BP- and the oil and gas industry as a whole – has been forced to respond to the downturn in commodity prices by embracing digitization as a means for cost-cutting.

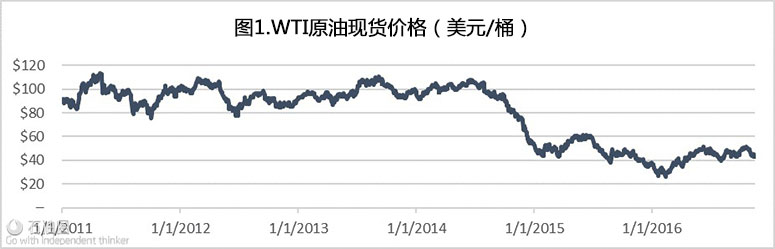

Digitization is transforming the oil and gas industry, and in particular the upstream producers of oil and gas. Given the commodity price downturn that started in the second half of 2014 following large production increases from unconventional shale drilling in the U.S. (see Exhibit 1 for historical oil prices), the “name of the game” has shifted away from big production to better margins and increased efficiencies.

While digitization is certainly nothing new, oil and gas operators have only recently started to truly embrace it, largely because they’ve been forced to following the downturn in commodity prices. The rapid advancement of big data and predictive analytics is transforming a variety of aspects of the business and operating models for oil and gas exploration and production (“E&P”) companies.

Exhibit 1: WTI Crude Oil Spot Price ($/bbl)[1]

For such a longstanding practice as oil and gas extraction, though, what exactly is a digital oilfield and how does it help? Technological and digital improvements have truly helped the industry in two main ways:

1.Improved recoveries: Technological advancements have helped spur increased recoveries (i.e., resource recovered per well) over time. Not only have technological advancements like hydraulic fracturing led to more economic energy resources available, but digitization has also helped E&P companies more accurately map their acreage, identify “sweetspots,” and therefore drill in more optimal locations – creating significant improvements in both recoveries and economics.

2.Increased operating efficiency: E&P companies are also utilizing technology that captures and feeds millions of data points from wellhead sensors, pipelines and various equipment installed in the field to computers at a remote monitoring stations. With this data, operational processes can become much more efficient – for example, a digital oilfield can use the data collected to manage the volume of oil extracted over time through automated pump controls. Digitization has allowed E&P companies to use technology, big data, and predictive analytics to extract resources more efficiently from each well, create a safer work environment, and do all of this with better labor utilization.

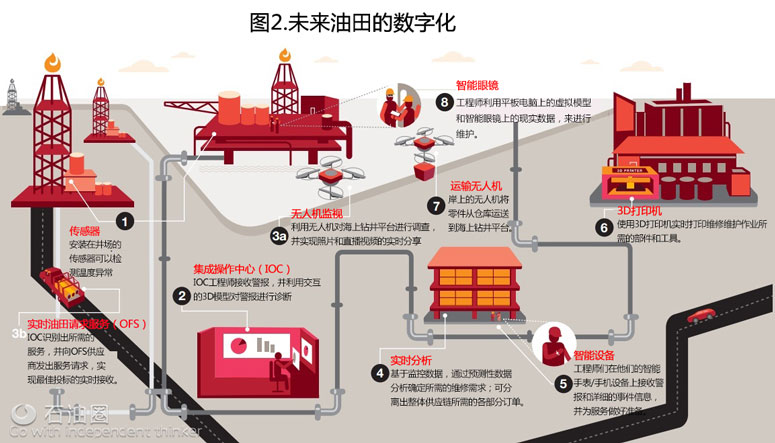

Exhibit 2 below shows some of the many applications and means of digitization across the oilfield value chain.

Exhibit 2: Digitizing the Future Oilfield[4]

1、Sensors Sensors on the rig detect abnormal temperature

2、Integrated operation center IOC engineer receives alert and perform diagnosis via interactive

3a Surveillance dronesDrones investigate the off-shore rig and share photos/live videos in real time.

3b Real -time request oilfield services(OFS) IOC identifies required services and issues service request to OFS vendors, best bid is accepted in real-time.

4 real-time analytics. Predictive data analysis determine maintenance needs based on surveillance data;integrated supply chain orders parts. 。

5 Smart devices Engineers receive alerts and incident details on theirs smart watches/mobiles devices and prepare for service.

6 3D printers. Parts and tools required to fix the issue are printed in real-time using 3D printers.

7 Delivery drones. On-shore drones deliver parts from the warehouse to the off-shore rig.

BP is just one example of an oil & gas E&P company that is embracing the opportunity for technological change within its business. The company has continued to update its operating model for new digitization opportunities in oil and gas. For example, about a year ago, the company announced that it has begun working with GE to connect 650 of its oil wells in a pilot project to test the potential of GE’s Predix data gathering and analytics platform. This platform of digitization should enhance BP’s business model, helping the company improve production, maximize cash flow, and ultimately boost shareholder returns. Engineers now have real-time access to operational data across its wells, allowing them to make more informed decisions on flow rates and well control, improving efficiency, preventing failures and minimizing downtime.

[5] GE estimates that operators can lose more than $3 million per week on a subsea well that is out of commission, so reduced downtimes should provide meaningful cost savings for the company.

As a second example, BP has also made efforts to use mobility in its digitization, particularly for assets in remote or harsh operating regions, where monitoring and inspection is both time consuming and extremely costly. The company is deploying drones to inspect pipelines in remote areas of Alaska at a fraction of the cost of piloted helicopters.

The drones send digital information and relevant, real-time data related to the pipeline integrity back to engineers on the ground, allowing them to make mission-critical decisions with a tablet computer.[7],[8] Exhibit 3 below highlights some of the benefits of this technology.

Exhibit 3: UAV Data Collection Highlights[9]

30 minutes Time it takes a Puma AE to check a three kilometer section of pipeline. This would take a human up to 7 days.

1200 miles Length of pipeline at BP’s Prudhoe Bay field in Alaska。

400,000 Number of pulses of light per second that LiDAR equipment transmits in order to collect

Overall, I think BP – and arguably the oil & gas industry as a whole – has done a good job of integrating digitization within its business and operating model over the recent years, particularly as it has been forced to with the recent correction in commodity prices.

Examples such as the two above highlight how digital technologies are enabling the company to gather, manage and leverage real-time data streams to boost output, reduce costs and maximize cash flow. That said, the majority of BP’s digitization efforts have focused on monitoring, anomaly detection and control in the recent past, and less so on prediction, where I believe that digitization can add the most value.

Moving forward, I think BP should (and we can likely expect them to) focus on integrating digitization opportunities throughout the entire value chain, both within its monitoring needs but also within the decision-making and prediction opportunities that digitization presents.

石油圈

石油圈