GE Deal offers Baker Hughes new beginning

Doug Sheridan

GE Oil & Gas and Baker Hughes recently shocked the oil and gas world with the announcement the two companies will come together to create the industry’s number two supplier. From a financial standpoint, thetransaction is effectively an acquisition of Baker Hughes by GE. In practical terms, it’s more like a merger.

Both companies will contribute their respective businesses to a new publicly traded entity (“New” Baker Hughes). GE Oil & Gas will also contribute $7.4 billion in cash, which will in turn go to Baker Hughes shareholders in the form of a one-time dividend. GE will own 62.5% of the new company and run the overall show. Baker Hughes shareholders will own the remaining 37.5% and will be represented in the boardroom with four of nine director seats.

The deal ends a long and arduous journey for Baker Hughes, one marked by shifting strategies and semi-bootless tactics. First was the move away from its famously decentralized business model. Then came the acquisition of BJ Services and entry into pressure-pumping. Next was the bid by Halliburton and the ensuing regulatory limbo, followed by headcount reductions and yet another strategy shift after the deal fell through.

Now the GE deal represents a new beginning for Baker Hughes stakeholders, including employees. Outside of certain corporate and back office functions, we expect much of Baker Hughes’ management team and operating personnel to be retained. In fact, given the lack of overlap between the two companies, it’s hard to see how it turns out otherwise.

By all accounts, there will be plenty to keep the staff busy. Effectively combining Baker Hughes’ business with GE Oil & Gas will be no simple feat. The idea is to create “best-in-class physical and digital technology solutions for customer productivity.” It’s intriguing — and easier said than done.

A key aspect of the plan is connecting the GE Store to Baker Hughes. In theory, this means Baker Hughes can tap the vast capabilities of GE and its various operating groups. Everything from advanced materials used in its aviation business to the support of its energy infrastructure group are on the table.

That the GE Store tie can lead to a competitive advantage in the oil patch is debatable. In some ways, the concept is simply a reimagination of the same cross-pollination angle many conglomerates pursue. While there are upsides to the strategy, it’s far from conclusive that a dependence upon affiliates produces outcomes superior to those afforded by a diverse and competitive supplier base.

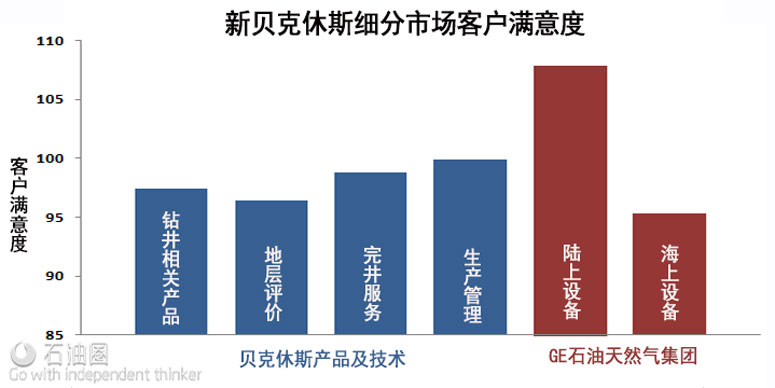

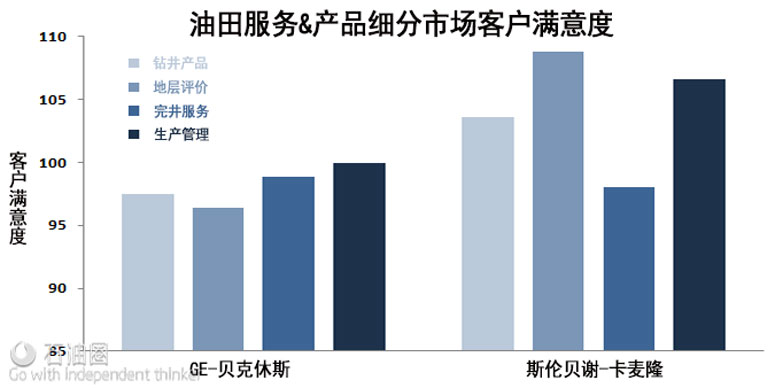

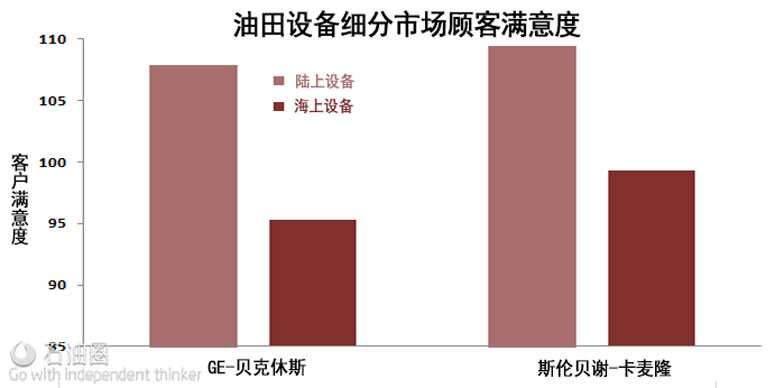

It’s also unclear whether either company currently has much to teach the other when it comes to satisfying customers. Except for strength in a handful of areas (e.g., flow control equipment for GE Oil & Gas, and downhole products and services for Baker Hughes), the number of categories in which either company currently tops the rankingsin EnergyPoint’s surveys is surprisingly small given the size and scope of both organizations.

Whether the new company succeeds in altering the competitive landscape will, in part, depend on the strength and execution of its digital strategy. There’s little question the industry is ripe for upgrade when it comes to connectivity and automation. That said, it’s no small task to do so. And it will likely take years before any significant impact is felt on the broader industry.

GE’s Predix industrial operating system — capable of collecting, storing and analyzing performance data on a range of products — could provide an edge. The system purports to predict and report maintenance issues more quickly and reliably than standard industry methods. It also has the added benefit of a relatively large installed base.

Still, it’s not clear Predix or any other GE operating system will provide the level of integration rival Schlumberger-Cameron is pursuing. If successful, Schlumberger-Cameron’s closed-system programming will produce an operating system that ties together —and manages in real time — key processes from drilling through production.

Combine this with EnergyPoint data that indicate Schlumberger-Cameron products and services tend to rate higher with customers, and it appears GE-Baker Hughes already has ground to make up if it wants to dictate how the industry’s products, services and software drive performance going forward.

The original source for this post can be found here.

石油圈

石油圈