持续走低的油价对于油田服务和装备制造业都产生了极为负面的影响。在即将过去的2016一年中,资本支出、钻井数量、工程承包情况、利润收入具体如何,油服业是否已经度过了寒冬呢?麦肯锡分析了目前的发展态势,给出了最准确的答案。

作者 | Nikhil Ati

编译 | 张强

目前,油价的稳定促进了石油行业某些业务的发展,而油服业正得益于此,市场日趋繁荣。然而,OPEC成员国虽达成了减产协议,将有重振市场繁荣的可能性,但实施起来仍然充满挑战。各大石油公司仍需要对该组织处理市场供应问题的能力持谨慎态度,市场回归有序状态仍将需要一段很长的时间,也将克服许多人无法预料的挑战。

油市动态回顾

1. 勘探开发(E&P)资本支出下降的趋势减缓

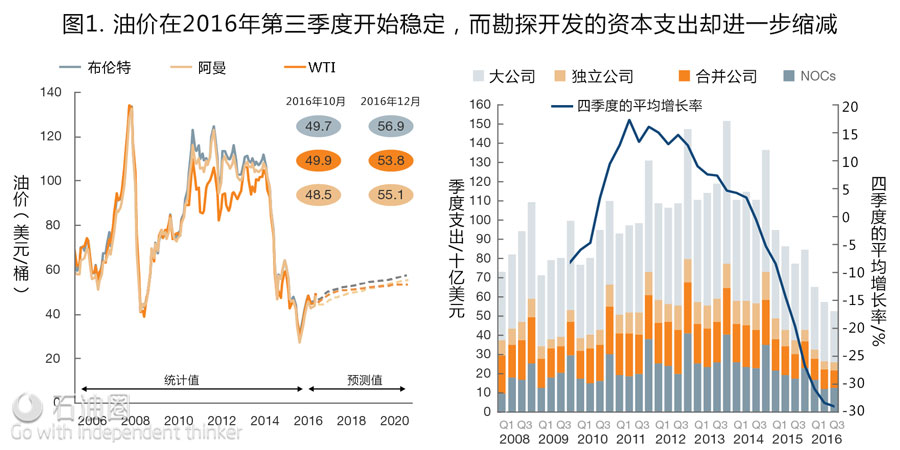

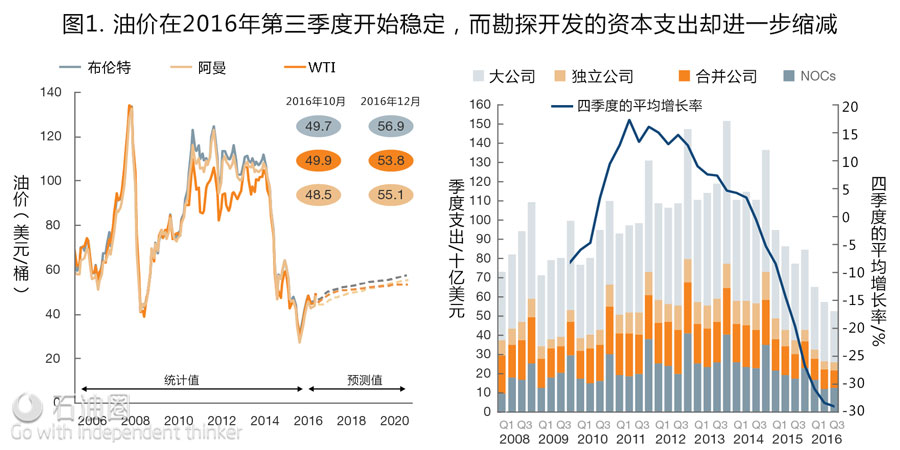

油服公司在第三季度的投资持续下降至500亿美元左右,低于2015年同期的750亿美元和2014年同期的105亿美元(图1)。整体上,今年E&P的资本支出同比下降了35%,而第二季度变化较小,该支出大幅缩减的原因主要来自综合性石油公司,而在此期间,国家石油公司(NOCs)的这部分支出却猛涨12%。

而一些公司利用油价的短期波动进行大规模投资并希望扭转颓势,例如,Nobele公司将投资从上个月的6900万美元增加到了第三季度的4.72亿美元,其中很大一部分直接用于了美国陆上油田。但是,市场没有任何关于明年投资回涨的迹象,像BP、Eni这样的大型石油公司透露,在2018年之前,他们将继续保持当前较低的投资水平。

除了低油价,政治上的不确定性也使得某些石油公司在主要产油国内的投资变得困难重重。例如,巴西腐败调查对巴西石油公司的短期盈利计划就产生了极其严重的负面影响。在安哥拉总统女儿Isabel Santos成为安哥拉国家石油公司(Sonango)总裁后,Cobalt区块销售受阻,其国家垄断Sonango经营权的意图也愈发明显。更重要的是,美国大选出人意料的结果也加剧了市场走向的摇摆不定。

2. 美国陆上钻井市场持续发展 海上进展不大

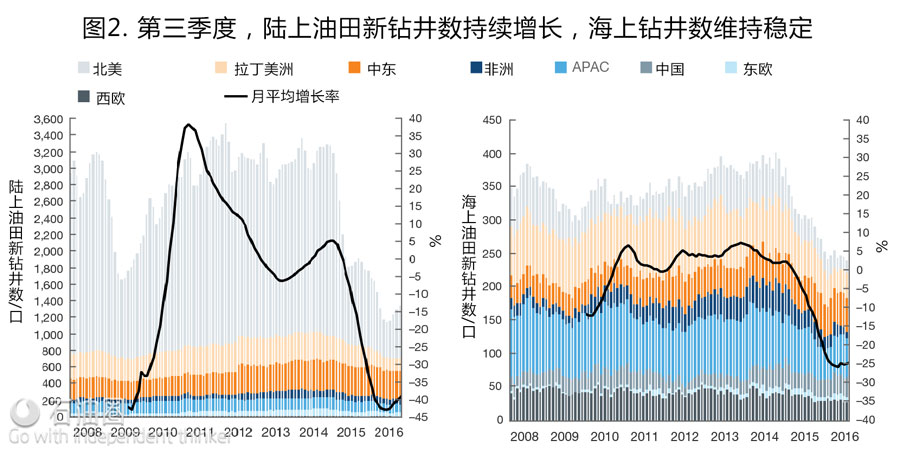

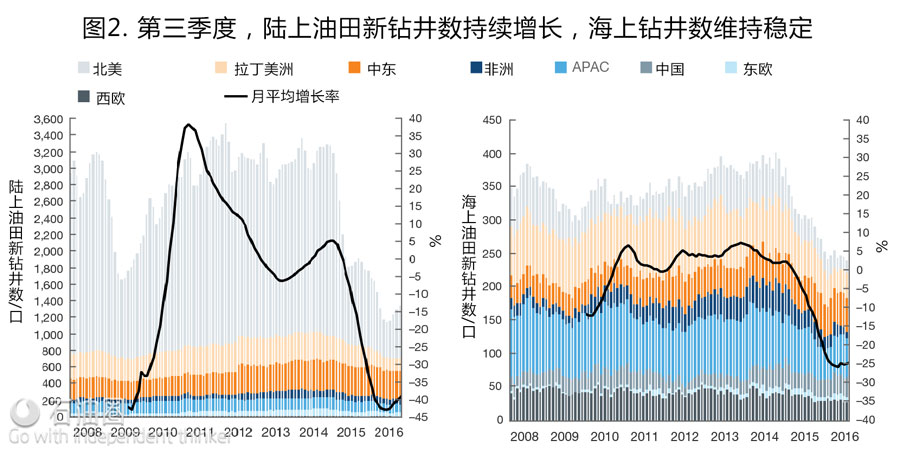

在油价稳定的激励下,各大油服公司开始重新钻新井,北美陆上油田新钻井数在第二季度略有增长(图2)。从贝克休斯的统计数据不难发现,总钻井数从6月份的458口增至七月份的521口,并在9月份达到了630口。然而,世界其他地区陆上油田的总钻井数却变化甚微,仅从6月份的717口增加为七月份的713口。截至2016年12月16日当周美国石油活跃钻井数增加12座至510口,再刷2016年1月以来新高,过去29周内有26周增加,且为连续第7周增加,累计增幅达194口。

因此,陆上总新钻井数从6月份的1175口增至1344口,而海上油田新钻井数从6月份的244口降至了9月份的240口,即第三季度仅多新钻了4口井,这很可能是受季节性因素影响;另一方面,由于合同签订数目的减少,这个冬天的新钻井数变化并不大。

更长远来看,到2020年油价将回涨至65~75美元/桶,在当前可能性最大的“缓慢复苏”市场模式下,预计在2020年之前,新钻井数量整体将保持稳定且略微浮动的状态,钻井船的数目有望在同期出现极小的增长。然而,拥有世界上最大型海上钻井船的Transocean公司的CFO Mark Mey,却坚持认为下个月钻井船利用率稳定后,租金将不再降低。

油田服务和装备(OFSE)市场动态

1. 业务不再下滑

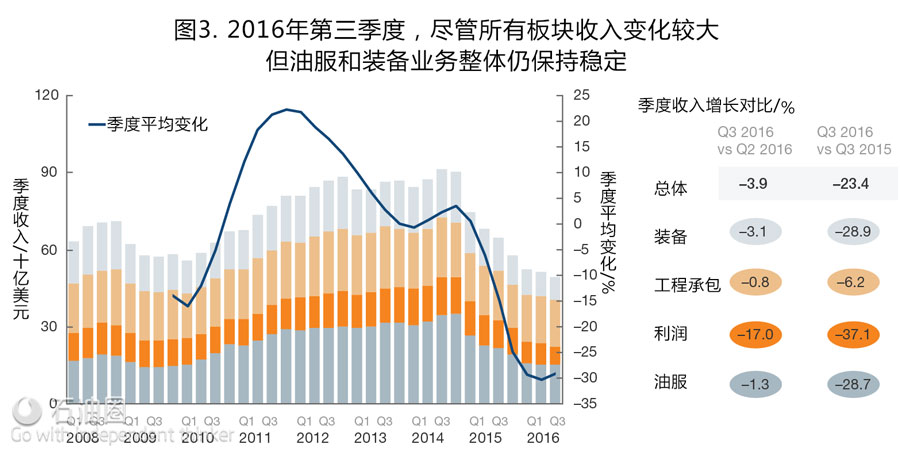

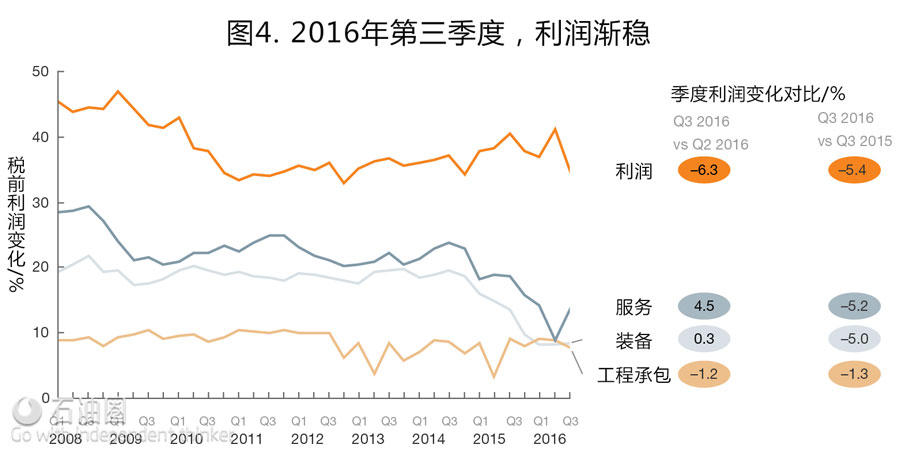

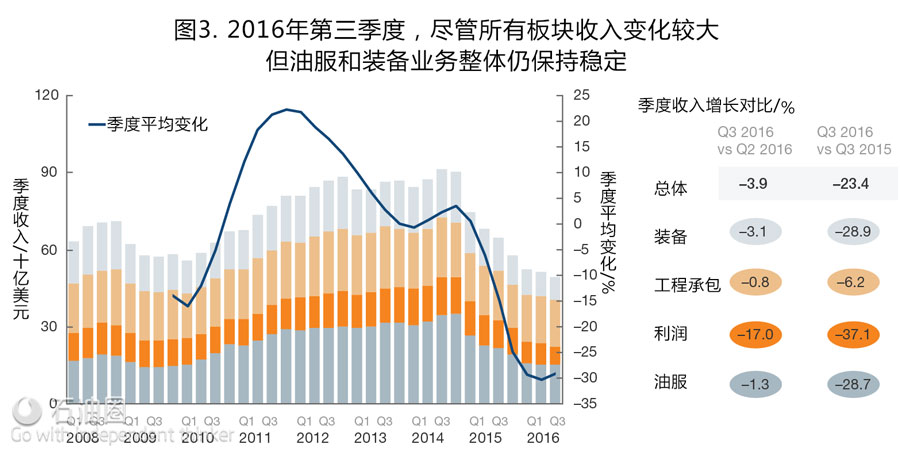

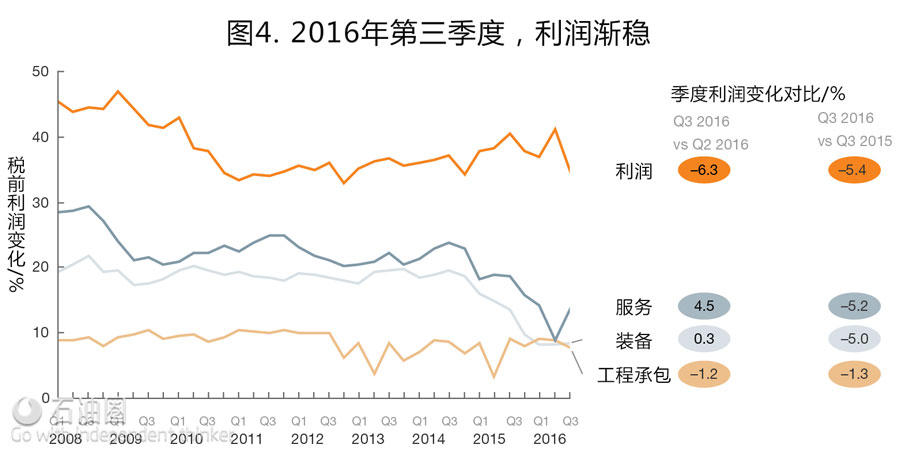

受低油价影响,2016年所有板块的业务都出现了下滑,油田服务和装备业务同比下降了23.4%,仅略小于第二季度25.6%的下降率(图3)。其中,第二季度收入下降3.9%,与第一季度的4.1%相差不大;这一数字也是2014年第四季度9.5%下降率的一半,这说明收入下降的幅度已基本稳定。尽管油服业务和工程承包数目变化不大,但是利润却出现了季度性的最大下滑。与去年相比,2016年所有板块业务都出现了缩减,利润也异常堪忧(图4);资产状况于第二季度有所好转后,又有急转直下的可能。

油服业务:2016年,油服公司税前利润与第二季度的31.3%和第一季度的41.1%相比,本年度油服业务下降28.7%。同2016年第二季度相比,第三季度的收入环比缩减1.3%,尽管此后出现了轻微的季度性增长,但仍远低于2015年第四季度和2016年第一季度18%的递减率。从这些数据不难发现,随着业务量开始稳定在新水平上之后,收入紧缩很有可能已经触底。

尽管贝克休斯在并购失败后削减了其服务费用,但贸易额仍在第一、二季度出现5.2%的递减后,上涨了4.5%,而税前利润的增长率则从第二季度的-30%增至第三季度的13%;截止第三季度底,年同比增长率下降了5.2%,而上季度年同比递减率为3.8%,由于资本投入的削减,收入出现明显下滑,但2015年上半年则处于相对稳定状态。

装备业务:2016年第三季度收入同比下滑28.9%,较第二季度递减率33.9%出现了轻微增长。第一、二季度收入减少5.4%后,上个季度收入缩减率为3.9%。尽管本年度交易额下降5.0%,但由于夏季装备业务的发展,2016年第三季度收入仍有0.3%的环比上涨。目前,其成交额增长率从上个季度的7.2%增至8%。尽管该部分增长存在业务积压的情况,但这一情况仍凸显出运营商已无法在当前利润水平下支付其投资成本的窘境。

另外,在2008~2105年间,装备公司实现了20%的平均交易额,尽管持续性存在一部分利润的损失,但装备制造商透露,一旦业务量上涨,他们将可能通过提升价格来收回部分成本。从2015年1月以来,装备公司的股东收益下降了10%,比总利润的跌幅还要大。

利润:2016年第三季度收入同比下降37.1%,但第二季度却同比增长30.4%,这说明新钻井和合同付给费用降低,处境不佳。同第二季度3.4%的环比递减率相比,第三季度递减率迅速扩大至17%,并与第一季度的递减率基本持平,这是截至目前为止,情况最糟糕的季度,几乎是2015年第三、四季度的两倍。但与一年前相比,2016年第三季度交易额同比下降5.4%,2016年第二季度却存在3.2%的增长量。与第二季度相比,2016第三季度交易额环比下降6.3%,而第二季度却由于2015年前三个季度中业务成交量在反经济循环周期的增长,交易额环比增长了4.3%。这意味着第二季度收入跌至了2015年1月的40%+,尽管当前商业形势极为糟糕,但这仍是其自2009年以来的最高水平。另一方面,根据收入统计,自2015年1月以来的股东收益继续保持近43%的大幅跌幅(图5)。

工程承包:2016年第三季度,工程承包公司收入较为稳定,环比仅下降0.8%,但第二季度环比下降5.4%,第一季度得益于分散投资出现了意外增长,为7.7%。2016年第三季度收入仅比2015年同比减少6.2%,但第二季度却有11.9%的同比增长量。交易额也与收入情况相仿,2016年第三季度仅环比下降1.2%、同比下降1.3%。今年订单较往年有所减少,订单出货比从2015年第四季度的9降至了今年第三季度的6。

从产业链的上下游关系的角度来看,油服市场的规模和发展则由石油公司的勘探及生产投资直接决定,而油气需求量、油价等因素则通过间接作用于勘探及生产投资而作用于油服市场。面对日益稳定的油价,油服公司更需要大胆投资,抓住机遇,积极创造和提升自己的技术优势,扭转亏损局面。

Stabilizing oil prices stimulated activity in some areas, which fed through to the OFSE sector, helping support the market. Emerging consensus amongst OPEC countries is likely to position the market for recovery; however, execution remains a challenge.

Quarterly perspective on oil field services and equipment: December 2016

OPEC agrees on reducing production in principle but execution could be challenging

The third quarter of 2016 ended on a positive note in the oil markets with Brent peaking at $53.76/barrel on October 10 driven by agreement in principle amongst OPEC members over the need to cut supply—reversing the Saudi-led policy of market share expansion that set prices tumbling two years ago. However, widespread concern that details of the agreement would be hard to achieve came to the fore in late October as members debated the level of cuts, sending prices back south. In September’s Algiers meeting OPEC agreed to limit production to between 32.5–33 million barrels/day, the latest (October) production number has risen to 33.8+ million barrels/day. The deal agreed to by OPEC members in the meeting at Vienna on November 30 is a positive sign and will lead to near-term recovery in prices. However, we remain cautious about the group’s ability to manage overall supply in the market and believe the journey to regaining market control will prove far longer and more challenging than what many expect. Overall, prices fell marginally in Q3, from $52.34/barrel on July 1 to $50.75/barrel on September 30, and at the time of writing this article Brent was trading at around $50/barrel after falling to a low $44.43/barrel on November 14.

Near-term demand growth continues to remain sluggish with talks about longer-term peak demand discussions emerging

Developments on the demand side include the IEA cutting its global demand outlook to 1.2 million barrels/day this year and next, down from 1.8 million barrels/day in 2015, which is lower than expected given current price levels. The news reflects slowing global growth, rising efficiency, and emerging alternatives. When combined with historically high inventories, we expect this will keep the market oversupplied into 2018 and prices in line with or below our “lower-for-longer” scenario. Looking further ahead, there appears to be a growing consensus that oil demand may peak by 2030–40, as backed up by recent announcements from Shell, OPEC, the IEA, and other industry observers. This outlook is largely dependent on adoption of electric vehicles (EVs) and battery technology improvements, so there may be some backtracking if unexpected political policies slow such a transition in some countries, but the trend is global and has considerable momentum behind it. In the near term, however, the demand growth is likely to dwindle to around 1 million barrels/day per year, according to most industry watchers.

Operator capex in Q3 fell again to around $50 billion—compared to just under $75 billion in Q3 2015 and about $105 billion the year before that. This represented a fall on the year of around –35 percent, little changed on the second quarter. Majors and integrated operators were responsible for the bulk of the decrease, while NOCs bucked the trend and managed to increase spending by 12 percent.

Some companies took advantage of competitive prices and invested heavily in anticipation of an upturn, with Noble, for example, raising capex from $69 million last quarter to $472 million in Q3 with much of it directed toward the US onshore. There is little sign that spending will pick up next year, with oil majors such as BP and ENI indicating they will maintain low capex levels until at least 2018. In addition to low prices, political uncertainty is making it even more difficult for operators to make investment decisions in some key oil producing countries. The corruption probe in Brazil continues to unfold and has pretty much put a stop to Petrobras’ growth plans in the short-term. In Angola, uncertainty around state monopoly Sonangol’s plans has become even more evident after its recent Cobalt block sale pull-back, with the market being cautious about the appointment of Isabel Santos—the Angolan president’s daughter—as head of Sonangol. Above all, the unexpected outcome of the US elections could yield some far-reaching implications for the market.

The North American onshore rig count moved firmly into positive territory, building on the slight second quarter rise, as stabilizing oil prices encouraged some operators to start drilling again. The total number of rigs rose from 458 in June to 521 in July, and on up to 630 in September, according to Baker Hughes’ rig count data. Onshore rig count totals elsewhere in the world, however, showed little change. June’s total of 717 edged down slightly to 713 in September, with only slight variations on a regional basis. This brought the overall onshore total up to 1,344, from 1,175 in June. Offshore rig counts fell from 244 in June to 240 in September, retracing the rise of just four in the second quarter, with both figures likely to have been influenced by seasonal factors—suggesting there could be worse to come this winter as contracts continue to roll off. Looking further ahead, in our most likely “slow recovery” market scenario (where oil prices will stay low for now and recover to $65–$75/boe by 2020), floater rig numbers are projected to remain broadly flat until 2020, while jackups are expected to see only minimal increases over the same period. However, Mark Mey, chief financial officer of Transocean, which owns the largest offshore fleet, insisted that he was expecting rental rates to drop no further as utilization stabilizes in the coming months.

OFSE market performance

Downward trend stabilizes

Overall oil field services and equipment (OFSE) revenue fell 23.4 percent year-on-year, just slightly down on the 25.6 percent rate of decline seen in Q2, with all sectors contributing to the fall (Exhibit 3). Revenues were down 3.9 percent in Q2, little changed on the 4.1 percent decrease seen between Q1 and Q2—which was half the 9.5 percent fall seen the previous quarter—indicating a stabilization of revenue decline. Assets showed the biggest quarterly decline, while services and EPC showed little change. Margins were also under pressure, with all sectors seeing falls versus the previous year (Exhibit 4). Assets fared worst after gaining ground in Q2.

Services: Services revenue fell 28.7 percent on the year, compared to 31.3 percent in Q2 and 41.1 percent in Q1. On a quarterly basis revenue fell 1.3 percent compared to Q2 2016—which is a slight improvement on the Q2 quarterly decline rate and much lower than the 18 percent contraction seen between Q4 2015 and Q1 2016. This suggests the contraction may have bottomed out, with activity beginning to stabilize around this new level. Falls in margins, on the other hand reversed, with margins rising 4.5 percentage points after a 5.2-percentage-point fall between Q1 and Q2, although this was largely due to a sharp bounce back at Baker Hughes as it cut costs in the wake of its failed merger, with its EBITDA margin rising from –30 percent in Q2 to +13 percent in Q3. This pulled average service margins up to 5.2 percentage points below last year’s levels at the end of the quarter, compared to a 3.8-percentage-point annual fall last quarter, and relative stability earlier in 2015 when revenue falls were more easily absorbed by rapid cost cuts.

Equipment: Q3 2016 revenue fell by 28.9 percent on the year—a slight improvement over the 33.9 percent drop in Q2. Compared to the previous quarter revenue fell 3.9 percent, after a 5.4 percent fall between Q1 and Q2. Margins were down 5.0 percentage points on the year, but gained 0.3 percentage points compared to Q2, building on a slight rise in Q2, helped by increased summer activity. Margins increased to 8 percent, up from 7.2 percent in the previous quarter—an 8-year low. The increase came despite a falling backlog, clearly indicating that manufacturers cannot sustain operations and cover the cost of capital at current EBITDA margin levels. Furthermore, equipment companies had achieved an average margin of 20 percent between 2008 and 2015, and while part of the margin erosion may remain, manufacturers have indicated they are likely to push prices up and recover some of the lost ground as soon as activity increases. Equipment companies saw a 10 percent fall in shareholder returns since January 2015, outpaced only by assets (Exhibit 5).

Assets: Q3 2016 revenue fell 37.1 percent on the year, an acceleration on the 30.4 percent contraction in Q2, compared to a year earlier, which could reflect a worsening situation as more rigs end contracts and are either rehired at lower rates or lie idle. Revenue declined by 17 percent compared to Q2—up sharply from just 3.4 percent quarterly fall in Q2, and closer to the falls seen in Q1, which was the worst quarter so far and roughly double the quarterly falls in Q3 and Q4 2015. Compared to a year ago, margins fell by 5.4 percentage points compared to Q3 2015, a reversal of the 3.2-percentage-point annual rise in Q2 2016. Compared to Q2, margins fell 6.3 percentage points, reversing the 4.3-percentage-point quarterly rise in Q2, which built on counter-cyclical rises in the first three quarters of 2015. This means asset margins have dropped back below the 40 percent-plus seen in Q2, which was their highest level since 2009, despite the recent abysmal business conditions. On the other hand, returns to shareholders since January 2015 from the asset category remain by far the worst OFSE performer, losing about 43 percent (Exhibit 5).

EPC: EPC companies saw revenue stabilizing further with just a slight fall of 0.8 percent compared to Q2, after a quarterly decline of 5.4 percent in Q2 compared to Q1—and an unexpected quarterly rise of 7.7 percent in Q1, helped by diversification. Revenue was just 6.2 percentage points lower than Q3 2015, an improvement on the 11.9-percentage-point Q2 annual fall. Margins performed similarly, losing only 1.2 percentage points on the quarter and 1.3 percentage points compared to Q3 2015. Order backlog ratios have been falling this year, with book-to-bill ratios down from almost nine in Q4 2015 to around six by Q3 this year.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈