As crude oil prices remained above the $50 per barrel mark for most of December, the oilfield services industry seems to have entered the year 2017 with a lot of optimism.With more than a 25% decline in the global spending in each of the last two years, the anticipated recovery in commodity prices is likely to draw in higher capital investment, and in turn boost the demand for drilling and exploration activities in the coming quarters. Further, the positive outlook has resulted in a sharp rise in merger and acquisitions in the oilfield services sector, as companies plan to consolidate their operations to benefit from the likely end of the prolonged oil slump.

In line with this trend, Schlumberger, the world’s largest oilfield services company, had completed the acquisition of Cameron International Corporation (NYSE: CAM), an oilfield equipment maker, in April of last year. The deal was aimed at integrating Schlumberger’s reservoir and well engineering and digital mapping technologies, with Cameron’s surface, drilling, processing, and flow control technologies, and bundle them together to offer an integrated “pore-to-pipeline” product to the global oil and gas industry.In short, the primary objective of the deal was to further strengthen Schlumberger’s leading position in the oilfield services industry. However, the Baker Hughes-GE (oil and gas operations only) deal announced in the last quarter of 2016 is being viewed as a severe threat to Schlumberger’s industry leader position. Here’s why we think otherwise:

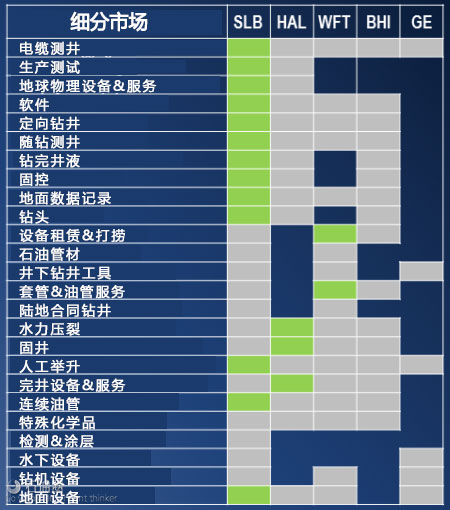

Strong Presence In Majority Of Markets

Being the largest oilfield services company, Schlumberger has a significant presence in a majority of the segments of the industry, through 19 technology product lines split among four groups. With its consistent planning and execution over the years, the company has expanded its presence in a number of segments and currently holds a leading position in 13 out of the 25 oilfield services markets that it operates in.

Besides, in the segments where it does not have the market leader title yet, the Houston-based company has worked out strategies to secure the top position through its focused acquisitions, technical expertise, and human talent. For instance, since its merger with Cameron, Schlumberger’s addressable market has increased by almost 45%, which is slightly less than double of that of its closest rival.

Further, being a leader in a majority of its markets, Schlumberger holds a strong pricing power and a large scope of negotiation with its clients, which is viewed as a striking lead over its competitors.For instance, the company managed to attract lucrative deals from its customers even in the weak price environment, when its peers, such as Halliburton and Baker Hughes, were struggling to win any new contracts.Thus, we believe that with a notable presence in a majority of the oilfield services segments and unbeatable pricing edge, it is difficult for Schlumberger’s counterparts to catch up with its performance, at least in the short term.

First Mover Advantage In Growth Markets

Schlumberger not only holds a large presence in the established markets of the industry, but also has a dominant holding in some of growth segments. For instance, the Subsea systems market is considered to be growth segment with a very promising upside potential. As the demand for deepwater market increased, the need for Subsea systems used to measure and boost the flow of oil and gas emerged.In order to tap into this market, Schlumberger formed “OneSubsea” with Cameron as its partner in 2013.Since then, the company’s market share in the Subsea market has grown from around 20% in 2014 to around 45% at present.

Since none of Schlumberger’s closest competitors have a presence in this segment, the company dominates the Subsea market, too. Yet, the only threat that the company has in this segment is from General Electric‘s oil and gas operations, which will soon be merged with Baker Hughes, to form a mammoth company, “New Baker Hughes,” with a pro-forma revenue of approximately $32 billion.That said, GE owns a fairly small share of the market, which should not be a reason of worry for Schlumberger and its investors in the foreseeable future. Apart from the Subsea market, Schlumberger also holds a remarkable position in some of the other growth segments, such as Artificial Lift market, which can provide the company a first mover advantage over its peers.

Exceptional Operation Performance Even In The Commodity Downturn

In addition to holding a market leading position in majority of its markets, Schlumberger has continued to hold up well in the current commodity down cycle.

The oilfield contractor has generated industry leading margins and returns over the last few quarters despite the plummeting commodity prices, reinforcing the strong track record of the company’s management.

Although its profitability and cash flows deteriorated over the last two years, the company reported improvement in its results in the third quarter on the back of the initial recovery in oil prices.

Moreover, with the Organization of Petroleum Exporting Countries’ decision to cut production by 1.2 million barrels of oil per day (Mbpd), the company’s stock recovered sharply and ended the year more than 20% higher compared to the start of the year.The move to cut oil supply has drastically improved the outlook for the commodity markets, resulting in a sharp rise in the global oil and gas rig count. With a more optimistic outlook for the coming quarters, coupled with Schlumberger’s solid technical and execution skills, we expect the company to continue to be an industry leader in the year 2017. While the Baker Hughes-GE deal may change the dynamics of the oilfield service industry to some extent, Schlumberger is in a strong position to continue to outperform its rivals.

石油圈

石油圈