OFSE convergence—how combined capabilities could impact OFSE value chain

M&A: Continued convergence

The announced deal between GE Oil & Gas and Baker Hughes looks to continue the convergence of complementary business models in the OFSE space. If successful, the combination would create a large, listed player, which GE believes could be better placed to compete with rivals like Schlumberger and Technip–FMC. GE proposes owning 62.5 percent of the new company, which will have combined estimated revenue of $32 billion, while Baker Hughes shareholders will own 37.5 percent. The deal came hot on the heels of Technip’s $14 billion merger with FMC in May, which followed the acquisition of Cameron by Schlumberger. The progressive convergence of business models could have far-reaching implications for independent OFSE companies and operator/supplier relationships, which we explore in more detail below. However, so far actual consolidation activity has been low during this downturn, which is potentially a reflection of structural oversupply in the market.

Rationale behind the deals

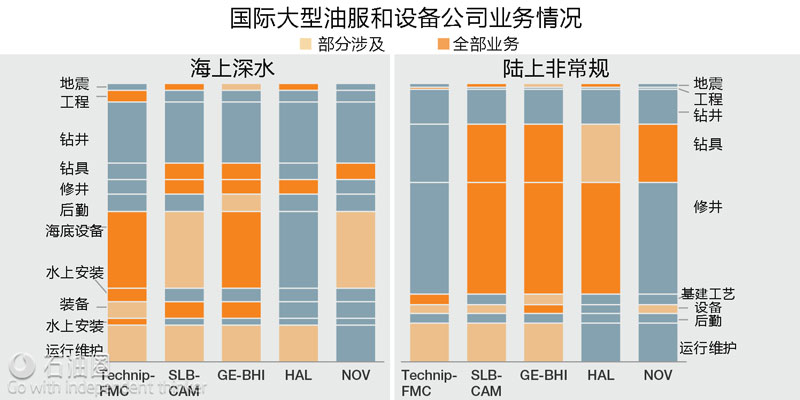

Of the major announced OFSE transactions, three (Schlumberger–Cameron, Technip–FMC, and GE–Baker) are focused on integrating service and equipment portfolios that open doors for new value delivery options in the OFSE space. A high-level review of the combined potential portfolio suggests a differing rationale and value-chain coverage across each of the deals (Exhibit 6).

Overview of top service and equipment companies offshore value chain coverag.

The Schlumberger–Cameron combination is geared toward integrating SLB’s reservoir and well technologies (seismic, drilling and completions, and production) with Cameron’s portfolio of surface, drilling, processing, and flow-control technologies, further building upon the rationale of the OneSubsea JV. The combination bets upon the benefits of integrating life-of-field service and equipment offering, and will be an interesting concept to watch particularly in onshore, shallow offshore.

The Technip–FMC combination aims to provide integrated front-end engineering, equipment, and installation services for operators, betting most importantly on engaging the operators early in the project life cycle (particularly in greenfield deepwater) to influence its relative competitiveness. Early announced results have been promising; however, we believe that for the combination to be effective in all resource/project plays, Technip–FMC will have to provide further clarity into other resource-specific offerings (eg, unconventional services).

The GE–Baker combination creates a portfolio quite similar in nature to the Schlumberger–Cameron tie-up, albeit much smaller. The deal seems to be driven as much by the combination logic as by the implications of post-Halliburton deal fallout for BHI and creating future options for GE.

Implications for operators and the OFSE sector

We analyze the potential implications of the announced deals across four broad operator categories—NOC, mature offshore excluding the US Gulf of Mexico, greenfield deepwater and unconventional (including US shallow water), and the OFSE sector.

The NOC segment has traditionally been inclined toward collaborating with large service companies for access to the latest technology. We don’t anticipate that behavior to change significantly and believe that NOCs will continue to engage with all service companies as before, and thus effectively manage their competitive and technological portfolios.

The mature offshore segment serviced by independent O&G companies has been one of the most cost conscious given the need to maintain competitive margins. This segment has traditionally relied on smaller/local OFSE companies apart from the larger players. None of the announced deals have a clear value proposition for this segment and thus may have limited impact on the current supplier landscape.

The deepwater greenfield projects in today’s low-price world are most challenged as they are increasingly being pushed toward the right side of the cost-curve, in spite of some impressive cost-reduction initiatives taken by operators. The challenges are compounded due to the inherent risk associated with large-scale capital investments in the current uncertain environment. We believe that this segment will see the most competitive interactions as all three companies target to offer integrated solutions aimed at reducing break-evens through lower cost and higher recovery. While Technip–FMC have the advantage of a few proven concepts and getting in early in the project planning phase, the SLB–CAM combination offers a higher value-chain coverage, especially over the life of field.

The unconventional market may not see significant change in the supplier landscape and operator behavior, unless one of the (announced) combinations offers some unique integrated solutions aimed specifically at further improving efficiency and recovery beyond what the operators are already targeting through the current supply chain.

Independent OFSE players may be forced to adapt to the changing landscape in certain submarkets as described above. In particular, we believe that some independent service/equipment companies may naturally align with the relevant combination (eg, engineering company with SLB–CAM, or drilling service company with Technip–FMC), whereas others may be pushed more toward later life project spend. There also exists a possibility that the offshore drillers—particularly those focused on deepwater development projects—may see further “commoditization” of their relationship with operators.

While these mergers are potentially beneficial for the industry in the long run, each of the concepts still needs to be proven and further strengthened through upgraded resource-specific offerings.

石油圈

石油圈