The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Ever since the invention of the internal combustion engine, oil has been one of the most crucial commodities on Earth. Without it, modern transportation as we know it would not be possible. Industries such as aviation, aerospace, automobiles, shipping, and the military would look nothing like they do today.

Of course, as we now know, this has all come with some extreme drawbacks from an environmental perspective. And while new green technology and the lithium revolution will aid in eventually reducing the role of oil in transportation, the fact is we still use 94 million barrels per day of crude worldwide.

As a result, the energy industry continues to have huge amounts of influence on our lives. Special interest groups with a focus on energy have influence on a domestic level. Meanwhile, from a foreign policy angle, countries like Saudi Arabia and Russia wield additional geopolitical and economic power because of their natural resources. It’s even arguable that everything from the Gulf War to the more recent Middle East interventions in Libya, Syria, and Iraq have been at least partially to do with oil.

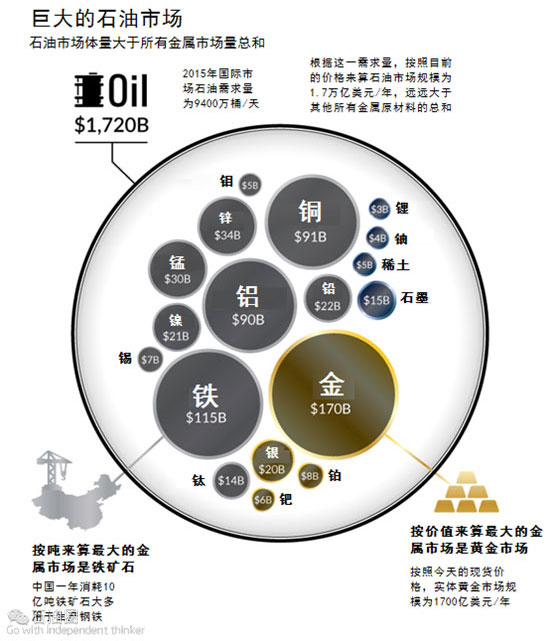

This week’s chart of the week aims to help explain the influence that oil has on countries and markets by using a very simple perspective: the size of the oil market vs. all metal markets combined.

THE TRUE SIZE OF THE OIL MARKET

While the amount of uses in one barrel of oil is quite incredible, we still need a mind-boggling amount of the natural resource each year to sustain consumption.

Oil production per year: 34 billion barrels (incl. other liquids)

Oil market size at current prices: $1.7 trillion per year

To consider how big this actually is, we compare the annual market sizes of all major metals and minerals that are mined throughout the world:

Other metals: $67 billion (Including platinum, palladium, titanium, tin, moly, uranium, and more)

The total amount works out to $660 billion – just a tiny fraction of the size of the oil market.

Note: we focus on raw, physical materials in this analysis. We leave out things like gold futures, or alloy markets such as steel in this analysis. To get market size numbers, we used the latest price multiplied by 2015 demand in most cases. We left out the smaller markets for many other metals like bismuth, antimony, or rhodium. Exact sources can be seen in the chart itself. Oil market size includes other liquids such as lease condensate.

BHP Billiton Ltd. sees oil and gas markets rebounding faster than its mined commodities as it considers potential acquisitions and weighs as much as $5 billion in project spending.

The world’s biggest miner, which booked write downs of $7.2 billion against its U.S. shale unit earlier this year, said recovering oil prices and efforts to lower costs are making investment opportunities more attractive.

BHP’s board will decide within six months on its investment in the BP Plc-operated Mad Dog 2 oil and gas project in the Gulf of Mexico, it said Wednesday in a statement. The company earlier flagged its share of the project at $2.5 billion. Additional investments of as much as $2.5 billion in existing project options are also being considered, Steve Pastor, the producer’s petroleum operations president, said in the statement.

“While currently well supplied, underlying fundamentals suggest both oil and gas markets are improving more quickly than our minerals commodities,” Pastor said. “Petroleum is well placed to maintain its position as BHP Billiton’s highest margin business and to grow its free cash flow contribution.”

Melbourne-based BHP’s petroleum unit, with operations in countries including the U.S. to Australia, had an average margin for earnings before interest, taxes, depreciation and amortization of 64 percent over the past 15 years, compared with 54 percent from iron ore, Macquarie Group Ltd. analysts wrote in a note Tuesday. The unit accounts for the second highest share of earnings after iron ore, according to data compiled by Bloomberg.

Oil has advanced about 11 percent since the Organization of Petroleum Exporting Countries agreed last week to cut production for the first time in eight years, with U.S. crude trading near three-month highs close to $50 a barrel Thursday. Petroleum is leading a commodities rebound, with prices poised for gains faster than metals and coal, BHP said Wednesday in presentation slides.

BHP said it expects oil prices to continue to recover. Crude at a 13-year low of $27 a barrel in January wasn’t sustainable for the industry, Pastor said.

The low prices “didn’t make a whole lot of sense and it wasn’t necessary to rush after volumes in a case like that,” he said on a media call.

Mad Dog 2 is an economically attractive option with prices below $50 a barrel, Pastor said in the statement. The operation could enter production by 2022, BHP said in a separate presentation.

‘Volume Challenge’

“Ultimately, the challenge they have is on volumes,” Sydney-based Deutsche Bank AG analyst Paul Young said before the presentation. “They don’t have any major projects, any high-margin projects, coming through until the next decade.”

Output from BHP’s petroleum unit in the 12 months to June 30 is forecast to fall for a second consecutive year to between 200 million to 210 million barrels of oil equivalent, BHP said in July.

Population growth and rising incomes will lift oil demand to more than 100 million barrels of liquids per day by 2025, a third of which will need to come from new sources, Pastor said in the statement. Rising demand, projected field decline and the impact of investment deferrals mean there’s a significant opportunity to make investments in growth, he said.

BHP, the largest overseas investor in U.S. shale, said its onshore assets are currently generating cash and have significant upside if oil and gas prices improve as forecast. The producer acquired Chesapeake Energy Corp.’s Fayetteville assets for about $4.8 billion in 2011 and later that year completed a $12.1 billion takeover of Petrohawk Energy Corp.

Cash Flow

Shale assets in the Permian basin could become the largest source of production and free cash flow in BHP’s petroleum division within five years, Pastor said.

The producer struck oil at its Caicos deepwater exploration well in the Gulf of Mexico and plans to drill the nearby Wilding well in November, it said in the statement, adding it is “optimistic” about commercial development in the area.

The company sees the most value for mergers and acquisitions in conventional deepwater oil assets, Pastor said on the call.

“It needs to be in basins that we know both economically and geologically,” he said.BHP’s Australian listed shares rose by 1.2 percent to A$23.13 at 1:34 p.m. in Sydney.

石油圈

石油圈