What will all top 10 oil companies do in 60 years?

When all the major oil wells run out, what will these huge companies do? Go bankrupt? I don’t think so. They have to be investing billions in what they are going to do next.

So what is the future of biggest oil companies?

I am looking for professional answers with sources (this is part of research I am doing at the moment).

Ryan Carlyle, I’m an engineer at an oil company

69.6k Views • Most Viewed Writer in Oil and Gas Industry with 330+ answers

Ryan Carlyle, I’m an engineer at an oil company

In 60 years all the oil companies will be merrily drilling and pumping away. (In fact, thousands of oil wells producing today will still be going.) However, oil companies may be smaller, and will be extracting almost exclusively unconventional oil, such as tar sands and oil shale. This requires more equipment, more technology, and more cost, but is perfectly viable in the foreseeable long term.

We are running out of “easy” oil, but there’s probably enough of the difficult/expensive/nasty stuff to last over a hundred years on current consumption forecasts. (Admittedly, forecasts vary wildly.) Oil companies constantly pursue new technology and new sources of profit, but my subjective impression as an industry insider is that the vast majority of R&D spending is focused on unconventional oil, not replacing oil. We do a fair amount of work in geothermal drilling and water drilling, but it’s a minuscule portion of the revenue stream.

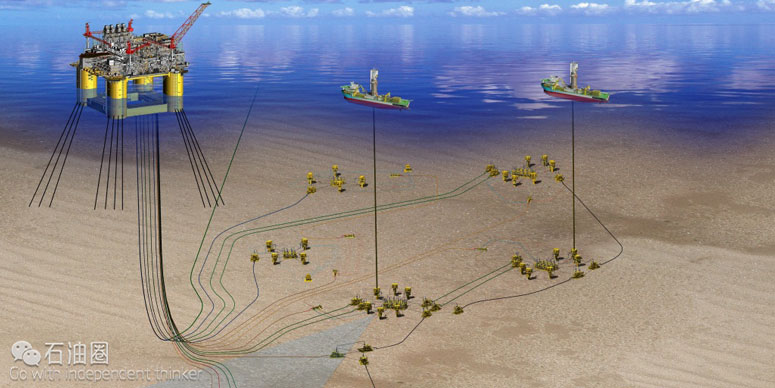

Fundamental economics support oil & gas until the bitter end. The key point is that because oil is an essential commodity with very limited substitutes, the market price of oil will continue rising until it’s high enough to justify bringing more expensive production on line. The less oil is left, the more money there will be in sucking out every drop. Scarcity increases profits and encourages companies to expand, not contract. This is happening today. Deepwater oil is a huge growth market but is not economical with oil under $40-50/bbl. The last figure I heard for Canadian tar sands was $65-75/bbl. If oil prices continue rising, many marginal oil shales will come into play. Every major price rise opens up additional resources.

In addition to making these new sources economical, high prices justify going into existing half-depleted wells and stimulating them to eke out more oil. The average oil well from the 1990’s may have only been produced to 10% depletion. (It varies wildly.) The technically-recoverable figure varies from field to field but is generally around 20-50%. So a single well may be able to economically produce twice as much oil at today’s prices than at 1990’s prices. If we see the price of oil double again in real terms, you should expect to see a lot of re-opening “depleted” fields to install advanced recovery equipment.

Price increases also cause demand destruction as power generation shifts to renewables and transportation changes to other energy storage mediums. Between marginal supply increases and demand destruction, what we should expect to see is a plateau and gradual tapering-off of oil consumption over time, rather than a sharp decline. There will be plenty of time for oil companies to update their business models over the many decades it will take for this slow decline to play out.

The long game, far, far down the road, is that we either stop using liquid transport fuels or we synthesize liquid transport fuels from other energy sources. Personally, I expect that either CNG (compressed natural gas) or GTL (gas to liquid) technology will play an increasingly important role in providing transport fuels. Natural gas is dirt-cheap right now and supplies seem to be much larger than oil reserves, so it makes a lot of sense to run cars on natural gas in the future. This could mean cars running directly on CNG with a new fueling infrastructure, or it could mean we chemically react natural gas to produce high-quality liquid blendstocks. Those liquids would be used to dilute the heavy, bituminous oil coming from unconventional oil sources. The net result of GTL technology is that we get to use natural gas with our existing gasoline/diesel infrastructure. We’re only a couple good catalyst advancements away from making that a reality today, so we may see it expand a lot over the next couple decades.

Another possibility is coal-to-liquid processes. These are not currently economical but would be if the price of oil doubles. Germany did this during WWII to supplement its oil supply. It’s proven technology but is dirty and expensive.

Electric cars are theoretically viable and could eliminate most oil consumption, but require a 10x improvement in battery technology and 10,000x expansion of charging infrastructure to be fully viable. We’re already pushing the fundamental physical limits of chemistry-based battery energy density, so we may or may not ever see battery-based electric cars replace liquid-fuel cars. If they do go mainstream, it’s not hard to imagine oil companies utilizing their massive supply chains and gas station real-estate to get into the battery-charging business. The electricity will be largely supplied by natural gas.

Speculation aside, investing R&D money today to stave off a probable decline 50-100 years from now is not rational from the viewpoint of accountants nor shareholders. 60 years is beyond the time horizon of any executive but the dynasty-building family business type. It’s unlikely any technology currently in the pipeline will turn out to be the new core business that far down the road. Some or all of the oil companies may not survive the coming transitions, but no one who works in the industry today will be around to see it.

I think the telephone industry is a good example. It’s still doing more or less the same thing it was 60 years ago, plus a ton of stuff no one could have possibly predicted. The best you can do for a 60 year prediction is dust off the ol’ crystal ball and make something up.

Written 13 Nov 2012 • View Upvotes • Answer requested by Mark Savchuk

Related QuestionsMore Answers Below

• How much Motor oil, Transmission fluid, Hydraulic fluid and Cooking oil, etc, is used in the United States each year? How many companies purif…

• What is the reason for 5 time increase of oil prices in the past 10 years?

• What are the top 10 oil spills in history?

• Oil (fossil fuel): When will crude go down to $60?

• What will Australia’s recent, massive oil discovery do for its economy in the coming 5, 10, 20 years?

Guy Maslen, geophysicist, leading a software development group in a geoscience research o…

1.7k Views • Most Viewed Writer in Royal Dutch Shell

Some of the oil companies will have faded away, and others will survive the disruptive change – the process will be a little bit like the impact of digital cameras on Kodak and Fujifilm.

Whether oil will “run out” is not clear; proven reserves seem to “kick” with technology improvements, and are currently rising much faster than demand.

It is worth remembering that the oil industry started off providing fuel for lamps, as whale oil was “running out.” Gasoline was a waste product. The industry survived the disruption caused by electricity.

My predictions are:

– oil will still be used as a chemical feedstock and other industrial uses

– some companies will become “energy” companies; you can see this happening now with Chevron’s position in geothermal, and Total’s position in solar energy

– natural gas will still be an important fuel

– some companies will leverage their drilling/gas knowledge into carbon capture and storage projects

– following Audi’s development of CO2 neutral liquid hydrocarbon fuels, oil companies are the logical partners for scaling production and distribution. I would anticipate seeing “carbon neutral” diesel pumps on garage forecourts within the decade

References:

Gasoline as a waste product : Gasoline Used To Be Considered Garbage – KnowledgeNuts

Kodak and Fujifilm: Surviving the death of your core business – Cordial

Audi’s CO2 neutral fuels : E-diesel

Guy Maslen’s answer to When is the earth supposed to run out of oil?

Storing CO2 underground: Carbon capture and storage

Chevron, Geothermal: Geothermal | Energy Sources | Chevron

Total, solar: Photovoltaic Solar Energy

And, above all else : The Prize: The Epic Quest for Oil, Money, and Power

Written 12 Jun 2015 • View Upvotes

Jason Hyun, MIT ’17, Chemical Engineering

I’m going to assume 60 years is an (optimistic) estimate for which oil is largely phased out of the energy system.

In terms of rebranding as cleaner energy companies, much of oil & gas technology and possibly equipment can be repurposed. Most apparent is the shift to unconventional gas, but the understanding of geology and reservoirs is also relevant to carbon capture and storage (CCS) schemes, which is predicted in the IPCC2014 report to become a major player in gas and biomass generation to approach net zero or negative carbon.

A lot of hydrofracturing (“fracking”) technology is also relevant to the stimulation of geothermal resources for geothermal power, which could theoretically cover the bulk of electrical generation in places where reasonably good resources are present (though currently not cost competitive).

Finally, with the rapid expansion of synthetic biology, a lot of downstream refining equipment could probably be repurposed towards producing biosynthetic alternatives to petroleum products such as fuels, lubricants, drug/cosmetics precursors, plastic precursors, specialty chemicals, etc. (Although I’d be hard pressed to find production volumes of those products reach as high as the rate at which we process oil today).

Written 12 Dec 2014 • View Upvotes

Elias Azrak

1.7k Views • Elias has 30+ answers in Finance

Some oil companies such as Shell do scenario analysis where they generally try to come up with 4 different futures

BP a few years ago started to rebrand themselves from British Petroleum to Beyond Petroleum.

Electric vehicles have still a limited amount of engineers as compared to the 300,000+ engineers working on internal combustion engines. VW has a super efficient car which can run 300 miles per gallon which for an average driver would mean refilling his car once or maybe twice a year only, except that it is not allowed in the US which makes you wonder why given that we have to reduce CO2 emissions to zero.

Already today from an accounting point of view, I understand that any known oil reserves which have no producing wells have to be accounted as stranded assets.

Most oil companies have been buying for decades now a lot of IP in many different energy fields i.e. hydrogen production and/or storage (currently best known methods are using liquid hydrogen BMW or for hydrogen gas tanks Quantum which uses a nano coat), different solar technologies from solar concentrator to photovoltaic (Shell & Siemens had a 50/50 joint venture)

Finally diversification most oil fields are also producing gas which is still being flared today causing an impressive amount of the GHG emissions.

Some others have a corporate venture arm Chevron Technology Ventures come to my mind. Chevron Technology Ventures

In France Total the oil company is a leader in biofuels.

During the apartheid years and being isolated from the rest of the World, South African oil company Sasol has been perfecting their skills at Fischer-Thorpe processes converting coal into oil.

Typical Brazilian fuel station with a choice of four fuels available: diesel (B3), gasoline (E25), neat hydrous ethanol (E100), and natural gas (CNG).

Piracicaba, São Paulo, Brazil

Corporate & venture equity investment in oil & gas innovation totaled $124mm across 12 deals in the third quarter, with 2 deals having undisclosed values. That total was 15% lower than the $146mm oil & gas innovators raised in 2Q2014 but was quite in line with the four-quarter running average of $119mm (a 4% increase). Deal volume, on the other hand, has seen a steady decrease from a high of 32 deals tracked in the first quarter of 2013. The 12 deals tracked in 3Q2014 represent a 40% quarter-to-quarter drop from 20 deals in 2Q2014 and a 48% drop relative to the trailing four-quarter running average of 23.

This compares to Venture capitalists investing $9.9 billion in 1,023

deals in the third quarter of 2014, according to the MoneyTree™ Report from PricewaterhouseCoopers LLP (PwC) and the National Venture Capital Association (NVCA), based on data provided by Thomson Reuters.

Updated 7 May 2015 • View Upvotes

Anonymous

1.3k Views

On the supply side of the oil industry, the possibilities are immense. We have used only the tip of the proverbial ‘iceberg of oil available. With new seismic survey techniques, big-data gathering and geological mapping, searches will become much more efficient and large discoveries are only waiting to be had. Also drilling techniques are improving every year. We even have techniques to drill and get oil out of the freezing Arctic – amazing achievements indeed.

Of course, if we do burn all that oil, we might not have any real icebergs remaining! The problem then is of course the irrefutable environmental side effect and public opinion. In a few decades, I foresee that the masses (even in today’s developing world) having taken all the luxuries afforded by oil for granted, will get all idealistic and sentimental about polar bears and whales. In such a scenario, it is not hard to imagine that “clean” oil companies will outlast the “not so clean” ones. Blunders such as BP’s (Deep-water Horizon oil spill) will become extremely costly (both in terms of fines and public standing) and is likely to bring down companies.

With regards to the CO2 emissions, I do not foresee our society falling prey to the Boiling frog syndrome. There is so much information around us. I foresee quite a few innovations on the demand side. I find it plausable that demand for fuels will move towards higher hydrogencarbon ratio. As evidence, we see a trend that power plants are gradually shifting from coal towards natural gas. If this continues, we might see the world shift increasingly towards a hydrogen economy from a carbon-based one (also because the production methods fit more or less with the current oil refinery infrastructure). Also creating clean electricity using hydrogen is not that far-fetched as long as carbon from associated process systems are disposed as solids (not as CO2 gas). There is a huge incentive for companies to be the first to crack these issues and the future is quite exciting for an engineer in the oil industry.

Written 23 Oct 2014 • View Upvotes

Matt Bennett, adventure-seeking software engineer

1k Views

Almost all of the answers here concentrate on the supply side of fossil fuels, with new extraction technologies and slow market forces allowing gradual adaption within the industry.

But there is research suggesting that we cannot reasonably burn even the reserves we currently hold without the climate warming by more than 2°C. See Carbon Bubble.

A reality where we suddenly see these assets as overpriced may be forced by regulators or a catastrophic event where society suddenly realises the frog is boiling, but there are gradual changes happening already. Plenty of people are divesting from fossil fuels and despite the hubris about “dirty” energy I suspect the movement is being driven by financialtypes.

No big energy company will be admitting now that their assets may become stranded, but the smart ones should surely be thinking about it. Those that diversify or M&A their way into renewables will put themselves in the best position for survival.

Written Jun 16, 2015 • View Upvotes

Joseph Wang, Ex-VP Quant – Investment banking – Hong Kong

2.4k Views

You’ll notice that they are no longer “oil companies” but “energy companies.”

Written Mar 31, 2014 • View Upvotes

Richard Ottolini

1k Views

One vast hydrocarbon resource that hasnt been tapped yet are methane hydrates in the seafloor shelf. They are high pressure, dangerous and expensive to produce. So no one, save for a Japanese project, are looking at them yet. But as we approach Peak Oil, suggested in the 2030s by industry economists, methane hydrates may become a production target.

(P.S. Some geologists think the 2010 BP Gulf spill hit a methane hydrate. this shows how difficult they can be to control.)

Written May 12, 2015 • View Upvotes

Mark Rogowsky, Forbes technology, raconteur, @maxrogo

2.9k Views

Be the top 3 oil companies.

(Think M&A.)

Written Sep 23, 2013 • View Upvotes

Jonathan Hughes, works in the healthcare, identity and credit fraud analytics sectors

1.3k Views

I predict that today’s oil companies that aren’t already state owned will be by then as ‘strategic assets’.

There will always be oil left in the ground since once it requires more than a barrel of oil to extract a barrel of oil, there’s no point.

Giesen Duan, 90’s in China and Shell employee as Lubricant KAM

979 Views

The oil company is trying to find new way to offer energy to public, base on what I know about Shell .Shell is trying so hard in new technology like solar energy and tide energy , and they have technology leading the world . So if the oil gone ,they maybe become smaller ,but they also can live by other profit.

Written Mar 24, 2014 • View Upvotes

石油圈

石油圈