Beyond the ‘Chicken & the Egg’: Are the Economics of Retrofitting Holding Back LNG Bunkering?

Beyond the ‘Chicken and the egg’: the hen has started to lay

LNG bunkering infrastructure is still limited, but projects proliferate

Gas engines facilitate use of LNG as a transport fuel

Dual-fuelled engines are generally preferred

• As dual-fuelled engines can also run on diesel only, their operation will not be affected in places that lack appropriate gas re-fuelling stations.

• Recent technological advances have concerned efficiency, emissions control, boil-off control, safety and reliability, system simplification, etc.

Gas and diesel engines run on different engine cycle

• Gas engines run on an Otto Cycle – air and gas mixture is injected into the cylinder, compressed and ignition is then applied (spark-ignition).

• Diesel engines run on a Diesel Cycle – air or an air/gas mixture is drawn into the cylinder and compressed; diesel then injected to cause ignition.

• Gas engines offer the merits of higher efficiency, fewer emissions and less noise.

LNG-fuelled fleet taking off, conversions remain anecdotic

Bit Viking, tanker, built 2007, converted 2011. Wartsila.

Tresfjord, Car/passenger ferry, built 1991, converted 2012. Rolls-Royce.

Ostfriesland, Car/passenger ferry, built 1985, converted 2015. Wartsila.

Fure West, tanker, built 2006, converted 2015. Caterpillar.

Bergen Viking, tanker, built 2007, converted 2015. Rolls-Royce

Abel Matutes, RoPax, built 2010, to be converted in 2016. Rolls-Royce.

Wes Amelie, containership, delivered 2011, to be converted in 2016/2017. MAN

Midnight Sun & North Star Alaska, containerships, built 2003, to be converted in 2016. Rolls-Royce.

So, what is holding the industry back?

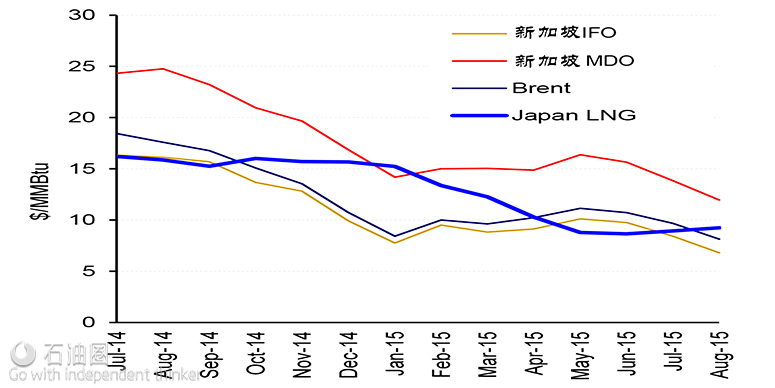

LNG and fuel oil prices have converged since the beginning of the oil slump mid-2014

Fuel Oil and Distillates vs. Natural Gas Prices, historical (Jan 2010 – August 2015)

Nonetheless, LNG remains significantly cheaper than its rivals on the basis of straight fuel cost

Asia – Fuel Oil and Distillates vs. Natural Gas Prices, historical (July 2014 – August 2015)

Europe and the US – Fuel Oil and Distillates vs. Natural Gas Prices, historical (July 2014 – August 2015)

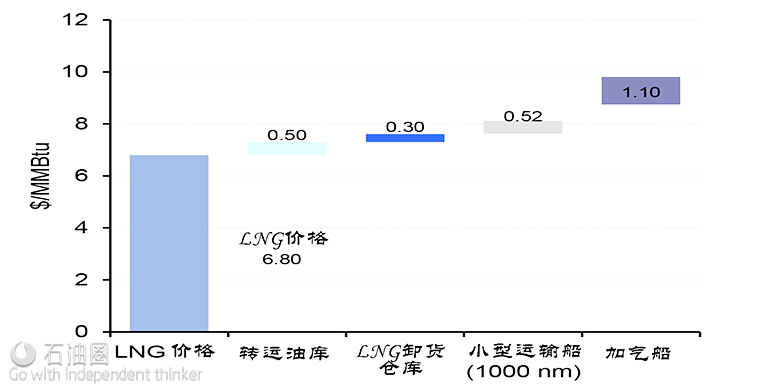

Natural gas must be purchased, liquefied, stored and delivered to a site that can fuel ships

We have modelled a Small Scale LNG economics for ship-to-ship bunkers, based on the following logistics chain:

• LNG DES Price: price of Bulk LNG delivered to the import terminal

• Bulk Terminal: costs are based on allocation of costs for the import terminal. Based on an existing EU terminal.

• Break Bulk Terminal: Costs for new break bulk facilities at the existing terminal where smaller-sized vessels are loaded

• Small scale shipping: 10,000 cubic metre shuttle vessel delivering to LNG bunker vessels and/or satellite plants

• Bunker Vessel: 3,000 cm bunker vessel delivering LNG bunker fuel Ship-to-Ship

LNG Ship Bunkering Value Chain, European example

LNG retrofits, when feasible, are a sophisticated, complex operation

• Modification of existing engines or addition of gas engines.

• LNG tank and gas piping system to be fitted.

• Safety control systems to be upgraded.

If not now, when will it happen?

Poten has modelled the cost of a LNG conversion for a 38,500 dwt product tanker

Key assumptions used for the calculation are as follows:

• Vessel assumed to sail 100% of the time in ECA. Tier III Nox regulation assumed in force.

• Total time lost is assumed to be 20 days for scrubbers retrofit and 60 days for LNG conversion.

• Resulting upfront investment is US$ 9.12 million for LNG conversions, US$5.9 million for scrubbers retrofit and US$ 0.87 million for MGO works.

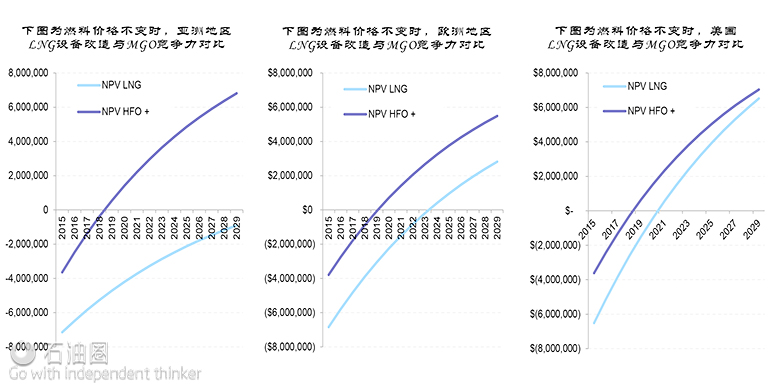

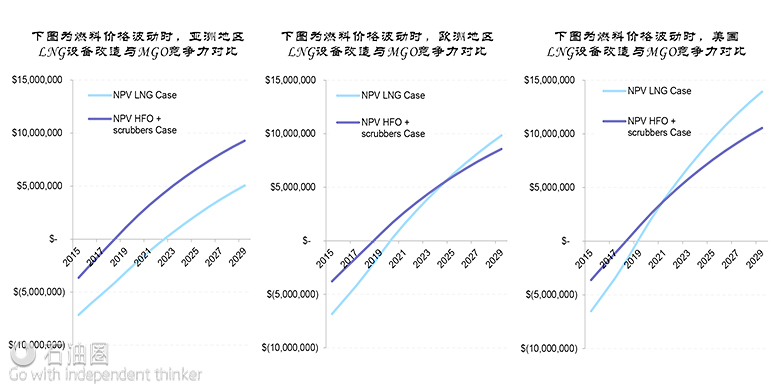

Poten has then compared the costs of LNG and scrubbers conversions against MGO in two different price scenarios

• Statu Quo price scenario, assuming the 2015 commodities price environment to remain unchanged. Oil, distillates, IFOs, gas and LNG prices increase based on inflation only.

• Poten price scenario, based on our in-house prices projections. Oil prices are expected to recover and reach 90/Bbl (15.6 US$/MMBtu) by 2025 and the spread between LNG and other bunker fuels is projected to widen between 2016 and 2025.

If the price environment remains unchanged, LNG retrofits will be competitive only in the US, and only against MGO

LNG and scrubbers retrofit, Competitiveness to MGO, Statu Quo scenario, Asia

Under Poten price scenario, repayment times are still long but LNG retrofits regain significant competitiveness

LNG and scrubbers retrofit, Competitiveness to MGO, Poten price scenario, Asia

石油圈

石油圈