil Companies

The unfortunate convergence of increasing oil supply and weakening global demand has created an oversupplied market and caused a sharp and sustained decline in international crude oil prices. From its last peak in June 2014, crude oil prices have declined by over 55% during the last thirty months. The recent agreement between OPEC and non-OPEC producers to cut output has provided much needed reprieve to the oil market by setting a floor price. However, we do not see that this

development will change our outlook of longer-term low prices.

For many emerging economies heavily dependent on oil revenue, the dramatic fall in prices has unleashed a chain reaction with far-reaching consequences on government budgets, sovereign investment, economic development How is changing the nature of this “contract with the State” impacting the NOC, and what ensuing repercussions may this have on the oil and gas industry?

Secondly, what changes in the contract would the NOC need from the State to set in place an equation that enables a sustainable return to equilibrium for national finances, in what is generally agreed to be the twilight era for the oil economy?

Weak oil prices have led to a decline in current account balances and, for the majority of emerging economies dependent on oil revenues, have caused a significant slowdown in their ability to fund economic activity. Despite putting in place some austerity measures, and an overall decline in spending from previous years’ level(s), the fiscal break-even prices for the majority of Middle Eastern and North African countries is still higher than the prevailing oil price, causing deficits for many national budgets. While some countries have used the cushion available from the government reserve surplus accumulated during the boom years, this option becomes ever more challenging when the oil price outlook remains weak for the next few years.

The OPEC member countries’ annual oil export revenues are estimated to decline for the third consecutive year to US$341 billion (not adjusted for inflation) in 2016. This is 34% lower than the 2015 revenues, and nearly one fourth of the 2012 levels, and notably the lowest in the past 10 years. This constituency has recorded a joint current account deficit of nearly US$100 billion in 2015 (the first time in nearly two decades), down from a US$238 billion surplus in 2014.

As a result, a more expansive strategy is required, bringing into play the national budget itself, major changes to costly subsidy programs, and potentially also the core function of the NOC. A good example of the extent of change impacting NOCs and hydrocarbondependent economies is highlighted in Saudi Arabia’s Vision 2030. The country’s fiscal reserves are estimated to provide cover for over six years and the ongoing shortfall in revenue has resulted in Saudi Arabia actively, and successfully, tapping into the international bond market to raise debt to cover part of the deficit.

There is an urgent need for NOCs around the world — particularly in heavily dependent hydrocarbon economies — to formulate a long-term plan to fulfill their obligations to the State, over and beyond short-term tactical responses.

The manner in which these NOCs are operating, their structures, and their contributions to the State, are simultaneously changing; a transformation so profound that it stands next to the nationalizations of decades past as the most defining moments of their respective histories.

NOCs are major players in the global oil and gas industry, accounting for 58% of global reserves and 56% of production. They often play a leading role in emerging market economies, and are normally called to be the custodians of a nation’s resource development and energy security. By definition, the hydrocarbon-driven economy prospers by the efficiency with which the country’s oil and gas assets are monetized, and the proceeds of which contribute significant proportions of the State’s revenue. However, the NOCs role rarely stops there, and depending on their home country, they may also be policy makers, regulators, trading commercial entities or a combination of such functions. They fulfill their government mandates, through a diversified group of structures along the entire hydrocarbon value chain, in various manners, including partnerships with foreign oil and gas companies, local partners or in government-to-government (G2G) cooperation agreements.

Moreover, in many hydrocarbondriven emerging markets, NOCs also act as engines of economic and social development and have explicit or implicit duties such as national infrastructure development and social welfare programs. KazMunayGas (KMG), the NOC of Kazakhstan for instance, has been tasked with integrating the country into the world economy and making sure that the company’s growth and development translates into more general economic growth for the country.

At the lower dependency end of the oil revenue continuum, NOCs will be looking to optimize around sustainable economic value. But for NOCs whose governments have very high reliance on oil revenue, the situation is very different. These governments face a more existential level of threat, firstly from the continuation of an oil price that yields less than half of its 2014 revenue, and secondly from the tangible growth of energy alternatives Country NOC % of revenue from oil and gas to the fiscal budget Key drivers and changes in NOCs contract with the state Saudi Arabia Aramco 80%

• Maximization of value in company listing

• Local content program to drive suppliers to have localized manufacturing in kingdom

• Double natural gas production

• Increase of downstream value capture Kuwait KPC 94% • Increase output to 4 mb/d by 2020

• Delivery of natural gas for industrial growth and energy mix

• Increase of downstream value capture

• Employment and development of Nationals UAE ADNOC 63.5% • Increase output by 3.5 mb/d

• Maintain competitive edge by being commercially driven

• Improve productivity across group businesses

• Increase of downstream value capture Nigeria NNPC N/A • Increase output

• Reduce import of refined products

• Increase efficiency and reducing bureaucracy by splitting NNPC to into seven independent units

• Successful implementation of Nigeria Content Act Angola Sonangol 70% • Restructuring of Sonangol to drive efficiency

• Two new entities — the Agency and the Superior Council —will be responsible for regulation and administration.

In this context, it is likely to be necessary to adopt a more expansive policy and to redefine the role and function of the NOC. Further along the continuum between low and high levels of dependency, it may be necessary to start thinking of NOCs less as a ‘National Oil Company’, and more in terms of them being a ‘National Company’. In such a role, a National Company’s investment strategy needs to be pushing greater economic diversity alongside maintaining or increasing production. For example, some NOCs are actively investing in solar power to generate steam for injection into the oilfields instead of burning valuable natural gas which can be channelled for manufacture of higher value added products. It may also make longer term sense to satisfy more domestic energy demand through gas imports (or even solar) and to export more crude. The additional revenue can then be reinvested in related, but non-oil, commercial ventures that are then spunoff once established in order to grow gross domestic product (GDP). The aim for a ‘National Company’ would be to maximize the multiplier effect of its domestic investments and contracting strategy. In this way, it help to fulfil the contract with the state in a different way, by actively growing the wider economy (and resulting tax revenues). At this end of the continuum, debt or equity financing is unlikely to represent a path to a sustainable new budget equilibrium in what may prove to be the twilight era the oil economy. A framework that takes into account both NOC obligations and critical elements for discussion/re-negotiation as the“new contract with the State” is set out in Figure 4.

The immediate focus is on the expectations faced by the NOC, to sustain and grow in this new era of oil price environment. We identify this (critical) expectation on the NOC as the new “fiscal responsibility” regime, which places a clear emphasis on profitability and quality of earnings.

To conclude, the case for NOC transformation is clear. The coming years will be defining for the NOCs as they progress to become “commercial NOCs”, fully embracing the need to embark on the capital transformation. Industry transformations are never simple. For an NOC to be able to maximize the quality of its earnings and contribution to the State, many aspects critical for the successful NOC of the future will need to be understood and addressed, which are included in Figure 8.

NOCs must change the way they relate to their government in order to maintain their critical roles within the global oil and gas market and within their governments. By implementing changes that maximize their margins and increase capital efficiency, NOCs will position themselves for survival and growth through this new era of abundance.

The NOC has a well-structured contract with the state and the oil and gas regulator, which enables the entity to allocate capital that will enhance its long-term value and produce quality of earnings.

Balancing national versus commercial objectives The evolution of the NOC serves as a key contributor of the country’s GDP while fulfilling both national objectives and the profitability expectations of key stakeholders of the entity.

Internationalization The NOC creates a significant international presence with investments in major high-growth-potential markets. Funding It has a combination of external commercial finance, equity investors and free cash flow from operations.

Enabling technology The NOC uses cutting-edge technology and digital solutions to improve efficiency and productivity that helps it retain status as one of the low-cost producers.

The NOC is fully integrated to capture and maximize income in the entire oil and gas value chain.

People, capabilities and skills development The transformed NOC has well-developed centers of excellence in key locations, and its staff are able to conduct market-leading training programs.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈