“高塔林立、豪车遍地”的中东最大产油国——沙特一直蒙着一层神秘的面纱,其经济状况一直备受外界瞩目。近期,沙特财政部公布了该国2017年财政预算报告,该报告将为我们呈现一个怎样的沙特?这个全球最大产油国能否在这场油气动荡中全身而退?

作者 | Tyler Durden

编译 | 王洋 徐文凤

2014至2016年油价暴跌,史无前例的预算缩水令沙特阿拉伯的经济几乎停滞,更遑论拖欠的数十亿劳工工资。这状况一直持续到沙特首次大规模向国际投资者发行国债,获得融资,以缓解国家迫在眉睫的现金需求。近期,沙特阿拉伯公布了明年的预算前景。

沙特财政前景如何?

沙特认为,即使明年支出增加,国家预算赤字仍将小幅下降,但其仍占GDP比重的7.7%。这间接表明,即使有一些乐观的油价假设,沙特的“烧钱”行为仍将持续。

近期,沙特财政部在其网站上发表声明称,该国2015-2016年预算赤字分别为3620亿里亚尔和2970亿里亚尔(占GDP的11.5%),而2017年有望下滑33%至1980亿里亚尔,即530亿美元,占GDP比重7.7%。

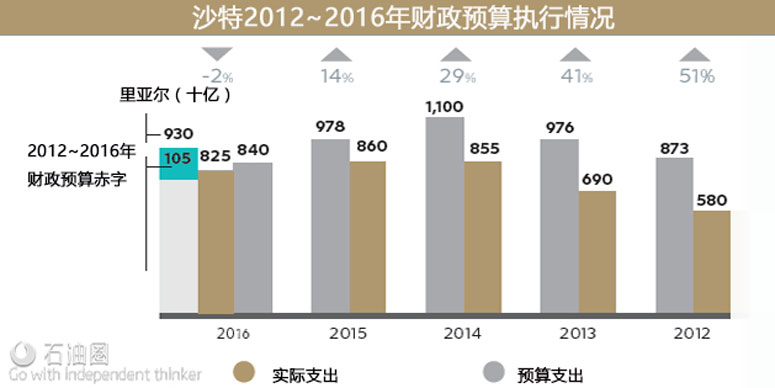

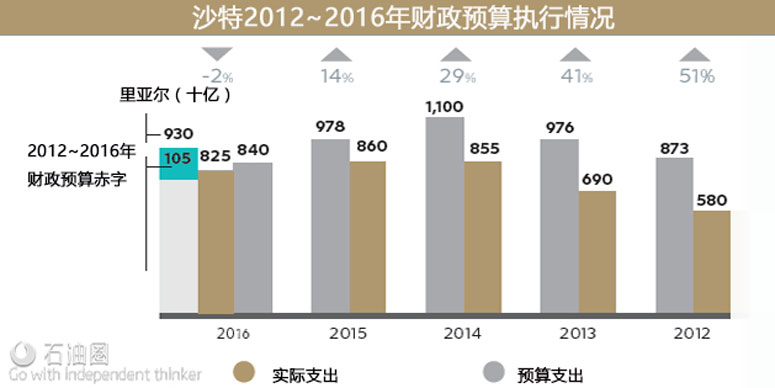

财政部表示,沙特2016年财政支出为8250亿里亚尔,低于预算8400亿里亚尔,而2017年预算支出为8900亿里亚尔,较2016年多8%;其中最大支出仍是教育业,达2000亿里亚尔;其次是军事,预算达1910亿里亚尔。2017年,沙特预算收入6920亿里亚尔,其中石油收入占总收入的2/3,达4800亿里亚尔,,其余2120亿来源于非石油行业收入。以上预算支出与收入差值即为2017年预算赤字——1980亿里亚尔。

2019年油价将达65美元/桶?

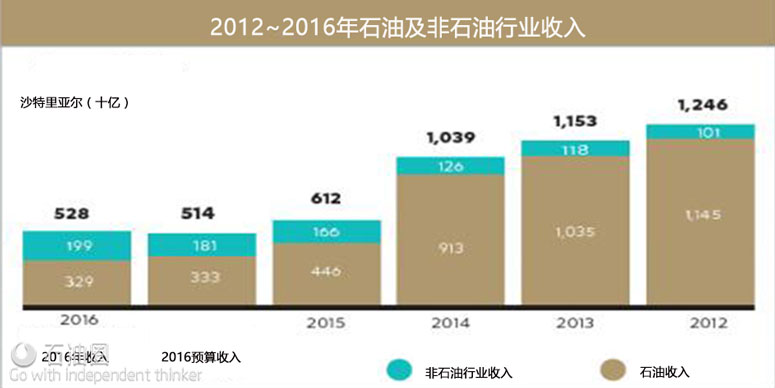

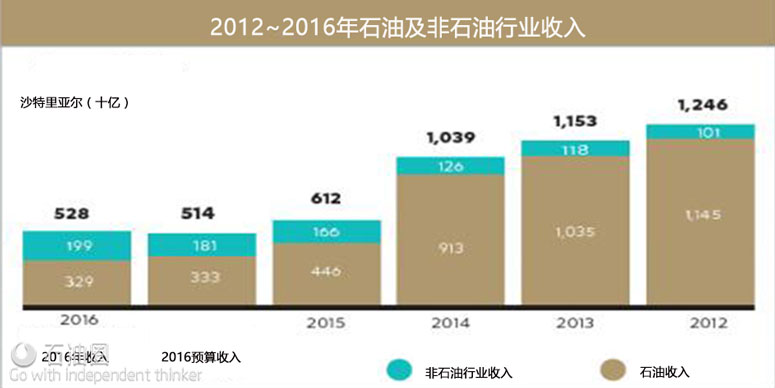

2012-2016年沙特财政总收入断崖式缩减,人们心如死灰的同时,逐年递减的沙特石油收入更是差强人意,如下表所示。

沙特财政部在声明中称,沙特期望2016年石油收入能上涨3.37%,其中炼油收入能增长14.78%。沙特政府称其会评估补贴措施,并对水电、石油产品等补贴系统进行调整,旨在于未来五年实现能源高效利用、保护自然资源、保障中产或低收入公民权益、创办有竞争力商业部门的计划。

沙特政府预计在2020年实现预算平衡。虽然2016年的预算赤字比政府最初估计的低9%,但是IMF(国际货币基金组织)预测,2017年沙特预算赤字将达到该国GDP比重的9.25%。

沙特预测2017年全球GDP总值有望增速3.4%,推动原油需求增长1.1%,至9530万桶/天,带动油价均价升至50.6美元/桶。

据沙特电视台Arabiya报道,尽管未体现在实际预算中,但沙特对2017-2019年油价分别进行了“基本”预测和保守预测。保守预测,2017-2019年油价主要在49-55美元/桶间浮动,而“基本”预测表示,2017年油价有望达55美元/桶,在2019年预计达65美元/桶。

债务飙升 沙特怎么办?

如果沙特估计有误,那么沙特债务危机将全面爆发,同时会推动沙特累计债务水平继续飙升。

正如彭博社指出,全球最大石油出口国即将面临自油价暴跌以来的首次财政危机。对此,今年该国实施了一系列紧缩措施,包括降低能源和水补贴、提高签证费及削减公职人员实得工资等。

沙特阿拉伯副王储Mohammed bin Salman曾公布过名为“沙特愿景2030”的改革计划,旨在减少沙特对原油的依赖。该经济改革涉及教育和卫生医疗等领域,十分贴近百姓生活。

若该计划得以实施,预计2030年沙特将实现GDP翻一番,家庭收入提高60%,新增就业岗位600万个。麦肯锡表示,实施沙特转型计划需4万亿美元的投资,采矿、石化、制造业、批发零售业、旅游、建筑、金融和医疗卫生这8个领域极具发展潜力,其对未来国家经济增长的贡献率有望超过60%。

这也解释了为何沙特要把更多注意力集中在收入方面。据了解,除了向本国公民征税外,沙特政府还考虑实行绿卡制度以及允许国外劳工付费来沙特工作等举措。Salman预计,这两项政策将可以每年增加收入100亿美元,合计可以带来每年200亿美元的收入。

此外,Salman估计,政府引入的增值税将增加100亿美元/年的收入;补贴改革也将带来300亿美元/年的收入。除上述政策外,沙特政府计划通过其他措施再增加400亿美元每年的收入。沙特政府也将在2017年财政年度,对香烟、软性饮料等实施“选择性税收”政策。

Salman在接受美国彭博新闻社采访时表示,沙特政府将在2020年前增加非石油收入1000亿美元(6500亿人民币),相当于目前非石油收入的三倍!

Saudis Forecast $51 Oil In 2017 Rising To $65 By 2019; Will Spend 20% Of Total Budget On Military

After suffering two record budgets shortfalls in 2015 and 2016 as a result of plunging oil prices, and which nearly brought both Saudi Arabia’s economy and banking sector to a standstill, not to mention billions in unpaid state worker wages at least until generous foreign investors funded the Kingdom’s imminent cash needs with its first, and massive, bond sale ever, today Saudi Arabia released it budget outlook for the next year.

And while the Saudis believe the country’s budget deficit will fall modestly next year even with an increase in spending, it is still set to be a painful 8% of GDP suggesting the Saudi cash burn will continue even with some generous oil price assumptions.

The budget deficit for 2017 is expected decline 33% to 198 billion riyals ($237 billion), or 7.7% of GDP, from 297 billion riyals or 11.5% of GDP in 2016 year and 362 billion riyals in 2015, the Finance Ministry said in a statement on its website on Thursday. In 2016, the finance ministry said its spending of 825 billion riyals ($220 billion) was under the budgeted 840 billion, and the 2016 budget deficit came to 297 billion, below the 362 billion in 2015.

The 2017 will be deficit is the result of 890 billion riyals in spending, 8% higher than in 2016, offset by 692 billion riyals in revenue, of which oil revenue is expected to contribute over two thirds, or 480 billion riyals, with non-oil revenue providing the remainder, or 212 billion.Of the biggest spending categories, the top one remains education, with 200 billion riyals budgeted, followed immediately in second place by military spending at 191 billion riyals.

When looking at its oil indsutry, the Kingdom expects its to grow 3.37% in 2016, with the refining industry set to grow 14.78%, Finance Ministry says in statement on its website. The government said it will review subsidies, including adjustments for petrol products, water and electricity, and re-pricing over next 5 years to achieve efficient use of energy, preserve natural resources, avoid irrational use, support middle or low income citizens, establish competitive business sector. The subsidy system for oil products, water and electricity was adjusted and re-priced in 2016.

The government is planning to have a “balanced” national budget by 2020. The 2016 budget deficit is 9 percent lower than the government’s initial estimate, while the International Monetary Fund predicted the 2017 deficit would be 9.5 percent of Saudi Arabia’s GDP. The government expects to spend 890 billion riyals next year — 8 percent higher than in 2016.

Finally, and most importantly, here are the assumptions the Saudis base their forecasts on. The Kingdom expects 3.4% global GDP growth in 2017, leading to a 1.1% increase in oil demand to 95.3mmbbl in 2017, resulting in an average oil price of $50.6.

Finally, while not revealed in the actual budget, according to Arabiya, here are the Saudi oil forecasts for oil, in both the base and conservative scenarios: the Kingdom sees oil trading between $49 in the conservative case, to $55 in the main, or “base case”, eventually rising to $65 in 2019.

未经允许,不得转载本站任何文章:

-

- 阿佳徐

-

石油圈认证作者

- 毕业于黑龙江大学英语口译专业,具有丰富的翻译工作经验。致力于观察国际油气行业动态,能够快速、准确传递油气行业最新资讯,提供丰富的油气信息,把握行业动向,为国内企业提供专业的资讯服务。(QQ:348418756)

石油圈

石油圈