近日,沸沸扬扬的OPEC冻产会议即将在月末召开,而油价也在此期间涨跌不一,与OPEC产油国相持的北海产油区,因其特有的商业背景和地理优势,产油量一直居高不下,事实真的如此吗?

过去两年间,OPEC发起的市场份额争夺战导致国际油价始终在低位徘徊。而北海地区的原油开采成本高、设备老化十分严重,本应是低油价首当其冲的受害者。但事实证明,北海地区对低油价抵抗能力之强,出乎所有人的意料。

变幻莫测的市场环境

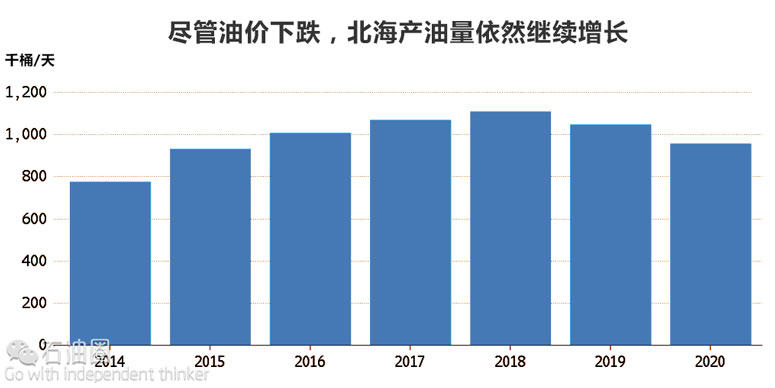

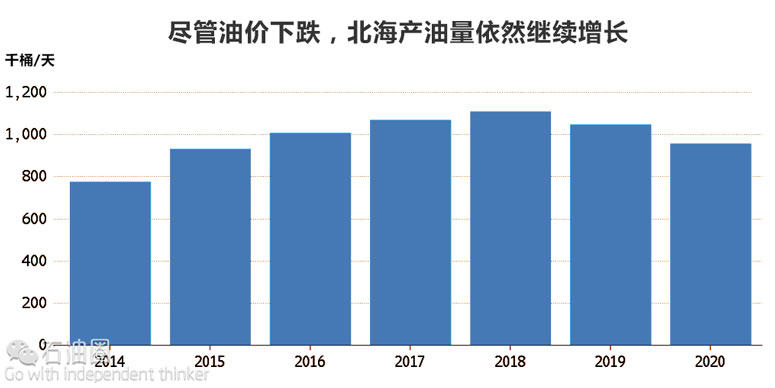

据能源咨询公司Wood Mackenzie预测,由于油价下跌前批准的项目现已逐步启动,北海地区的原油和凝析油产量将会持续增长至2018年,之后产量便开始回落。即使如此,北海地区2020年的产量仍然与2015年基本持平。

自2014年以来,OPEC为维护其成员国的市场份额,将高成本的竞争对手挤出市场,大幅增加了原油产量,导致国际油价跌至12年来的新低。然而,这场市场份额争夺战远未结束,OPEC的目标是让非OPEC国家的产量在今年减少84万桶/天。但是在北海地区,其运营商表现出了超强的抵抗力,而且非常善于通过生产原油来维持现金流。这将导致全球原油市场供应过剩更加严重,油价低迷的时间更长。

Wood Mackenzie能源咨询公司表示,“北海地区的产量依然坚挺,高油价时期北海地区的投资水平达到了历史新高,而这些投资仍在产出新的石油”。

不仅如此,OPEC和IEA此前也曾表示,某些产油国的产量预计将会继续上升,这将导致全球原油市场供需状况重回平衡所需的时间更长。近日,OPEC在其报告中指出,到2017年,非OPEC产油国的产量将会增加20万桶/天,而非此前预计的下降15万桶/天。

而IEA则表示,非OPEC国家的产量将会出现反弹,其原油供应量预计将增加38万桶/天。考虑到原油需求放缓、产量增加等因素,原油市场要到2017年下半年才会恢复平衡。

Wood Mackenzie能源咨询公司的数据显示,今年北海地区的原油和凝析油产量将会达到100万桶/天,较去年产量大约增长了8%。据估算,北海地区产量将在2017年达107万桶/天,2018年达110万桶/天,2020年回落至95.6万桶/天。

英脱欧对北海油气的持续影响

英国公投脱欧加剧了油气投资环境的复杂性和不确定性,在此背景下,北海油田项目关停数不断增加。

英国油气产业协会预计,到2024年,英国油气项目关停的相关成本预计高达169亿英镑,这比2014年的预估值高出16%,其主要原因是关停项目数量增多。英国北海地区是全球石油开采成本最高的地区之一。伍德麦肯兹咨询公司认为,国际油价跌至50美元/桶以下,导致北海地区约30%的油田项目运营亏损。即便在英国脱欧公投结果出台前,已经有许多石油企业加速关停海上钻井项目。伍德麦肯兹分析师认为,近期项目关停数量将增加,进而导致项目停工也提升了成本。

英国目前仍在工作的平台中,约1/3已有超过30年历史,这已超出了原有设计寿命。此前有估算认为,只有国际油价保持在每桶100美元,这些老旧平台进行技术改造升级持续运营在经济上才是可行的。但现在情况又有了新变化,根据BP数据显示,北海油田产量在不断下降。1999年北海油田产量达到峰值,为290万桶/日,而2015年则为96.5万桶/日。

伍德麦肯兹预计项目停工开支,包括海上平台钢结构拆卸从目前到2025年的10年将达230亿英镑。今年的相关开支为8.89亿英镑,但到2018年将达28亿英镑,是现在的3倍。这一数字大大高于英国油气产业协会的估算,不过目前项目停工并不多,相关成本数据还不甚明朗。

另外,北海油田最大生产商之一Shell也正在关停布伦特油田。布伦特油田的停产工作已持续10年,今后可能还要再持续10年;Fairfield Energy公司表示,考虑到项目生命周期、油价低迷和北海作业条件恶劣,去年该公司已开始关停Dunlin油田项目;马士基石油工商表示,该公司于11个月前已向英国油气产业主管部门申请关停Janice项目。

近年来,北海油气生产很大程度上受政府税收优惠支撑。今年北海油气生产商的开支将比去年下降40%,然而受脱欧影响,分析人士认为,不确定性会影响投资,投资减少会加速推动油气项目的关停。

俄罗斯:后苏联时代原油产量创新高

国际油价从2014年年中开始下行趋势之后,一些国家发现,与其将油田关停,油价回升之后再重启,还不如维持油田继续运行,因为这种做法难度更小,成本更低。俄罗斯能源部数据表明,该国的原油产量达到了后苏联时代的历史新高。卢布的大幅贬值降低了俄罗斯的原油开采成本,一定程度上抵消了油价下跌带来的负面影响。

挪威的许多石油公司在降本增效方面成果显著。挪威石油管理局的数据显示,作为西欧最大的产油国,挪威今年上半年的原油产量超过了去年同期水平。效率的大幅提升以及新油田的投产,使得挪威的原油产量大幅超过了政府预期。

根据EIA的预测,美国在墨西哥湾地区的原油产量将在2017年达历史新高。然而,由于利润空间大不如前,许多运营商不得不缩减勘探预算,并减少钻机的数量。

油价持续低迷 北海地区后劲不足

油价低迷已经进入第三个年头,石油公司和产油国的财政状况越来越糟糕。钻井作业的不断削减投资,导致新增原油储量跌至近七年来的最低水平,这将严重影响未来原油供应甚至是油价。

Birol表示,“如果油价持续低迷,那么产油成本高的地区迟早会失去动力,原油产量难以维持。”

如今,北海地区的运营商们正寻求所有可以进一步削减成本和加强合作的可能。今年早些时候,包括Shell在内的一些石油公司开始分摊零部件和作业工具的费用,并加强作业流程交流,提高钻井速度,降低钻井成本。

彭博社高级分析师Philipp Chladek认为,北海地区石油公司在降本增效方面的成效相当明显。但是,如果无法增加勘探开发投入的话,降本增效带来的效果也仅能持续3~5年。

作者/Rakteem Katakey 译者/杜超 编辑/王月

Oil producers in the North Sea were supposed to be among the first victims of OPEC’s battle for market share. Instead their high-cost, decades-old facilities are proving surprisingly resilient to the price slump.

Crude oil and condensate output is likely to continue rising in the UK North Sea until 2018 as projects that were sanctioned before crude’s plunge four years ago start up, according to estimates by industry consultant Wood Mackenzie. Even though production dips after that, output by the end of the decade will still be roughly equal to the 2015 level.

Since 2014, the Organization of Petroleum Exporting Countries has pumped without limits and allowed prices to plunge to 12-year lows to squeeze higher-cost rivals. While the strategy is expected to reduce non-OPEC output by 840,000 bpd this year, the battle is far from over. The unexpected stamina of areas like the North Sea, where operators have proved adept at keeping the taps open to keep cash flowing, is adding to the global glut and keeping prices lower for longer.

“Production has stayed resilient,” said Ian Thom, an Edinburgh-based senior research manager for UK upstream at Wood Mackenzie. “We saw a record number of dollars invested in the high-oil price environment,” and that is still delivering new production.

OPEC and the International Energy Agency have said they expect production from some countries to increase, deferring a return to balance in the market. OPEC, responsible for more than 40% of the world’s oil, said Sept. 12 it expects production from outside the group will grow by 200,000 bpd next year, raising it from an earlier projection of a drop of 150,000 bpd.

A day later, the IEA said it estimates supplies outside OPEC will rise by 380,000 bpd, rebounding from a sharp decline this year. Coupled with slowing demand, increasing output will delay the rebalancing of the market until the second half of next year, the Paris-based agency said. Only last month it predicted a return to equilibrium this year.

“There are pockets of resilience across the world,” IEA’s Executive Director Fatih Birol said in an interview in London. “Some companies were able to bring costs down substantially and this provides some resilience.”

Production of crude and condensate will top 1 MMbpd in the UK North Sea this year, about 8% higher than last year, according to Wood Mackenzie. Output will reach 1.07 MMbpd in 2017 and 1.11 MMbpd the next year before falling to about 956,000 bpd at the end of the decade.

Post-Soviet High

When oil prices started their decline in the middle of 2014, some countries found it easier and cheaper to keep the fields running instead of shutting them now and starting again later. In Russia, production has been running at a post-Soviet high all year, Energy Ministry data show. The plunge in the ruble has reduced costs, offsetting the decline in oil prices.

In Norway, companies have brought down costs and become more efficient. Output in Western Europe’s biggest producer has exceeded 2015 levels in six of this year’s first seven months, according to the Norwegian Petroleum Directorate. Efficiency gains and new field start-ups have helped the country beat the government’s own forecasts.

In the U.S. Gulf of Mexico, output is projected to reach a record high in 2017, according to the Energy Information Administration. However, narrowing profit margins have forced many operators to pull back on future exploration spending, and they are putting fewer rigs to use, according to the agency.

Losing Steam

With oil’s downturn now running into its third year, companies’ and producing countries around the world are seeing their balance sheets getting weaker. Drillers have been cutting investments in exploration, contributing to a drop in discoveries to the lowest in seven decades. This will affect supply at some point in the future and, potentially, prices.

If oil prices continue to be low “the general trend is high-cost areas will lose steam sooner or later,” Birol said.

For now, operators in the UK’s North Sea are seeking to weather the price slump by cutting costs and even collaborating in ways they never thought possible. Earlier this year, some including Royal Dutch Shell started pooling spare parts and tools, and are even sharing plans on how to drill wells so they can work faster and cheaper.

Companies are “working on cost efficiency reductions which seems to be going fairly well” in the North Sea, said Philipp Chladek, a senior industry analyst for Bloomberg Intelligence in London. “But without new investments in exploration, you will see the effects on production levels in three to five years.”

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈