A deal deluge typically follows an oil-price collapse—but hasn’t always created value. Past cycles teach that deals enabling players to lower costs will probably be most valuable in today’s volatile oil-price world.

Unlike what happened during previous oil-price collapses, M&A activity has been limited since prices started to fall in 2014. But the signs are that M&A activity may be building, and oil-company management teams should think about what deal strategies they should pursue. The oil-price trend has historically been one of the most important determinants of how value is created in the oil and gas industry, and some M&A strategies that worked in the rising-price environment over the past 15 years may not work in today’s market. In this article, we look at the industry’s M&A performance across cycles back to 1986 and identify strategies that could help oil and gas companies create value through the price trough, measured by total returns to shareholders (TRS).

The next M&A wave may be starting to break

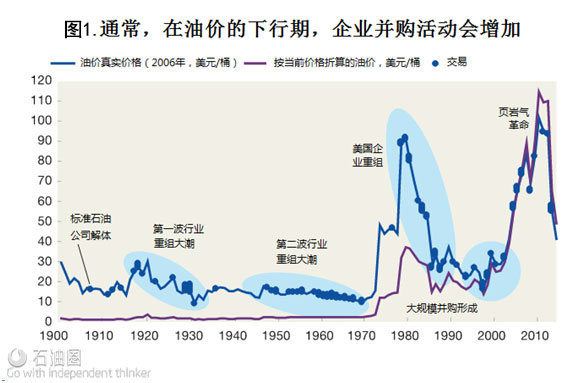

Most commodity industries are prone to consolidation during the downside of the cycle, when supply surpluses accumulate, prices fall, and competition heats up. The oil and gas industry is no exception (Exhibit 1). In the 1998–2000 price trough, more than 25 deals greater than $1 billion in value were executed in North America alone, including the BP–Amoco, Exxon–Mobil, and Chevron–Texaco megamergers. In total, this wave of deal making amounted to more than $350 billion in just over two years. It took another decade to match the same amount of deal volume in North American exploration and production (E&P).

Historically, oil-price down cycles have led to an increase in M&A activity.

Oil prices are recovering a bit from a 12-year low in January (below $30 a barrel) but remain well under the levels of most of the past decade. There are signs of rising M&A activity, even though few deals have been executed so far. Over the past year, bid–ask spreads have been too wide for deals to proceed. However, this could change, given the increasing signs of vulnerability among the weaker players in the market.

First, industry-wide leverage has risen significantly over the past three years, and it is particularly high for independent E&P companies with exposure to US shale production. This group’s leverage has spiked—with debt at nearly ten times earnings before interest, taxes, depreciation, and amortization—indicating an increasing likelihood of restructuring for the most indebted players. Second, pricing hedges are beginning to come off. As a result, it is possible that there will be oil and gas companies available at distress prices, either because they are in Chapter 11 (continuing to operate while restructuring their debt) or because their market valuations will sink to such low levels that they could be attractive acquisition candidates, even if the buyer has to reach agreement with their bond holders as part of the deal.

It’s not easy to create value through M&A in the oil industry

Companies will clearly want to be on the lookout for how to use this time of transition to strengthen their competitive position through M&A. Successful oil and gas M&A obeys many of the same rules that should prevail in any other industry, beginning with not overpaying. But oil-price volatility adds a unique element to the mix. Oil-price levels have a powerful influence on most aspects of the industry’s performance, as the profitability figures of the past year make clear, and M&A performance is no exception. The industry therefore should be careful about the lessons it takes from its M&A experience during the period of rising and high oil prices in the nearly 15 years to 2014.

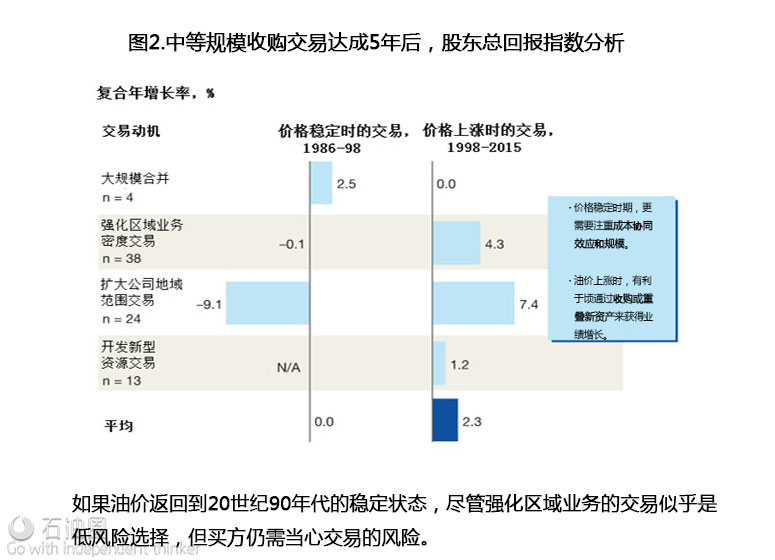

This view is supported by research we have undertaken on E&P M&A in the United States over the past 30 years. The research segmented deals into the four themes that characterize most deal activity—megamergers, increasing basin or regional density, entering new geographies, and entering new resource types. We contrasted the value-creation performance of the deal themes under the two main pricing environments in force during the period: low prices from 1986 to 1998 and rising prices from 1998 to 2014 (with the exception of 2008 to 2009).

There have certainly been a number of successful deals struck throughout the period. But the research shows that on balance, the oil and gas industry’s ability to create value from M&A has been mixed, and that value creation is particularly challenging when deals are struck during oil-price down cycles (Exhibit 2). Of all the deals evaluated for the 1986–98 period, only megadeals outperformed their market index five years after announcement. Periods of flat prices appear to call for a focus on cost synergies and scale. In contrast, in the 1998–2014 period, when prices were generally rising, more than 60 percent of all deal types outperformed their market index five years after announcement. Not surprisingly, this kind of rising-price environment rewarded deals more focused on growth through acquisitions of overlapping or new assets. However, with prices at low levels again, this historical perspective suggests we are back in less-favorable territory for value creation through M&A.

Buyer beware if we return to a 1990s steady state of flatter oil prices, although basin-building deals appear to be the lower-risk option.

What are the implications for M&A strategies and practices today?

“This is the sixth downturn of my career” is a familiar refrain in our conversations with senior industry executives. However, much has changed in the industry since the last downturn, with the ranks of the major companies radically thinned, while the shale-oil boom, in combination with plentiful credit, has launched hundreds of mom-and-pop producers to create a whole new branch of the industry. A review of deals over the last cycle is necessary but not sufficient. As the industry works to find its bearings, here are five guidelines to help oil-market participants.

• Be clear on the strategy. Companies should define their rationale for M&A activity as part of their corporate strategy before focusing on deal sourcing. Investment themes should seek to achieve a strategic imperative and complement a company’s competitive edge. How does this deal fit with what you want to look like long term? How will the acquisition supplement your organic growth? Are you a “better owner” than competing buyers? Further, different themes may be appropriate for different types of players, depending on their structure, appetite for risk, and oil-price outlook. There are a number of different deal types that also may be appropriate, for example asset transactions, mergers of equals, or a series of small bolt-on acquisitions.

• Identify value through a rigorous due-diligence process. Many executives place too much emphasis on simply looking at whether a transaction is accretive or dilutive of the acquirer’s earnings per share or on basing deal value on market multiples. Instead, they should conduct a due-diligence process focused on a granular understanding of the assets’ resource potential, the target’s business model and operations, and value potential under varied market scenarios. This approach allows the acquirer to gauge the real-world viability of the operating model, including upside and downside scenarios. Are the forecast growth rates and estimates of returns on invested capital consistent with those of similar historical periods? What “black swan” scenarios should you consider? Do your pro-forma analyses consider competitiveness against other resource types?

• Focus on identifying cost and capital synergies up front. Regardless of the strategic intent underlying the deal, in today’s price environment executives should work hard to identify opportunities to cut costs and improve capital efficiency. All deals are likely to present the opportunity to create value through overhead cost reduction at the company, region, and basin and field levels. This should be a focus of the due-diligence process. What capabilities do you have that are complementary to the target? What opportunities are there to combine infrastructure within a region or basin?

• Don’t bid away the value in the deal process. Winning acquirers establish a rigorous deal process with clear decision stage gates, as well as a clear understanding of important risks or upside opportunities. This approach allows companies to avoid overpaying, forfeiting potential value. In addition, good acquirers are less likely to waste resources on deals the market previously deemed unattractive and more likely to focus solely on objective measures of value creation. Are the downside risks in the deal and the implications on valuation clear? How will that influence the approach to negotiations? Is a robust deal process in place, with clear “walk away” rules established?

• Plan postmerger integration early and execute rigorously. Winners make critical decisions about integration governance and value potential well ahead of the close. They also make beating, not just meeting, the value-creation pro-forma target results part of the postmerger plans and associated management incentives. They do all this while at the same time recognizing that oil and gas is a people business, and winning the hearts and minds of key employees at acquisition targets is essential to success. Empowering the integration-management office (IMO) to update and exceed the synergy target, and executing quickly at the start of the integration, are important factors in maximizing value creation. Putting a senior leader in charge of the integration is also an important success factor, particularly for larger transactions. Is the IMO designed to capture maximum value? Can the IMO be launched on the day the deal is announced and be completed rapidly? If the answer is no, value leakage is inevitable.

Another big wave of M&A activity in the oil and gas industry could soon break. As leading players in the sector plan their moves, they should recognize that deals offering cost-reduction opportunities are likely to create the most value in a lower-for-longer oil-price environment. At the same time, excellence in M&A practices throughout the deal process—from the identification of opportunities to postmerger integration—will remain an important contributor to value creation.

石油圈

石油圈