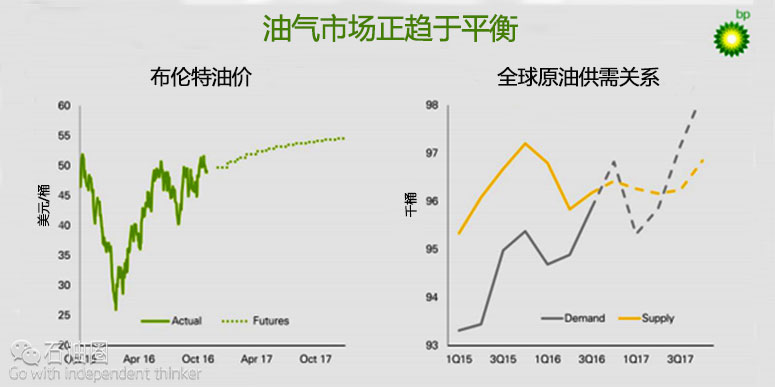

In BP’s (ticker: BP) 3Q earnings call, CFO Brian Gilvary saw progress towards market rebalancing, echoing CEO Bob Dudley’s comments earlier this month at the World Energy Conference.

“The physical market appears to have moved broadly into balance with daily oil production broadly in line with consumption. Oil inventories remain at record levels and will decline gradually next year supported by continued demand growth and sustained weakness in non-OPEC supply,” said Gilvary.

“By 2017, the company aims to “reestablish a balance in our financial framework where operating cash flow covers capital expenditure and a current dividend in a $50 to $55 a barrel price range.”

Excluding Russia, 3Q reported production was 5.9% lower year over year. The company’s estimated share of Rosneft 3Q production was just over one million barrels of oil equivalent per day, a 2.7% increase year over year.

CapEx is expected to be roughly $16 billion in 2016, lower than original guidance of $17 – $19 billion, while improving capital efficiency will push 2017 spending towards the lower half of $15 – $17 billion, a 30% to 40% drop compared to peak 2013 levels.

Despite reduced CapEx, the company is currently on track to start up five major projects this year, with four already online, and eight on track to start up in 2017. “Looking out to 2020, more than 90% of the 800,000 barrels of oil equivalent per day of new production that we expect to bring online has passed through the final investment decision and are either being completed or are well under construction,” said Gilvary.

Deepwater Horizon Payments Supported by Asset Disposals

Charges associated with the Deepwater Horizon accident and oil spill continued to impact company results this quarter. These stem from the settlement of federal, state and local government claims in 2015 and additional provisions this year, when a reliable estimate for all the remaining material liabilities was determined. This was discussed with analysts on the call.

Q: “You talked about the offsetting the Macondo cash outburst with disposals next year. Could you just give a bit more confidence that can be achieved and a bit of flavor in terms of where you see disposals or disposal potential in the BP portfolio going forward?”

BP: “In terms of disposal proceeds, we’ve set a target this year of $3 billion to $5 billion. We have a number of projects in train that we’re comfortably get you to the $5 billion over an 18-month period. Some of those will flow into the first quarter next year. That will underpin $2 billion to $3 billion next year. A lot of the projects we’re looking at are midstream assets that we own globally. You will see that we announced the sale of our property assets down in Sunbury recently which we’ve sold with significant proceeds.

In terms of Macondo liabilities, this is a big, lumpy year with the settlements from last year that originally transacted this year and the private settlements that we’ve managed to resolve, along with the payments next year. And then we get into a steady state of $1 billion a year. Actually, you only need about $1.5 billion of disposal proceeds beyond 2018 to cover it, although, we’ll probably continue to churn at $2 billion to $3 billion. A lot of that churn just comes out of looking at the portfolio as we take options to move certain commercial projects, other projects within the portfolio may have lower returns. And therefore, we’ll look to move out of those assets.”

BP Quarterly Highlights

•Trinidad Onshore Compression project sanctioned, representing the third final investment decision this year.

•First platform jacket for Shah Deniz Phase 2 completed and installed, on schedule for 2018.

•Agreement announced for a second production sharing agreement with CNPC for shale gas in the Sichuan Basin in China

•Amendment announced of a number of concessions in Egypt that enabled the fast-track development of the Nooros field.

•Formation of their Norwegian joint venture with Det Norske completed in September.

•In Amenas Compression project in Algeria on schedule to commence operation in the fourth quarter, making it the fifth major Upstream project to start this year.

•Decision not to continue exploration program in the Great Australian Bight, off the south coast of Australia, announced in October.

Analyst Q&A

Q: What can we expect going forward as the annual or quarterly run rate on Gulf of Mexico cash payments into 2017?

BP: We’ve got a schedule we’ve put out from all the various settlements from last year 2015 and from the criminal settlements back in 2012. There are specific payments in certain quarters going forward. The only uncertainty will really be around how the payments that go out associated with the class action lawsuit settlement, the PSC settlements, particularly business economic loss claims. We are accelerating a number of those at the moment.

We also resolved a lot of private claims through the second and third quarter of this year, which you will see come out in the payment schedules. They are likely to run down over the next couple of years, so they are the only things where there’s any uncertainty. But now into sort of final stages of that fund, I think we’re down from the peak on business economic loss claims. I think we had a 144,000 claims at the peak of which now we’re down to 25,000, but all 35,000 including claims linked to original claims. And they are being processed with a fairly rapid rate right now in terms of facility.

If the only uncertainty is around what the phasing looks like around the class action lawsuit settlements and how that payment schedule goes down, they are being covered by our disposal proceeds going forward. We already have close to $3 billion disposal proceeds along with the proceeds of next year. They will cover the bulk of the claims.

In terms of the forward trajectory on Macondo liabilities, the lumpy years of this year and next year and then we get in to the $1 billion a year, which is certainly those future schedules which will be sort of more like a sort of dividend for the Gulf State out to 2030 or so.

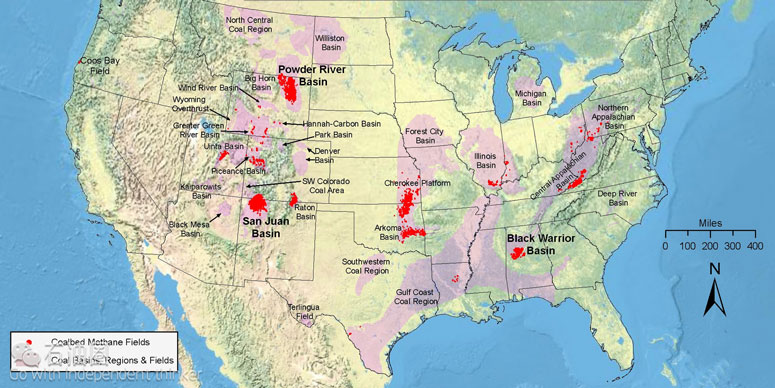

Q: On the U.S. onshore gas business with gas prices up at closer to the $3 level in the third quarter. Can you talk about the underlying profitability of that business given you have such a large kind of natural gas business there?

BP: In terms of Lower 48, we’re now running about five rigs the last time I looked, in terms of where the activity is. We’re continuing to reduce costs in that business, which is bringing the breakeven prices down. The key is really about what we learn about technology and how we run the business. We run it with a different financial frame to the rest of the group in terms of how it’s managed. And it is continuing, as you’ll see from the various quarterly numbers that we now start to release, get to be more and more profitable going forward. And of course, help somewhat this quarter by the prices if the prices come up. So, Lower 48, it really is about testing new zones, looking at innovative well designs. It’s really experimenting with that business and getting more comfortable with how we run the Lower 48 and reducing costs over time and the amount of capital that’s going in. But today, it’s running about 5 rigs, I think the peak last year is around 11 or 12 we had at one point.

Q: In a kind of sustained $55-plus environment next year, I know you have your CapEx range, but what’s the short cycle CapEx opportunity that you have? And how much capital could you put to work in a kind of $55-plus sales strong gas price environment if the opportunity arise?

BP: We’ve set a range on CapEx for next year. We’re now down at $16 billion for this year. We’re going to be below that in setting our plans for next year in the 15 to 17 range, and then, we’ll know that at 50/55, we’ll get back into balance. That means we’ve got about $1.5 billion of CapEx flex, which we’ll be able to deploy as opportunities arise, and those opportunities could be in terms of getting back to work on some of the onshore.

You have the obvious places you’ve looked out below 48 as you’ve flagged up in terms of where the gas price is. But that will be completely commercially driven. And then, of course, there may be other opportunities for us where we can access existing positions that we have where we can deepen, maybe going to some new areas. So, we’ve got flex within the capital frame to allow us to do that, which should of course, help with future growth beyond 2022 to 2023.

BP: In terms of exploration, as we’ve gone through the re-set of the company in the last couple of years, there is a big inventory of exploration intangibles that we’re working our way through. And you’re seeing that come through, if anything, it’s actually reduced compared to the run rate that we were seeing only in a couple of years ago.

We’ll try and give you more information around what that looks like around the fourth quarter results. But I can at this point say that we’ve reached a sort of stable steady state. Everything gets back to strategy and how we’ve reviewed what we’re doing around exploration strategy. We’re doing a lot less wildcats. There’s a lot more focus now on the infield developments.

The Great Australian Bight is a good example of this change. Ultimately, that was not commercial for the company. And if we stacked it up in the portfolio of options that Bernard and his team we’re looking at, the Great Australian Bight simply didn’t work and, on that basis, we stepped away. We’re still absolutely committed to Australia. It’s not about that location and we actually announced a license around a new access position we’ve taken in the North West Shelf.

It’s really about how we now sift and sort the portfolio of options we have. And as a direct consequence of that, some things we’ll view as not being commercial going forward. And, of course, they get taken through to underlying earnings in terms of exploration write-offs. But I can’t, at this point say where we are in the cycle given the size of the intangible asset base that we still have.

Q: Has anything changed in your mind about the Alaska LNG project, just based on looking at it in the last quarter and some of your partner’s comments.

BP: We still have 30 Tcf of approved resources up there, in terms of gas. I understand the most recent comments of some of our partners have made. I think gas is a great opportunity for Alaska going forward, and for those of us who have lived around and seen this project over many, many years, I’m sure we’ll have more machinations going forward. But there is nothing permanent at this point, in terms of where the point forward is, in terms of that stage in the resource space. But it is a great resource space, it’s covered, we know it’s being reinjected today. I think the short-term economics make it difficult, but in terms of long-term resource it may well be a great opportunity to bring it to market.

Q: In the U.S. onshore business, CapEx seems to be quite volatile from quarter-to-quarter and this quarter was particularly low. I was wondering if you could give a bit more color around what is driving that? And also what is a sustaining CapEx number for that number to the whole production flat over the next year or two on an annual basis?

BP: On CapEx, it’s down 63% year-on-year, which is completely driven by the planned investment schedule that the team had. They went through a period, where they did a series of experiments around particular types of activity around multi-laterals that they ran. That’s thought them a lot about some of the reservoirs. And actually, they are going to start revamping up and restarting investment in the third quarter. So, you’ll start to see some of the CapEx ramp up.

In terms of a point forward capital for that business, I was thinking something around $0.5 billion or north of $0.5 billion is what you’d expect going forward. And I think that when we first put the frame in place, we had up to $1 billion of capital allocated. But, again, it’s really a function of what are the options for us. That’s a great short-term opportunity. If we will have to ramp activity up quickly, let’s say, because of prices or because we have discretionary capital, that would be an obvious place where you’d start to do it.

So, it can take some of the float in terms of options for us depending on what’s happening in a short-term. It’s a great way in terms of getting short-term paybacks and high returns. And the more and more we learn about that business in a way in which it’s run, I think the more value we’re going to bring.

石油圈

石油圈